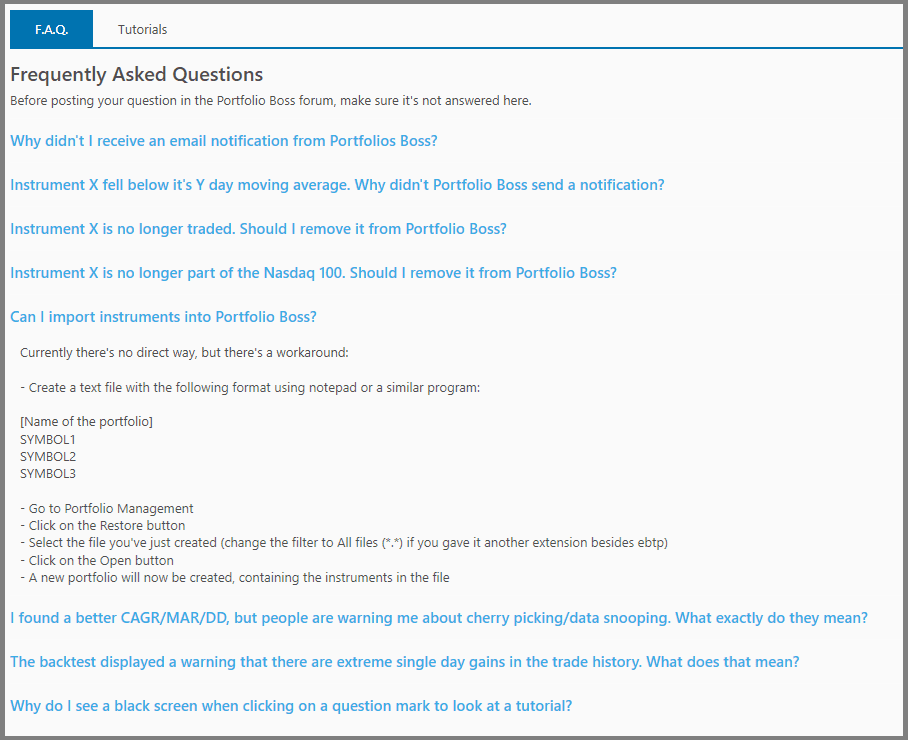

Frequently Asked Questions

This Tab contains the list of Frequently Asked Questions. Simply click on a question, and an answer will be expanded below it. Please note, we have listed some more FAQs in this user guide than the one contained on this Tab.

- Why didn't I receive an email notification from Portfolio Boss?

- Instrument X fell below its Y day moving average. Why didn't Portfolio Boss send a notification?

- Instrument X is no longer traded. Should I remove it from Portfolio Boss?

- Instrument X is no longer part of the Nasdaq 100. Should I remove it from Portfolio Boss?

- Can I import instruments into Portfolio Boss?

- I found a better CAGR/MAR/DD, but people are warning me about cherry picking/data snooping. What exactly do they mean?

- The backtest displayed a warning that there are extreme single day gains in the trade history. What does that mean?

- Why do I see a black screen when clicking on a question mark to look at a tutorial?

- Why does Portfolio Boss disappear after I try to open it?

- Can I trade inside an IRA?

- Is this legal?

- How many signals will I receive each day?

- What time do I receive trade signals?

- How do I receive the trade signals?

- How do I contact Portfolio Boss?

- What are the Terms of using Portfolio Boss?

- How does Portfolio Boss deal with data privacy?

- How will Portfolio Boss software be delivered?

- What if I don’t like Portfolio Boss?

- What devices can I use the Portfolio Boss on?

- My anti-virus software flagged Portfolio Boss, what's this?

- My Drive C is full. How can I change PB database folder to use another drive?

- Portfolio Boss crashed often lately, what should I do?

1. Why didn't I receive an email notification from Portfolio Boss?

In order to receive notifications from Portfolio Boss, all of the following must apply:

-

- Make sure the automation setting “Send email notification for strategies that have notifications enabled” is enabled.

- At least one strategy must have notifications enabled. You can do this in the “Strategy Management” page.

- Preferably, Portfolio Boss must be running 24/7. Hibernation/sleep mode should theoretically work, but if you're not getting notifications, try not using it.

- Check your spam folder to make sure the notification was not marked as spam.

- Check the log to see if there are any errors that might indicate a problem with sending notifications.

By far the easiest to set up is using the default Portfolio Boss Mail Service, since you only have to enter one or more recipient addresses. Should you for whatever reason want to use any of the other options then:

-

- Make sure you've entered correct email settings. Verify this by sending a test email.

- In case you're using 2 factor verification for your email account, make sure to create a separate app password for Portfolio Boss, because it doesn't support 2 factor verification.

- In case you're not using 2 factor verification and you receive emails that a login attempt has been blocked, consider switching to 2 factor verification and make an app password for Portfolio Boss.

2. Instrument X fell below its Y day moving average. Why didn't Portfolio Boss send a notification?

The following is required for an instrument to trigger a signal:

-

- Make sure you compare the correct moving average type (SMA, EMA, or whatever type Portfolio Boss might support in the future).

- The instrument closed below the moving average. If it falls below the moving average intraday, but closes above, no signal will be triggered.

- Portfolio Boss uses the adjusted close Yahoo provides. So if the close is below, but the adjusted close isn't, no signal will be triggered.

3. Instrument X is no longer traded. Should I remove it from Portfolio Boss?

No. You can mark it as “Suspended”. That way Portfolio Boss will no longer try to download price data for it, but your backtests will stay accurate. It of course won't pick the instrument after its last trading day. Note that an instrument that's no longer traded will eventually be marked as “Delisted”, but it takes time; all the bureaucratic works need to finish before it is marked as such. So instead of waiting, you can mark it as “Suspended”.

4. Instrument X is no longer part of the Nasdaq 100. Should I remove it from Portfolio Boss?

No, because it will change the result of your backtests. You could mark it as “Suspended”, but no longer being part of the Nasdaq 100 doesn't change the exponential nature of the instrument, which was our initial rule for adding instruments.

5. Can I import instruments into Portfolio Boss?

Currently there's no direct way, but there's a workaround:

- Open the Windows “Notepad” and type in the symbols top to bottom. The Portfolio's name can be written at the beginning of the file, enclosed by square brackets. Something like this:

[Name of the portfolio]

SYMBOL1

SYMBOL2

SYMBOL3

- Now, save the file with the EBTP extension. To do this, from the dropdown “Save as Type”, choose “All Files”. Then type the file name on the “File Name” field. The name must be followed by the extension .EBTP (with the dot character).

- Once the file is created, you can double-click it to be processed by Portfolio Boss. Or, you can go to the “Portfolio Management” page and click on the Restore button

at the top of that page. Select the file you've just created and click the Open button.

at the top of that page. Select the file you've just created and click the Open button.

- A new portfolio is now created, containing instruments you specified in the file. Portfolio Boss automatically downloads all the necessary data for those symbols. Even if the symbol is now delisted, Portfolio Boss will know accordingly.

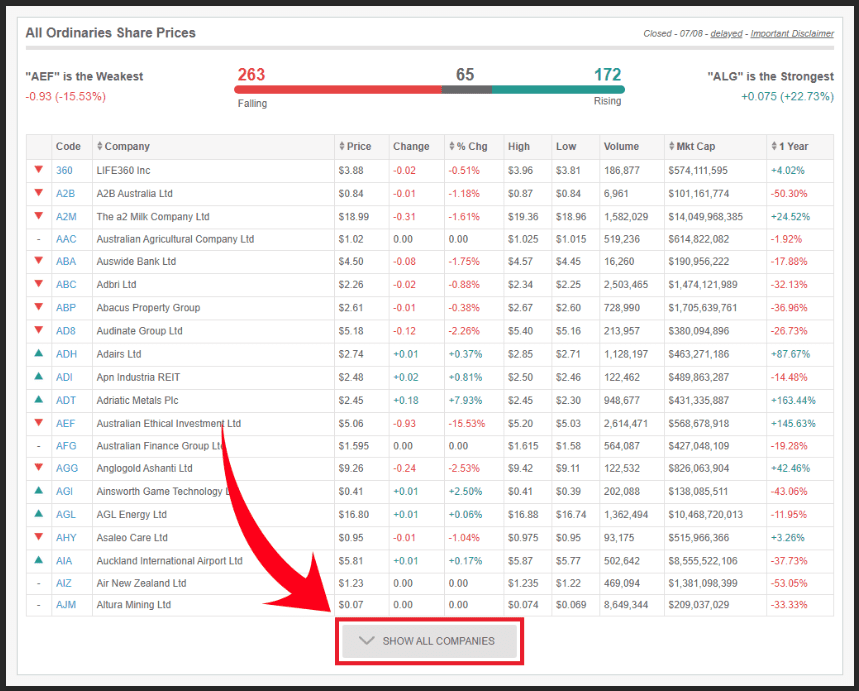

If you don't want to type the symbols manually, you can copy the textual symbols from a financial website. Let's say you have hundreds of symbols you want to import into Portfolio Boss. Thus you go to a website that provides such a list, for example www.marketindex.com.au/all-ordinaries and copy-paste the symbols toward Notepad. But copy-pasting from a complex website may not be as straightforward as it seems, so here are the steps:

- Make sure to fully expand the table that lists the instruments. In the case of that website above, press the button “Show All Companies”.

- Now, select the entire table from the outside. That is, place your cursor at the top left area of the table, but outside of it. Then click-drag your mouse toward the bottom right area of the table, again releasing the mouse outside the table.

You can also select it from the bottom-right corner to the upper-left. It doesn't matter. The point is, you select the entire table from the outside.

- Now that you have the entire table selected, press Ctrl + C on your keyboard to copy the contents.

- We will paste them toward a spreadsheet first. So go to sheets.google.com and create a new spreadsheet. Or you can use Microsoft Excel if you have one.

Press Ctrl + A on your keyboard to select all cells, then press Ctrl + V to finally paste the data. If there's a warning dialog, just press OK to proceed.

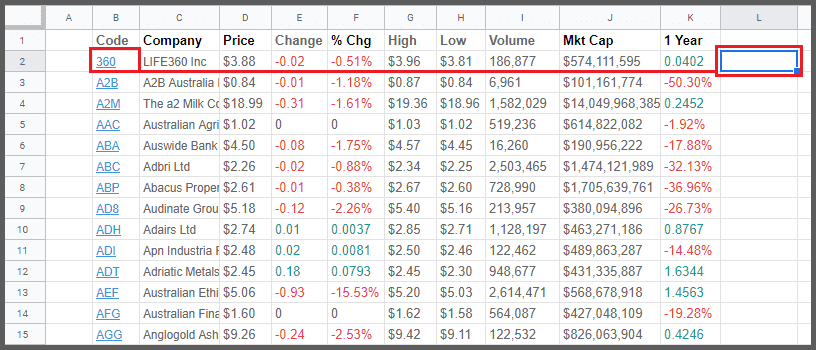

- Now click on any empty cell whose row parallels the first symbol. For example here, click on cell L2 as it parallels the symbol “360” at Row 2.

On that cell L2, copy and paste this formula =CONCAT(B2, ".AX") and press Enter. That way, the cell L2 now contains the “concatenated” (combined) contents from cell B2 and the text string .AX, therefore it now reads “360.AX”. This is to append the symbol with the .AX extension so Portfolio Boss recognizes it as Yahoo data. If the symbol is located at a different cell, let's say C2, then replace B2 with C2 on that formula.

- We'll do that concatenation to all symbols, so select cell L2 and press Ctrl + C. Then click the Column L header, thus all cells within Column L are selected. Then press Ctrl + V to paste. The cells now contain their respective symbols combined with the string .AX. It is these contents that will be used by Portfolio Boss.

- Now let's copy the contents of all that Column L, and paste it to the Notepad. But before we do that, click the topmost cell that says Code.AX, and press Delete, we don't want that content because it's not part the symbol. Then, click the Column L header again to select all its cells, and press Ctrl + C.

- Then open Notepad as already described, and press Ctrl + V to paste the data. You'll see the symbols are sorted top to bottom; and at the file's beginning you can write the portfolio's name as usual. Note the lower part of the file contains empty symbols (only the extension .AX). It's okay, just leave them be. Save the file as EBTP, and load it to Portfolio Boss as you already know.

6. I found a better CAGR/MAR/DD, but people are warning me about cherry picking/data snooping. What exactly do they mean?

Cherry picking or data snooping in itself is not bad. It's the fact that you're taking advantage of unknowable data that makes it bad. You see, CAGR/MAR/DD are all based on hindsight.

Now, what does this mean?

Suppose you add stock X and run a backtest over the past 10 years. You notice the CAGR/MAR/DD improves and you may think therefore the stock is a keeper. Or the opposite happens and you might believe the stock should be removed from Portfolio Boss. Now turn back the clock 10 years. You now no longer have the data of these 10 years, since they haven't happened yet. And no data means no way of knowing the effect of stock X on the CAGR/MAR. This means an improved CAGR/MAR/DD cannot be a reason to add or remove a stock. Because if you do, you're really expecting the performance of stock X in the next 10 years to be the same as the past 10 years. And past performance (good or bad!) is no guarantee for the short term future (with us switching every month).

So what good is the CAGR/MAR/DD then?

These numbers should be interpreted as an indication of whether whatever theory you're testing is worth trading. For instance: the theory behind EGR is that there's an edge in buying exponential stocks above a certain market cap on the 6th trading day that are in the top right corner of the chart and just had a dip. Portfolio Boss shows us that indeed this edge exists. Note that the theory doesn't care which exponential stocks are used. Dan just added all of them (he just left out Biotech to get a more diversified picture). Basically the CAGR says if you had stuck with this theory for the past X years, this would have been your result. (In reality of course a bit lower due to commission and slippage). Because the theory isn't tied to the performance of single stocks, it's reasonably safe to extrapolate the graph into the future. It becomes safer as the backtest period becomes longer. But if you're polishing up the CAGR by taking out bad stocks and putting in good ones, you're undermining the validity of the CAGR, because suddenly the CAGR starts depending on the performance of single stocks.

What then would be a reason to add/remove a stock?

Removing a stock will hardly ever happen, unless a company decides to go do something completely different that no longer matches the theory you're testing (suppose you have a theory about the textile industry and therefore deem a certain Berkshire company no longer fitting because they stopped doing textile stuff; I know, bad example…). If a stock is no longer traded (FIO for instance), you can still leave it in Portfolio Boss for backtesting purposes, since it will give you a more historically accurate picture. It won't be picked by Portfolio Boss again after its last trading date.

Adding a stock should be done because it matches the theory you're testing. Maybe you think that a certain type of industry has more potential than others. Or who knows, maybe you believe there's a market edge in companies that have been founded under a full moon. But whenever you're adding a stock, don't be smarter than the market, instead just add all stocks that match your criteria and then let Portfolio Boss calculate whether your criteria have any tradeable edge in them. Of course, when new companies are founded that match the criteria, you can simply add them as well.

7. The backtest displayed a warning that there are extreme single day gains in the trade history. What does that mean?

It means that somewhere in the backtest, Portfolio Boss held one or more positions that jumped over 300% in a single day. This is caused by errors in the ‘End of day' data we obtain from Yahoo. Since Yahoo has no official channels to report such errors, you have no choice but to remove the instrument from your portfolios.

If you don't, your CAGR will be artificially inflated and future returns will be disappointing.

Even in the extremely unlikely event that a stock really manifested such gains, we advise you to remove the instrument, because having to rely on such impossible gains to happen again makes for a very bad strategy.

8. Why do I see a black screen when clicking on a question mark to look at a tutorial?

Some systems seem to have restrictions in place that prevent the tutorial video from playing within the Portfolio Boss application. Usually installing Adobe Flash Player solves this issue. Or if you prefer to stay away from Flash, you can also go to https://api.portfolioboss.com/Tutorials/ and play the videos from there.

Note that these video tutorials have been superseded by the online User Guide, so unless you're using an old version of Portfolio Boss, when you click the question mark icon you'll be brought to the online documentation pages.

9. Why did Portfolio Boss disappear after I tried to open it?

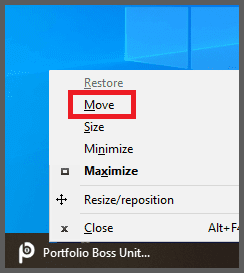

Portfolio Boss does not actually disappear or close, but its window might be located off the screen. This issue may be encountered if you're using multiple monitors. To reposition the window back to its default location, press Shift + Right-click on the Portfolio Boss taskbar icon, and a pop-up appears:

From there, choose “Move”, and press the keyboard arrow buttons until Portfolio Boss window shows up. Or, as soon as you choose “Move”, can click-drag and move the mouse until the window appears).

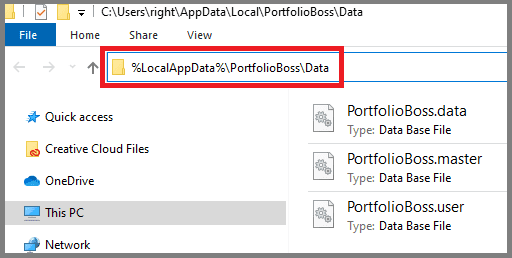

Alternatively, you can also reset PB user settings (including its appearance and window location) by:

-

- closing Portfolio Boss. You can do this by choosing “Close” on the taskbar pop-up as shown above.

- with File Explorer, go to:

%LocalAppData%\PortfolioBoss\Data

(you can copy and paste that address to the address field as shown above, and press enter.)

-

- in that folder, delete the file “PortfolioBoss.User”,

- now open Portfolio Boss again, and it will be loaded with the default appearance settings, including the window's location.

10. Can I trade inside an IRA?

Yes! Brokers like Interactive Brokers allow you to open a margin IRA so you can trade on unsettled funds. Please consult your tax professional.

11. Is this legal?

Yes, perfectly. While we have an advantage, it’s not an unfair advantage.

12. How many signals will I receive each day?

If you’re trading a maximum of 10 stocks at once, then you’ll receive 1-2 signals per day on average. You can test different settings inside Portfolio Boss.

13. What time do I receive trade signals?

Typically after 5 PM Pacific or 8 PM Eastern when quotes are updated. Simply place your orders with your broker for execution the next morning.

14. How do I receive the trade signals?

You receive the Oracle Orders trade signals inside our trading platform, Portfolio Boss. You can also receive the signals automatically by email.

15. How do I contact Portfolio Boss?

Please visit our contact page by clicking here to reach the Portfolio Boss staff for any questions or support needed with your Portfolio Boss software. Portfolio Boss is a US based company located in the state of California.

16. What are the Terms of using Portfolio Boss?

You can review the entire terms of use for the Portfolio Boss software and Portfolio Boss website by visiting our terms and conditions page by clicking here.

17. How does Portfolio Boss deal with data privacy?

We take data privacy very seriously and respect your right to privacy. For our current privacy policy please visit our privacy policy page by clicking here.

18. How will Portfolio Boss software be delivered?

All Portfolio Boss purchases are delivered online as a download. There is no shipped software disk or other shipped product. You will have instant access to the Portfolio Boss software download after your purchase has been completed.

19. What if I don’t like Portfolio Boss?

Each product/service has its own guarantee. Please refer to the sales material.

20. What devices can I use the Portfolio Boss on?

You can use the Portfolio Boss software on any Windows based computer or on a Mac running Windows through Apple's boot camp or using virtualization software tools like VM Ware Fusion or Parallels.

21. What if my anti-virus software flagged Portfolio Boss?

Some anti-virus programs tend to be over-cautious and raise false positives on completely legitimate software, such as Portfolio Boss.

Why do they do this? If a program displays behavior that is also commonly found in bad guy’s software, they assume it’s a bad software. Unfortunately this is pretty much the equivalent of going to a hardware store and putting all hammers under lock and key, labeling them as dangerous weapons because they have been used in crimes as well. Only if enough people report the program to be safe, the program gets a good reputation and will no longer be flagged. For big software vendors with millions of users, this is not an issue, but small software companies like ours are out of luck here.

So what can you do about it?

Most anti-virus programs allow you to report a file as being safe or to exclude the file from being scanned. Since there are too many different anti-virus programs out there, we can’t give you detailed steps on how to do this. You’ll have to ask Google or consult with the vendor of the anti-virus program.

Also, when you exclude Portfolio Boss, make sure you exclude the path %LocalAppData%\PortfolioBoss\Application\PortfolioBoss.exe rather than the path to the quarantined file.

If Windows gives you the message “This app can’t run on your PC”, then most likely the anti-virus program already removed what it thinks is the ‘bad behavior’ from PortfolioBoss.exe. Modifying this file however causes our digital signature to be removed, which causes Windows to start mistrusting the file.

In this case you need to reinstall Portfolio Boss and make sure you exclude it from your anti-virus program, before it scans and ‘fixes’ the newly installed version.

So, how can you check if PortfolioBoss.exe hasn't been modified by your anti-virus software (or even by a virus)? Here are the steps to check if the Digital Signatures (to ensure the software stays pristine, un-modified) have been removed:

-

- Make sure to do this on a fresh install, not on a quarantined or cleaned file.

- Open Windows File Explorer.

- Type

%LocalAppData%\PortfolioBoss\Application\in the address bar (or you can copy-paste that address), followed by Enter. - Right-click on PortfolioBoss.exe (the extension .exe may or may not be visible, depending on your Windows settings).

- Select Properties from the dropdown menu.

- Click on the tab Digital Signatures (if it’s not there, there’s no signature anymore and the program has already been altered; reinstall Portfolio Boss in this case).

- Select the signature and click on Details.

22. My Drive C is full. How can I change PB database folder to use another drive?

Please refer to the help page for “Database Tab”, we explain exactly how to do this.

Report

Block Member?

Please confirm you want to block this member.

You will no longer be able to:

- See blocked member's posts

- Mention this member in posts

- Invite this member to groups

- Message this member

- Add this member as a connection

Please note: This action will also remove this member from your connections and send a report to the site admin. Please allow a few minutes for this process to complete.