Correlation Rule

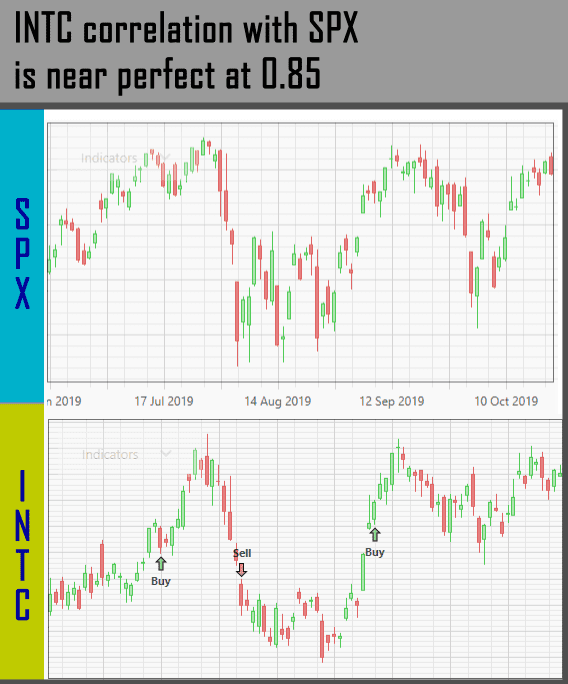

This rule ranks your instruments based on how correlated they are to an index. In other words, if an instrument moves perfectly in line with the index (whether up or down, and by the same amount) then the instrument has the highest correlation score, and vice versa.

Do note, you can specify not just an index as the yardstick, but another instrument as well. For example, if you know an ETF performance is steadily gaining, and you want to look for stocks that mimic this behavior, you can input that ETF's symbol in this filter.

But beware, ETF or other stocks have a more variable performance than an index, so your strategy may not stay true for the longer term.

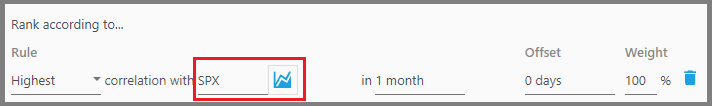

1. The first parameter defines whether you're looking for instruments that have the “Highest” correlation with an Index, or the “Lowest” correlation.

2. The second parameter defines the index that you want to compare against. Simply type in the symbol in here. There's also a little “chart” icon next to this parameter, which brings you to the Price Chart for that index.

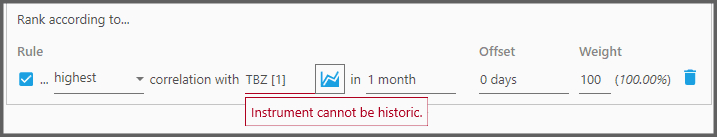

You can actually input instruments other than index here, like an ETF. But make sure that instrument isn't delisted (indicated by square brackets suffix containing a number), otherwise there's a warning and the strategy can't be backtested:

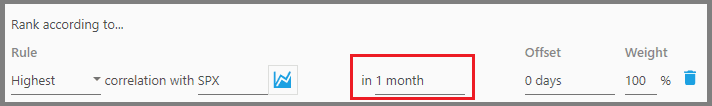

3. The third parameter defines the period for calculating the correlation score (note, an instrument's correlation with an index continuously changes).

Note

Regarding the “Offset” and “Weight” parameters, please refer to the guide about Ranking Panel.

Report

Block Member?

Please confirm you want to block this member.

You will no longer be able to:

- See blocked member's posts

- Mention this member in posts

- Invite this member to groups

- Message this member

- Add this member as a connection

Please note: This action will also remove this member from your connections and send a report to the site admin. Please allow a few minutes for this process to complete.