Do Candlestick Patterns Work?

Corona Del Mar, CA

Howdy Friend!

Patterns, patterns everywhere and not a trade to make.

The above line is a variation of The Rime of the Ancient Mariner.

“Water, water, every where,And all the boards did shrink;Water, water, every where,Nor any drop to drink.”

It's an old tale about a mariner who is cursed to tell his story after killing an albatross that had helped he and the rest of the crew out of icy waters.

No good deed goes unpunished.

So hopefully I'm not the albatross as you read this message in entirety.

I was recently reading an article about candlestick patterns and their endless variations…

You have hammers, morning stars, bullish engulfing, three white soldiers, abandoned baby (not kidding), dark cloud cover, and on and on.

As I read through the article, the author gave recommendations on what to do next if you see these patterns.

“Buy on bullish confirmation after a hammer pattern.”

“Bullish confirmation” was vaguely described as higher prices on rising volume.

If you've been reading my blog posts for awhile, you probably know there is a glaring problem with this approach…

…there's not one shred of PROOF that candlestick trading makes any money whatsoever in this article.

You're purely taking the author's word for it.

Believe me when I say, if they had programmed those candlesticks into a computer, they would have shared the results of the test 'cause it's a pain in the ass.

Come on…you and I both know that there was no test.

Just more pseudo-science being peddled as fact.

How many times have you felt like Charlie Brown trying to kick the football — and Lucy once again pulls it away as he falls on his head.

How many times have your dreams of striking it rich been dashed against the rocks?

For me it has to be dozens of times before leap-frogging over all the BS peddlers.

How many times have you gone down a new path for trading only to find it leads to a dead end?

Back in the mid-2000's I went in and started programming candlestick patterns and saw mediocre results.

I could EASILY beat candlestick patterns with simple mean reversion strategies.

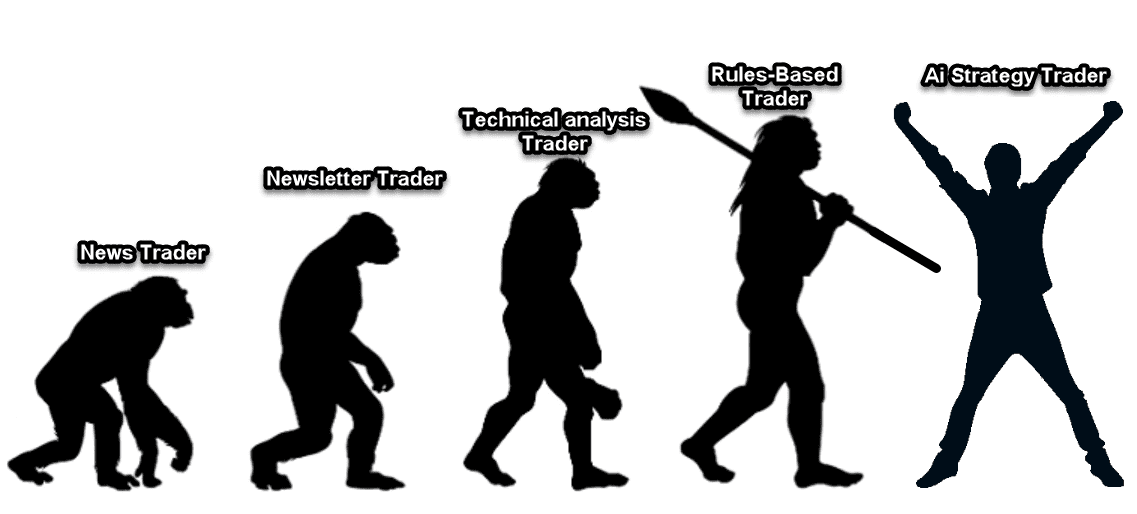

As usual, I'll refer you to the image below on the evolution of a trader (candlestick trading can be classified under technical analysis):

I have seen some machine learning techniques find some patterns that work OK, but it's funny how it's not one of the above named patterns.

And even if they did work, it's not a complete system. When do you close your trade? Where's your stop loss? I must have missed that part in every single mention of candlestick trading ever.

The same nonsense happened when I tested for retracement level trading.

You know: Fibonacci lines and all that jazz.

Well, there was a number that constantly popped up in the markets, but it's not a Fibonacci.

0.33333 and 0.66666 came up all the time. Clearly not Fib numbers.

Like the albatross, my goal is to guide you away from the icebergs and into smooth open waters.

I hope this helps you stay on the right path (which is to only make a trade with a complete strategy that has been thoroughly tested).

Oh, and please don't shoot the messenger! 🙂

P.S. What happens when you combine a simple mean reversion indicator with The Boss Ai Strategy builder?

144% return in 2020? A positive return in March during the ‘rona crash? How is that even possible?

Come find out in this quick on-demand training >>

|

|

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses