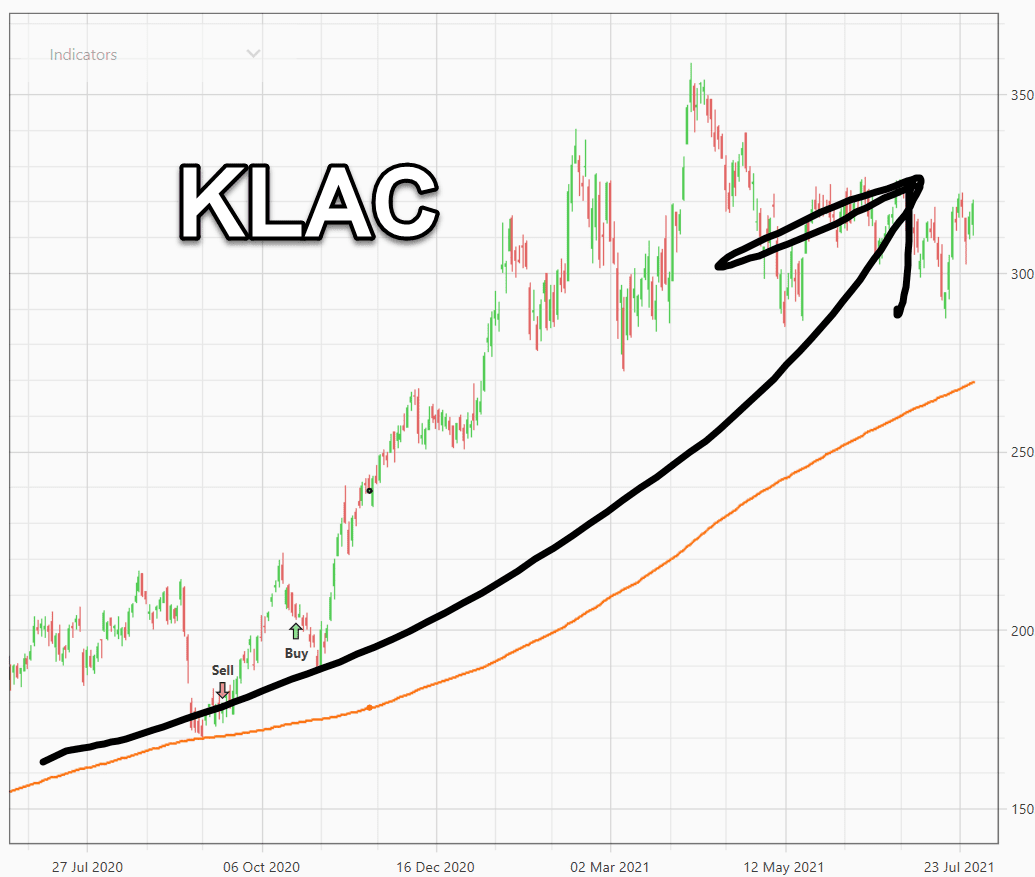

Stocks on the Run: KLAC

Corona Del Mar, CA

Howdy Friend!

KLA Corp (KLAC) beat earnings this morning and is currently up 9%. It never ceases to amaze me the power of rotational investing. That's where you have a universe of stocks like those in the NASDAQ 100, and trade the top 10 or 20.

How do you rank the top stocks?

Technically, there's an infinite number of ways to rank a stock, but the most popular is to use momentum over the past 1 to 12 months.

Momentum is just percent gain/loss over N periods.

My most popular book by far, The Relaxed Investor, proved this works since 1926 (it's been downloaded over 200,000 times).

Not too many back test to 1926 because it's hard work. I had to buy a dusty old used book on eBay, then have to transcribed by hand into a spreadsheet.

Then I hired a programmer to do some custom back testing…which of course was absolutely shocking because it works so well for so long. That's how I got the nickname of “The Prince of Proof.”

The vast majority of back testing platforms DO NOT have the capability of ranking a bunch of instruments.

That's why I reluctantly built Portfolio Boss in the first place.

Here's a tip for you Portfolio Boss users:

If you want to trade less often, then increase total positions to hold to a large number like 100, and simply buy the top 10 until they fall off the top 100 list.

It doesn't make as much money as monthly rotation, but it's less work.

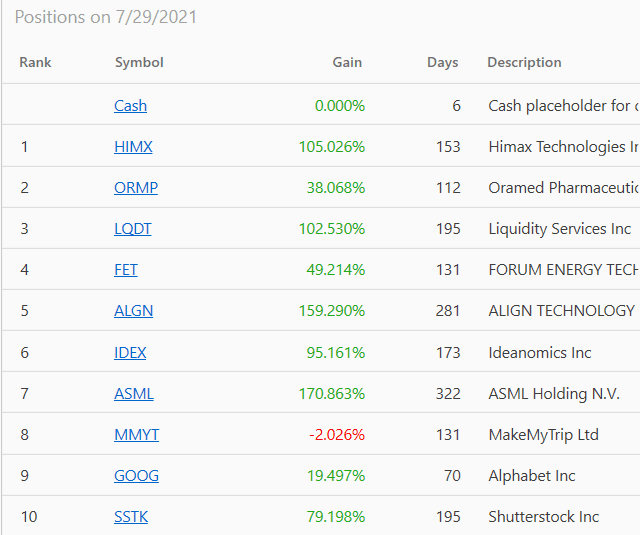

Here are the current Top 10 based on several different ranking factors:

KLAC is currently #59 on the list.

Yet isn't it amazing how often these upside “surprises” occur in stocks that are already going up?

It's almost as if people buy in anticipation of the news…which means the news is pretty pointless in your trading isn't it?

P.S. Here's how to build a trading strategy that uses Ranking in under 5-minutes. One that makes about 40% per year before fees, and it only trades about once a month.

|

|

Wondering how to get started?

Step 1: Looking for more consistent profits?

Get a free copy of my book: Artificial Intelligence, Real Profits here >>

Step 2: Want to build a trading strategy in under 10 minutes?Watch this free training video >> (Scroll down the page)

Step 3: Want A.I to build tailor-made trading strategies for you?

A.I is beating people at just about anything related to numbers and data. Nearly every billion-$$$ hedge fund now uses A.I to boost profits.

Watch a demo of The Boss “SuperAi” Strategy Builder as we harness the raw power of 3500 computer cores and strong A.I.

During the presentation, you'll learn: How to Generate Consistent Retirement Income Using “SuperAi-Designed” Trading Strategies. Click here >>

Step 4: Looking to discover new trading ideas to help grow your nest egg?

Online training to vastly improve your trading with A.I.

Watch the podcast >> | Read the blog >>

Step 5: Additional Resources

The Relaxed Investor (The simple strategy proven to work since 1926. Downloaded by over 200,000 readers)

The Ghost of Bernie Madoff is Not Yet Dead (Is your broker on the naughty list? Many traders have no idea they're being sold out)

The Ultimate Crash Detector (The strange weekly report that helps predict crashes. LIVE trading signals since 2006)

Portfolio Boss User Guide (Our flagship strategy building platform User Guide. See what it can do to help you on you quest for F U money)

Trading With Other People's Money – Coming Soon!

Bit-coin for Busy People (How to get started with Bit-coin in under an hour without the complicated new exchanges, high fees, and complicated wallets)

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses