Bull or Bear?

|

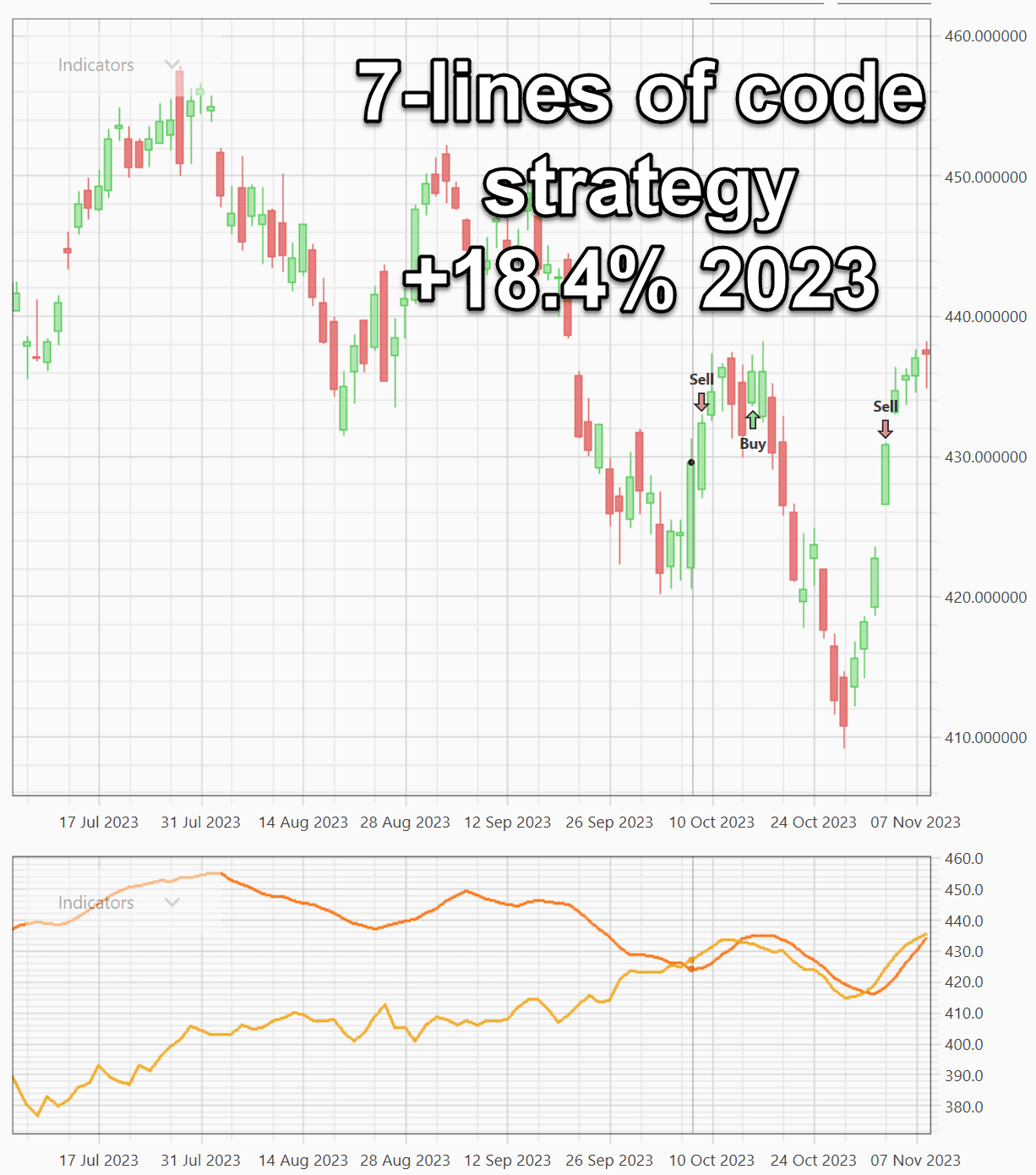

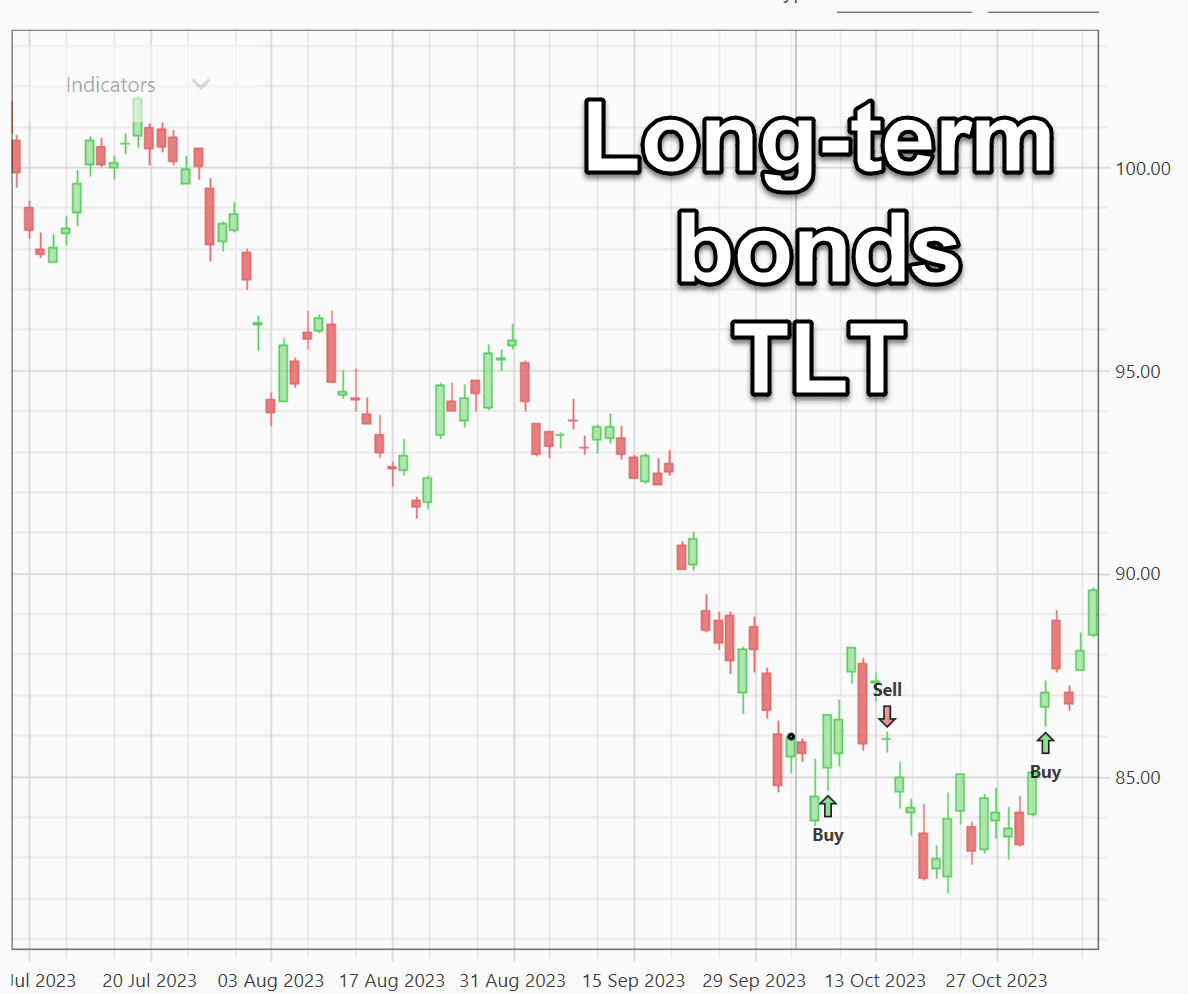

You might remember this strategy from my book Outfoxing Wall Street. It sold out of SPY recently, and got into bonds. Amusingly, bonds then started to outperform right on cue.

Even though the strategy is simple, it manages to combine trend following with mean reversion.

When the S&P 500 does end up falling, it'll trigger a sell on bonds, and a buy on S&P 500. We'll have to rise a few more percent for the trend following element to kick in. For now, it's going to ping pong back and forth between stocks and bonds.

What about our other strategies?

At this point, I'm looking at hundreds of strategies. Dozens of those trade stock indices. That's why I invented a new form of machine learning that predicts which strategies will perform best over the next month.

Let the tools do the work.

|

|

Responses