Goldfinger

Corona Del Mar, CA |

Three quick Goldfinger shockers: |

That’s it. |

Portfolio Boss Strategy Performance: |

|

Trade smart,

Dan “Prince of Proof” Murphy

Government required disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

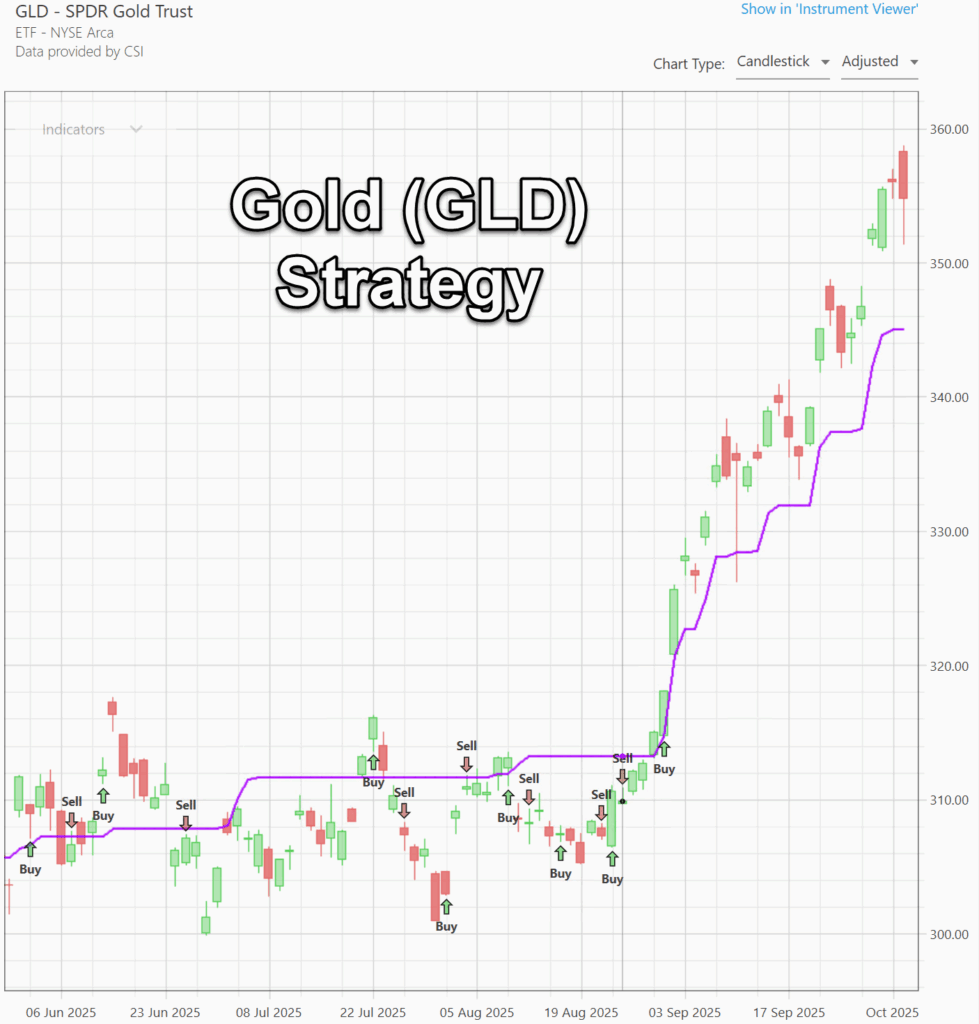

Trend-following: Only buy when price is above the purple line (below).

Trend-following: Only buy when price is above the purple line (below).

Responses