Trading as a Business: Capacity is King

| Corona Del Mar, CA

Howdy Friend,

Someone once told me how to solve any problem in business…just imagine what a smart person in your industry would do…and do that! For me, that person would be Jim Simons, the founder of Renaissance Technologies. Back in the 90's, they ran into a capacity problem (more on that in a bit).

Every trader should understand what capacity is, not just fund managers of multi-billion-dollar hedge funds, which is why we're going to dive into it today. Capacity is how much money you can trade with before you start moving prices around.

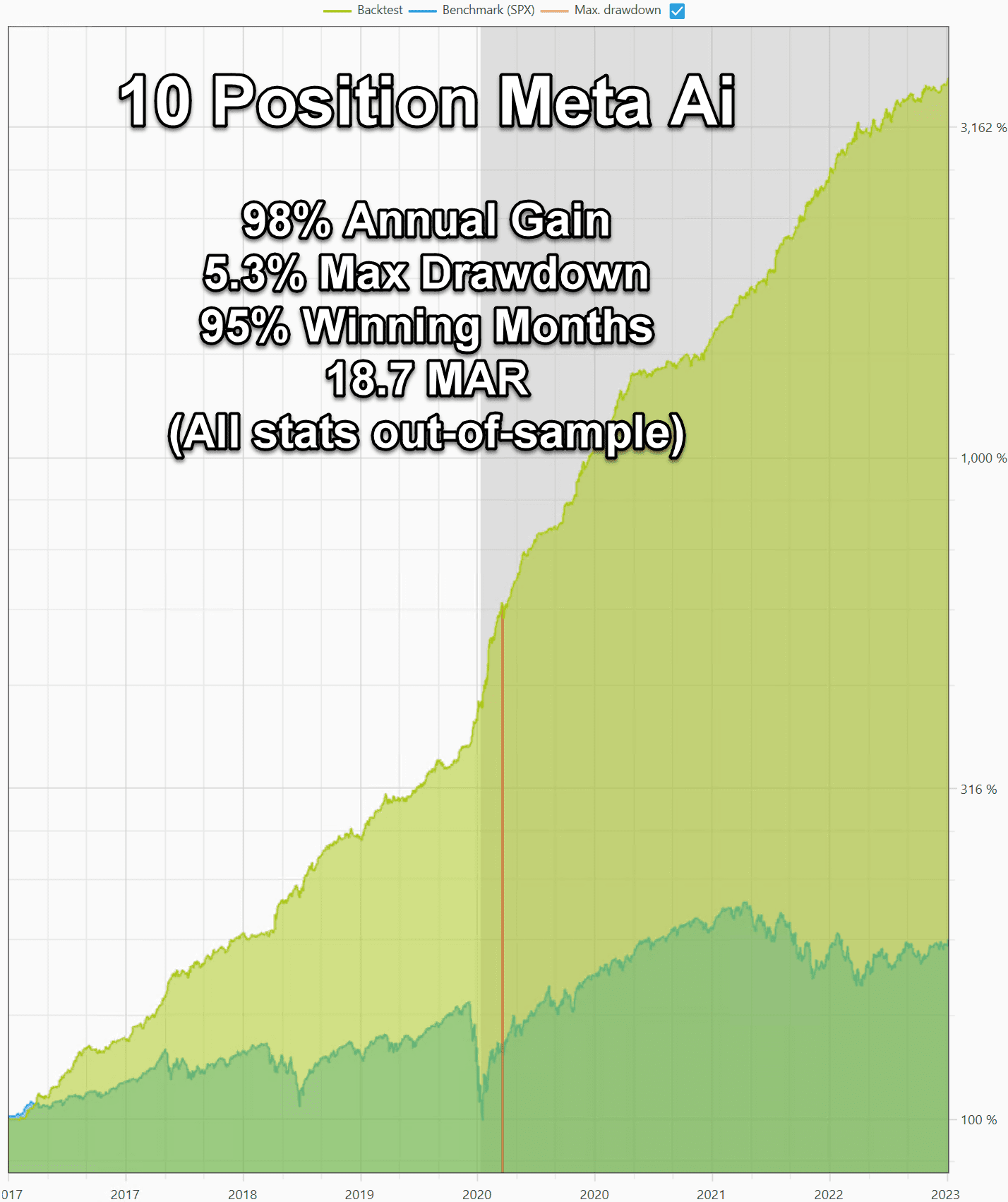

Let's use this Meta Ai strategy as an example: |

It trades 10 strategies at once. Yesterday, it had four ETF trades: LABD, SOXS, BOIL, TECS

These are highly popular ETFs with volume in the millions of shares per day.

A general rule of thumb is to never trade more than 1% of the average daily volume — otherwise you're going to get terrible fills (slippage). So for example, TECS had 1.7MM shares traded. The closing price is about $19, so the dollar volume is about $32 million.

You shouldn't be trading with more than $320k in this ETF. TECS is a 3x leveraged ETF, so I actually dial it back by weighting the strategy at 30%. Starring at the ceiling at 3AM wondering why I have so much leverage in my portfolio sounds about as fun as licking a bug zapper. |

Let's look at an ETF that is thinly traded: 2x inverse gold (GLL)

This is the one weak link in the Josh 100 program because its max capacity is about (80,000 * 27 * 0.01) = $21,600

The simple fix is to delete the strategy from the list. As your account grows, you trade more strategies at the same time to increase capacity (and the added benefit of smoother results).

Earlier I mentioned Jim Simons had a capacity issue. They were maxing out in the futures market. So they looked to the most liquid market of all: U.S stocks. After a long R&D phase involving machine learning, they were able to swing trade almost every listed stock long and short.

That raised their capacity to around $10 billion. I could throw a helluva party for $10 billion.

A few months back, we had a similar breakthrough.

We figured out how to trade just about any liquid stock long/short. My estimate for capacity is also in the $10 billion range…which is why I'm looking into starting a fund.

It took nine years of development, and millions out of my pocket to finally get to this level…Meta Ai was the final piece of the puzzle. Portfolio Boss can manage an entire trading business whether you have $50k or $500M.

Notice I said “business”…you really should be treating trading as a business rather than a hobby.

Hit reply and let me know your thoughts.

P.S. The Josh 100 program is closed to new members.

|

|

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Insert Image

Responses