BAD ADVICE

Corona Del Mar, CAHowdy Friend,

Some time ago, I wrote a blog post about shorting high rated ESG stocks (Environmental, Social, and Governance).

Capitalism typically follows merit…not socialist ideology.

I was seriously considering buying the rating data just to prove my point, but there's not enough history to feed into the machine learning.

When “The Man” started going after Elon when he dared to rock the media monopoly boat, his electric vehicle company was given a bad rating. |

He called ESG a “scam”…And rightfully so.

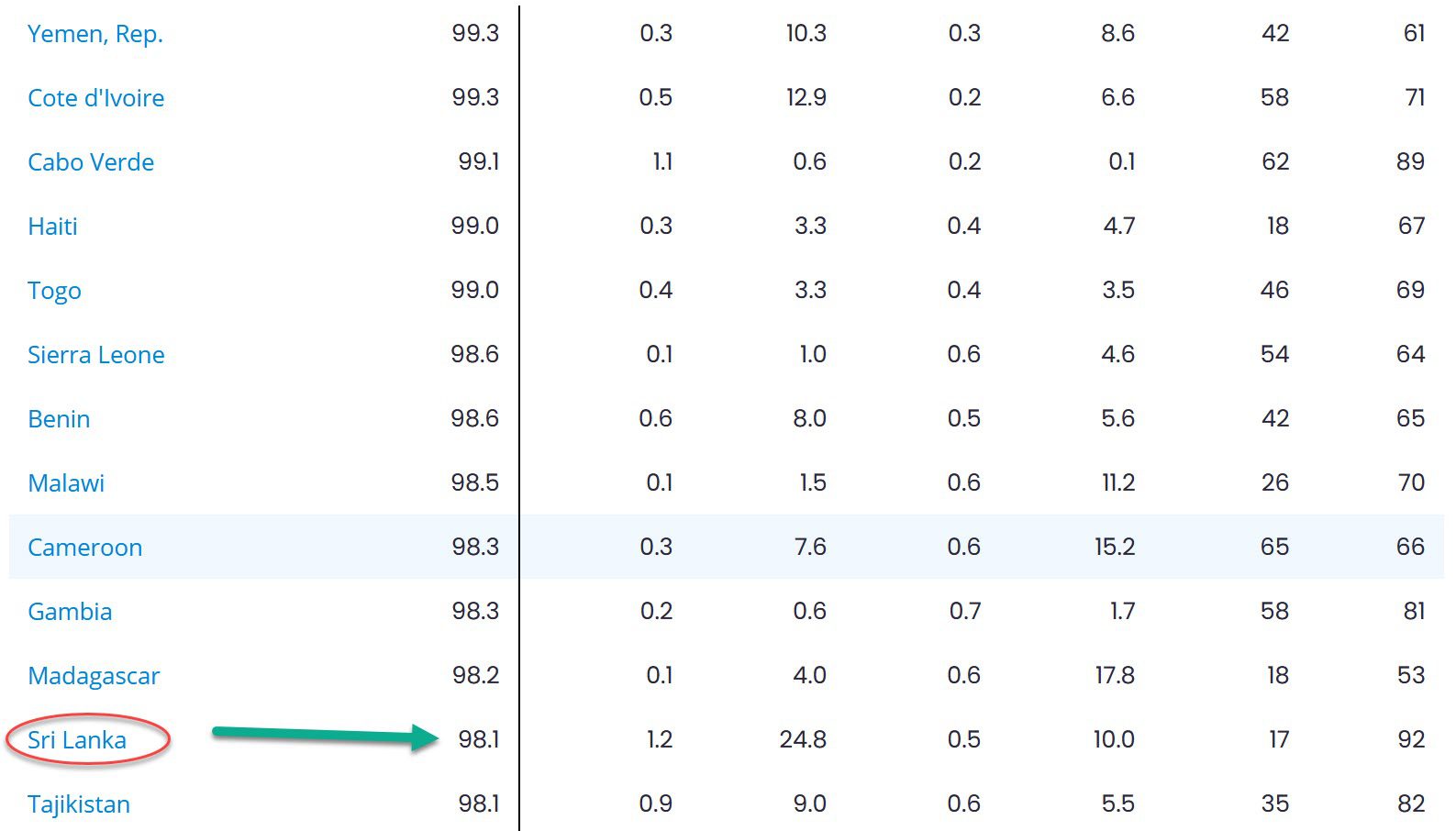

If you sort countries based on ESG, here's what you'll find: (Source: https://www.worldeconomics.com/ESG/Environment/Ghana.aspx) |

You have war-torn Yemen at the top, and the now collapsed Sri Lanka in 12th place.

Further down is the collapsing Ghana.

Perhaps they'll make the top 10 soon?

What's a perfect 100%?

A country where everyone is living like a caveman or DEAD?

Is this the kind of performance you can expect from highly rated ESG stocks?

Perhaps I'll start a grave-digging company where we only use picks and shovels.

That could be a high growth industry these days…maybe we'll make the cover of Inc 5000 and ESG Today at the same time.

Folks better get the cobwebs out of their head and stop listening to bad advice.

Now of course this is a trading newsletter, so let's talk about good advice and what could help fatten your trading account.

We've been able to get our hands on True Asset Price data.

Turns out there are wild disconnects between the assets a fund holds, and how the market is pricing that fund.

Take a look at the most undervalued funds from this morning:

Notice a pattern?Lots of precious metals over-sold right?

Astute readers might start plugging in some of those tickers to see what happened next…I'll bet that'll help you more than some fudged ESG rating.

Until next time… |

|

|

Wondering how to get started?

Step 1: Looking for more consistent profits?

Get a free copy of my book: Artificial Intelligence, Real Profits here >>

Step 2: Want to build a trading strategy in under 10 minutes?Watch this free training video >> (Scroll down the page)

Step 3: Want A.I to build tailor-made trading strategies for you?

A.I is beating people at just about anything related to numbers and data. Nearly every billion-$$$ hedge fund now uses A.I to boost profits.

Watch a demo of The Boss “SuperAi” Strategy Builder as we harness the raw power of 3500 computer cores and strong A.I.

During the presentation, you'll learn: How to Generate Consistent Retirement Income Using “SuperAi-Designed” Trading Strategies. Click here >>

Step 4: Looking to discover new trading ideas to help grow your nest egg?

Online training to vastly improve your trading with A.I.

Watch the podcast >> | Read the blog >>

Step 5: Additional Resources

The Relaxed Investor (The simple strategy proven to work since 1926. Downloaded by over 200,000 readers)

The Ghost of Bernie Madoff is Not Yet Dead (Is your broker on the naughty list? Many traders have no idea they're being sold out)

The Ultimate Crash Detector (The strange weekly report that helps predict crashes. LIVE trading signals since 2006)

Portfolio Boss User Guide (Our flagship strategy building platform User Guide. See what it can do to help you on you quest for F U money)

Trading With Other People's Money – Coming Soon!

Bit-coin for Busy People (How to get started with Bit-coin in under an hour without the complicated new exchanges, high fees, and complicated wallets)

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Insert Image

Responses