No Good Deed Goes Unpunished [Don’t be this Guy]

Corona Del Mar, CA

Howdy Friend!

There are makers in this world, and there are takers.

For example, the IRS takes from the productive makers and gives to a bunch of free-loaders.

That's why when you spell out the IRS, it turns into: T-H-E I-R-S

And also freeloading members of your family and friends right?

You know…the guy who suddenly turns into T-Rex arms as the dinner bill is passed around the table.

There are even free-loaders like Roger that read this newsletter, download my free reports, attend my free webinars, and then complain EVEN WHEN I GOT IT RIGHT.

Don't be a Roger.

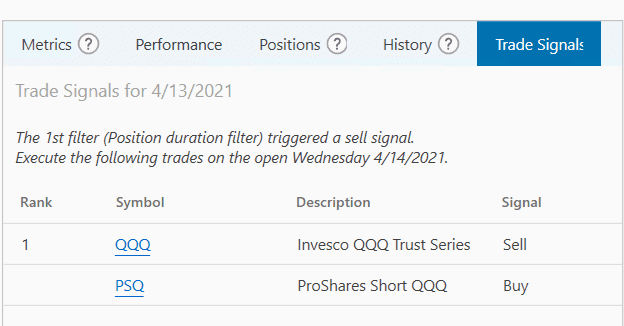

You see, I went through in painstaking detail how there's a cycle in the NASDAQ 100 that would without a doubt give a sell signal on April 13th. I even said that exact date live on a Zoom webinar.

It did give a sell signal, and the NASDAQ 100 did decline! That's because the cycle rule is hard-coded into the strategy (It's literally “sell after holding QQQ N days”). It was discovered by The Boss Ai.

I even told an entire story about Jack Bauer from the hit series 24 spraying nitrogen on the wires of a nuke in order to delay the explosion.

Then I explained the metaphor in greater detail, and how there are about 14 hours between the time the strategy sends you a signal and the beginning of the next trading day.

Plenty of time to put an order in with your broker even if you type with one crooked finger.

That means, with a high degree of probability, that April 14th would be a down day. It was! I even explained how you could use PSQ to make money as the market fell.

I was trying to be helpful to the salt of the earth folks like you that read this newsletter. I guaranteed the Time Bomb strategy would flash a sell signal.

Notice that I didn't guarantee a down day.

I certainly didn't guarantee a crash. That would be pretty damn stupid.

Yet free-loading Roger heard what he wanted to hear and emailed and complained to my office that the strategy didn't work.

And he's never purchased a damn thing in six years.

Don't be a Roger.

You see, when opportunity knocks, Roger complains about the noise coming from the front door. Roger could have even asked me live on the Zoom call to explain things further if he was confused.

But he didn't. He just complained.

Don't be a Roger.

Anyhoo, I'm guessing those who purchased the Time Bomb strategy are happy with their decision.

When the strategy does its daily update, they'll know whether this was a one day affair or the start of something worse…because they know all about the “nuclear football” trigger.

Here's what they received after the close on Tuesday.

Pretty clear right?

That's because unlike Roger, your eyes are working and you don't have rocks for brains.

Anyhoo…

The Time Bomb offer has expired and won't be released again anytime soon. In the mean time, I'm going ahead with Forecast Friday and I have two new complimentary reports that are done and done.

I just ordered 200 hard copies of Trading With Other People's Money. I think it'll open up a whole new world for the right trader (it's not for everyone which is why I didn't order many copies…it's especially not for Roger).

More from me soon!

|

|

Wondering how to get started?

Step 1: Get a free copy of my book: Artificial Intelligence, Real Profits here >>

Step 2: See a demo of The Boss “SuperAi” Strategy Builder.

During the presentation, you'll learn: How to Generate Consistent Retirement Income Using “SuperAi-Designed” Trading Strategies. Click here >>

Download Portfolio Boss Software >>

Step 3: Online training to vastly improve your trading with Ai.

Watch the podcast >> | Read the blog >>

Step 4: Additional Resources

The Relaxed Investor (Downloaded by over 200,000 readers)

The Ghost of Bernie Madoff is Not Yet Dead

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses