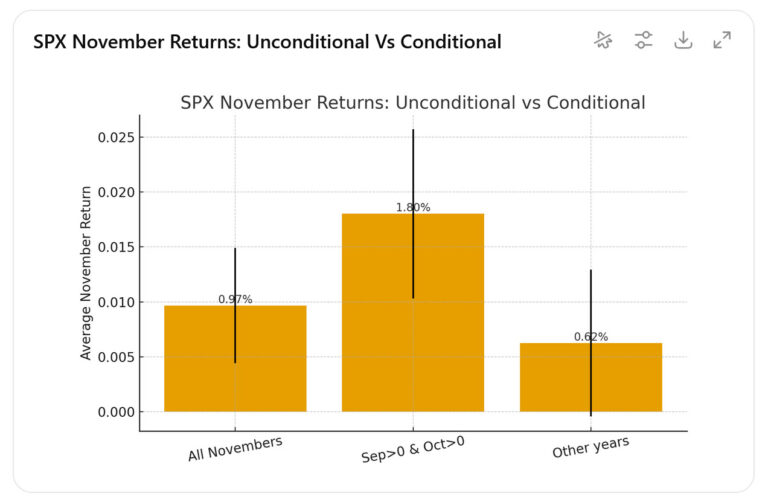

What happens if BOTH Sep and Oct are UP?

Corona Del Mar, CA |

Those that track seasonality and are bearish were pretty sure September would be down. |

Humans are great at many tasks, but statistical intuition is not one of them.

If I plug the numbers into Chat-GPT, it tells me this is absolutely not an edge. In fact, seasonality is not an edge. I've already gone down that rabbit hole so you don't have to.

A team led by Ryan Sullivan (with Allan Timmermann and Halbert White) went even further than me.

They took 100 years of daily U.S. stock data and tested a huge universe of calendar rules — day-of-week, week-of-month, month-of-year, holidays, you name it.

Then they corrected for the thing almost nobody corrects for: data-snooping.

Result? Once you adjust properly, those “can’t-miss” seasonals don’t remain significant.

They didn’t just try a handful…they built a massive menu of thousands of calendar rules and ran a bootstrap “Reality Check.”

The headline finding: after the correction, no calendar rule reliably beats the market. In-sample, out-of-sample, or across sub-periods. In plain English: the magic evaporates when you penalize for all the shots on goal.

That’s why seasonality keeps letting people down.

So ignore the calendar chatter and focus on edges you can measure, stress-test, and re-test.

Portfolio Boss Strategy Performance: |

Entry level: All-weather Alpha is at 2.3% for October, and 39% for the year. |

Trade smart,

Dan “Prince of Proof” Murphy

Government required disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Responses