Is Quantum a buy or sell?

Howdy Friend! |

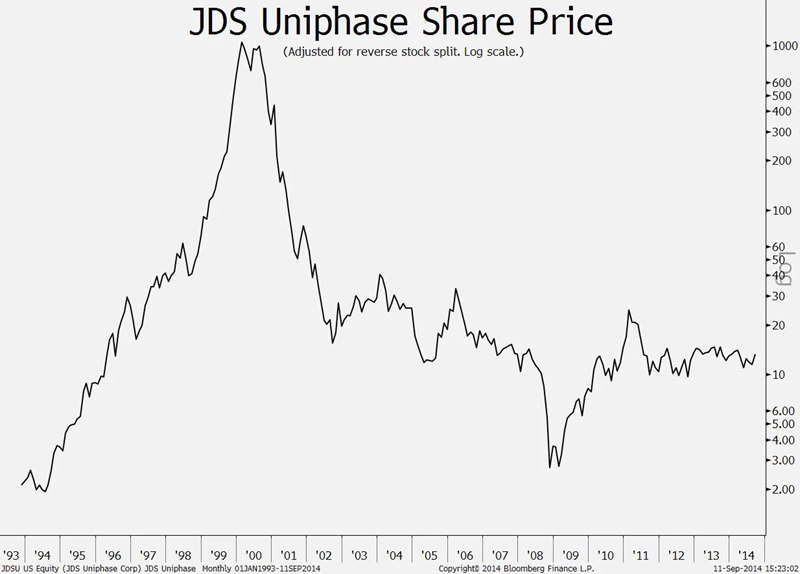

I don't short stocks because when I was younger, I watched JDS Uniphase bubble up 200x before collapsing. |

They never lived up to the hype, but newsletter writers sure pitched the heck out of it.

The reason they were growing so much was due to M&A.

If you're been following the quantum space, that sounds an awful lot like IONQ.

The CEO sold nearly all of his shares as he pitched quantum as an Nvidia killer. That's a MASSIVE RED FLAG.

Recall that Nikola's CEO was sentenced to four years in prison stemming from false claims. He was pardoned by Trump before spending any time in jail.

Quantum is very task specific and will never ever ever compete with general computing tasks.

The military might like it for cracking codes, but it's complete vapor-ware at this point. It can't even add two numbers together because of all the noise.

Many quantum stocks started as SPACs (red flag #2!) so it's really hard for me to build trading strategies on the data. Almost as noisy as the technology.

So I'm not trading any of them. And I'm certainly not shorting them.

I am of course giving you fair warning to avoid that sector.

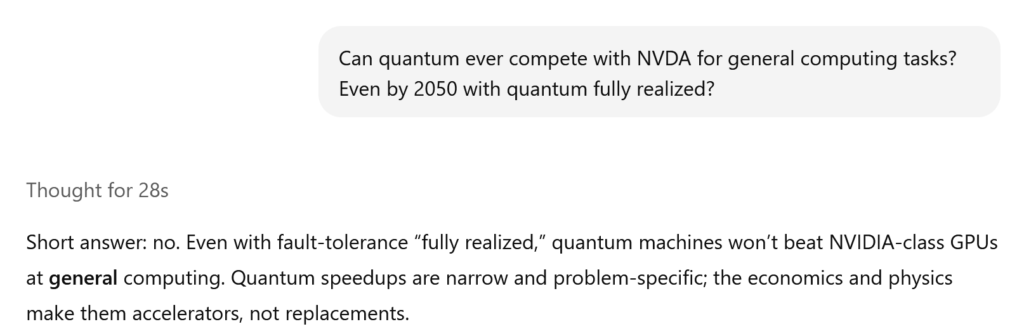

Even ChatGPT knows:

Disagree with me? Perfect. Markets exist because people see price differently.

If we were a Borg hive mind, the order book would be empty.

So if you want a bit of exposure to quantum, the QTUM ETF has some in their holdings (although it's mostly a who's who of tech stocks, not a pure play).

There's not much history, but I tried all four of our different techniques to build a strategy on it: Indicators (Human-made)

Indicators (Human-made) Cyber code (linear genetic programming)

Cyber code (linear genetic programming) TAP data (Mispricing “glitches”)

TAP data (Mispricing “glitches”) Dark Pool data (Where most trading is done these days)

Dark Pool data (Where most trading is done these days)

The winner was mispricing “glitch” data with a 53% CAGR.

Human-made indicators lowered the max drawdown, but didn't significantly outperform the ETF itself. |

Portfolio Boss Strategy Performance: |

|

Trade smart,

Dan “Prince of Proof” Murphy

Government required disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses