Price Range Filter

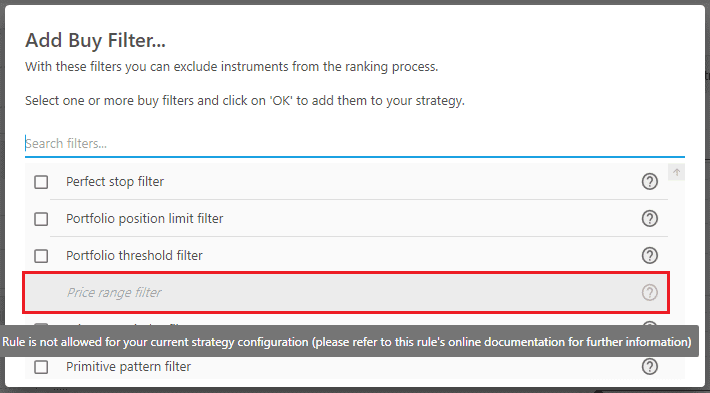

This filter is only available as a Buy Filter.

It uses a certain price as a threshold; so if an instrument's closing price is above or below that threshold price, then the instrument will be bought (or sold).

This is a very simple filter to exclude instruments that don't meet a certain price. For example if you don't want to trade “penny” stocks, since they usually have small dollar liquidity thus harder to make regular trades (incurring more slippage), or they may signify bad company reputation, or because their volatility is quite extreme.

Alternatively, you can use this filter to find those penny stocks since you're just beginning to trade and have a smaller account, for example.

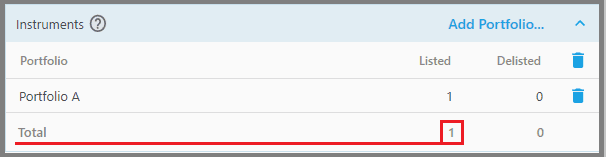

Keep in mind, this filter can't be applied if your strategy contains only one instrument as its Portfolio (the filter is grayed out and you can't add it to your strategy). This applies to both Sell and Buy filters.

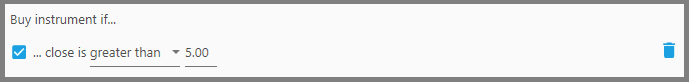

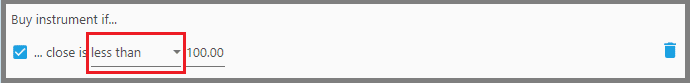

1. The first parameter defines whether the instrument must be “Greater than” or “Less than” a certain price to be considered as a buy/sell.

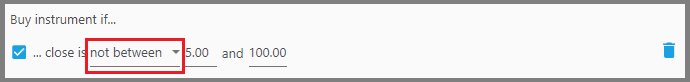

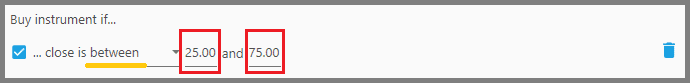

You can also define whether the instrument must be “Between” (within) the minimum and maximum prices that you set, or “Not between” (outside) the maximum and minimum prices (in other words, you're looking at instruments that have very low or very high prices).

2. The second parameter defines the threshold price that you want (in dollar value). Now, if on the previous parameter you set either “Between” or “Not between”, you can define the minimum and maximum prices on this second and third parameters that show up.

Note:

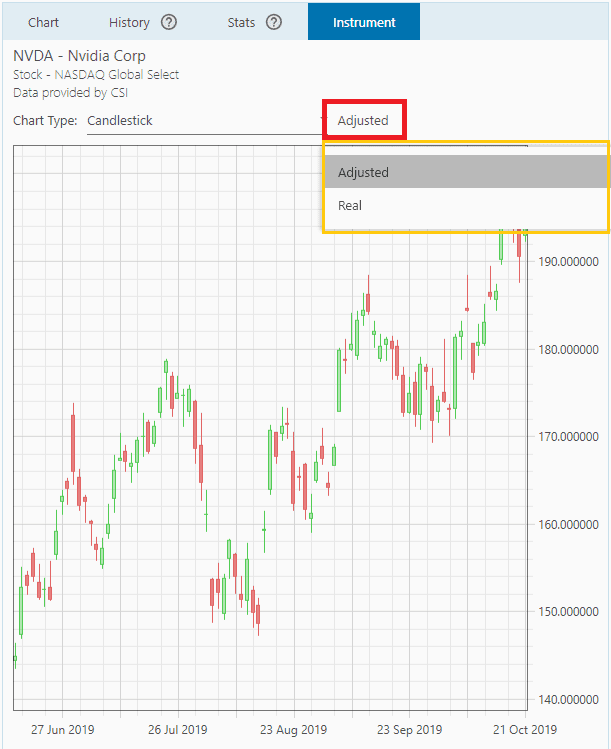

The price used here is the “real” closing price of the instrument, as opposed to the “adjusted” closing price (refer to this page to know the difference between “real” and “adjusted”). You can display “real” or “adjusted” price by going to the Instrument Tab.

Report

Block Member?

Please confirm you want to block this member.

You will no longer be able to:

- See blocked member's posts

- Mention this member in posts

- Invite this member to groups

- Message this member

- Add this member as a connection

Please note: This action will also remove this member from your connections and send a report to the site admin. Please allow a few minutes for this process to complete.