Too Many Cooks in the kitchen

Corona Del Mar, CA |

I mentioned the other day that I've been using X to put my finger on the pulse of politics and markets. |

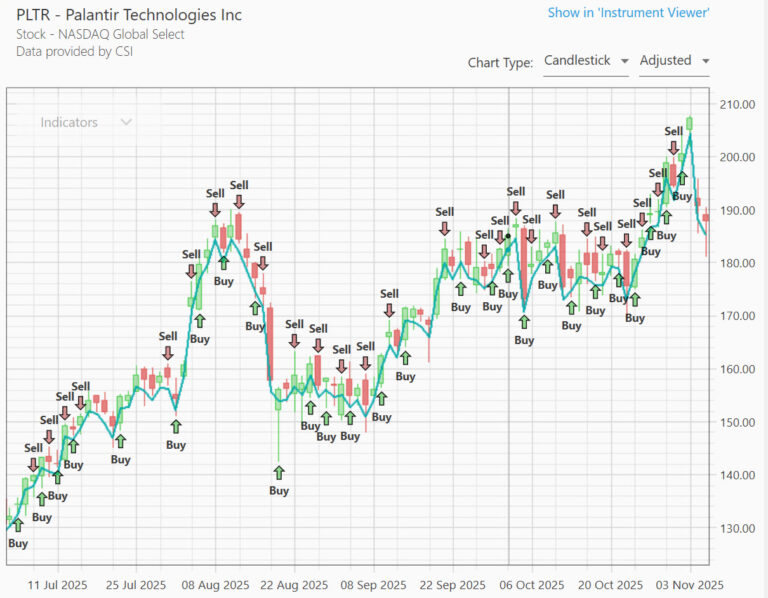

It actually sold out this morning, but I'm sure it'll be back in soon enough. The average trade only lasts 2.6 days, and the strategy did just fine when PLTR collapsed 84% in 2022.

So should you care how Michael Burry is positioned?

NO!

It's a case of too many cooks in the kitchen. I just stick to the trading strategies and ignore the constant fear mongering in the news.

Remember their mantra: If it bleeds it leads.

It's the same thing with the Hindenburg Omen.

Those signals are just noise up until you see a cluster of them.

There have been 217 of them in 60 years.

So again, too many cooks in the kitchen…this is pure noise for a trader.

I'll leave you with one more thought…

…there seems to be this anti-prosperity mob that is dead-set that AI is all smoke and mirrors. It's a giant bubble they say.

They also say if it wasn't for a handful of stocks, the market would be down right now.

Don't listen to them. The equal weight S&P 500 also hit new highs so they're full of hot air. Take a look:

By the way, our crazy Alpha Manhattan Project is still going strong — computers have been running 24/7 for two weeks building strategies. |

Portfolio Boss Strategy Performance: |

Entry level: All-weather Alpha is at -0.4% for November, and 36.5% for the year. |

Trade smart,

Dan “Prince of Proof” Murphy

Government required disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses