The Kiss of Death Indicator

Corona Del Mar, CA

Howdy Friend!

There's almost always one of these people in every group…

I call them “Kiss of Death” indicators because they inexplicably get in near the top of every bull market.

And as soon as they buy…well you know what happens next.

The bottom falls out and they're left scratching their head about what went wrong.

I've seen this in:

- Tech stocks in 2000

- Housing in 2007

- Gold in 2011

- Bit-coin in 2017

- And many more…

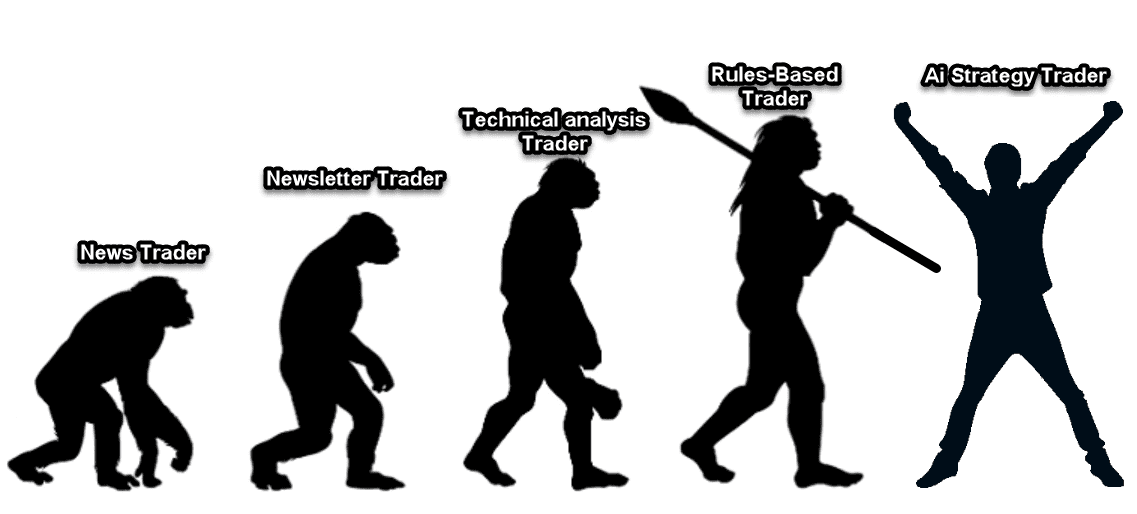

Typically I see this in Phase 1 & 2 traders (see the above image). They either listen to the news or follow newsletter “gurus” for their trading ideas. That lures them into a false sense of security about their knowledge on the subject.

Overconfidence mixed with under-competence = Disaster in the making.

The Dunning-Kruger Effect comes to mind:

Yours truly has suffered many Dunning-Kruger episodes over my lifetime, so I'm not immune from being over-confident either.

What sure helped me kick the cocky outta my noggin' was a book named “The Optimism Bias” by Tali Sharot. It's a good mental flush that'll help drain the swamp between your ears.

Another disease of the mind people have is “never-ask-for-help-itis.” It tends of afflict the more intelligent among us.

We want to do everything ourselves…

From refusing to ask directions to account killing mistakes that an experienced trader can easily help you avoid.

It wasn't until I blew out my third trading account that I asked for help.

Man those were dark days. I ended up joining one of the original Turtle Traders of Richard Dennis' fame and got my head screwed on correctly.

These days I have a new trading mentor that's been showing me new trading ideas.

My ego has been thoroughly kicked in the balls like I was in an episode of Jackass.

“Why didn't I think of that” is a phrase I mutter over and over.

Of course my “mentor” is an A.I made of about 3000 computer cores so that puts some calamine lotion on the sting.

Good thing because one of the first strategies it created in 2019 has been doing this already in 2021:

Lately things have gotten crazier because The Boss “SuperAi” creates its own trading indicators from scratch.

Bollinger Bands, ADX, RSI, MACD…all thrown in the trash because the computer programs itself with C# code. Putting computer code from the 1980's into The Boss is like putting a 8-track in your new Ferrari 488.

I'm still wrapping my head around the crazy formula it came up with for trading Bit-coin…

But that's a story for another time.

I hope this message helps you avoid the Kiss of Death in your trading.

Cheers to 2021 being your best trading year ever!

P.S. If you'd like to see a demo of The Boss “SuperAi” Strategy Builder in action, click here now >>

|

|

Wondering how to get started?

Step 1: Get a free copy of my book: Artificial Intelligence, Real Profits here >>

Step 2: See a demo of The Boss “SuperAi” Strategy Builder.

During the presentation, you'll learn: How to Generate Consistent Retirement Income Using “SuperAi-Designed” Trading Strategies. Click here >>

Download Portfolio Boss Software >>

Step 3: Online training to vastly improve your trading with Ai.

Watch the podcast >> | Read the blog >>

Step 4: Additional Resources

The Relaxed Investor (Downloaded by over 200,000 readers)

The Ghost of Bernie Madoff is Not Yet Dead

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses