Designing a $250MM Hedge Fund

Corona Del Mar, CA

Howdy Friend,

After seeing the incredible brokerage statements of my students, and 100% Club member Josh placing #3 out of 18,000 in a trading contest…I've been researching the money management business.

I've never wanted to do it because of all the hoops and regulations. So I'm in research mode trying to figure out if it's worth it. I think you'll be intrigued by what I've uncovered, and it'll help you with your trading.

So let's dive in!

Interactive Brokers has about 50 funds listed on their Marketplace. The average fund has $50MM in asset under management (AUM). Only 12% of those funds has made money every year for the past five years.

My goal is to make money every month, so it's a good mental note to realize that many hedge funds aren't even keeping up with the S&P 500. One of the funds was down 90% last year. I'm pretty sure that fund is dead to outside investors. What you may find surprising is that the gains these funds are shooting for is well under 20%. |

For example, one of the top AUM funds has averaged about 15% per year.

The typical fees are 1-2% annual management fee, and 20% of profits. So if you if you have an average two-man $50MM fund and 15% gain, then the reward for the management team is $1.5MM. The 1-2% comes out to $500k-$1MM. That would pay for operating expenses like employee salaries, audits, legal, sales.

I read through about a dozen Offering Memorandums to see what they had in common.

Here's the skinny:

- The minimum investment is typically $250k to $1MM

- You must be an accredited investor (Make $200k/year or have $1MM in assets outside your primary residence). Dems da rules!

- They can only accept 100 accredited investors. What they really want are “qualified purchasers” who are those with over $5MM in assets

- They don't want to be a bank, so many funds have lockup periods or require advance notice that you want to take money out

As I read through the offerings, it's very clear that funds want to repel the pain in the ass types. Quick story: I was traveling with some friends in Europe a few years back. One of my buddies ran an introducing broker business where he would get a commission for client referrals.

Anyhoo…one of his clients was calling him non-stop while he was on vacation (and he knew he was on vacation). I could hear him whine about the S&P being down, and my friend would remind him that the strategy didn't rely on direction.

That's just crazy. No amount of money is worth being harassed, so I get why a fund wouldn't want someone that's putting every nickel of their life savings on the line.

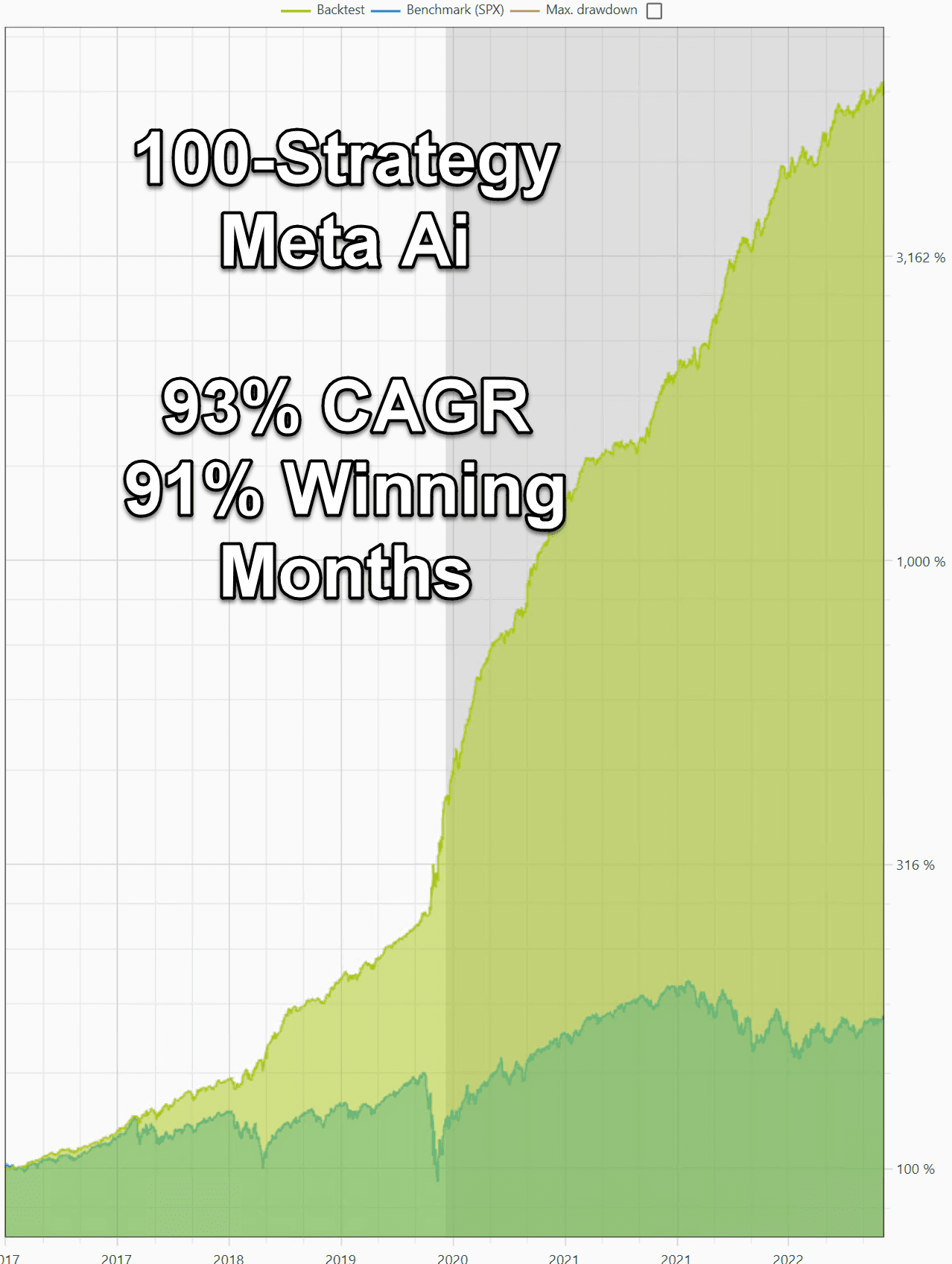

Just for fun, I came up with a 100-strategy Meta Ai in about 15-minutes for this newsletter. I estimate this one could handle $250MM+ in AUM. I cranked down the leveraged ETFs, so a fair amount is sitting in cash — which I'd sweep into t-bills as is common practice.

I ran out of the time for today's post, but dang it…the growth rate is too high.

This would actually scare away hedge fund investors. Imagine that. I didn't check off “re-balancing” so a few strategies began to dominate. A quick re-run got it down to 46% CAGR, a tiny 4% max drawdown, and 93% winning months.

Now I'd invest in that fund!

Let me know if you'd like me to continue to document my research into **possibly** starting a hedge fund or if you don't care about this sort of thing. Hit reply.

|

|

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Insert Image

ASAP, Please Sign me up!!!

Please continue

please continue your hedge fund work.

Your research is very enlightening. Keep up the good work.