Hofstadter’s Law

Corona Del Mar, CA

Howdy Friend, I know it's tough. This world of trading can be rough, like a stormy sea with wild waves. You and I, we're sailors trying to find land, aren't we? Let's chat about something a bit funny but very true. It's called Hofstadter's Law. It's pretty simple. It says, “Everything takes more time than you think, even when you remember that everything takes more time than you think!” |

Funny, right? But, boy, it's true.

In our world of trading, you might have thought, “I'll be making big bucks in no time!” But then, days turn into weeks, weeks into months, and maybe even months into years. And you're thinking, “Why is this taking so long?”

Well, that's Hofstadter's Law doing its dance right there. Trading is like trying to catch a fish in a big, vast sea. Sometimes you'll hook a small one right away, sometimes it takes all day to land the big one. It's not always as quick as we hope. But that doesn't mean the fish aren't there, right?

And then, there's all the noise, the endless chatter, the gobbledygook and baloney. The flashy ads promising to make you a millionaire overnight. The scary news headlines telling you the sky is falling. It's like trying to hear a whisper in the middle of a noisy party.

But remember this: Most of that noise? It's just hot air. Baloney. A lot of folks talking loud but saying nothing.

So, how do we beat Hofstadter's Law and all this noise?

Well, it's simple but it ain't easy. We gotta stick to our plan, keep our heads down, and keep at it. Keep learning and keep trading. Take one step at a time, one day at a time. Keep your eyes on the prize. Ignore the noise. And don't quit. Don't ever quit.

Becoming a successful trader might take a little longer than you thought, but the view at the top is worth the climb. So, don't lose heart. You're closer to striking gold than you think.

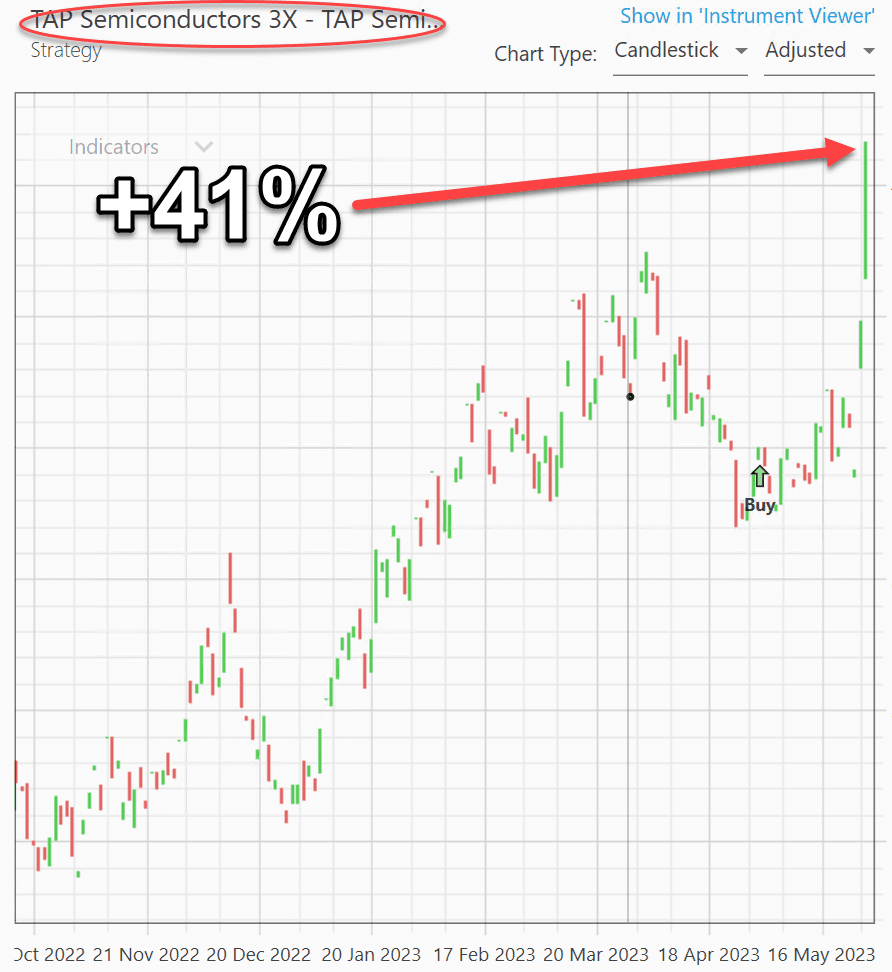

Remember, every great journey begins with a single step. So keep stepping, and one day, you'll look back and see just how far you've come. Speaking of first steps, you might want to get involved with leveraged ETFs like SOXL/SOXS.

Why?

Well, not for the leverage (In fact, I tend to dial these ETFs back by trading them with less $$$)…but because they have a distinct statistical advantage. For example, Meta Ai didn't want anything to do with semiconductors for several months. But at the beginning of this month, they were predicted to be one of the top performing strategies by Ai.

Boy did it ever!

The daily re-balancing and volatility decay in these ETFs seems to make them more predictable. We could all use more predictability in our lives.

Hope that helps!

|

|

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Insert Image

Responses