Attention: Traders looking for a 100% PROVEN source of steady

Attention: Traders looking for a 100% PROVEN source of steady

income whether we see inflation, deflation, boom, or bust

$100 Gas!?

Use this Simple 2-Step True Asset Price Prediction Formula…and You Could Immediately Start Unleashing a Bonanza of Steady Profits Even if Inflation Soars, Stocks Crash, or Interest Rates Skyrocket!

Billionaire Trader Paul Tudor Jones Says:

“You can't think of a worse environment than where we are right now for financial assets. Clearly you don't want to own stocks and bonds.”

“If someone put a gun to my head, I'd say [algorithmic] strategies. They will probably do very well in the next five to ten years.”

Dear Self-directed Trader,

Jeez, have you filled your tank with gas lately?

It’s not pretty. In fact, we haven’t seen inflation like this since the early ‘80s.

But while most Americans are feeling the pain at the pump — and everywhere else…

You could be part of small group of insiders that are on track to double their money this year.

They don’t own oil wells or gas stations.

They’re not selling or leasing the equipment for drilling.

In fact, they’re not connected with the oil industry at all.

Their Secret Weapon…

These are ordinary traders like you and me, but they have a “secret weapon” that lets them take advantage of economic change, such as stratospheric gas prices.

And if the price of gas ever goes back down, they could make money from that, too.

In fact, it’s not just gas. These traders are cashing in on gold, metals, wheat, and other commodities WITHOUT trading the volatile futures markets.

They can spot safe, modest trades that are virtually guaranteed to turn a healthy profit over time — as sure as thunder follows lightning.

They’re cleaning up — buying commodities, blue chip stocks, bonds, and gold at fire sale prices—and then selling them a week or two later for inflated profits.

My name is Dan Murphy, and I’ll introduce myself fully in just a moment, but first I need to get something off my chest.

The REAL Problem…

You see, all the news you’re hearing about inflation is just a symptom of something that has been happening on Wall Street every day for the last hundred years…

…and it will keep on happening forever.

I’m talking about people paying too much—or too little—for every asset that has ever been bought or sold.

If you could see the true price of a stock, crypto, or ETF and compare that to the price everyone was currently paying, your path would be simple.

All you would have to do is buy whenever something was selling below its True Asset Price (TAP)…

And sell whenever buyers were rushing to pay more than it was worth.

You might not always find huge trades, the kind that would double or triple your stake overnight.

But imagine gaining 2%, 5%, or even 10% month after month.

It starts to add up.

Proof: Pure Stupidity

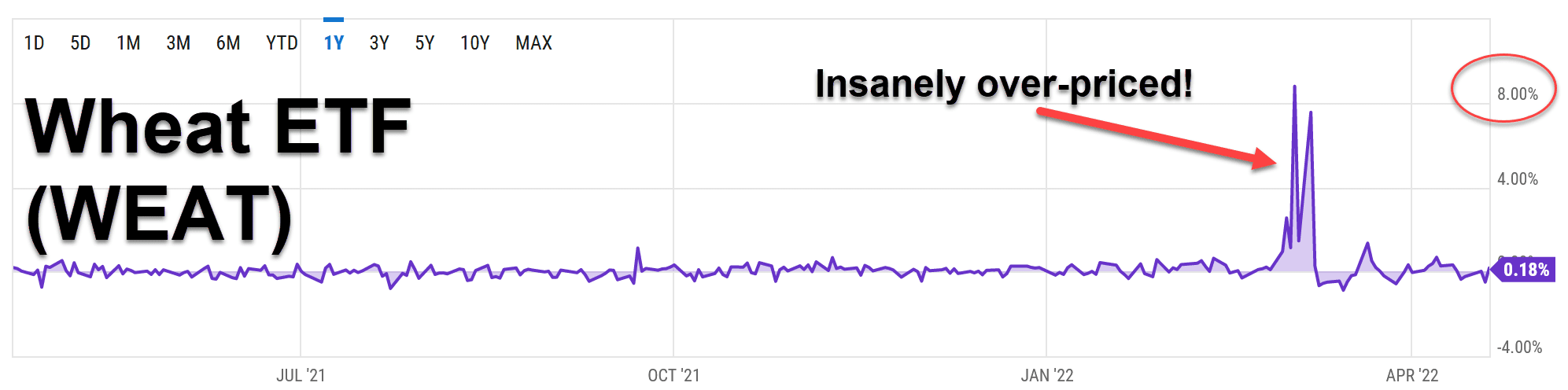

Here’s a chart that shows you how irrational traders can get…

You've probably heard by now that there are supply problems with food.

Well, there was such a stampede for wheat that the Wheat ETF (ticker: WEAT) was selling for 8% more than it was worth!

Take a look:

Would you pay 8.77% more for bread when you could easily buy a loaf from the store across the street?

This is pure stupidity from traders willing to get in at any price.

They failed to look at a simple number which makes it clear when you’re overpaying!

I’ll tell you what this number is shortly. But let’s look at how these blind trades usually turn out.

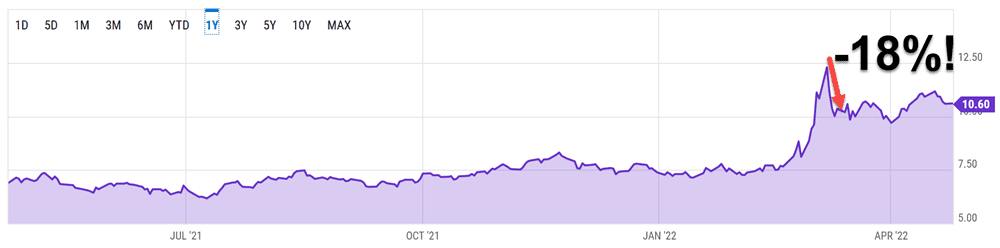

Within a week, the price had fallen 18%.

Now, imagine you had a clear “buy signal a few days before WEAT shot up in price…

And a clear signal to “sell” a short time before the drop.

The “signal” is nothing more than objective knowledge about the True Asset Price.

Once I show you how to do this, you can find amazing deals every week.

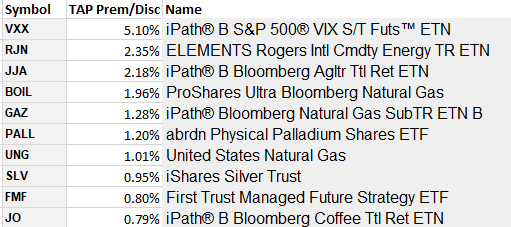

Here's a recent list of the ETFs selling at the biggest discounts.

It's common to see discounts of 1.5%, 2%, and even 5%.

On the flip side, you absolutely don't want to buy ETFs when they're over-priced compared to their holdings.

Take a look at this list. If you bought any of these ETFs, you'd be paying well over sticker price.

There are over 100 million ETF traders and investors…and I'd wager the vast majority have no idea their favorite ETFs can trade so out of whack to reality.

Members of a small elite circle of traders are using this TAP data, and mixing it with a secret weapon I call “TAP Income”…

…to make consistent profits in just a few minutes a week.

I'll reveal how you can calculate this TAP formula in just a minute.

First, let’s look at what this means for you.

Let’s say you start with a $50,000 portfolio….

You make a few trades, following the “green light, red light” TAP strategy I’m about to share with you.

At the end of the month, you’re up 3%.

You’ve made $1500 by spending just a few minutes a day placing orders for modest, relatively safe trades.

But if you do that for six months, your portfolio is now worth $59,702.61…

At the end of the year, you’ll have $71,288.04…

Within two years, you will have almost doubled your money…

And in 5 years you’ll have $294,580.15.

At that point, bad economic news almost doesn’t matter anymore.

The latest inflation numbers, the chaotic swings on Wall Street, the collapse of the supply chain, the war in Ukraine, and the meteoric rise in prices…

All of these things can create a bonanza for the people who use TAP Income to take advantage of these events.

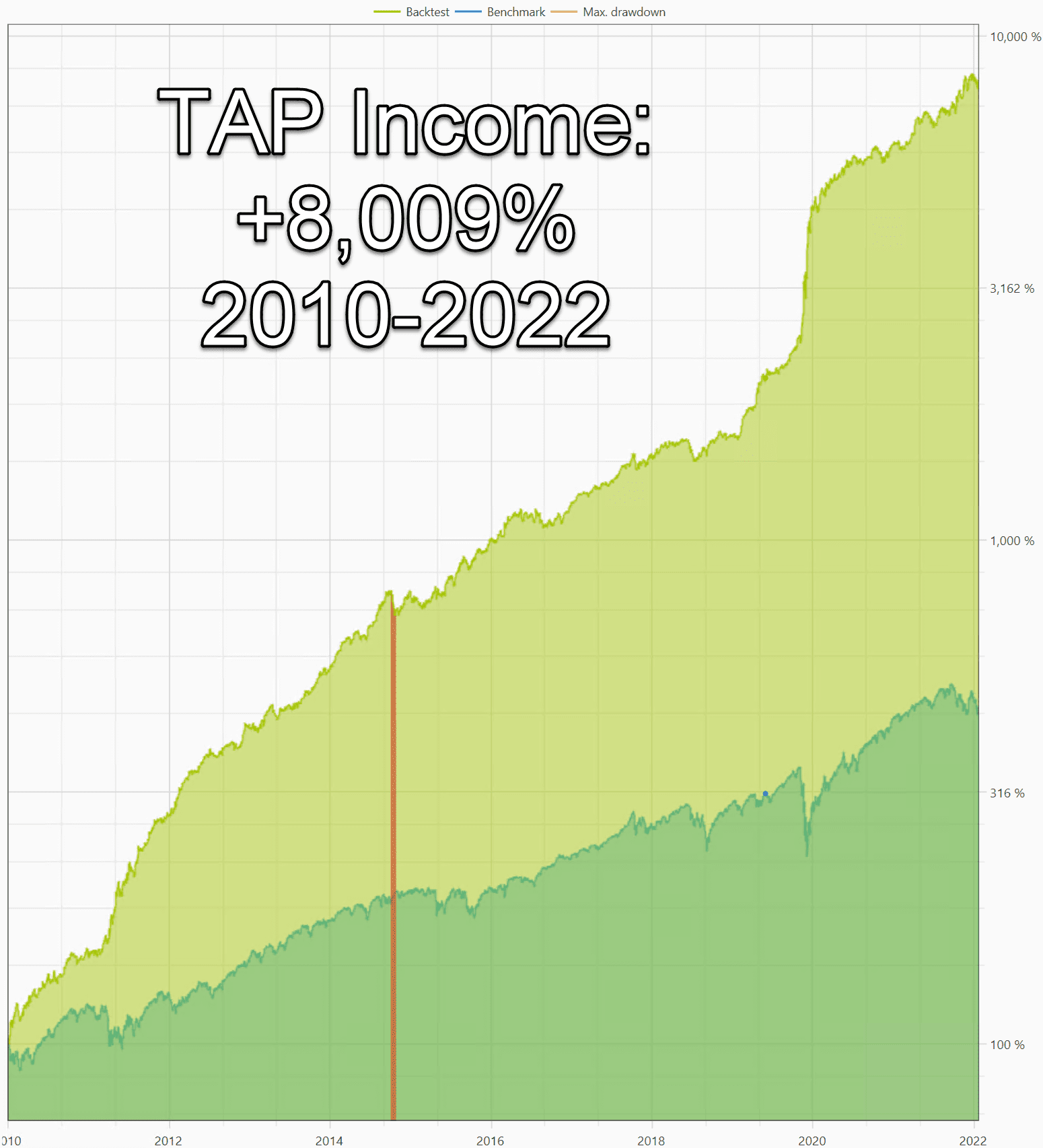

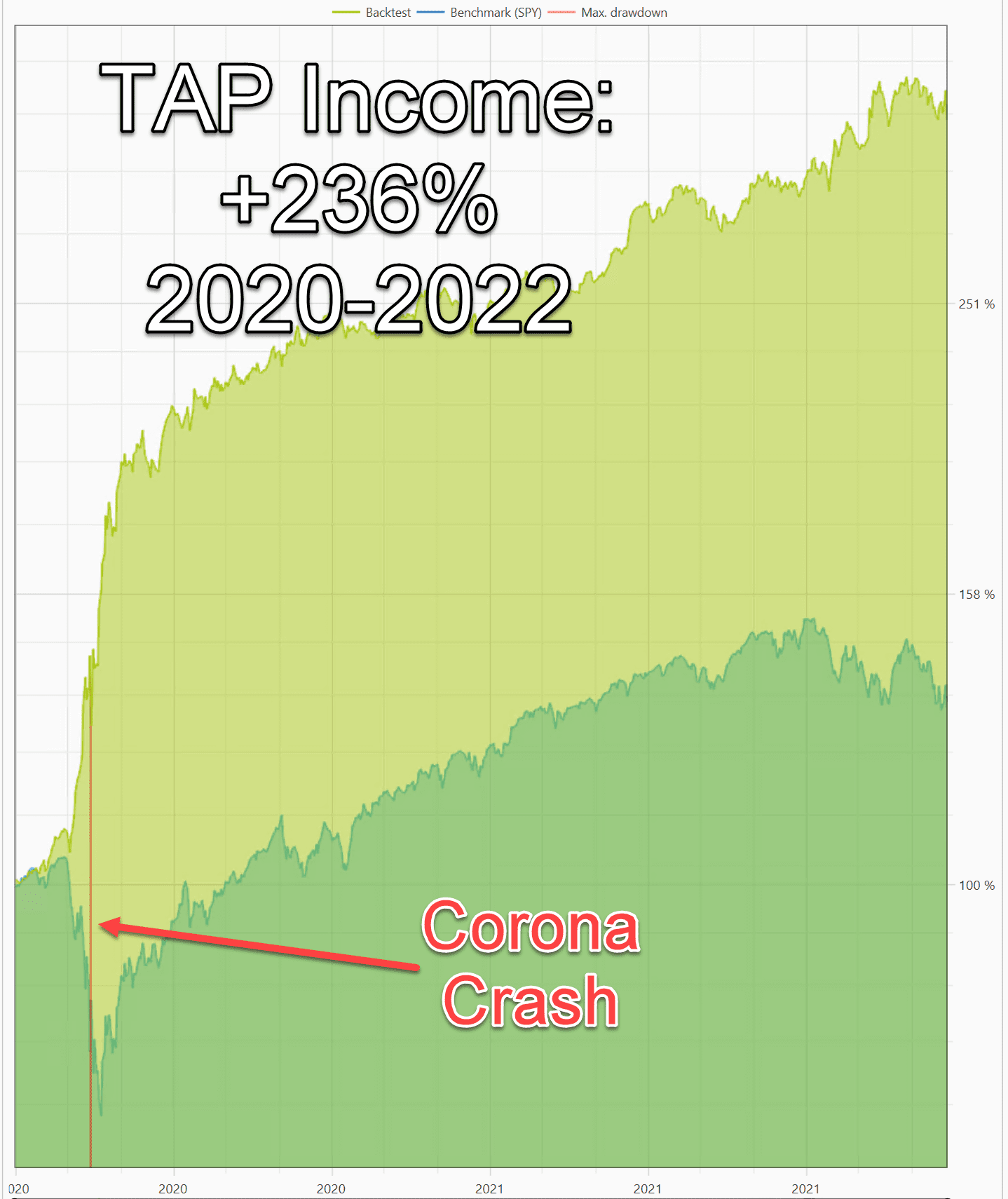

Here’s an example of TAP Income in action:

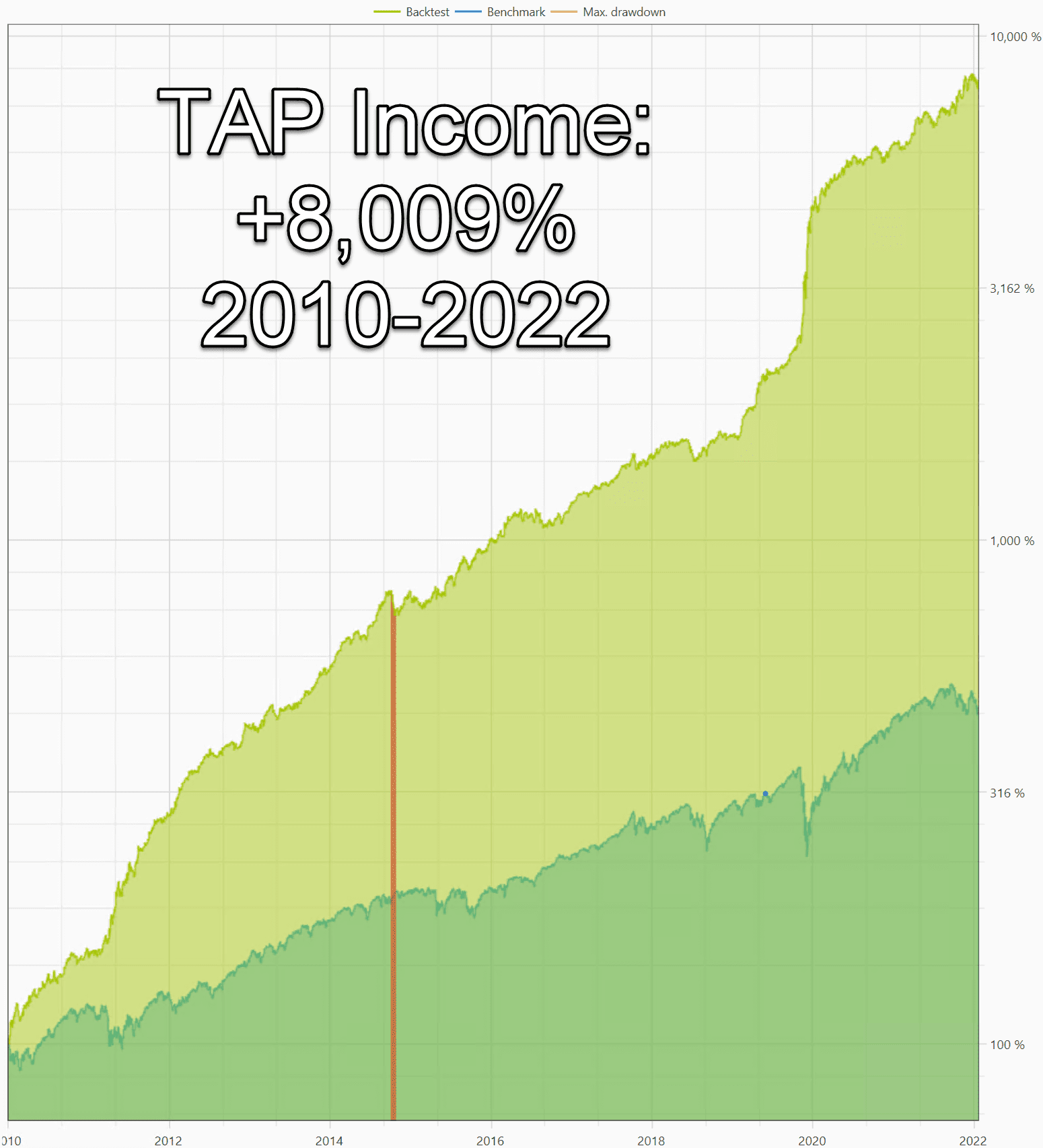

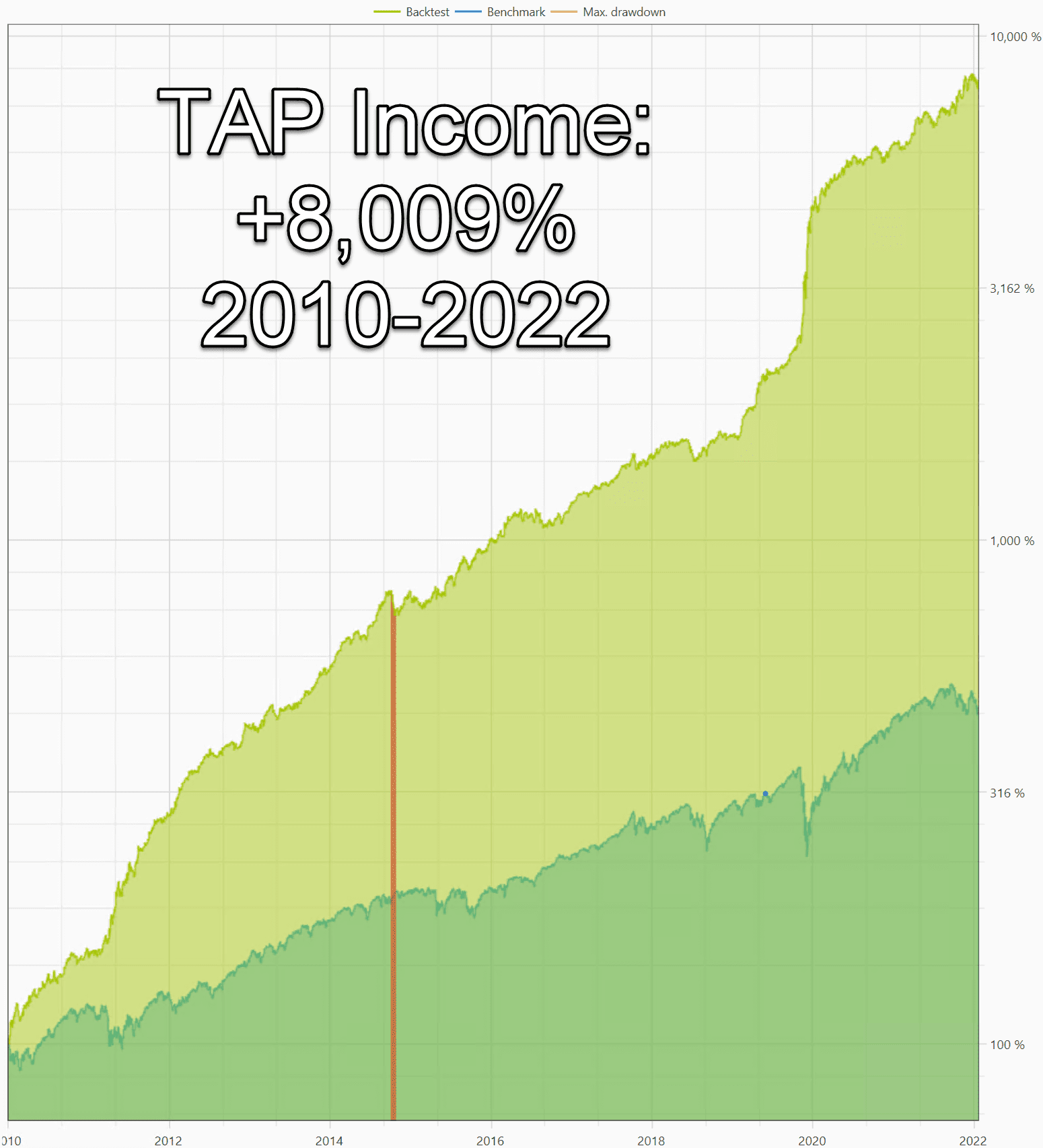

The dark line shows the S&P 500 from 2010-2022.

In that time it has gained a respectable 452%.

The lighter line shows the TAP Income historical test.

Over the same period, history shows an 8,009% gain before trading fees.

Notice how the strategy saw massive gains (122%) during the 2020 Corona Crisis as the stock market tanked.

That's because it can make more money when stocks go down.

As you can see, TAP Income is currently at new highs while the stock market has been dropping.

I’m showing you this because I want to make sure you understand what’s possible.

It’s possible to make a profit when inflation is out of control.

It’s possible to make a profit even when assets are falling off a cliff.

There’s a way to make profits no matter what the stock market is doing.

In fact, this is the only way you can repeatedly beat the market and retire with safe and consistent cash flow.

A few years ago, getting your hands on a system like this would have been impossible.

But now, thanks to some carefully guarded breakthroughs, you can access the only strategies that create these kinds of profits on request.

I know this system doesn’t exist anywhere else because I built it myself.

Now, there are some details about TAP Income that I literally can’t tell you.

But let me reveal what I can.

How to Make 53% in a Paralyzed World Economy

It’s spooky to watch Artificial Intelligence analyze millions of trades representing trillions of dollars…

…and then come up with brilliant strategies that never would have occurred to any normal human being.

But the strategies work. Here’s an example:

You can see the losses when people started dumping stocks on news of the pandemic. (Dark green)

In just four trading days, the Dow Jones dropped 26%.

You can also see when it went back up.

If you bought almost anything in February or March, and held onto it, you could have made a nice profit within a few weeks.

But not everyone had to wait weeks or months to take a profit.

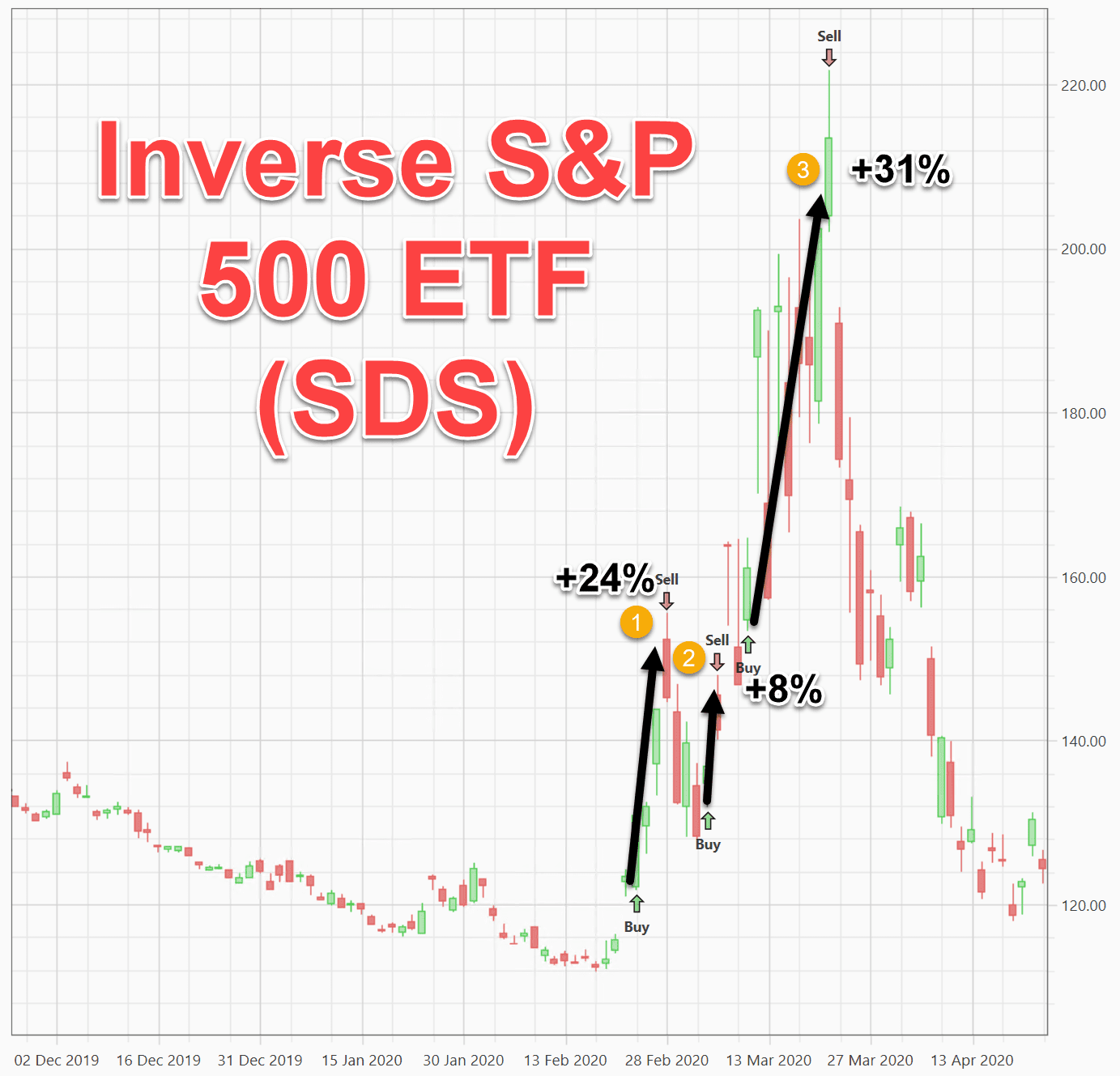

Look at this other chart that shows TAP Income. There’s March 12, when TAP Income sold out of the S&P 500 ETF and bought SDS, an ETF that makes money as stocks go down.

Schools were shutting down and people were hoarding toilet paper.

TAP Income sold SDS on March 16 for a 24% gain.

Then the market rallied. Folks were working their jobs on Zoom. The inverse ETF actually fell a little bit.

TAP Income bought SDS again, and sold it two days later for a quick 8% gain.

Then the buy signal came back, and we bought back in.

Dr. Fauci went on CNN saying the lockdown would last longer than he originally thought.

Unemployment reached new highs.

Congress voted on a stimulus package for Americans unable to go to work.

TAP Income sold SDS near the top and made 31% in 9 days.

You can see that if you were using TAP Income, your portfolio would have been up 53% for the month of March 2020.

And as the market recovered, your portfolio would have gone up some more.

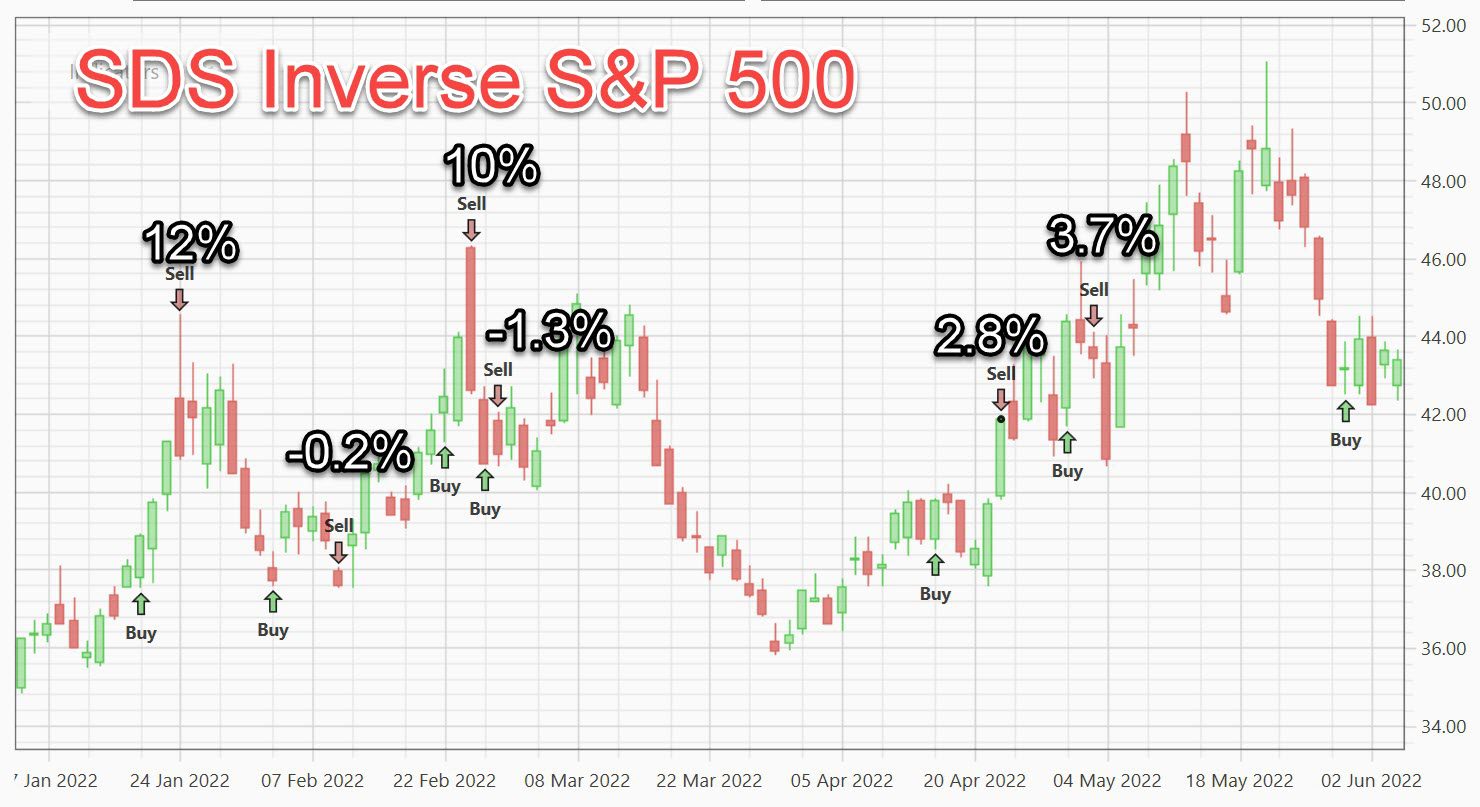

Let's look at a more recent example: 2022

Stocks have been in the toilet.

If you had bought the leveraged S&P 500 ETF (SSO) at the beginning of the year, you'd be down 27%.

On the other hand, if you broadened your horizons to include trading bonds, gold, commodities, and inverse funds…

…you could have been up 23% as I write this.

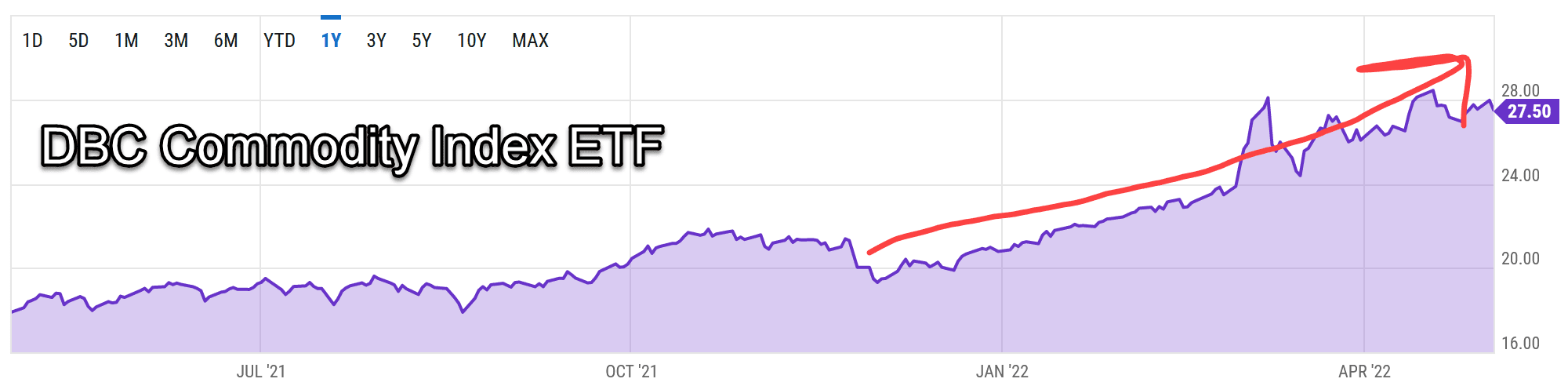

As you might imagine, trading the commodity ETF (DBC) has been the big winner for the model portfolio.

Look at this series of trades:

I just paid $7/gallon for gas the other day…

…it sure stung a lot less knowing that I could haul in a small fortune as gasoline and other commodities explode higher.

During times of turmoil, it really pays to trade in markets outside of stocks.

It also pays to trade inverse funds like SDS that go up when the S&P 500 goes down.

Check out this series of trades using SDS:

Now you can cheer as stocks go down. And oh boy do stocks fall faster than they rise!

Now, I’m not recommending you go out and trade SDS. That’s just a small part of the picture.

Plus, I haven’t even told you how to determine when to buy and when to sell.

There’s actually a lot more you need to understand about trading this way without getting burned.

The Unwritten Rule of Trading

Imagine you’re out playing golf. You’re having a great day.

You put everything you’ve got into a perfect, 300 yard drive…

And a split-second later, you hear a loud pop.

The fingers in your right-hand tingle for a moment, and a dull pain shoots up your arm.

An hour later, you’re in urgent care getting treatment for a dislocated shoulder. The doctor pops your arm back into its socket and sends you home with a sling and an ice pack.

For the next two weeks, you’re going to tell the story to all your friends. It’s something to brag about.

You see, every sport-related injury is a badge of honor.

“Nobody Wants to Look Like a Failure or a Fool”

But when you lose money in a trade, that’s a different kind of injury.

You’ll do everything you can to carry that secret to the grave.

Because nobody wants to look like a failure or a fool.

What would happen if you lost so much on a trade that it had a serious impact on your finances?

What would you say to your family?

How would you explain that you had to cancel a vacation or cut corners on the next round of birthday presents?

What would the people you love think about you if you defaulted on your mortgage?

The “unwritten rule of trading” is simple: The pain in your wallet leads to much deeper pain in your soul.

It’s no wonder that so many folks are worried right now.

It’s no surprise that many traders today are pulling their punches and cutting their losses.

The sad part is, when you become too defensive, you’ll settle for much lower returns.

Take a look at the chart below. It shows the daily percent changes in the stock market.

Notice that the biggest up days follow the biggest down days…just as sure as daylight follows the night:

Right when everything is about to launch up, you sell to stop the pain.

That’s a terrible way to plan for the future.

And it’s a shame, because the unwritten rule of trading works in reverse, too.

You see, when you make good, profitable trades, you’re a hero.

When the money is flowing in, week after week, your friends and family look up to you.

Strangers admire you.

They call you a genius.

You see, your success or failure as a trader tells the world something about you.

The beauty of this rule is you don’t truly need to be a financial wizard. It doesn’t take much to make a respectable income in today’s trading environment.

All you need is the right set of tools to stay on the winning side.

The Prince of Proof

Is TAP Income really going to work?

After all, anyone can pull a number out of their ass and tell you it’s carved in travertine marble.

I prefer presenting proof.

As a matter of fact, many people call me the Prince of Proof.

I want to show you how TAP Income worked in other situations, so I performed a historical test from 2008.

As you'll recall, that was the worst bear market since 1929.

There’s September 15, 2008 when Lehman Brothers filed for bankruptcy and the whole economy imploded.

But look at what TAP Income would have done.

It dropped a little bit, but then it took off vertically as the stock market imploded, and was making money for the rest of the year.

And as you've seen, it’s continuing to reach new highs to this day.

Of course, charts don’t always tell the full story, especially when you’re looking at a backtest.

I wanted more evidence, so I reached out to some of the people who were using TAP Income.

I was blown away by what they told me.

One of them told me he made 28% in just over a month.

These aren’t lottery-winning numbers. But they’re good enough to do right by your family.

More importantly, they’re probably better than the results you’re currently getting.

And that’s not your fault.

You’re up against an insidious barrier that stands between you and true wealth.

The Obstacles Blocking Your Income are Real—and You can Break Through them Forever

Look, no matter what you’ve tried in the past, the cards have always been stacked against you.

You’re wearing a blindfold when you trade.

You have one hand tied behind your back, and your feet are shackled together.

You see, whenever you lose money on a trade, it’s because of factors you can’t control.

Number one, you have a life.

Sure, you might make a few more bucks if you were chained to your computer all day, every day, watching the market’s every move.

But the whole point of trading is to take back your time.

To work from anywhere.

To earn the freedom to sail or golf or have lunch at a good restaurant whenever you want.

So, let’s be absolutely clear:

Nobody has the right to blame you if you miss a trading opportunity because you were doing the things you love, with the people you love.

Nobody has the right to blame you for living your life.

But the market will still bite you.

And there’s another obstacle that’s more insidious.

The Money Secret that’s Keeping You from the Financial Success you Deserve

You need to hear something before we go further.

There are a lot of powerful people who don’t want you to know about trading secrets like TAP Income.

You know who they are.

They are the technocrats, the corporate lobby, and most of all the Big Media who do everything they can to whip you into a panic.

The last thing they want is for you or me or anyone to find the secret to easy wealth.

Big Media wants to keep us living in fear and anxiety, because they have their own money secret that has always worked:

Fear sells.

If they can keep you worried, keep you afraid, they will get more views.

If they can make you anxious with every news development, you will be dependent on them.

They want to keep you scared, paralyzed, glued to the screen…

Because that’s how they sell their products…and their agendas.

But they also know that if they let you get away…

If you learn to create consistent wealth…

Providing everything your family needs…

Living your best life…

With no money worries…

They know that if you have no need for a government handout and definitely no desire for government hand-holding…

They could lose you forever.

That’s why the media will do everything in their power to keep you awake at night…

To make you second-guess yourself…

To keep you dependent on lukewarm retirement strategies that haven’t worked for the last 20 years.

Strategies that feed their institutional sponsors, large banks, and other prime market makers.

The media want to scare us all into growing old and meek on the couch, timidly seeking comfort by consuming more media, more distortions, more bullshit.

And the most insidious part of this?

If you don’t have a system that consistently brings good returns…

When you slip up and lose money on a trade…

When you’ve spent hours of time tracking the market and trying to buy low and sell high and it doesn’t work for any number of reasons…

Then you’ve confirmed their narrative.

You’ve proven that true independence is pie-in-the-sky, as the media have been saying all along.

You’ve shown that you’re a fool, and you should have listened to Dave Ramsey and Suze Orman.

You should have watched “Bulls and Bears,” like all the good sheeple do, instead of watching the market.

They want to keep you and me in our place.

Because when we lose, they win.

Well, today we have a weapon big enough to win.

The Truth About Your Future

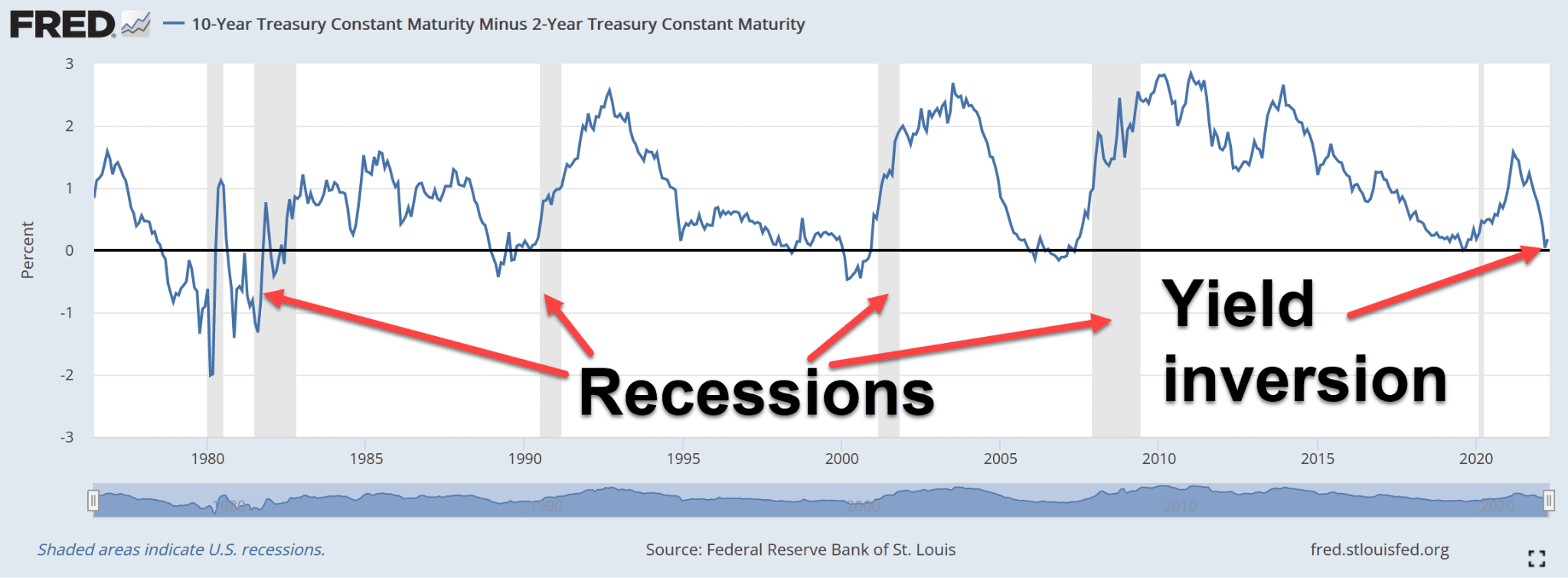

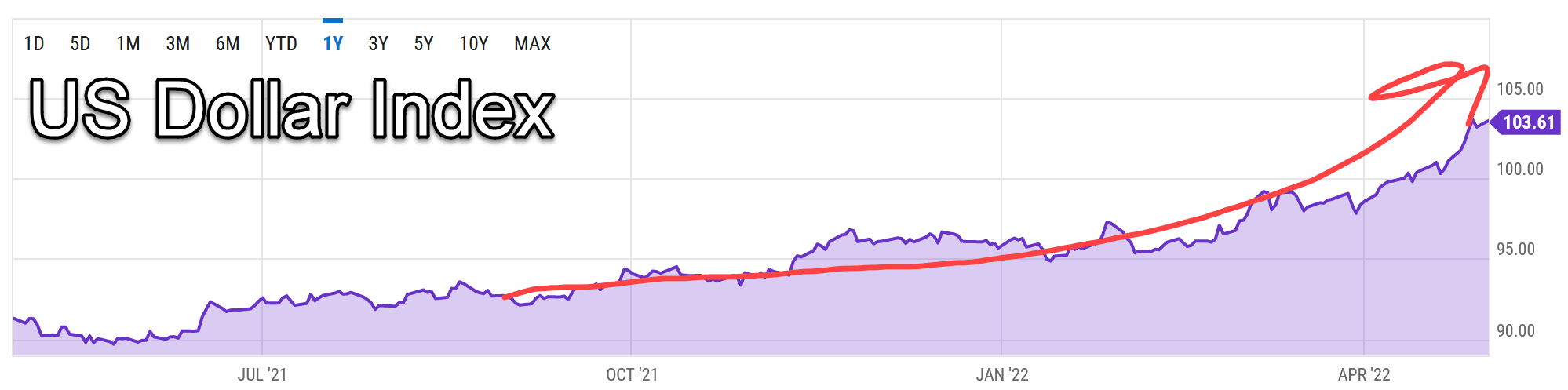

I want to show you a very important development.

It just happened recently. Take a look:

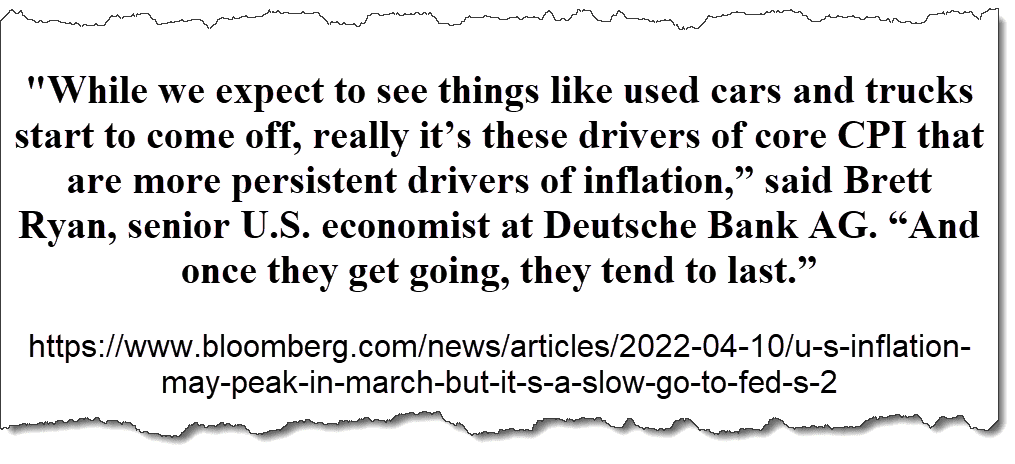

This is the yield curve of interest rates. The 10-year minus the 2-year.

Normally, the yield goes up as the time to maturity increases.

That is, if you’re lending your money for 10 years, you would expect to get a better yield than if you were lending it for just two years.

But as you can see, the yield curve was inverted for a few days, starting April 1st.

The yield curve inversion shows people are desperate for short-term credit.

This should be setting off a big red alert in your brain.

Since World War II, a recession has followed every yield curve inversion within 18 months.

This is a sign of another 2008.

In fact, the analysts at Goldman Sachs believe the next recession is coming before the end of 2023.

(Source https://www.foxbusiness.com/economy/goldman-sachs-economic-recession)

Wells Fargo CEO Charlie Scharf said there was “no question” that the U.S. economy is heading toward a recession.

But there’s one thing that could be worse than a recession in the next 18 months…

A recession combined with inflation.

A recession with inflation, where incomes are plummeting while the price of virtually everything is rocketing to the stratosphere.

When businesses are shutting down, jobs are disappearing…

And profits are evaporating.

A recession with inflation would lead to a perfect storm of misery which we haven’t seen for decades.

And the possibility of inflation plus recession brings up an important question:

How much did it cost, the last time you filled your tank with gas?

We haven’t seen inflation like this in 40 years.

And this time it’s not going away.

Forty years ago, America was still the most productive country in the world.

Our only real competitor was a communist regime that was already starting to crack.

Forty years ago, most Americans had money in the bank. The average working American could buy a home and pay off the mortgage before they retired.

Forty years ago, the deficit was a quarter of what it is today, and we had much better prospects for making up the difference.

Forty years ago, we were stronger, more resilient, and we had far more resources to fall back on.

Forty years ago, inflation was a cyclical problem which was bound to fix itself.

Not today.

Today, all our goods are made in China and shipped to us through a failed supply chain.

Today, our rivals inhabit every corner of the globe. Many of them lurk in the shadows, and most of them don’t play by the rules.

Today, we don’t know where the next threat is coming from.

Today, the average working American can’t afford to buy a home.

Today, America is more vulnerable than ever before. And things are about to get worse.

The truth is hard, but it’s crystal clear:

Either you find a way to take control of your finances…

A way to take advantage of inflation and instability…

Or inflation will take advantage of you. This time, you could lose everything.

Or, you might be able to resolve all your financial worries, once and for all.

The Dumbest Trade of my Life…and it Eventually Paid Off Big Time!

It’s about time I introduce myself.

I’m Dan Murphy, and I’m almost too embarrassed to tell you this story.

But it will help you understand how I’ve managed to turn ordinary traders into market-beating wizards.

So here it is.

More than 25 years ago, I paid a taxicab driver $19.95 for a flimsy paperback book about how to sell naked call options.

Of course, not once did I think to myself that this book wasn’t the real deal. (Isn’t it wonderful to be young?)

Not once did it dawn on me to ask him why, if this book was really that great, why he wasn’t in the trading business for himself.

Not once did I step back and wonder why this guy wasn’t a filthy rich millionaire.

The truth is, I wanted to believe.

I wanted to believe in a silver bullet that would remove all the stress and uncertainty around trading.

Many traders are like gamblers in this way.

They spend their whole careers looking for that secret edge.

Some of them think they can discover knowledge that other traders don’t have. Many of them look for a pattern, a theory, or a formula that will give them the upper hand.

Like most gamblers and traders, I thought I just needed one big play or one lucky stroke.

So, I threw away 20 bucks, which was a lot of money for me back then.

But here’s the thing. Buying that worthless book was part of my obsession to leave no stone unturned. Fortunately, I’ve always been the kind of person who digs deep and looks for facts.

And because I was relentless in my search, I eventually discovered great traders and their secrets.

I Had to Almost Die to Bring You this Secret

Over the years, as I did my research, I started to make more money.

Through a series of lucky events, I was able to join one of the original Turtle Traders, where I absorbed a graduate degree’s worth of information in just a few short years.

Soon I was building strategies that worked. I wrote about this in The Relaxed Investor (2013), one of my books which have collectively had more than 500,000 readers.

With the money I made, I was able to hire programmers and use a computer to do the calculations for me.

I probably would have continued to get rich quietly, and you would never have heard about me.

But then, on a sunny day in Newport Beach, CA, my girlfriend and I were blasting ‘80s music in my Range Rover.

I noticed something out of the corner of my eye… and then…

BAM!

The cabin exploded in smoke and debris as the side airbag exploded like a right hook from Mike Tyson.

I tried to inhale, but my lungs didn’t work.

For a second, my life flashed before my eyes. Was this how I’d go out? Crushed to death in a car crash? What about all my dreams?

Suddenly, my lungs remembered how to inhale, and I began to breathe in what smelled like air mixed with gasoline.

I didn’t care. I was alive!

Over the next few months, I was able to really do some self-introspection.

I decided I wanted to concentrate on creating trading software to help tens of thousands of everyday traders like myself make money for themselves and their family.

I decided that when I punch my ticket to the big house in the sky, I’d leave the world a better place.

So I reinvested my trading and business profits — and several thousand hours of my time — back into my company to the tune of $4 million.

Here's a screenshot of just one of just one of the companies I use to pay freelancers:

Fast forward to 2020, and that tool had finally arrived in the form of Artificial Intelligence (AI) mixed with supercomputing technology.

The multi-million-dollar network, which I called “The Boss,” enabled many of my students to weather the Covid pandemic.

In fact, as I showed, they were able to make great trades while most people were hunkering down, or even losing money.

It’s time to explain how they did it.

Harness the Power of a Lightning Bolt

Imagine you’re sitting in your house during a thunderstorm.

Suddenly you see a flash of lightning.

You know what’s coming next.

It might take a second, 5 seconds, or even 10 seconds.

But you know you’re going to hear the thunder soon.

This isn’t about predicting the future. Thunder and lightning happen at the same time. It just takes longer for the thunder to reach you, because light travels much faster than sound.

It’s the same with markets.

Remember how I showed you that assets are routinely overpriced and under-priced?

It’s time to look at this in more depth.

An ETF, as you know, is a basket of stocks, bonds, or other assets.

Sometimes, the price of the ETF is a lot higher, or a lot lower, than the assets it contains.

But the market corrects itself, usually in a matter of days.

So after you buy an under-priced ETF…

You just sit back and wait until everyone else pours their money into it.

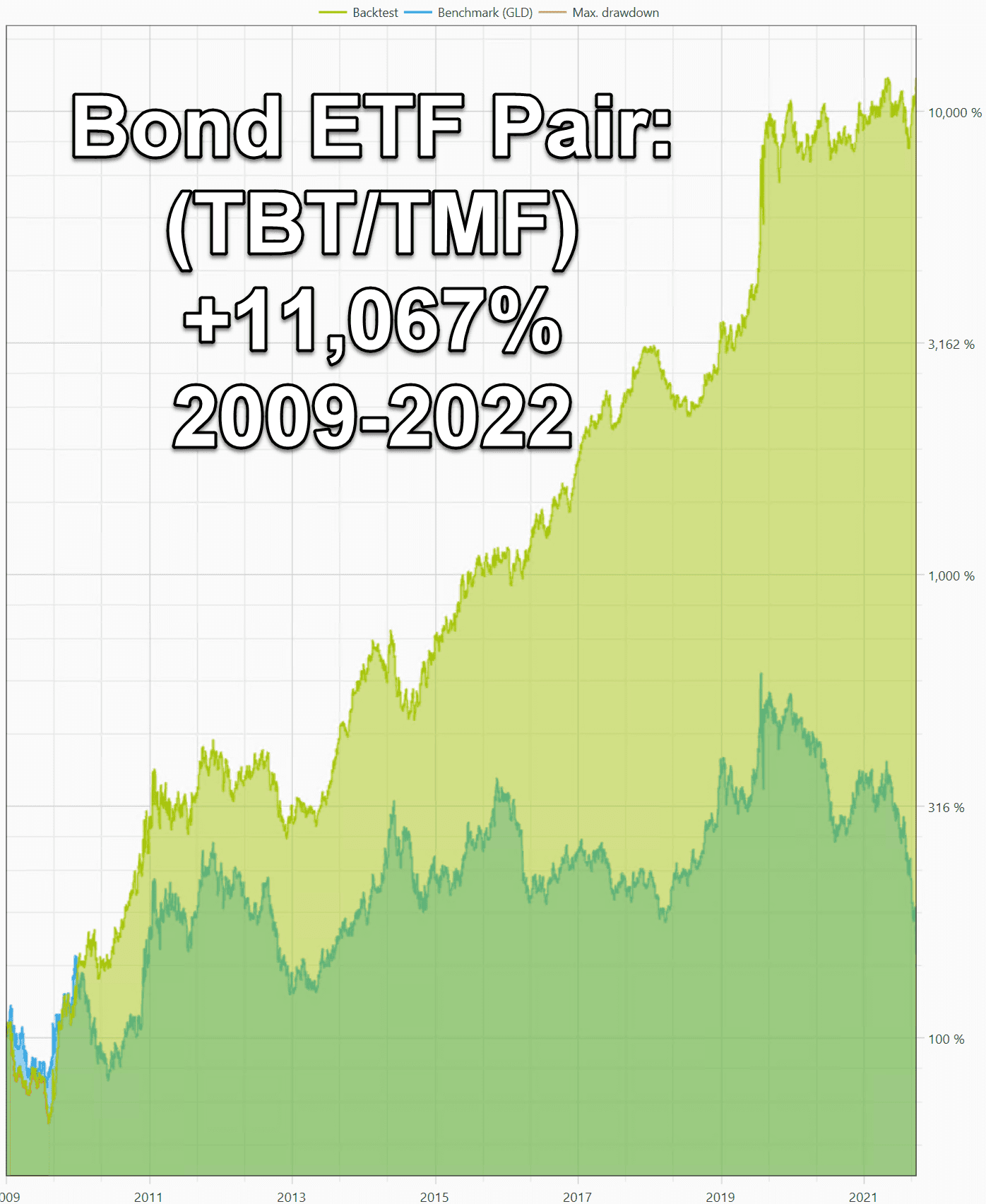

Look at this series of trades in the supposedly “boring” bond market.

This was during the Corona Cash of 2020 when all hell broke loose.

That's an 83.2% return without compounding.

See how you can make more money trading assets that go up during a crisis?

You'll learn how to get excited when markets are in trouble because that could mean more money in your pocket.

Let me show you how to find these opportunities.

T.A.P Formula Revealed…

ETFs are required to tell you how much their assets are worth.

Once you know the value of the assets, you can divide it by the number of shares that exist, and you’ll know the true value of each share.

I call this the True Asset Price, or TAP.

Once you know the TAP, you can calculate the percent of mispricing.

You don’t have to do any math with the method I’m about to share.

But let me show you the exact formula, just so you understand how it works.

Here’s the exact formula:

Last close /(AUM / Total Shares) – 1

Let me give you an example.

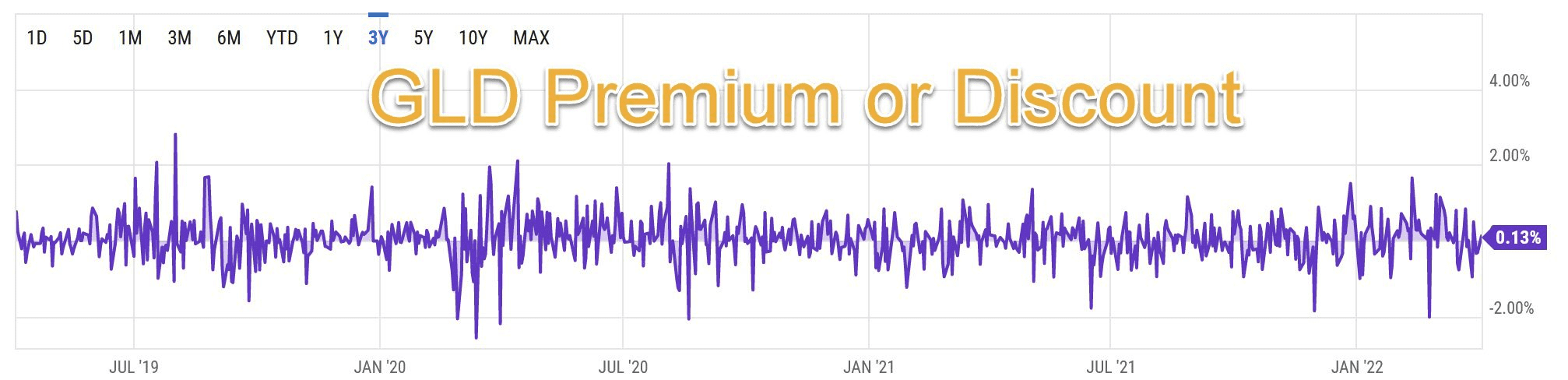

Recently, the gold fund GLD had $68.41 billion in Assets Under Management (AUM).

On that same trading day, the fund had 375.7 million shares outstanding.

All you have to do is divide $68.41 billion by 375.7 million, and you’ll get the TAP for GLD on that day, which was $182.09.

The closing price for GLD that day was $182.37, which means the asset was slightly overpriced.

To calculate exactly how mispriced an asset is, you divide the closing price by the TAP and subtract 1, so:

(182.37 / 182.09) -1 = 0.15%

On that day, GLD was overpriced by 0.15%, which isn’t a very big deal. But there are times when it’s overvalued by 2% or more, which IS A BIG DEAL.

See, look:

Since 2020, there have been at least seven opportunities to buy gold at a 2% discount, and five chances to sell it at a premium of 2% or more.

You’ll be surprised at how often ETFs trade for a lot more or a lot less than their true value.

You can find discrepancies of a percent or two almost every day the markets are open. That’s where you can make a profit with very little risk.

You can buy cheap or sell high, because you know the TAP with mathematical certainty.

You’re not guessing or making a prediction.

When you spot a mispriced ETF, that’s the lightning.

These assets eventually revert to a trading price close to their TAP. That’s the thunder.

When you see the lightning, you know the thunder is inevitable. When the correction comes, you’ve already locked in your profit–while other traders are left scratching their heads.

You could make a modest income simply by trading on TAP. But it may not be enough to weather a recession. And it might not be enough to beat the market when times are good.

So let’s look at how you can leverage your TAP trades.

These Four Proven “Inflation Harvest” Strategies will have You Cheering Every Time You Hear News About Price Increases.

(And You’ll be Cheering Just as Loud if Prices Drop)

What makes stocks go up? Good news, solid earnings, and a strong economy.

If you own just one broad market ETF, you can take advantage of economic growth without putting forth any extra effort.

But what happens to your ETF in a contraction?

You might get lucky and sell it near the top.

Of course, a safer bet is to have some of your money invested in bonds. These tend to hold their value or go up when the market is down.

If you really want to optimize your portfolio, you’ll invest in gold and commodities as well. They’re a good hedge against inflation, and they tend to do well when there’s economic growth.

When you have the right balance of stocks, bonds, gold, and commodities, you’re protected against almost anything that could happen in the economy.

If market conditions cause one of your assets to go down, the same conditions are likely to make at least one of your assets go up.

You may recognize this approach as the “All Weather Portfolio” that Ray Dalio uses.

Ray Dalio is the Chief Investment Officer of the world’s largest hedge fund, Bridgewater Associates. His net worth is somewhere in the neighborhood of $22 billion.

Dalio predicted the 2008 market crash, and made sure his fund was well prepared. In fact, Bridgewater yielded 9.5% in 2008 after subtracting all fees, while most investors were losing half their nest egg.

The All-Weather portfolio is safe in practically any situation, short of a zombie apocalypse. But it has its limits. It only yields about 8% a year.

Take this Simple Instrument for Perpetual Income, and Put it on Steroids

The problem with the All-Weather portfolio is it’s a passive system. When you rebalance an all-weather portfolio, you’re simply selling some of the excess value of one asset class and buying other assets close to their market value.

But if you take a little bit of initiative, you can boost your returns without a lot of extra risk.

The first step is to trade in and out of ETFs in stocks, bonds, gold, and commodities when these assets are out of sync with their TAP. That alone can goose your returns quite a bit.

To really get things going, add inverse ETFs to the mix.

Inverse ETFs short the assets of an ETF, so when the price of the assets go down, the price of its inverse goes up.

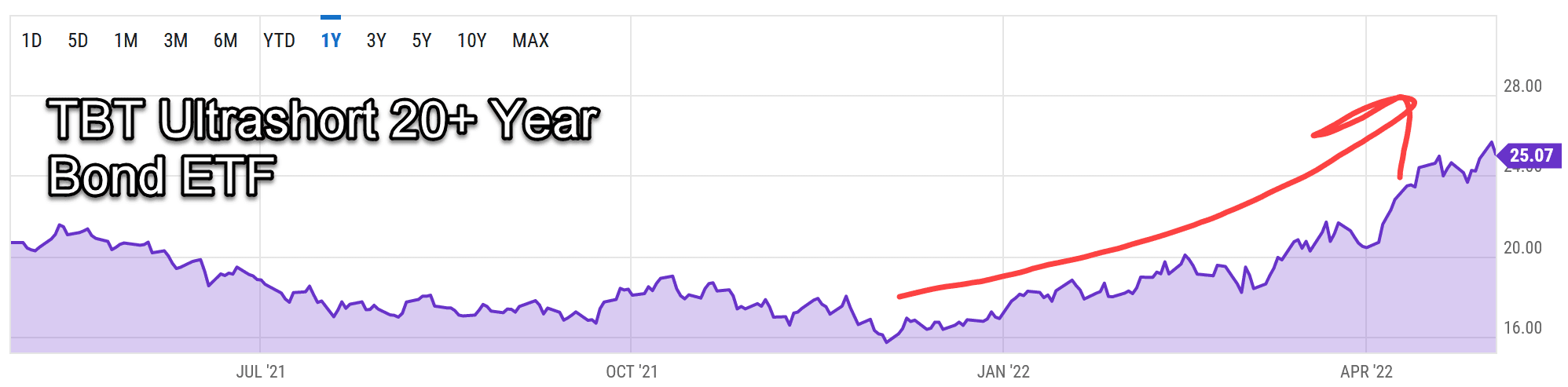

For example, TBT goes up when bonds go down.

Some of these inverse ETFs are also leveraged, meaning that when the ETF goes down 2%, the inverse goes up 4%, or sometimes 6%.

I showed you a few examples of how TAP Income uses a leveraged inverse ETF to make money during a down market.

Using paired ETF strategies can give you big gains for relatively low risk, as long as you follow the True Asset Price as a guide for buying and selling.

As long as you know the underlying TAP, you just trade in and out of the two assets in accordance with their TAP.

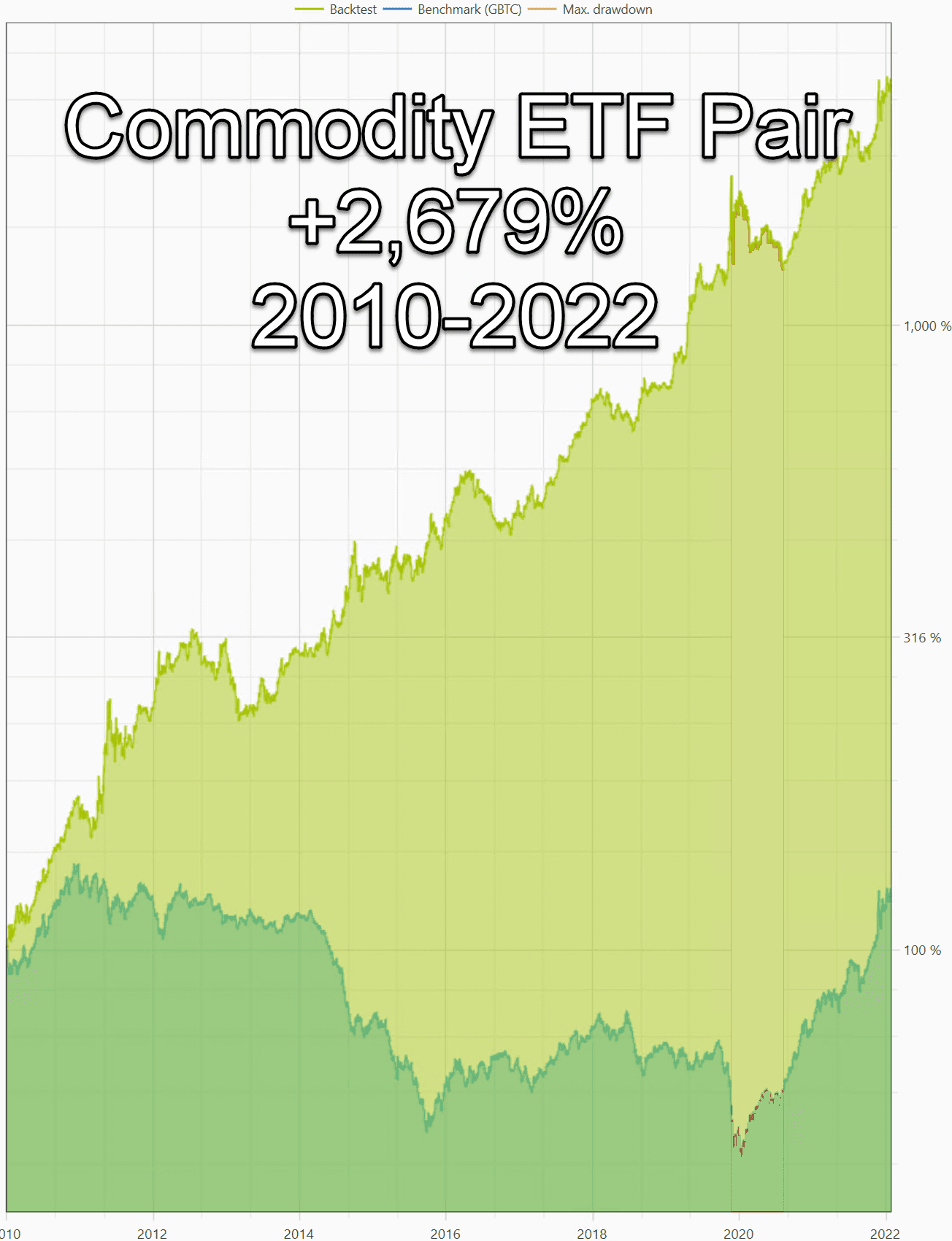

Now, let’s see what happens when you put together something resembling an all-weather portfolio…

Increase your return in three easy steps by…

1) Adding a leveraged inverse ETF to each asset class…

2) And trade your portfolio using TAP to buy assets at a discount and sell them at a premium.

3) Then, for an extra layer of gains, let’s trade more often—once a week, or even once every few days… as often as we can take advantage of mispriced assets.

Four ETF Pairs for Stocks, Bonds, Gold, and Commodities

These three modifications show you what would happen if the All-Weather Portfolio went to the gym and pumped iron five days a week.

You would have a ripped, robust, dynamic beast of a portfolio that could kick butt and take names in any kind of market.

That’s a pretty accurate description of TAP Income.

Now look how smooth the returns become as all four ETF pairs are traded together:

And check out these consistent gains the TAP Income strategy shows in a year where the stock market has been battered.

Life as a TAP trader is much more calm when you're not up at 2AM checking the futures market, worried that your stocks are about to crash.

And to be candid how I feel about TAP Income:

I've taken all my experience in designing trading strategies over the past 25 years,

…plus tens of thousands of hours of my team's hard work,

…plus over a million hours of cloud computing time to build TAP Income,

…plus profitable real-world results from our two salt of the earth beta tester groups,

…which leads me to give it my full 100% stamp of approval for TAP Income.

What We’re Up Against

Now, let me walk you through the next 12 months. I want to show you what we’re up against, and what to do about it with TAP Income.

First, there’s the supply chain issue. And I’m not talking about empty shelves at Costco or waiting another week for Amazon to deliver your dog food.

The problem runs deeper than that.

You already know what’s happening to the price of gas. Inexcusable, and it’s just the tip of the iceberg.

Fuel has an impact on the price of thousands of other products.

It affects farms, mines, refineries, and mills throughout the world.

We’re short on commodities. We’re short on people to produce and process them. And the price of fuel to deliver these commodities is through the roof.

By the time you read this, inflation may have peaked. But it’s not going away.

It’s going to take a long time for prices to come down.

We’re talking about literally everything that has to be raised or harvested or pulled from the ground, everything that needs to be transported or processed, every raw material that mankind has ever put to use.

Now, these aren’t paper or digital records like a stock or a bond. These assets are real, physical objects that are sold by the trainload.

That’s why, if you wanted to trade commodities in the past, you needed millions of dollars just to get started.

But now you can play the commodities game, thanks to… you guessed it, an ETF.

This ETF ticker symbol is DBC, and it’s one of the pillars of TAP Income.

It’s easy to trade…just like buying a stock.

In one single asset, DBC lets you trade in copper, zinc, silver, and gold. Sugar, corn, and soybeans. Wood, coal, aluminum… as well as crude oil and liquid natural gas.

All this stuff is set to go up.

Here’s a chart of what DBC looks like now.

You can see the effects of the supply chain issues. DBC is up almost 31% for the year.

You can expect a lot of activity in commodities over the next 12 months, and you’ll miss out on some of the biggest gains in a decade if you’re not involved.

And if I’m wrong?

TAP Income also trades an inverse ETF that goes up if DBC goes down.

Take a look:

And remember, commodities aren’t the only issue we’re facing.

If there’s a recession (and signs show it’s here right now), the stock market will go down. It could drop 25% or more in a short time.

I showed you how TAP Income automatically traded the inverse of the S&P 500 during covid and in 2008.

Trade like this, and you could be sitting pretty in the next recession.

But just to make sure, TAP Income also trades an ETF pair for bonds.

For some reason, a lot of traders don’t find bonds very interesting. But look at what TAP Income did by trading in and out of these two ETFs:

This asset class isn’t doing very well now unless you're in the inverse ETF (TBT).

However, there are two big trends you should keep in mind.

First, there’s the yield curve inversion that consistently signals a recession.

Bonds do well in a recession. TAP Income could have made you 155% just from trading bonds in 2020. (Suddenly this boring asset is exciting!)

More importantly, we’re already dealing with high inflation. As prices go up, the yields on bonds go up, and the trading price of bonds goes down.

By trading the inverse of the bond market, you can cash in on inflation.

Now, the weirdest story we haven’t talked about yet is gold.

Based on what’s happening in our economy, gold should be going through the roof!

But it’s been mostly dead money since it topped out in 2011. We’ve been watching it fall for years.

I’ll tell you why.

The situation is so bad all over the world right now, America looks good by comparison.

That’s keeping the dollar strong, which weakens gold.

But if something happens to the value of the dollar, it’s good to own gold.

In the meantime, TAP Income has been trading the inverse of gold, and this is going well, as you can see on this chart:

By trading in and out of these paired ETFs, and only buying significantly below the TAP, you can make an income trading gold right now, and slowly build up a strong inflation hedge.

So if you want to make a reliable income no matter what the stock market is doing, you’ll need to have exposure to four major asset classes: Stocks, bonds, commodities, and gold…

Each one paired with an inverse ETF…

Bought when they’re available at a discount to their TAP…

And sold when the price is significantly higher than the TAP.

With low risk, you have a trading system that can realistically deliver modest gains month after month.

This system can help protect you from a recession…

Help ensure you have a steady income in a stagnated economy…

And give you the capability to rapidly grow when everyone else is just recovering.

There’s only one more thing you need to build a strategy like this.

Hidden Away in an Undisclosed Location… 3,516 Computers are Working 24/7 to Bring You TAP Income

You probably already realized the obvious.

All this trading takes a lot of research and number crunching.

You’ll have to constantly monitor your ETFs and calculate their TAP.

This is where TAP Income gets involved.

TAP Income is powered by a high-tech monster called “The Boss.” My team and I have been working on The Boss and its supporting software platform since 2014.

I had to hire more than a dozen programmers.

I spent years trying out different computers, servers, and various components.

Most of the computers I tried to use were just too slow for the job.

In the end I had to rent million of dollars worth of industrial-grade hardware from a private supplier.

I’m now leasing 3,516 computers, linked together into one monster supercomputer that looks like something straight out of a science fiction movie.

Altogether, I spent eight years and four million dollars to bring you the latest version of The Boss.

The real superpower of this network of 3,516 computers is that it can build trading strategies from scratch…

…because it uses evolutionary A.I to program itself and design more and more profitable strategies over time.

It does this by breeding together the most profitable strategies and mercilessly killing off the rest.

Take a look at this simple computer code that generates buy/sell signals on gold:

It was completely coded by The Boss…something that would have taken a human programmer months or even years to figure out.

The Boss backtests each strategy to make sure it’s a winner.

Then it compares the past results to out-of-sample data—and that’s important.

Out-of-sample data is a way of confirming that a strategy would work just as well over a different time frame or using different assets.

Much of the trading software out there skips this extra step.

As a matter of fact, the fatal error that one of the Turtle Traders made was to trust their backtesting without using out-of-sample data for verification.

That's like putting a commercial airliner into service without taking it for a test flight.

Now, I’m pretty darn good at spotting the lightning and getting in before the thunder hits. I’ve made a lot of money this way.

Even twenty-five years ago, I would program a computer to look for opportunities.

But TAP Income is different.

The Boss can see lightning that’s completely invisible to the rest of us…then you just follow the trade signals.

No complex math required. All the hard work and research has been done.

Traders are already making steady profits while TAP Income does all the work behind the scenes.

And now it’s your turn.

Harvest the Coming “Panic Equity” for the Next 12 Months!

Let me tell you a personal secret.

I keep a big digital timer on my desk.

It reminds me when I’m near a deadline, or when I’ve vowed to get something done by a certain date and time.

It’s a great productivity tool, but now I’m using it for a completely different reason.

On April 1st, when I saw the yield curve inversion, I set my timer for 364 days, 23 hours, 59 minutes, and 59 seconds.

That’s the maximum amount of time I have to get my shit together.

By this time next year, I need to have my cash flow protected. I need to have a dynamic portfolio that will make money when assets are falling off a cliff.

I’m not facing another 2008 unprepared.

Lucky for you and me, I finished the project in record time, so I’m all set.

And you won’t be left behind, either. Not if I can help it.

When you use TAP Income with a big enough grub stake, you have the potential for inflation-beating, recession proof, long-term retirement income that can kick all your worries to the curb.

TAP Income uses well-known, constantly traded assets, so you’ll have plenty of opportunities to get in and out of each trade.

Here’s what happens when you sign up…

You’ll get to download Portfolio Boss.

That's the software that runs all four TAP Income strategies.

Then, every morning…Portfolio Boss will send you alerts telling you which ETFs to buy and which ETFs to sell.

You just tell your broker the trades to make.

These days, it just takes a couple minutes and a few clicks of your mouse.

You don’t have to do anything else after that. Just log in and watch your money grow.

So let’s sum up everything TAP Income gives you…

- Portfolio Boss trading platform that gathers TAP data and quotes automatically. This is the ONLY engine that can run the TAP Income strategies. No other platform on the market has TAP data. No wonder why it works so well!

- You’re getting four proven, dynamic strategies that are designed to work together and generate income and profits in any kind of economy. By trading stocks, bonds, gold, and commodities together, you can get the extreme consistency you've always dreamed was possible. Both long and inverse ETFs are traded so you can make money going up AND down.

- Portfolio Boss Community. Join an elite community of high-performing traders to discuss winning methods. Whenever you need encouragement, advice, a place to share your ideas or just to vent, the Portfolio Boss Community is your private Mastermind group.

- Customize…so you can adjust the weight of each ETF pair based on your income goals and your risk tolerance, or you can keep the defaults for an optimized risk/income balance.

- Simple instructions: All you have to do is follow the buy/sell instructions Portfolio Boss sends to you by email every morning.

- You can automate the entire process, and literally have a $4 million Artificial Intelligence machine working 24/7 to make money for you.

The Key to Consistent Cash Flow with Just a Few Minutes of “Work” is in Your Hands.

Most users have paid $25,000 to access this system in the past. And they’ll tell you it’s totally worth it.

“

“Beginning on 5/9 I started trading a Meta Strategy that trades 6 of 14 strategies. As of close last night (6/9) the strategy was up 20.43% and the SPX index was down 1.55% Not too bad for 1 month”

Gary H.

“

“What a sense of empowerment!

Every day now, I power up “The Boss” and see what edges it can find for me. Its like having my personal gold mine, I just need to tell the computer where to dig.

Thank you so much for creating this amazing tool!”

Randy B.

“

“Balls to the wall, very good money. +28% in a little over one month.”

Jay Adams

Think of it this way. If you have a $500,000 portfolio and you hire a human being to manage it, the standard cost is “2 and 20.” That is 2% of the value of your portfolio and 20% of the gains.

Let’s assume your manager is really good. He gets you a 30% return.

This would be decent even by TAP Income standards.

Your manager pockets $30,000 (20% of the gains) plus another $10,000 (2% of the portfolio value), for a total of $40,000.

By comparison, TAP Income is a bargain at $25,000.

But you won’t be paying anything close to $25,000 that others have paid for access. Not even $5000. No where close to $1000.

I decided that it wasn't fair that only those with 6, 7, or even 8-figure accounts could harness the hyper-consistency TAP strategies have shown…

What about the everyday Joe that needs TAP Income when food prices skyrocket?

What about traders that are about to get a nasty surprise as fuel prices hit all-time highs?

What about retirees that aren't ready for a simultaneous stock and bond market implosion?

That's why I've decided to dramatically drop the barrier to entry so you can…

Get Started for $1!

But I want to do even more for you, so I’ve added bonuses when you join today for $1:

- Bonus #1: TAP Income Secrets 10-Part Video Series ($997 value) Peak behind the curtain and see exactly how I built these TAP strategies with the aid of Artificial Intelligence and 3,516 computers. Prepare to have your mind blown when you discover how these strategies work in this exclusive masterclass. I guarantee you've never seen anything like this in any book, course, or YouTube video. When you understand the logic behind this one-of-a-kind method, you're more likely to trade it…and mint money in the process. Part 1: Fast-Track Overview. How to get started in less than 5 minutes.Part 2: What exactly is True Asset Pricing? (TAP)Part 3: TAP Ranking (Excel). How can an edge like this exist? Part 4: Why ETF Pairs for maximum gains? Part 5: TAP and the big, fat, honkin' machine learning breakthrough Part 6: Quick demo of The Boss A.I Part 7: Pulling the curtain back on the code. It's all about trust. Part 8: “All-weather” multi-strategy secrets revealed Part 9: Inverse pairs for profiting in down markets (Excel) Part 10: Putting it all together for an avalanche of profits

- Bonus #2: Strategy Builder (a $2799 value) If you’re feeling adventurous, you can step beyond the TAP Income system and use the software to create strategies of your own from scratch. This point-and-click software does the work of a team of analysts, in minutes, at your command.

- Bonus #3: Built in historical quotes (a $6,000 value) TAP Income does the research and runs the backtests for you automatically. But if you want to experiment on your own, you can find historical quotes, including delisted assets, going back to 1986. Just the TAP data alone costs me $6000/year. We’re buying it for you when you join TAP income.

- Bonus #4: Smart Money S&P 500 and Bond Trading Strategies ($997 value) Many investors split their money 60/40 between stocks and bonds. With this mix of strategies, you can time when to get into stocks and bonds using the Commitment of Traders reports. Since 2006, I've been using this method to beat the markets with an average 3-month holding period.

TOTAL BONUSES: $10,793

TAP Income cost me four million dollars and eight years of my life to finally get to this level.

But remember, I built the darn thing so you can have a better deal.

So, if you sign up today, it won’t cost you $25,000. It won’t cost you $2,000.

When you sign up today, you can have full access for thirty days for just one dollar.

After you’ve had a month to test drive TAP Income, you can keep using it for just $197 $97 a month. That's half off the normal rate.

At about $3 per day, that’s less than a daily latte at Starbucks. Much less than you’re paying for a gallon of gas.

I only ask for one thing in return.

When you’ve been working with me for six months, booking solid gains and bagging healthy profits no matter what the market does…

Write me a testimonial so that other traders will know how easy their life could be.

One dollar for the first month, then three dollars a day, plus a testimonial.

In return, you’ll have full access to the entire system.

Receive an alert whenever an asset in TAP Income is mispriced.

Make the recommended trades, and watch your profits grow.

You can automate the process if you want.

And, just to make sure this is a great deal with zero risk, I’m giving you…

My Rock-solid, Fail-proof, Plain-and-simple, Never-ending GUARANTEE.

If TAP Income fails to blow your mind and do everything I told you it could do…

If you’re not making a steady income with just a few minutes of work…

If you’re not earning consistent profits by simply taking a few minutes to place the trades the TAP Income recommends…

Even if you’ve already been using TAP Income for ten years…

You can cancel your subscription and I’ll refund your last payment. No questions asked.

The Road Less Traveled

Now, before you make a decision, please think carefully about whether TAP Income is right for you.

You’ve seen how easy it is to make regular income by trading assets outside their True Asset Price.

You’ve seen that when you compare the current market price to TAP, you can find profitable trades as consistently as thunder after lightning.

And you know that if you place enough of these trades, the income is substantial.

But unless you want to create your own bank of more than 3,500 computers…

Hire a team of programmers to create the software that monitors the TAP and market price of your assets in real time…

Draw upon 25 years of trading experience to plan and guide the process…

Unless you have $4 million to spend and eight years to complete the project…

TAP Income is the only plan that can reliably bring in a safe retirement income.

With just a few minutes of work…

No matter what happens in the news or the economy.

The way I see it, there are three choices you can make…

First of all, you could do nothing. You could keep on doing what you’re doing now.

This is not necessarily a bad choice.

If you have enough savings for the retirement you want, or if you’re satisfied with the income you’re receiving now…

And if you think you will continue to make this much in the future…

Then maybe you don’t need TAP Income.

But if you’d like to build a little extra cash flow… then you have a few other choices.

Your second choice is to start making TAP trades on your own.

If you’re one of those people who loves to crunch the numbers…

If you’re willing to sift through millions of trades, calculate the TAPs, find the mispricing, and look for decent winners…

If you enjoy whiling away the hours in front of a screen, spending your week watching the trading prices and comparing them to the TAPs…

Then you might be able to pull it off on your own.

Or, you could choose to let TAP Income do it all for you.

Access all the power behind TAP Income and its 3,516 computers.

TAP Income will scan millions of trades, representing trillions of dollars…

Pinpoint the mispriced assets…

And show you exactly how to optimize the risk/income balance.

All you have to do is log in for a few minutes……

Follow TAP Income’s instructions on what to trade and how much to trade…

Then go back to bed, or hit the golf course, or watch your grandson play soccer.

Come back in a few days, sell your overpriced assets, buy new ETFs below TAP, and pocket the difference.

Rinse and repeat, usually about once a week.

Of these three choices, ask yourself, which of these options is going to be the easiest for you and the best for your family?

You see, there are only two ways you can feel when you look back on your life.

You can regret the things you didn’t do, the choices you didn’t make, and the great opportunities you dismissed with a simple, “No.”

Or you can feel proud of the work you did, the risks you took, and the results you achieved.

Most people don’t take charge of their retirement.

They place their future in the hands of the government or a pension or a large institution that they expect to take care of them.

This is the reason the 80/20 principle works. This is why most of the world’s wealth gets concentrated in the hands of a few.

Most people don’t act.

They don’t seek the tools and information that will make them better.

They settle for an average income, an average life.

Many of these people have dreams…

They tell you they want to retire rich…

But they just keep dreaming.

Since you’re read this far, I don’t think that’s you.

I believe got where you are now by doing things most people didn’t.

You’re the kind of person who sees a shot and takes it. The person who sees a way forward and decides to go for it.

If I’m right and you’re still with me…

I’m ready to send you the credentials to download the TAP Income app, and you can start making money this week.

It’s your choice.

Bitcoin “Code-V” Strategy Mega-Bonus

“Like trading Bitcoin without the huge declines”

“I like bitcoin as a portfolio diversifier.” – Paul Tudor Jones

In case you're still on the fence, here's something sure to get you moving…

Rockstar traders like Paul Tudor Jones have recently added Bitcoin to the mix of assets they trade.

Why?

Because it helps smooth out results while offering the potential of making a killing.

So far, it has shown a 120,020% gain in historical testing, and it successfully sidestepped the 2021-2022 bear market in real-time.

Wouldn't it be nice to trade Bitcoin without the bear markets?

Don't worry, you don't have to go out and create a new account and learn about Bitcoin wallets and cold storage.

You can trade Bitcoin using the popular Grayscale fund (ticker: GBTC). It trades just like a stock or ETF.

Normally, Bitcoin “Code-V” sells for $1997…

…when you start your TAP Income 30-day trial for a measly $1, you'll automatically receive instant access to the Bitcoin “Code-V” strategy.

Warning! TAP Income and all the bonuses will disappear!

I wish I could tell you that this opportunity will be around forever.

But it won’t.

In order to provide you with access to The Boss…

To give you the software that lets The Boss talk to your computer…

In order to continuously update market data in real time…

Well, it involves a lot of complex cloud computing. Our database provider will be swamped if we add too many new users at once.

My tech team says we can only handle 220 new accounts without risking unnecessary service delays.

I can buy more capacity, and you bet I will.

In fact, I’ve already upgraded four times.

But every time I do this, my service providers have to follow a string of bureaucratic requirements.

There are state and federal laws…

Internal company policies…

Rigid protocols that can bring the entire system to a grinding halt if my team doesn’t follow them.

For example, to put more computer cores online, I have to go through an “application and review” process.

The last upgrade took 60 days to complete.

So, this time around I reluctantly drew a hard line.

Currently, we will only accept 220 new sign-ups for TAP Income.

Only 220 traders will get the full power of Portfolio Boss, the ONLY engine that can run the TAP strategies to make a steady income with low risk in any kind of market…

Only 220 of you will get the secure, stable income most traders dream about—in just a few minutes a day…

Only 220 people will be able to join the Portfolio Boss Community… where you can get elite-level advice and encouragement from traders who are living the dream…

Only 220 of you will have access to the brand-new Mega Bonus, Bitcoin Code-V… which lets you supercharge your portfolio with Bitcoin and likely dodge the next bear market…

Without the risk of being hacked, without the need to read a dozen books, without creating wallets and cold storage.

As soon as we get another 220 people, we’ll close down abruptly.

Now, Napoleon Hill said the ability to make swift decisions and act immediately was the seventh key to riches.

I hope you’ll make a swift decision to join the fortunate 220 and grab TAP Income before it’s gone.

Trade smart,

Dan Murphy

P.S. TAP Income works because the market panics and sells too low… or gets greedy and buys too high…

But your window of opportunity won’t stay open forever.

You see, the truth is we’re not running short on gas or anything else.

There is absolutely NO EXCUSE for prices to soar this high in America.

Today’s problems are 90% political.

They are the result of politicians deliberately cutting off supplies, printing trillions of dollars, interfering with the economy to serve their own agendas.

Most people will lay down and take a financial hit from all this manipulation.

But with TAP Income, you get to hit back!

You’ve seen this happen before.

In the 1970s, we were experiencing record inflation, just like today.

We had a president whose policies led to gas rationing and high interest rates… much like today.

We were involved in a global conflict… like today.

We even had the swine flu, which almost became a “pandemic.” It could have led to masks and gags and lockdowns… like today.

They say “history doesn’t repeat itself, but it rhymes.”

History also shows us that the biggest profits are made when there is chaos, upheaval, and uncertainty…just like today.

The Turtle traders took advantage of the problems of the late ‘70s and early ‘80s to make almost a billion dollars in today’s money.

Likewise, the biggest problems could deliver incredible windfalls for those using TAP Income.

But this opportunity won’t last. If you don’t seize the day, it could be another forty or fifty years before you get another chance like this.

Either you join us and let the worries of the world become your next windfall…

Or you become another victim of high gas prices and recession.

Questions and Answers:

Q: What kind of computer does this require?

A: Portfolio Boss (the engine that runs TAP Income strategies) was built for modern Windows computers. A computer with 4GB RAM will work. It's also compatible with a modern Mac computer running Parallels.

Q: What's the minimum account size?

A: $10,000 is the bare minimum suggested.

Q: How long does the average trade last?

A: About a week.

Q: Is the software complicated to run?

A: No, you can get up and running in about a minute, then press start to see the trades.

Q: What broker to you recommend?

A: A deep discount broker with good order execution tools like Interactive Brokers.

Q: What time do I place the trades?

A: TAP data is available at about 6AM Pacific/9AM Eastern. Portfolio Boss will automatically download and email you the trades.

Government required disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

© {tcb_current_year} PortfolioBoss, Inc. All rights Reserved.