The Pseudoscience of Charting

Corona Del Mar, CA

Howdy Friend!

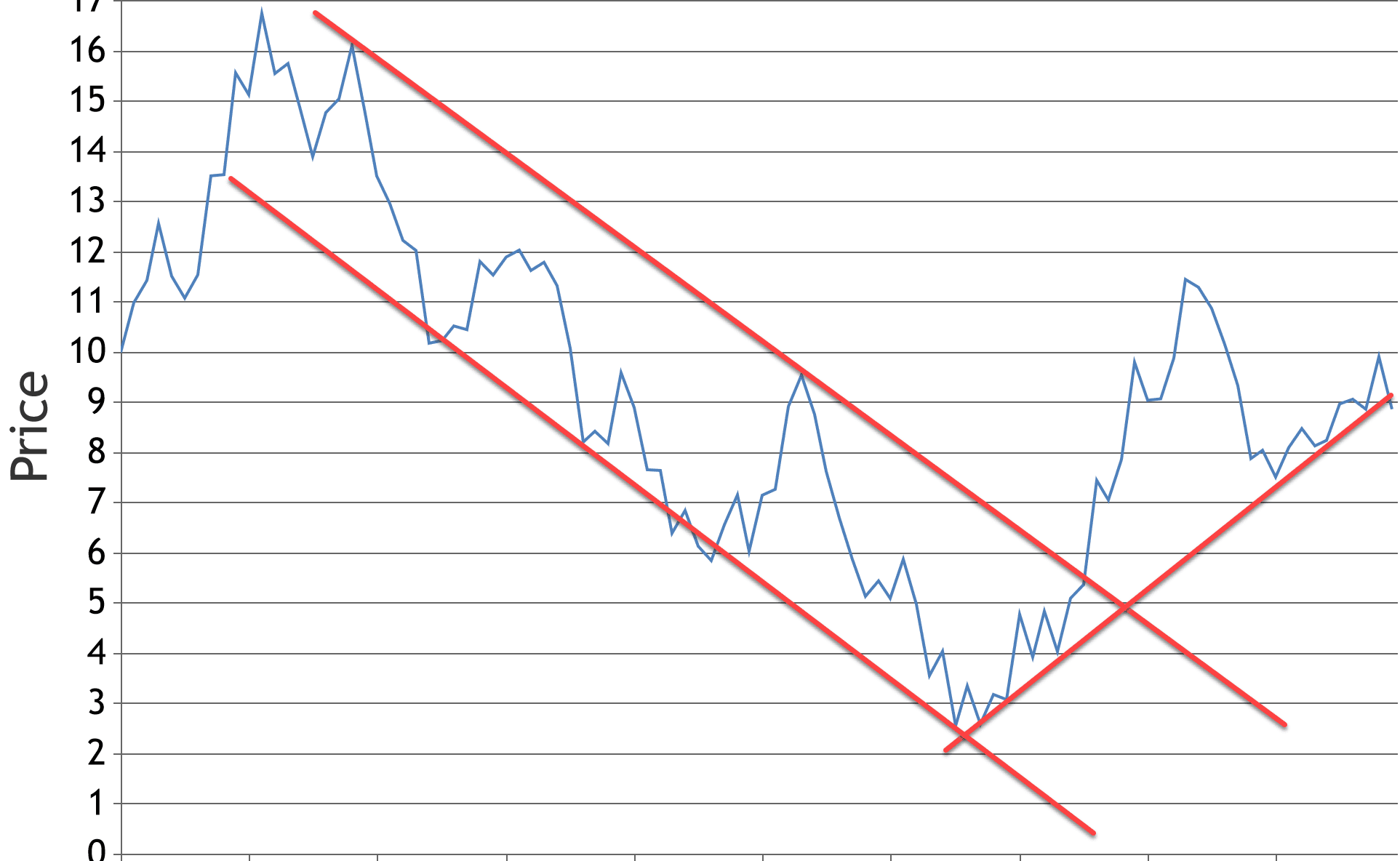

Check out this chart…I drew some trend lines on it:

See look! There are clearly trends in prices, and all you have to do is play connect the dots on charts and you'll become a billionaire!

Problem is…this chart was built with a random number generator. Humans are pattern recognition machines…that's why you can look up into the clouds and see faces, animals, etc.

It's called Pareidolia: “the tendency to perceive a specific, often meaningful image in a random or ambiguous visual pattern.”

I can't stand Bill Nye because he's a sellout to the “agenda”, but a broken clock is right twice a day. Here's what he said:

“The process of testing claims is called science. Now, If you have a claim that can't be tested that's what we call pseudo-science. The difference between pseudo-science and science is whether or not you can test it.”

Now you can certainly program a computer and have it automatically create trend lines and generate buy and sell signals on historical data.

But that takes work. Most people don't want to work. They want draw lines on charts and call it a day.

I'm no superhero (I wear my underwear inside my pants thank you), but I don't shy away from work if I think it could be revolutionary.

So me ‘n the team decided to test all price patterns to see if any repeat, and therefore make money.

When I say all patterns, I mean all of them. We took every stock in our database (including delisted) from 1986. This is daily bar data, not intraday.

Then we took a bunch of multi-core computers and had them look through trillions of possible patterns.

We used a wide variety of methods to even objectively determine what a “top” or “bottom” was, and what even defines a pattern.

Newsflash: The more complex your pattern (like a “Gartley”), the fewer you'll find historically (yes, a Gartley is pseudo-science).

We spent 18 f-ing months on the project.

Three people, An entire freaking app separate from Portfolio Boss. It even went as far as ranking the top price patterns and then only trade the most “profitable.”

It was an abject failure. A complete bust. Thousands of man-hours wasted.

Why? Because price patterns are mostly random. It's mostly noise.

So think about that the next time you're tempted to draw lines on charts or listen to anyone talking about head and shoulders patterns.

You're listening to pseudo-science and I've got the receipts to prove it.

Thankfully, me ‘n the (now bigger) team have had some much more successful ventures.

Building The Boss SuperAi was a much bigger project, but that resulted in the computers (over 3,500 of them) building better strategies than I ever could.

And now to celebrate my 25th year trading the markets, I'm going to share with you my magnum opus…the biggest breakthrough yet in trading.

It has to do with True Asset Pricing (T.A.P), and how it can be used to profit during times of inflation, deflation, economic expansion, and economic contraction (big shout out to Ray Dalio).

Just about any asset class (yes, even food and fuel), up or down. And yes, it's scientifically proven using weird data that costs me $6000 a year.

Stay tuned for Tuesday, April 19th where I reveal the formula behind True Asset Pricing.

In the meantime check out my podcast on building strategies with machine learning here.

|

|

Wondering how to get started?

Step 1: Looking for more consistent profits?

Get a free copy of my book: Artificial Intelligence, Real Profits here >>

Step 2: Want to build a trading strategy in under 10 minutes?Watch this free training video >> (Scroll down the page)

Step 3: Want A.I to build tailor-made trading strategies for you?

A.I is beating people at just about anything related to numbers and data. Nearly every billion-$$$ hedge fund now uses A.I to boost profits.

Watch a demo of The Boss “SuperAi” Strategy Builder as we harness the raw power of 3500 computer cores and strong A.I.

During the presentation, you'll learn: How to Generate Consistent Retirement Income Using “SuperAi-Designed” Trading Strategies. Click here >>

Step 4: Looking to discover new trading ideas to help grow your nest egg?

Online training to vastly improve your trading with A.I.

Watch the podcast >> | Read the blog >>

Step 5: Additional Resources

The Relaxed Investor (The simple strategy proven to work since 1926. Downloaded by over 200,000 readers)

The Ghost of Bernie Madoff is Not Yet Dead (Is your broker on the naughty list? Many traders have no idea they're being sold out)

The Ultimate Crash Detector (The strange weekly report that helps predict crashes. LIVE trading signals since 2006)

Portfolio Boss User Guide (Our flagship strategy building platform User Guide. See what it can do to help you on you quest for F U money)

Trading With Other People's Money – Coming Soon!

Bit-coin for Busy People (How to get started with Bit-coin in under an hour without the complicated new exchanges, high fees, and complicated wallets)

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Insert Image

Responses