What $20k taught me about September Gloom

Corona Del Mar, CA

Howdy Friend!

Here in normally sunny Newport Beach, we get what's called “June Gloom.”

That's where the heat variation between the rising air temperature and cold ocean collide to create fog…

Lots of it…

September is thought to be a foggy month for the markets. The average decline is about half a percent since WWII. Why do they just measure from WWII?

Data is hard to come by…in fact, I had to spend $20k on the oldest database out there to find out.

The verdict?

No month on average is down since 1800 in the stock market.

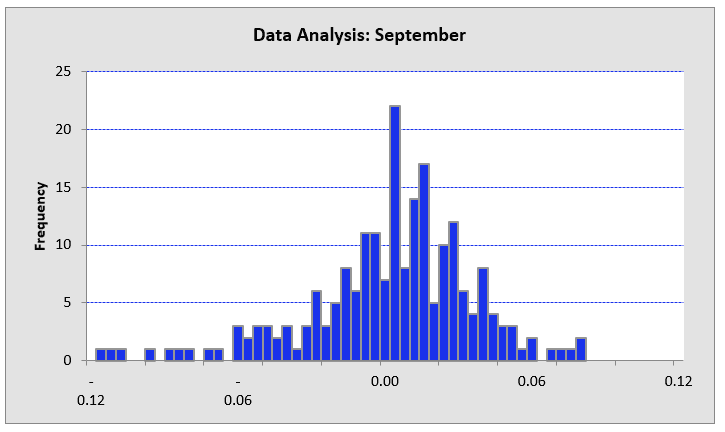

As you can see, most Septembers center around a slight gain, with a few outliers.

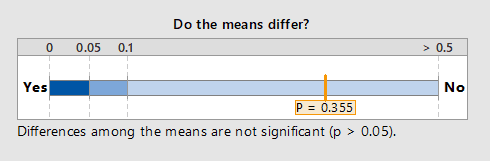

We did a one-way ANOVA on all the monthly data, and found no statistical difference between months of the year.

In other words, the performance differences by month are random.

The conclusion here is that using seasonality basically doesn't work.

Old adages like “Sell in May and go away” are wrong. You don't see Jim Simons of Ren Tech fame pack up his supercomputer and quit trading in May right?

Nope…the dude made so much money that he and his crew owe $7 billion in back taxes. They used exotic options that “The Man” doesn't like, so they settled.

“How did they make over $100 billion in profits” is the better question.

By making a prediction on all U.S stocks, and then buying half and selling short the othert half (via options).

Typical trade is less than a week. Our latest project here at Portfolio Boss? Using machine learning to predict next week's prices for all stocks in the S&P 500.

More from me soon…

|

|

Wondering how to get started?

Step 1: Looking for more consistent profits?

Get a free copy of my book: Artificial Intelligence, Real Profits here >>

Step 2: Want to build a trading strategy in under 10 minutes?Watch this free training video >> (Scroll down the page)

Step 3: Want A.I to build tailor-made trading strategies for you?

A.I is beating people at just about anything related to numbers and data. Nearly every billion-$$$ hedge fund now uses A.I to boost profits.

Watch a demo of The Boss “SuperAi” Strategy Builder as we harness the raw power of 3500 computer cores and strong A.I.

During the presentation, you'll learn: How to Generate Consistent Retirement Income Using “SuperAi-Designed” Trading Strategies. Click here >>

Step 4: Looking to discover new trading ideas to help grow your nest egg?

Online training to vastly improve your trading with A.I.

Watch the podcast >> | Read the blog >>

Step 5: Additional Resources

The Relaxed Investor (The simple strategy proven to work since 1926. Downloaded by over 200,000 readers)

The Ghost of Bernie Madoff is Not Yet Dead (Is your broker on the naughty list? Many traders have no idea they're being sold out)

The Ultimate Crash Detector (The strange weekly report that helps predict crashes. LIVE trading signals since 2006)

Portfolio Boss User Guide (Our flagship strategy building platform User Guide. See what it can do to help you on you quest for F U money)

Trading With Other People's Money – Coming Soon!

Bit-coin for Busy People (How to get started with Bit-coin in under an hour without the complicated new exchanges, high fees, and complicated wallets)

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses