Profiting During Times of Turmoil

Corona Del Mar, CAHowdy Friend!

2022 has been off to a rocky start for stocks.

If you had invested in the leveraged S&P 500 ETF (SSO), you'd be down 27%. |

On the other hand, if you broadened your horizons to include trading bonds, gold, commodities, and inverse funds...you'd be up 23% as of today. |

As you might imagine, trading the commodity ETF (DBC) has been the big winner for the model portfolio.

Look at this series of trades:

I just paid $7/gallon for gas yesterday.It sure stung a lot less knowing that I could haul in a small fortune as gasoline and other commodities explode higher.

During times of turmoil, it really pays to trade in markets outside of stocks.

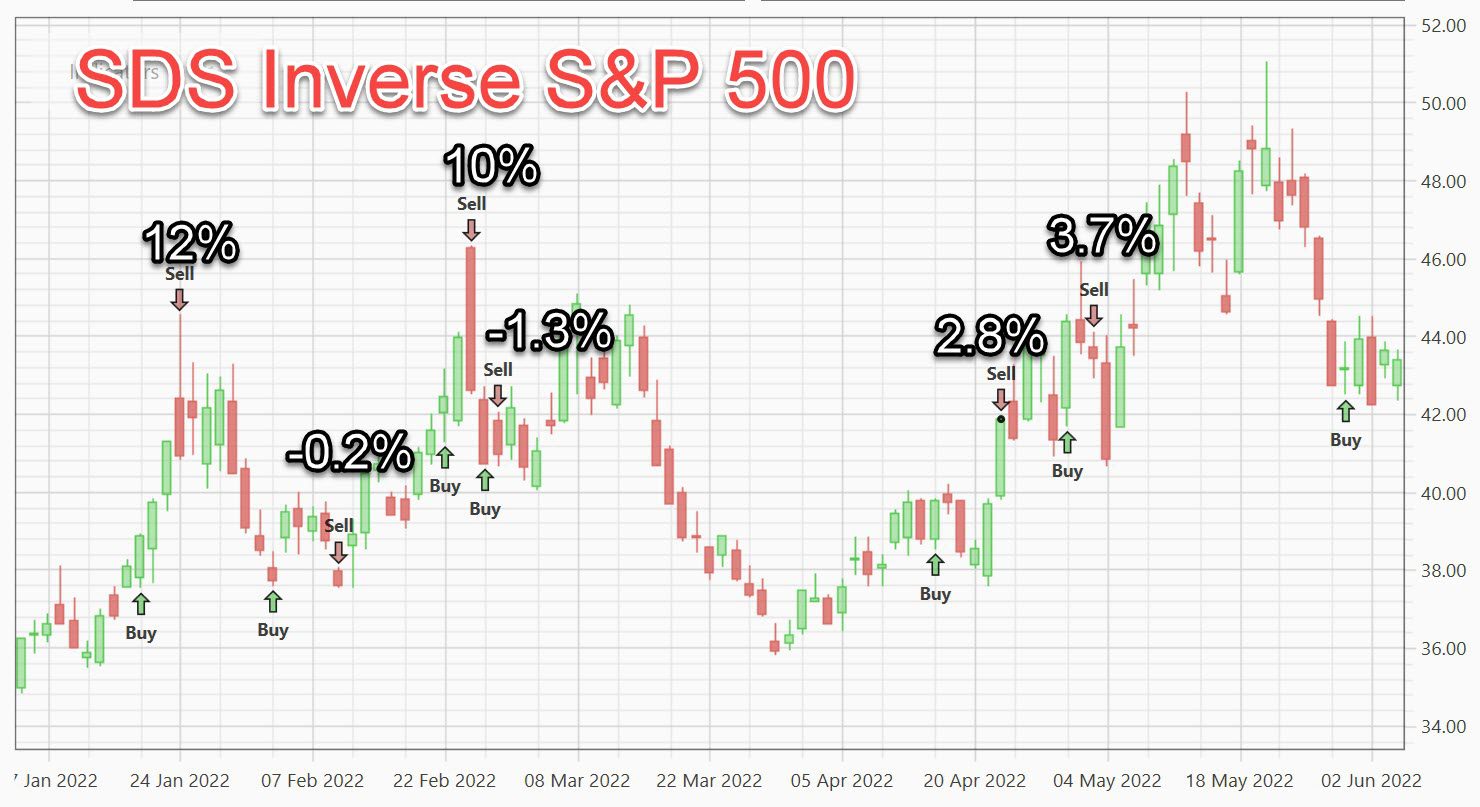

It also pays to trade inverse funds like SDS that go up when the S&P 500 goes down.

Check out this series of trades using SDS: |

Now you can cheer as stocks go down. And oh boy do stocks fall faster than they rise!

There are three main lessons to be learned from this style of trading:

- Trade the markets up and down. Use inverse ETFs. That way you're not married to which way the market goes.

- Trade several asset classes. Ray Dalio made billions by investing in stocks, bonds, gold, and commodities. Investors in his fund love the stable returns.

- Understand that the markets are crazed and insane! Just look at what happened with Gamestop. The players in the trading game are completely irrational. They create huge trade imbalances that allow you to buy low and sell high all the time.

If you want to understand how to discover value and spin these short-term imbalances into gold, then read this article >>

It all boils down to this simple formula that you could write on a post-it note:

Listen, we live in a crazy world...

- there are shortages in basic goods a la USSR in the 80's.

- gas prices hit $10 per gallon in Northern California.

- the "Cash me outside" girl made $50 million from Onlyfans.

While you can't change these things, having extra money in your pocket sure helps.

Don't get mad...get even.

|

|

|

Wondering how to get started?

Step 1: Looking for more consistent profits?

Get a free copy of my book: Artificial Intelligence, Real Profits here >>

Step 2: Want to build a trading strategy in under 10 minutes?

Watch this free training video >> (Scroll down the page)

Step 3: Want A.I to build tailor-made trading strategies for you?

A.I is beating people at just about anything related to numbers and data. Nearly every billion-$$$ hedge fund now uses A.I to boost profits.

Watch a demo of The Boss "SuperAi" Strategy Builder as we harness the raw power of 3500 computer cores and strong A.I.

During the presentation, you'll learn: How to Generate Consistent Retirement Income Using "SuperAi-Designed" Trading Strategies. Click here >>

Step 4: Looking to discover new trading ideas to help grow your nest egg?

Online training to vastly improve your trading with A.I.

Watch the podcast >> | Read the blog >>

Step 5: Additional Resources

The Relaxed Investor (The simple strategy proven to work since 1926. Downloaded by over 200,000 readers)

The Ghost of Bernie Madoff is Not Yet Dead (Is your broker on the naughty list? Many traders have no idea they're being sold out)

The Ultimate Crash Detector (The strange weekly report that helps predict crashes. LIVE trading signals since 2006)

Portfolio Boss User Guide (Our flagship strategy building platform User Guide. See what it can do to help you on you quest for F U money)

Trading With Other People's Money - Coming Soon!

Bit-coin for Busy People (How to get started with Bit-coin in under an hour without the complicated new exchanges, high fees, and complicated wallets)

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses