The Knife in the Turtle Traders’ Back

Corona Del Mar, CA

Howdy Friend!

Serendipity… It's when something that happens by chance turns out to be a benefit.

In this case, the beneficiary is YOU.

Back in the 90's when I was a wet behind the ears wannabe-millionaire trader, I ended up custom programming several trading strategies.

Some were good, most were bad.

My poor trading account got beat up more than a red headed stepchild.

It wasn't until I studied under one of the original Turtle Traders (taught directly by Richard Dennis and Bill Eckhardt) that really burned clarity of thought into my lil ‘ol noggin.

Shockingly, it was actually the flaw of the Turtles that stands out in this example.

You see, they didn't really teach the proper way to separate data.

You might as well pan for gold without a pan.

Back in the early 2000's, one of the members wrote a book describing how even random entry and exit rules could make money trend following — only they didn't make money.

This particular member of our group ended up quitting.

Why is it that all his careful research ended up leading a man to drink away his sorrows like a Johnny Cash song?

Because he over-fit his system to the past.

The trick is to segregate a chunk of data so the computer never sees it. Recently, we were adding a bunch of weird indices to “The Boss” automated strategy designer.

One of the symbols is “@TICA” which is the AMEX tick index.

@TICA has only been available since 2006.

We had a bug in “The Boss.”

Instead of a back testing NASDAQ 100 stocks going back to the days of big hair 1980's rockers like I wanted, it only went to the shortest history of these new indices — 2006.

The result is awful.

Clearly 14 years is not enough history and I'll explain exactly why…

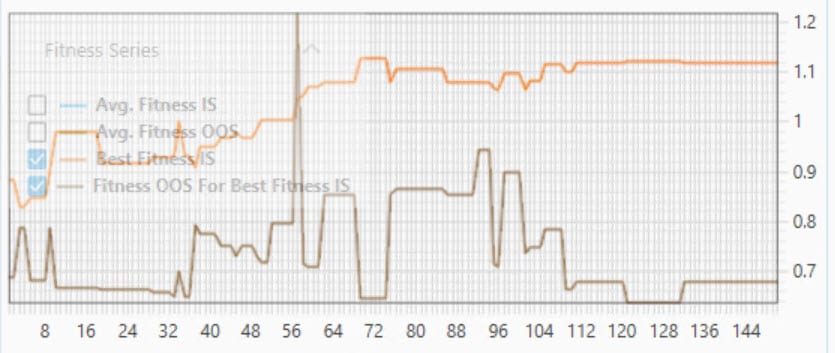

Take a look at the graph below…it's the knife in the back of the Turtle Traders.

The orange line shows the gradual improvement of the best strategy over time on in sample (seen) data from about 2007 to 2016.

The brown line shows the results from the unseen data from 2016-2020.

Where's the improvement?

The out of sample just gyrates randomly like a drunk on a unicycle.

This strategy should be balled up, lit on fire, and thrown in the nearest trash can.

This is a clear example of over-fitting to the past, and it's something you won't see in the vast majority of back testing platforms.

Luckily, it's something “The Boss” figured out in about a half hour of “work” instead of the dozens of hours I would have put in if I programmed this example by hand.

If I had to take a guess at why system trading didn't work for you in the past, I would bet dollars to doughnuts that this is the reason.

Please heed this warning or those dreams of F U money will be looted from your mind quicker than a Target during a riot.

|

|

Government required disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses