What Spending 6-Figures on Cloud Computing Can Teach You [Part 2]

“The secret of getting ahead is getting started. The secret of getting started is breaking your complex, overwhelming tasks into smaller manageable tasks, and then starting on the first one.” -Mark Twain

Corona Del Mar, CA

Howdy Friend!

Let's continue our discussion on what every systematic trader wants to know: What works?!

Each of these episodes will be little bite-sized nuggets that are easily digestible.

OK, let's get started.

Today's we're going to talk about characteristics of stocks.

I have to specifically target stocks here because they have different characteristics than futures.

You can get away with fairly close stops on futures, but not on stocks.

They need a lot of wiggle-room because there are two main characteristics to stocks: Mean reversion and momentum.

A prime example would be Warren Buffett's long-term trading method.

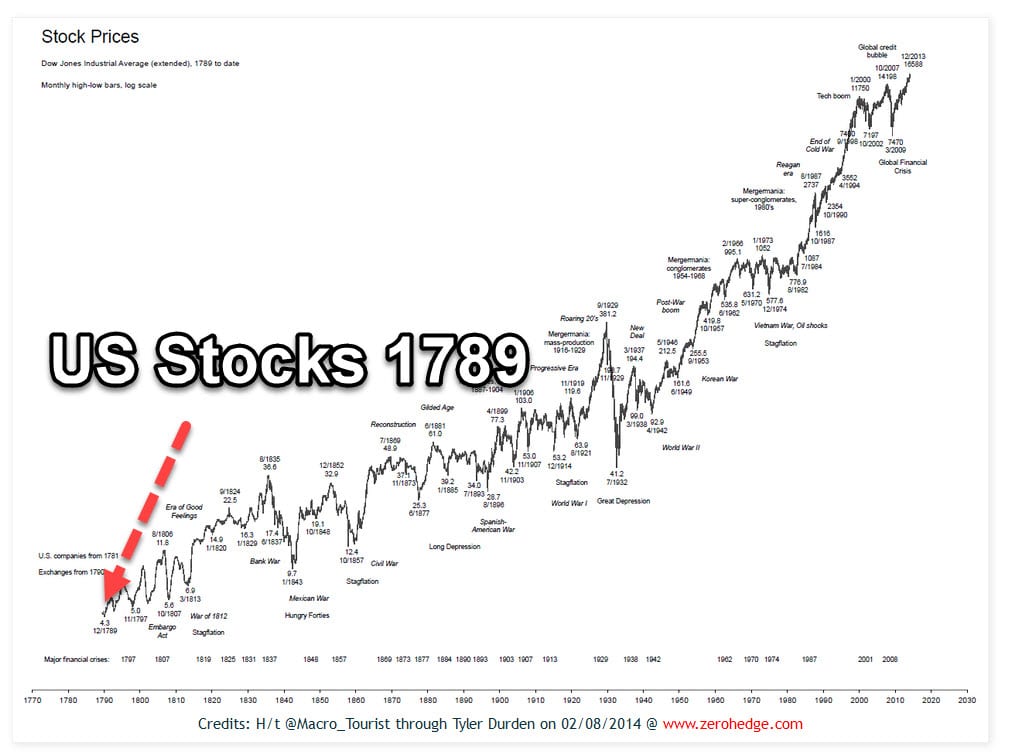

He buys the dips (what we short-term traders would call a crash) within the long-term capitalism growth curve as represented by this long-term chart:

Clearly there is a long-term trending component with shocks every couple years…then like a rubber-band, stocks head back higher.

They not only revert to the mean (a mean is just an average of price), but exceed it.

Buffett buys the dips when everyday investors start selling.

What's great news for us short-term traders is that there is also a momentum component along with mean reversion in the short-term…in everything from weekly to monthly trading.

Momentum stocks typically keep going up AND revert to the mean much stronger.

In other words, the best performing stocks continue to out-perform AND their dips are quickly bought.

Therefore you can damn-near double your profits taking advantage of both (which is a more advanced topic in itself…what I call “synergistic” trading).

Anyhoo…

The reason I had to create our software platform, Portfolio Boss, is because nothing on the market was really designed for ranking hundreds of stocks against each other so you can buy the cream of the crop.

There sure are a lot of duds in the S&P 500…why buy them all?

Pretty silly.

Fund managers have to invest passively in all 500 or so stocks in the S&P 500 because of its huge liquidity.You can't just short-term trade with $1Bill smackers in 10-20 stocks because you'll move them too much.

But for everyday traders — it's very doable.

During yesterday's group call for The Boss members, I asked how everyone was doing in their trading.

The answers ranged from 30% to 70% this year. One trader was up 30% last month.

The key to navigating 2020 was to minimize losses during the March decline, then get right back on the horse instead of listening to the quacks on the news spout their propaganda. Using evidence-based trading strategies, it was easy to see that mom and pop traders had been chased out of the market near the bottom.

They are very clearly represented by the “non-reportable” positions in the e-mini S&P 500 Commitment of Traders report.

As they sold, Warren Buffett came in and bought (minus airlines).

And then we saw one of the quickest reversions to the mean and then some in history. Like it or not, that's the game we play.

As the ledgendary trader Ed Seykota sings in his Whipsaw Song:

“You get a whip and I get a saw, honey

You get a whip and I get a saw, babe

You get a whip and I get a saw

One good trend pays for ‘em all.

Honey, trader, ba-by mine.”

P.S. If you're looking to generate consistent profits, then this is one of my favorite strategies for doing so. Click here >>

Here are its current holdings. The next switch date is December 17th…just days away. The train is leaving the station.

You coming aboard?

|

|

Wondering how to get started?

Step 1: Get a free copy of my book: Artificial Intelligence, Real Profits here >>

Step 2: See a demo of The Boss “SuperAi” Strategy Builder.

During the presentation, you'll learn: How to Generate Consistent Retirement Income Using “SuperAi-Designed” Trading Strategies. Click here >>

Download Portfolio Boss Software >>

Step 3: Online training to vastly improve your trading with Ai.

Watch the podcast >> | Read the blog >>

Step 4: Additional Resources

The Relaxed Investor (Downloaded by over 200,000 readers)

The Ghost of Bernie Madoff is Not Yet Dead

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses