Is predicting lows GOOD or BAD? [Graph Inside]

Corona Del Mar, CA

Howdy Friend!

While there isn't an average wage listed for “tightrope walker,” the average pay for a circus performer is $21/hour. I guess they're not selling as many bags of peanuts as they used to.

However, if you do that same stunt in spectacular fashion — like crossing the Grand Canyon — it could make you a cool $500k. That's what stuntman Nik Wallenda makes PER STUNT.

Of course Nik's job is life and death, and he's a 7th generation performer with balls of steel.

Yet his balancing act is certainly important to us traders as well.

As a consistent Part-time Market Maker, you want to want to place an order below where your favorite stock closed.

That way you're trading like a Prime Market Maker (and we all know they make billions doing this tens of thousands of times a day).

Here's the catch:

Not only do you want to maximize profit on the trade, you also want to increase the chance of getting filled.

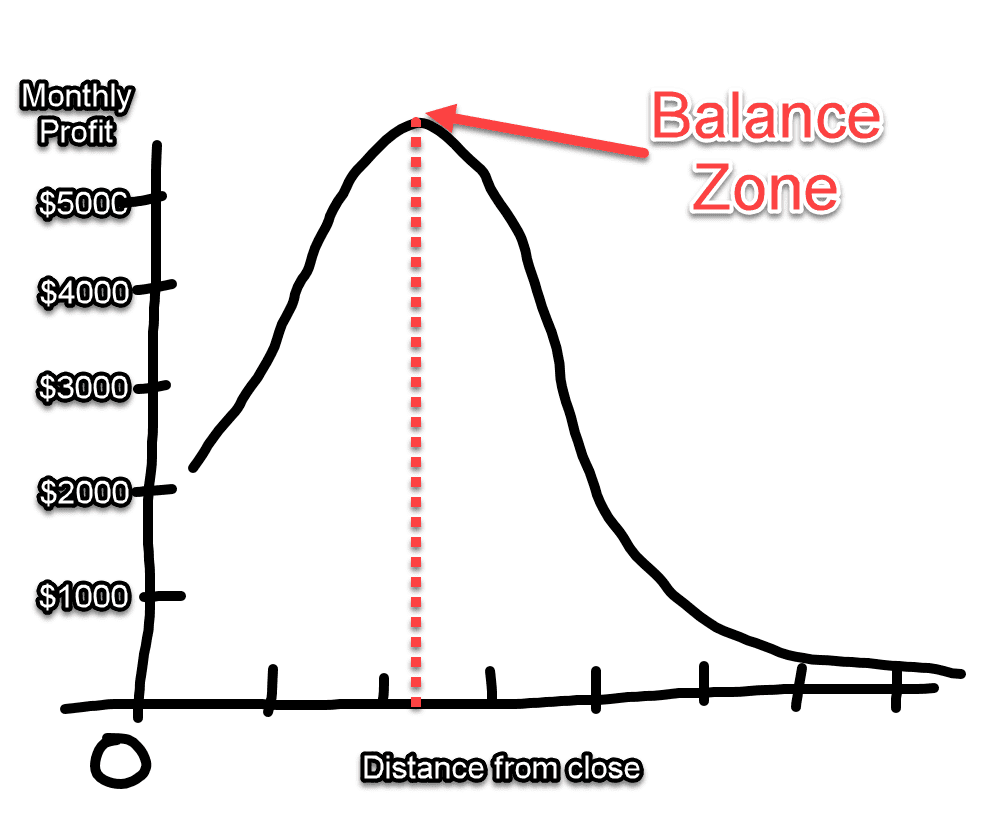

If I can identify a stock that's over-sold, and I put in a limit order right where the stock closed the day before, maybe I can make let's say $2000/month.

If I put my limit order WAYYYY below the previous day's close, then I'll rarely get filled, and maybe I make 500 bucks a month.

But if I put my limit order in the Balance Zone, now we're making the most amount of fungolas possible in the minimum amount of time.

So you don't want to try to capture the low of the day…you want to walk the tightrope between getting filled on your order and getting in at a low price.

Make sense?

I hope you said yes, because this technique could easily add an extra zero to your trading account post haste.

Ready, set, go!

P.S. Want to plug-n-play our automated Part-time Market Maker technology to your trading account?

…so you can generate retirement income without the headaches of trying to time “The Market”

…and you're not sacrificing hours of your life pouring over useless charts or listening to the talking heads of disinformation on your TV

…while spending only an hour per week on maintaining your part-time Market Making business?

…and it'll only take you 1 hour 45 minutes to learn the ins and outs of being a part-time Market Maker

…and you'll get my help month after month for 1/6th what others have paid.

We're not getting any younger, so join me now.

Here's what the Market Maker Secrets Program is all about:

>>> Click here to get started <<<

|

|

Wondering how to get started?

Step 1: Looking for more consistent profits?

Get a free copy of my book: Artificial Intelligence, Real Profits here >>

Step 2: Want to build a trading strategy in under 10 minutes?Watch this free training video >> (Scroll down the page)

Step 3: Want A.I to build tailor-made trading strategies for you?

A.I is beating people at just about anything related to numbers and data. Nearly every billion-$$$ hedge fund now uses A.I to boost profits.

Watch a demo of The Boss “SuperAi” Strategy Builder as we harness the raw power of 3500 computer cores and strong A.I.

During the presentation, you'll learn: How to Generate Consistent Retirement Income Using “SuperAi-Designed” Trading Strategies. Click here >>

Step 4: Looking to discover new trading ideas to help grow your nest egg?

Online training to vastly improve your trading with A.I.

Watch the podcast >> | Read the blog >>

Step 5: Additional Resources

The Relaxed Investor (The simple strategy proven to work since 1926. Downloaded by over 200,000 readers)

The Ghost of Bernie Madoff is Not Yet Dead (Is your broker on the naughty list? Many traders have no idea they're being sold out)

The Ultimate Crash Detector (The strange weekly report that helps predict crashes. LIVE trading signals since 2006)

Portfolio Boss User Guide (Our flagship strategy building platform User Guide. See what it can do to help you on you quest for F U money)

Trading With Other People's Money – Coming Soon!

Bit-coin for Busy People (How to get started with Bit-coin in under an hour without the complicated new exchanges, high fees, and complicated wallets)

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Insert Image

Responses