The Lazy Trader’s Road to Riches

Corona Del Mar, CA

Howdy Friend!

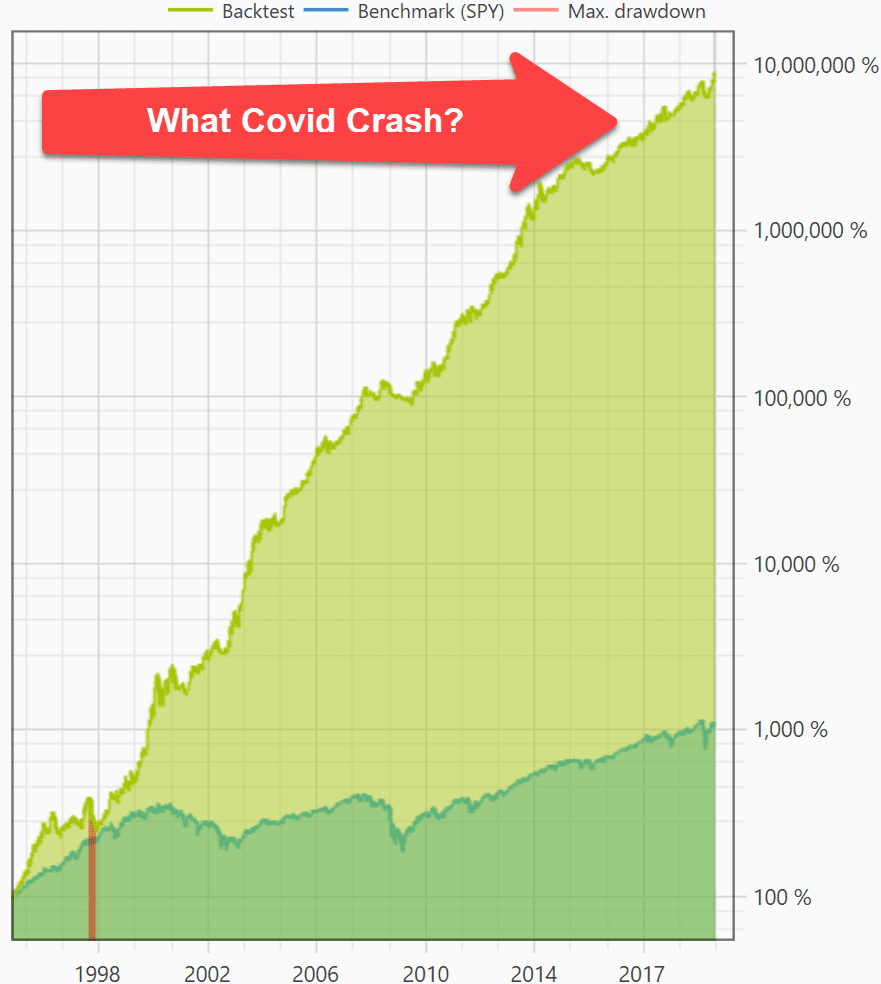

Nearly a year ago, I rented one of the fastest single computers in the cloud to test a hypothesis…

…could the computer discover a more profitable version of my “DB Transaction” strategy?

After several weeks of constant number crunching (on a 64-core machine), I had an answer:

YES!

Hypothesis confirmed!

But of course, the biggest worry for systematic traders is over-fitting to the past.

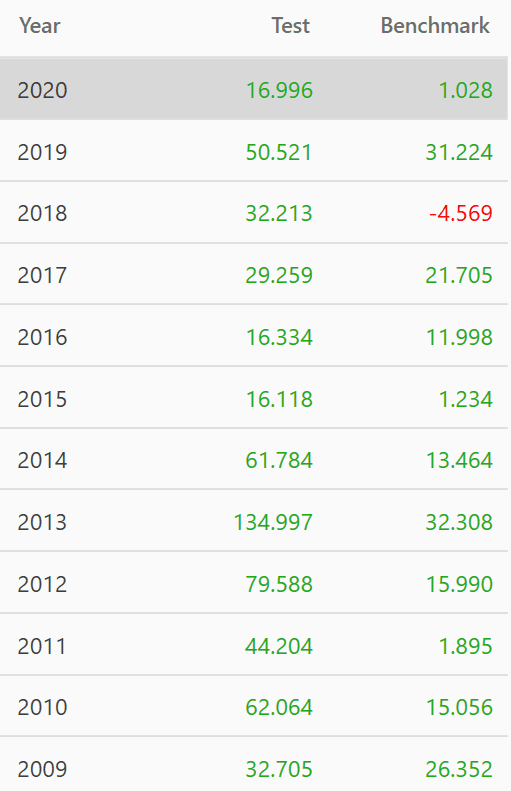

Well, now the strategy has been battle tested — how did it do?

As you can tell from the graph above, it's done very well, with the C-19 crash just a blip in the past.

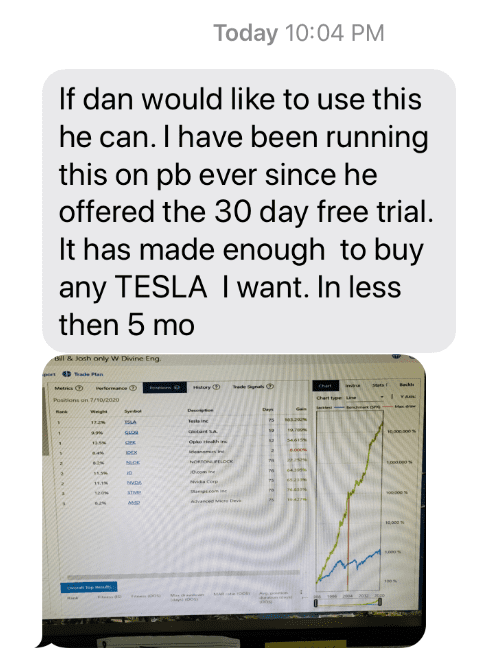

Bill H, a fellow trader from Florida sent this kind text the other day:

Zoomed in:

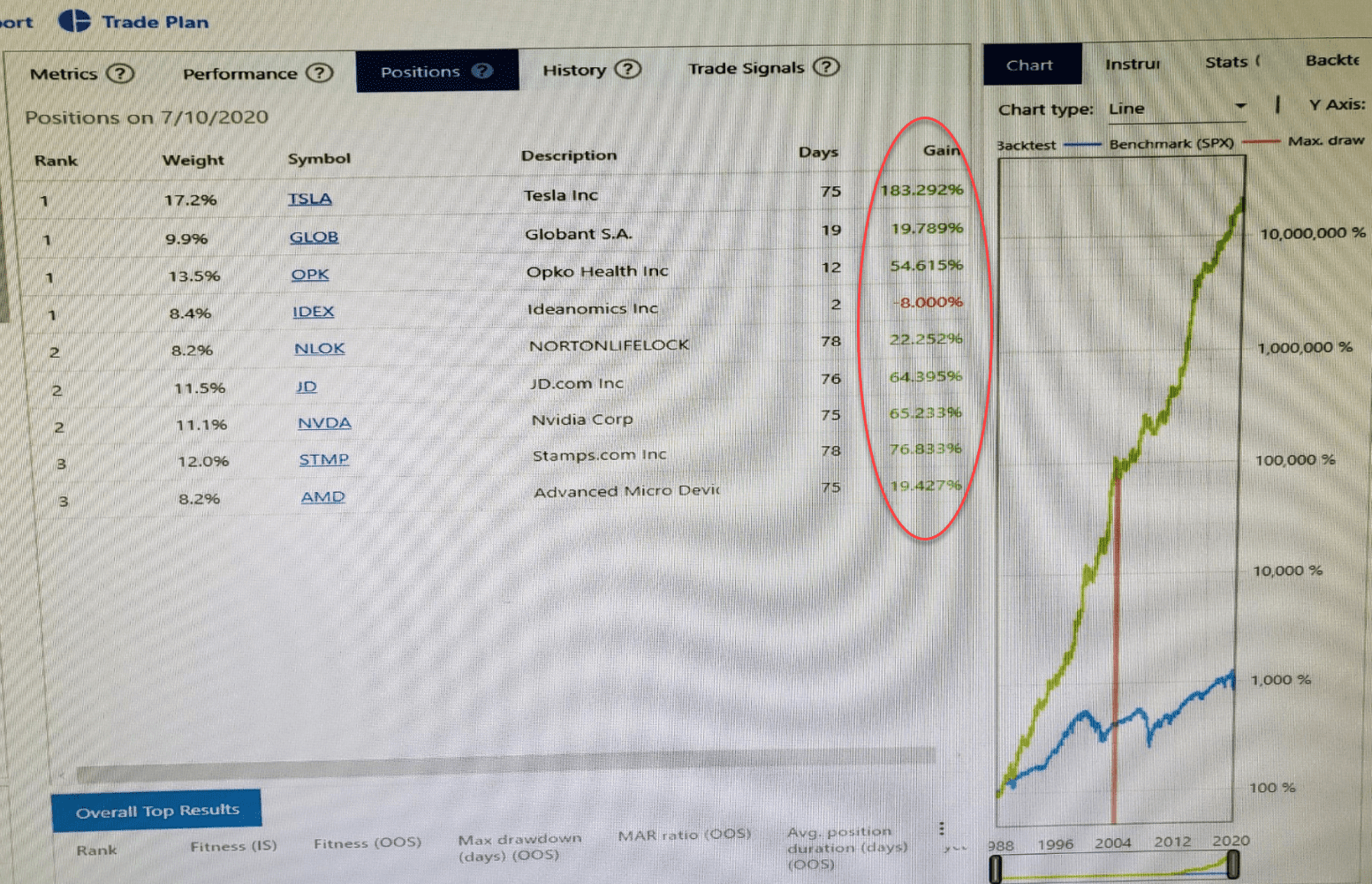

When I zoomed in on his text, I could see why he said he could buy any Tesla he wanted!

Those are some juicy gains.

If you'd like to learn more about how the strategy works (it's a bit counter-intuitive), then click on this link and take a gander >>

Time is of the essence however, as the new switch date is fast approaching.

The switch date is where the strategy picks all new trades, and it occurs this Tuesday the 21st.

|

|

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses