Scaling to 8-figures

Corona Del Mar, CA |

If this doesn't motivate you to keep trading, I don't know what will. |

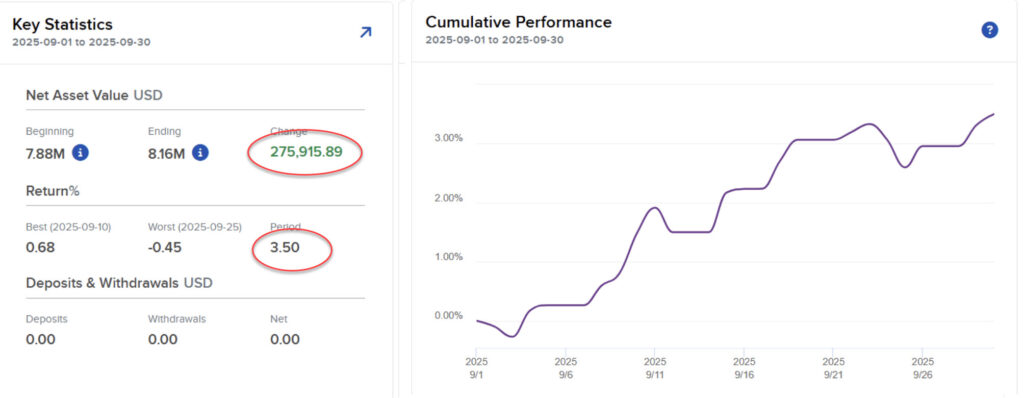

I'm stoked he didn't listen to the talking heads about September being a down month.

While he was “only” up 3.5% for the month, with an account that size, he raked in $275,915.

My specialty is scaling accounts from 5 to 6, 6 to 7, and 7 to 8-figure accounts. That's why some folks gladly pay me $50,000 for a year of consulting.

Now lean in because I'm going to save you some money… so read this entire email if you want to take trading seriously.

Portfolio Boss has scaling tools built right in. In fact, I've said for years now that when I start my fund, I'll be able to run it with Portfolio Boss.

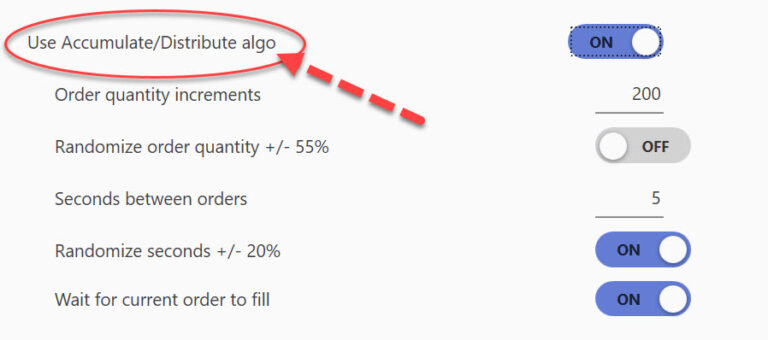

You see, Portfolio Boss (even the free Evo version) has built in scaling orders when you use Interactive Brokers.

Yup, you just go into Settings->Trading and select the accumulation/distribution algo. This breaks apart larger orders so you don't take out the order book.

I go into great detail about this in Chapter 4 of 7-figure Ai Trader.

Then you export the trades into IB's Trader Workstation. Easy peasey.

If you are using a “free” broker you are getting skimmed. They send your orders to “wholesalers” like Citadel that make billions off retail traders. It ends up costing you more in slippage (bad fills) than commissions. It's a tax on ignorance. Use IB Pro instead. |

Portfolio Boss Strategy Performance: |

|

Trade smart,

Dan “Prince of Proof” Murphy

Government required disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses