Price Range Index Filter

This filter looks at an index's last closing value, and if it falls within the specified threshold value, your strategy is allowed to enter or exit Positions. This is a simple filter to look at the market condition (provided your Portfolio is related to the index).

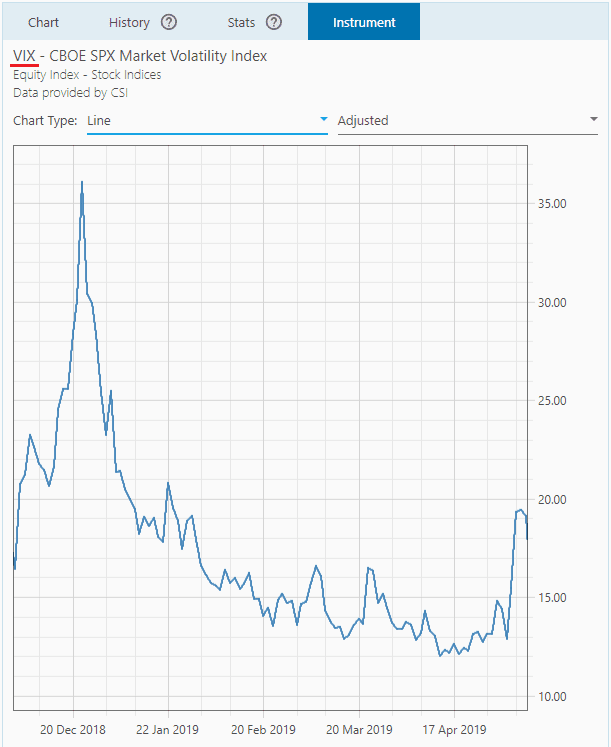

For example, you’re looking at market’s volatility using VIX (an index that calculates the volatility of the S&P 500).

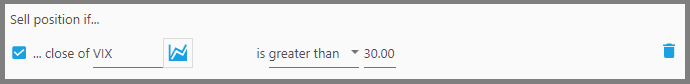

If VIX goes above 30, which indicates a highly volatile market, then exit out of all Positions, and vice versa: when VIX goes below 20 it indicates a generally stable market so your strategy is allowed to enter Positions.

1. The first parameter defines what index to use, which is related in some ways to your Portfolio. You can actually enter other types of instrument here, preferably ETFs, representative of your Portfolio:

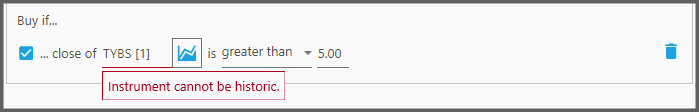

Note, you can't enter a delisted instrument here (those indicated by a number suffix inside square brackets). Otherwise a warning appears and you can't backtest the strategy:

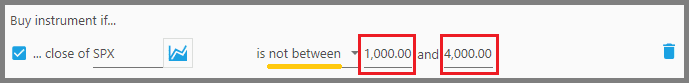

2. The second parameter defines whether the index must be “Greater than”, “Less than”, “Between”, or “Not between” the threshold value(s).

“Not between” might be good if you're Short Selling, that is, you'll only trade if the market is either very low, or very high (over exhausted) thus you're looking for downtrending market.

3. The third parameter defines the threshold value for the index. A negative value is not allowed here, since an index value can’t be negative.

Report

Block Member?

Please confirm you want to block this member.

You will no longer be able to:

- See blocked member's posts

- Mention this member in posts

- Invite this member to groups

- Message this member

- Add this member as a connection

Please note: This action will also remove this member from your connections and send a report to the site admin. Please allow a few minutes for this process to complete.