Lowest Close Index Filter

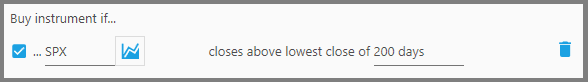

This filter looks at an index's lowest closing-value during the past certain period, and if the Index's latest closing-value is above that lowest close, you're allowed to enter Positions. In essence, whether or not you will trade your Portfolio is based on the Index's closing-value, so preferably your Portfolio is related that Index.

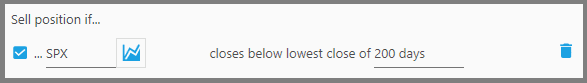

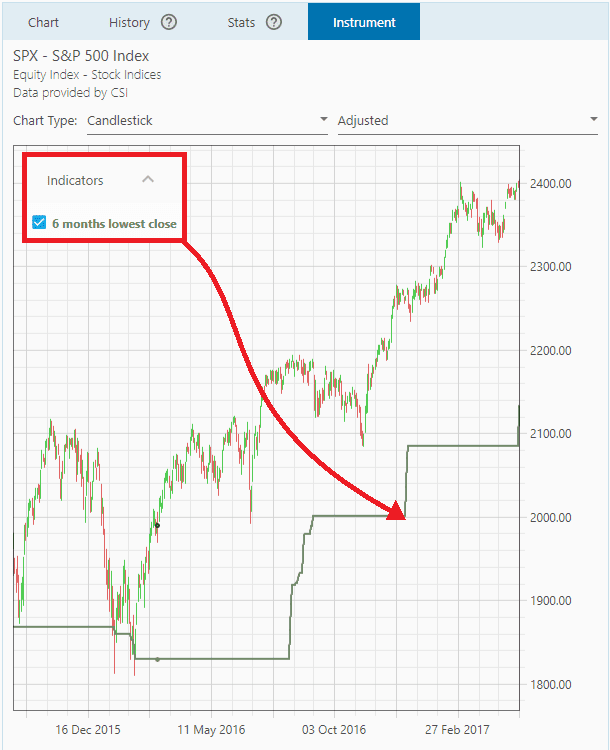

For example, if the Index's last closing value is $2147, well above $1829 which was the lowest close of the past 200 days, then the index is likely in an uptrend, thus instruments in your Portfolio will be considered to be bought since they too are likely in an uptrend.

This filter is good as a last defense mechanism before entering Positions, that is, you're looking at the market condition before you enter the Positions. But since the criteria is too loose for entering a Position, you must use this filter in tandem with other filters to constrict the criteria even more.

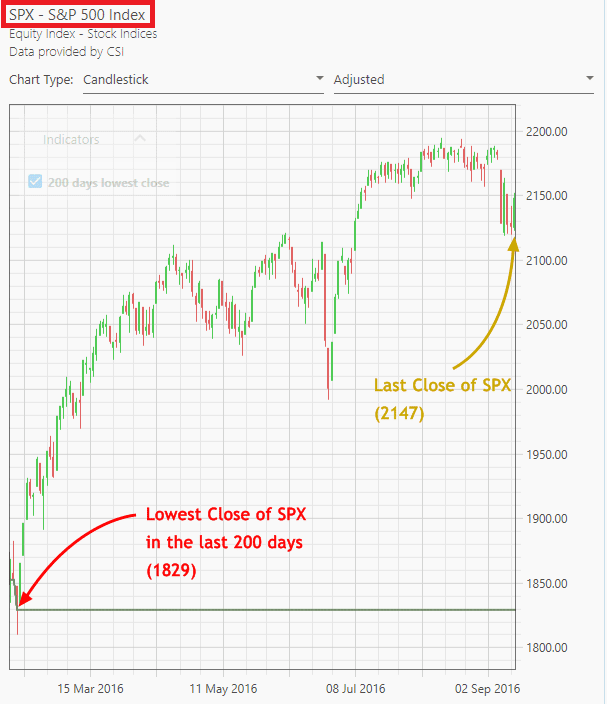

With that being said, it actually makes more sense to use this filter as a Sell Filter, i.e. a stop-loss for your Positions. When used as a Sell Filter, it will look whether the Index's last close is “below” the lowest close (instead of “above”), and if it is, then the strategy will exit all your Positions.

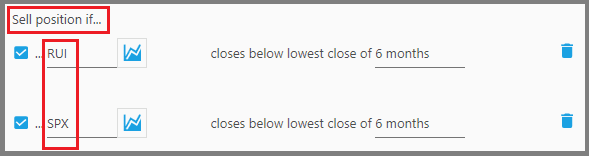

This is a good way to be on the safe side, since the Index generally resembles your Portfolio. So if it goes downward you know your Portfolio will go downward too (systematic risk is on the way, so get out of the market). For even better protection, you may add this filter more than once, with each filter covering a different index.

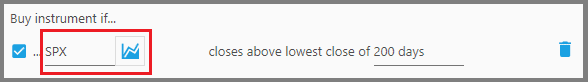

1. The first parameter defines what index you'd like to watch for. You can also input other types of instrument here, like ETF.

You can click on the little “Chart” button next to it, to show the index's price history (on the Instrument Tab). The chart is overlaid with the Lowest Close indicator.

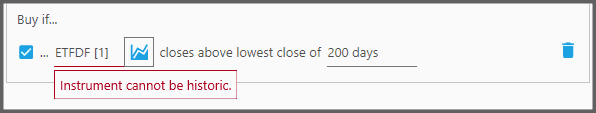

Now keep in mind, you can't enter a delisted instrument here (those indicated by a number suffix inside square brackets). Otherwise a warning appears and you can't backtest the strategy:

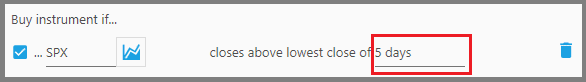

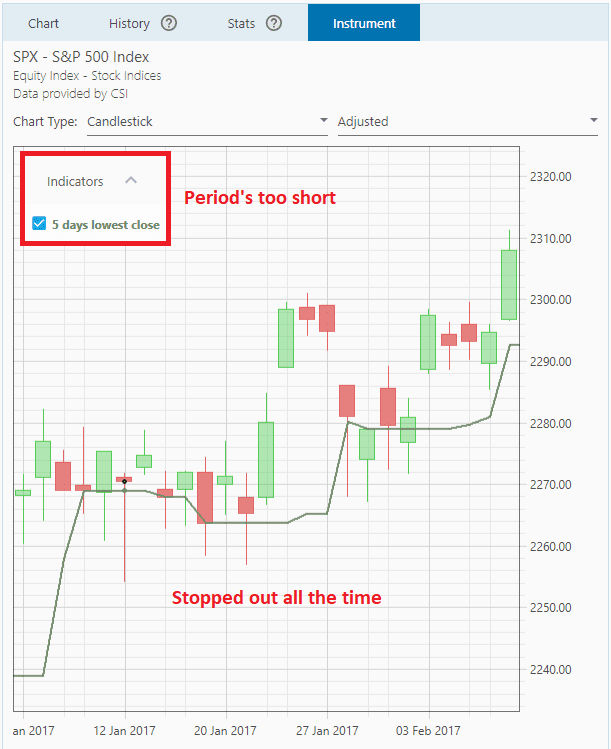

2. The second parameter defines how many days (or months) to look back for the index's lowest closing value.

Changing this parameter will immediately change the Lowest Close indicator on the chart.

Keep in mind you don't want a very short period set in here, as you'll get stopped-out all the time with false signals (the index just swings up and down its usual daily range). A 6-month period is the norm here.

Report

Block Member?

Please confirm you want to block this member.

You will no longer be able to:

- See blocked member's posts

- Mention this member in posts

- Invite this member to groups

- Message this member

- Add this member as a connection

Please note: This action will also remove this member from your connections and send a report to the site admin. Please allow a few minutes for this process to complete.