Simple Change for More Profitable Trades

Corona Del Mar, CA

Howdy Friend!

Here's a topic near and dear to my heart…

Let's talk about a simple change to extract more money outta the markets on nearly every trade.

It's an order type few know about.

But first, I'll tell you the WORST order type.

The one that had me buy the very tippy top price for the day, only to see the bottom fall out a few minutes later.

It was a MOO order.

Market on open.

It's funny because everyone is so worried about half a cent per share commission (like at IB) when they should be more worried about order execution.

I ended up with 68 cents of slippage per share on that MOO order trade!

So 68 cents x 1000 shares = $680 in idiot fees.

I felt like a naïve kid again, and Shaquille O'Neal just stepped on my sandcastle with his size 23's.

So which orders are best?

The best way not to get royally screwed is to use limit orders.

That way you don't pay above a certain price on entry, or below a certain price on exit.

But then you stand the chance of missing out on the trade.

Man, it's a terrible escalating rage to see a trade you were going to make go higher and higher while you sit on the sidelines.

There is a solution Kimosabe, so keep reading…

Interactive Brokers (IB) has an order type called accumulation/distribution.

Let's say you have 5,000 shares to buy up Tesla (TSLA).

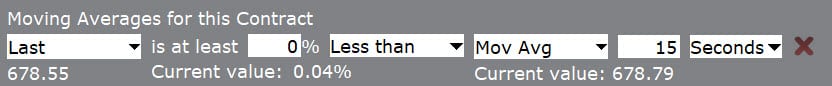

What you can do is place limit orders for let's say 200 shares every few seconds IF the price of TSLA is BELOW a really short-term moving average.

The moving average can be 15, 30, or 45 seconds for example.

In the example below, TSLA was slightly BELOW the 15 second moving average, so the acc/dist algo would start making trades.

The LAST price was 678.55 and the 15-second average was 678.79.

So now what you're doing is the best of both worlds:

- You can easily get in and out of your trades, but only at a slight discount.

- You also can fool the HFTs that try to front run large orders.

- Great alternative to simply breaking up your order into blocks of 100-200 shares (Even if the ask shows 10,000 shares, I won't submit a market order to buy even 1,000 shares because the HFTs will see the order and pull their offers…which means you get a terrible fill price).

- Add randomness to your order to further confuse the HFTs.

- Try using REL orders, which add more flexibility to your limit orders.

What are the drawbacks?

- Need to be connected to TWS platform.

- Clunky platform not easy for beginners.

- Better have a stable Internet connection setup a VM in the cloud (super easy and inexpensive).

In conclusion, most traders' priorities are bassackwards.

They sign up for these “free” trading services and wonder why they get such horrible fills (slippage).

It's like the airlines these days…they charge you an arm and a leg for every little thing from bags to peanuts to printed boarding passes.

Next thing you know, they'll force you to watch a timeshare presentation.

Anyhoo…hope that helps you save a ton!

P.S. That tip alone could easily save you $5k on a $100k account. You could take the savings and invest in this market edge while you still can.

|

|

Wondering how to get started?

Step 1: Looking for more consistent profits?

Get a free copy of my book: Artificial Intelligence, Real Profits here >>

Step 2: Want to build a trading strategy in under 10 minutes?Watch this free training video >> (Scroll down the page)

Step 3: Want A.I to build tailor-made trading strategies for you?

A.I is beating people at just about anything related to numbers and data. Nearly every billion-$$$ hedge fund now uses A.I to boost profits.

Watch a demo of The Boss “SuperAi” Strategy Builder as we harness the raw power of 3500 computer cores and strong A.I.

During the presentation, you'll learn: How to Generate Consistent Retirement Income Using “SuperAi-Designed” Trading Strategies. Click here >>

Step 4: Looking to discover new trading ideas to help grow your nest egg?

Online training to vastly improve your trading with A.I.

Watch the podcast >> | Read the blog >>

Step 5: Additional Resources

The Relaxed Investor (The simple strategy proven to work since 1926. Downloaded by over 200,000 readers)

The Ghost of Bernie Madoff is Not Yet Dead (Is your broker on the naughty list? Many traders have no idea they're being sold out)

The Ultimate Crash Detector (The strange weekly report that helps predict crashes. LIVE trading signals since 2006)

Portfolio Boss User Guide (Our flagship strategy building platform User Guide. See what it can do to help you on you quest for F U money)

Trading With Other People's Money – Coming Soon!

Bit-coin for Busy People (How to get started with Bit-coin in under an hour without the complicated new exchanges, high fees, and complicated wallets)

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses