Smart Money

Corona Del Mar, CA

Howdy Friend!

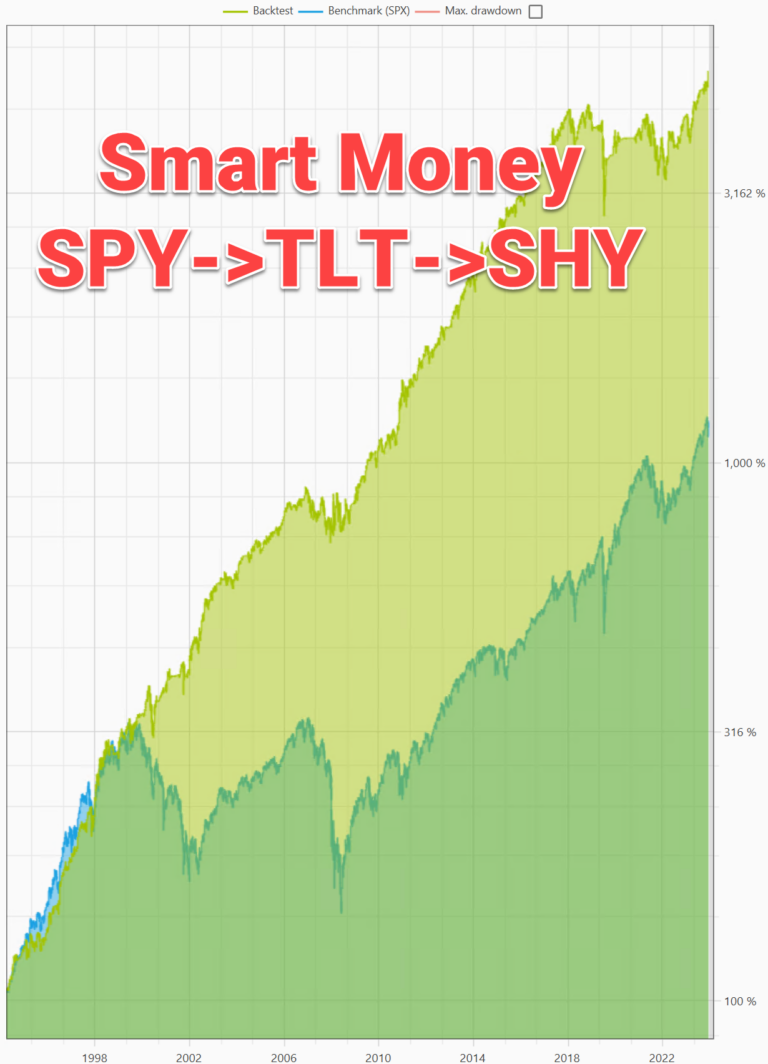

Many years ago, I invented a trading method called “Strategy Stacking.”

That's where you can set priority for trading models…effectively stacking strategies on top of each other.

For example, when trading the Smart Money, the main money-maker is the S&P 500 (SPY).

If there's a sell signal, you can get into the next highest priority Smart Money Bonds (TLT). If that too is on a sell signal, you'd get into short-term bonds (SHY).

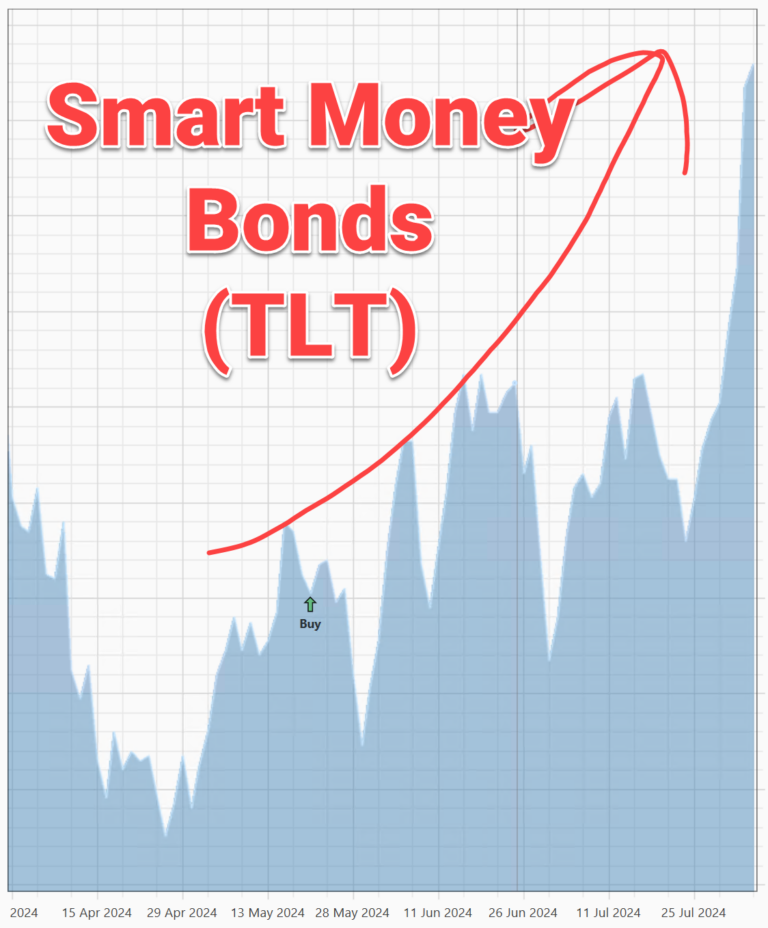

The strategy has been in bonds (TLT) for several months.

For months, it looked like dead money. Then TLT sprinted upwards seemingly out of no where.

Or this AMD/SH strategy…it was correctly out of AMD, but it looked like dead money being in the inverse S&P 500 (SH). Then all of a sudden it was a great hedge.

The “Crazy Ivan” took some of the high fliers to the woodshed over the past few days as well. We've been cleaning up for a long time so we're working with profits.

Every few years you get these gut checks where a problem come to a head, looks like the end of the world, then gets fixed. The key point on market stats is that the biggest up days come after the biggest down days.

So riding the bucking bronco has paid off in the long run.

My point is that you have to stick with the strategies and be patient. You're not going to get every top, you won't catch every bottom. The key is to focus on perfect order execution and let the trading strategies do their magic.

So here's what typically happens with TAP strategies when volatility picks up like it is now: We'll start selling into rallies and moving into inverse funds. Ideally the market will overreact either way, allowing us to make money from both sides of the market.

Here's a classic example with Microsoft (MSFT). It one of my Strategies of the Month. It's like one line of code plus a volatility filter. In other words: Simple.

See how it trends and there's not much action? Then when global volatility picks up, the ETF mispricing data we use starts gyrating back and forth like a Hula dancer.

Then all of a sudden you're trading like a machine, catching those mean reversion moves, gobbling up small (and sometimes not so small) gains like Pac-Man gobbles up power pellets.

So don't get all shell shocked on me. I crave this kind of volatility because it's when I've historically made the most money. I killed it in 2008 by the way.

Shut the news off. Obey those signals. Only trade what you have tested with a computer. Do the opposite of what most traders are doing.

I hope that leads to some serious money in your near future!

Trade smart,

Dan “Prince of Proof” Murphy

Responses