Technical Trading in 384 BC

“Those that fail to learn from history are doomed to repeat it.” – Winston Churchill

Corona Del Mar, CA

Howdy Friend!

If you're going to make it in any industry, you better know its history…otherwise you could be making the same mistakes as your predecessors.

For example, did you know that technical analysis goes all the way back to Babylonian times? As far back as 384 BC, there were technical traders speculating on the markets. They would trade barley, dates, wool, mustard, and more. Astrologists would write down price data on clay tablets, so here's a shout out to those mystics from southern Iraq.

In fact, I've acquired a dataset from 384 BC to 60 BC.

(I was mildly ticked off that Larry Hite had a longer back test than me, so take that Larry! wink wink nudge nudge)

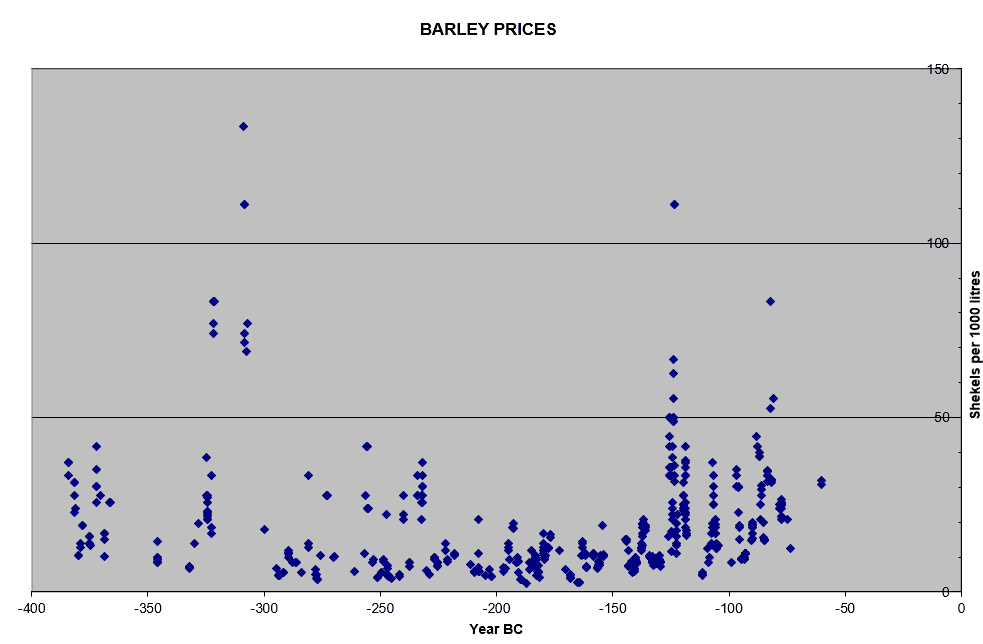

Thankfully someone else converted the data to “price in silver shekels” instead of “liters per shekel.” Imagine if Apple was priced in shares per dollar? Yikes. Anyhoo, here's a chart of barley prices during that time. Notice the crazy spikes and reversion to the mean (the way to trade back then would be a simple reversal system…serial correlation was very very high).

There's a reason I'm pointing a finger at technical trading being an ancient concept…because so many think of it as some kind of new discovery or that no one else has thought about drawing lines on charts and getting rich in the process.

Why isn't there some family dynasty that makes their fortune from trading this way? After all, this form of “analysis” has a 2300 year head-start on computerized trading.

In 1936, Gann famously said that the Dow would never sell above 386 again.

I think the Elliott Wave guys said the same thing after the 1987 crash.

People like Gerald Tsai used TA in the 1960's, and became a prominent figure at Fidelity Investments…then he blew up spectacularly in the 1969-1970 bear market.

Jesse Livermore did the same thing, eventually committing suicide. (why he is so celebrated, I don't know). Look, there are plenty of edges in the markets, but you have to be doing things that are out of the ordinary to make serious money…and more importantly, they have to be proven statistically.

For example, in the last post, I showed that seasonality in the stock market does not exist…yet it's often quoted as being true. So what works, Dan?

Here's a bunch of strategies that work and have stood the test of time.

>>> Click here for access, and turn your trading around TODAY <<<

|

|

Wondering how to get started?

Step 1: Looking for more consistent profits?

Get a free copy of my book: Artificial Intelligence, Real Profits here >>

Step 2: Want to build a trading strategy in under 10 minutes?Watch this free training video >> (Scroll down the page)

Step 3: Want A.I to build tailor-made trading strategies for you?

A.I is beating people at just about anything related to numbers and data. Nearly every billion-$$$ hedge fund now uses A.I to boost profits.

Watch a demo of The Boss “SuperAi” Strategy Builder as we harness the raw power of 3500 computer cores and strong A.I.

During the presentation, you'll learn: How to Generate Consistent Retirement Income Using “SuperAi-Designed” Trading Strategies. Click here >>

Step 4: Looking to discover new trading ideas to help grow your nest egg?

Online training to vastly improve your trading with A.I.

Watch the podcast >> | Read the blog >>

Step 5: Additional Resources

The Relaxed Investor (The simple strategy proven to work since 1926. Downloaded by over 200,000 readers)

The Ghost of Bernie Madoff is Not Yet Dead (Is your broker on the naughty list? Many traders have no idea they're being sold out)

The Ultimate Crash Detector (The strange weekly report that helps predict crashes. LIVE trading signals since 2006)

Portfolio Boss User Guide (Our flagship strategy building platform User Guide. See what it can do to help you on you quest for F U money)

Trading With Other People's Money – Coming Soon!

Bit-coin for Busy People (How to get started with Bit-coin in under an hour without the complicated new exchanges, high fees, and complicated wallets)

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses