$700MM Profit – Better Lucky than Good?

Corona Del Mar, CA

I was reading about Senvest Management and how they made $700 million on GameStop…by far their best trade ever. Good for them.

Today is the 1-year anniversary of peak meme stock insanity by the way.

Here's what I wrote that day about the would-be “Reddit millionaire” traders: “…most of these traders are in Phase 1 and have no idea of what's about to hit them.”

Phase 1 being a complete newb that is about to lose it all.

Unfortunately almost all of them did lose. I've been there, so I feel for the millions of good folks that drank the Kool-Aid.

Getting back to the $700 million trade…

What caught my eye in the story was that Senvest used a tweet from Elon Musk to exit the trade.

You'd think a multi-billion-dollar fund would be using sophisticated computers.

Nope.

Elon simply said, “Gamestonk!!” in a tweet, and they got out.

Their reason to be in the trade — along with just about everyone else — was that short interest in GME was 141%.

I argued that this was incorrect. In fact, the short interest was at 58%.

S3 Partners, a data provider, had pointed out that the calculation of short interest as a percent of float is completely flawed. I agree.

Strange how even a multi-billion-dollar hedge fund didn't know that.

I guess it's better to be lucky than good.

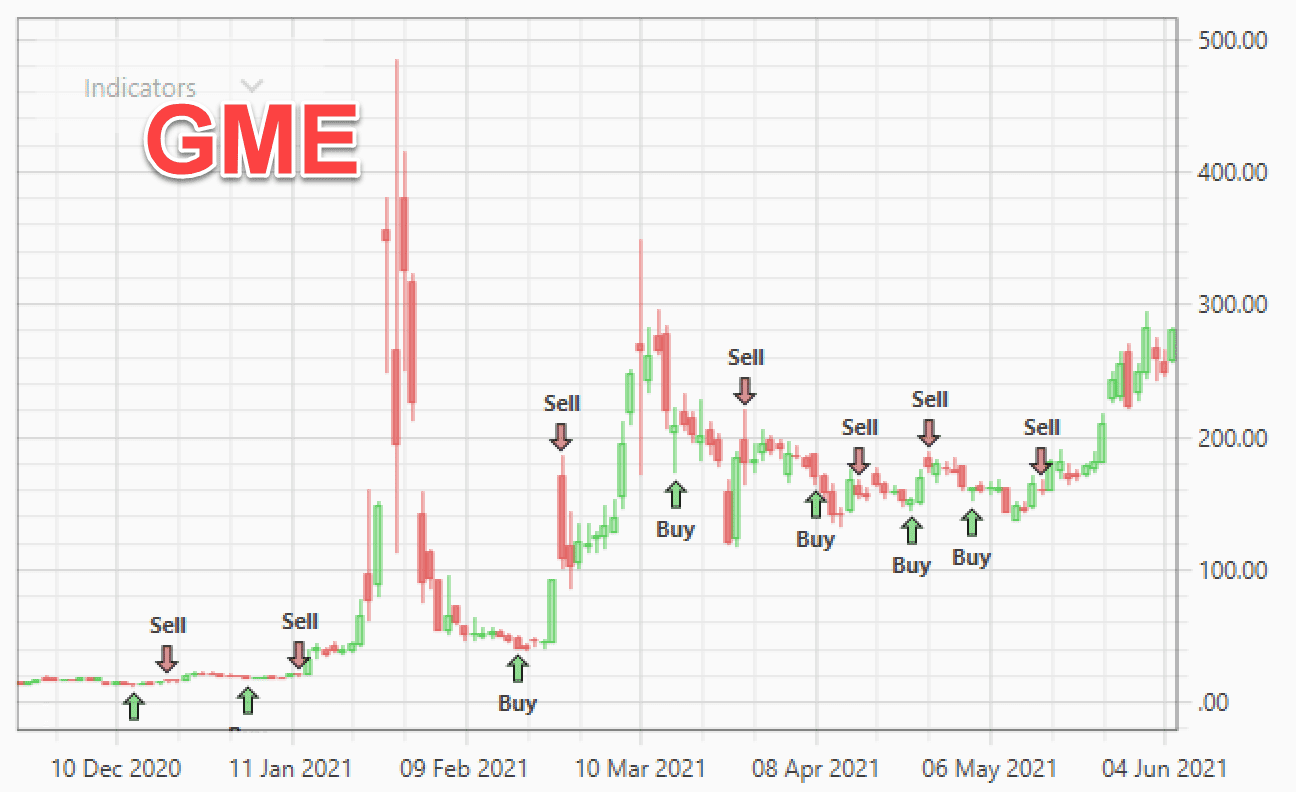

GameStop did of course exhibit price anomalies, which made it ripe for part-time market making.

Check out this series of trades:

+25%, +9.6%, +297%, +5.7%, -4.1%, +26%, +6.7%.

Those are definitely not typical results, but it's interesting how you could have made these trades by simply placing a precise limit order the night before.

And instead of pouring through Elon Musk's tweets, Reddit message boards, and watching Cramer flap his yap for hours on end, you receive the signals in an email at 4:30PM.

Then you place the orders with your broker and go about your business.

That's how trading should be right?

If you'd like to become a part-time Market Maker, then now is the perfect time: I'm holding a live training session this coming Monday the 31st.

Here are the details of the program >>

|

|

Wondering how to get started?

Step 1: Looking for more consistent profits?

Get a free copy of my book: Artificial Intelligence, Real Profits here >>

Step 2: Want to build a trading strategy in under 10 minutes?Watch this free training video >> (Scroll down the page)

Step 3: Want A.I to build tailor-made trading strategies for you?

A.I is beating people at just about anything related to numbers and data. Nearly every billion-$$$ hedge fund now uses A.I to boost profits.

Watch a demo of The Boss “SuperAi” Strategy Builder as we harness the raw power of 3500 computer cores and strong A.I.

During the presentation, you'll learn: How to Generate Consistent Retirement Income Using “SuperAi-Designed” Trading Strategies. Click here >>

Step 4: Looking to discover new trading ideas to help grow your nest egg?

Online training to vastly improve your trading with A.I.

Watch the podcast >> | Read the blog >>

Step 5: Additional Resources

The Relaxed Investor (The simple strategy proven to work since 1926. Downloaded by over 200,000 readers)

The Ghost of Bernie Madoff is Not Yet Dead (Is your broker on the naughty list? Many traders have no idea they're being sold out)

The Ultimate Crash Detector (The strange weekly report that helps predict crashes. LIVE trading signals since 2006)

Portfolio Boss User Guide (Our flagship strategy building platform User Guide. See what it can do to help you on you quest for F U money)

Trading With Other People's Money – Coming Soon!

Bit-coin for Busy People (How to get started with Bit-coin in under an hour without the complicated new exchanges, high fees, and complicated wallets)

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Insert Image

Responses