Portfolio Threshold Filter

This filter exists only as a Buy Filter. It looks at a Portfolio, and if at least N percent of the Portfolio is accepted by the Buy Filters (other than this Buy Filter we're talking about), as long as they don't hit the Sell Filters as well, then the Portfolio is allowed to be traded.

In other words, this filter sets the minimum number of instruments that a Portfolio must be able to trade.

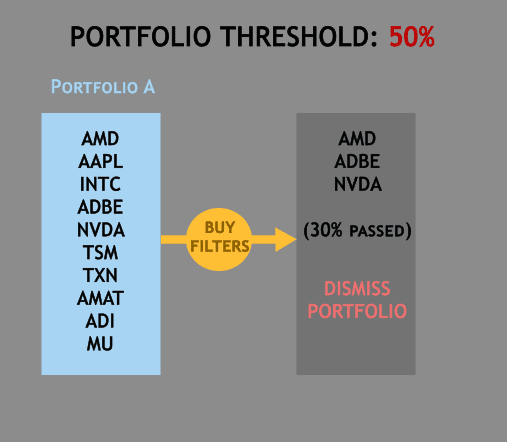

For example, the minimum amount is set to 50%: if a Portfolio is only able to pass 30% of its instruments through the Buy Filters, then that Portfolio will not be traded at all.

But note, if a Portfolio passes this minimum amount, and then a few days later some of its instruments hit the Sell Filters thus the Portfolio is trading at less than the minimum percentage, the existing Positions will still be maintained.

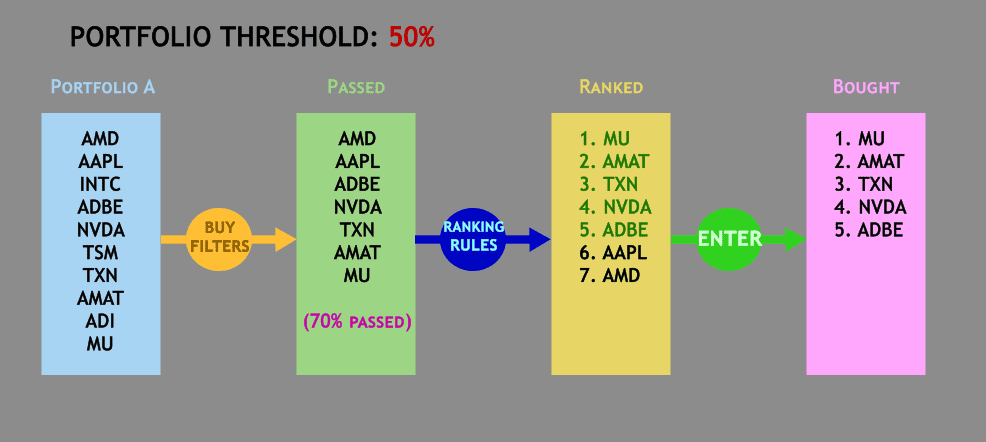

Also note that despite passing the minimum percentage, not all of those instruments (that passed the Buy Filters) will be entered as Positions.

The strategy will only allow x amount of Positions at any given time (set through the parameter “Total Positions to Hold”) after they have been ranked by the Ranking Rules (only top x instruments will be entered as Positions).

The purpose of this filter is to see whether a Portfolio is profitable to be traded before actually committing to it. Let's say the market is at the end of economic recession, and you want to know whether the Technology Sector is profitable to be traded.

If more than 50% of the Technology Portfolio's instruments passed the Buy Filters, then you can be confident this sector is profitable during the market cycle. Because if just one or two instruments passed, it could be just a fluke for the whole Portfolio.

Note that all Portfolios within the strategy will be checked whether they pass this percentage amount.

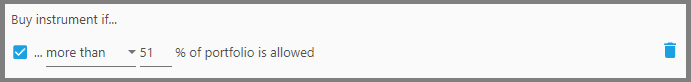

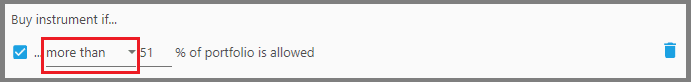

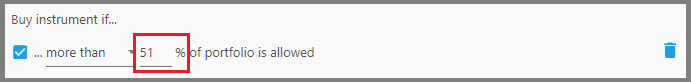

1. The first parameter defines whether the Portfolio must pass “More than” or “Less than” the threshold percentage. Generally, you always want to set this to “More than”.

“Less than” can be useful for example if you want to trade a Portfolio that is highly risky, but only a small percentage of it, as part of diversification.

2. The second parameter defines the percentage threshold that these Portfolios must pass.

Report

Block Member?

Please confirm you want to block this member.

You will no longer be able to:

- See blocked member's posts

- Mention this member in posts

- Invite this member to groups

- Message this member

- Add this member as a connection

Please note: This action will also remove this member from your connections and send a report to the site admin. Please allow a few minutes for this process to complete.