Thank you. Your 1-Page TAP Income Checklist download will arrive within 15 minutes. In the mean time, here's here's an imortant message if you're looking to massively improve your profits and consistency…

For the trader or investor that has“seen it all” and is looking for a PROVEN way to generate income from just about any asset you can imagine…even as they tumble straight down…

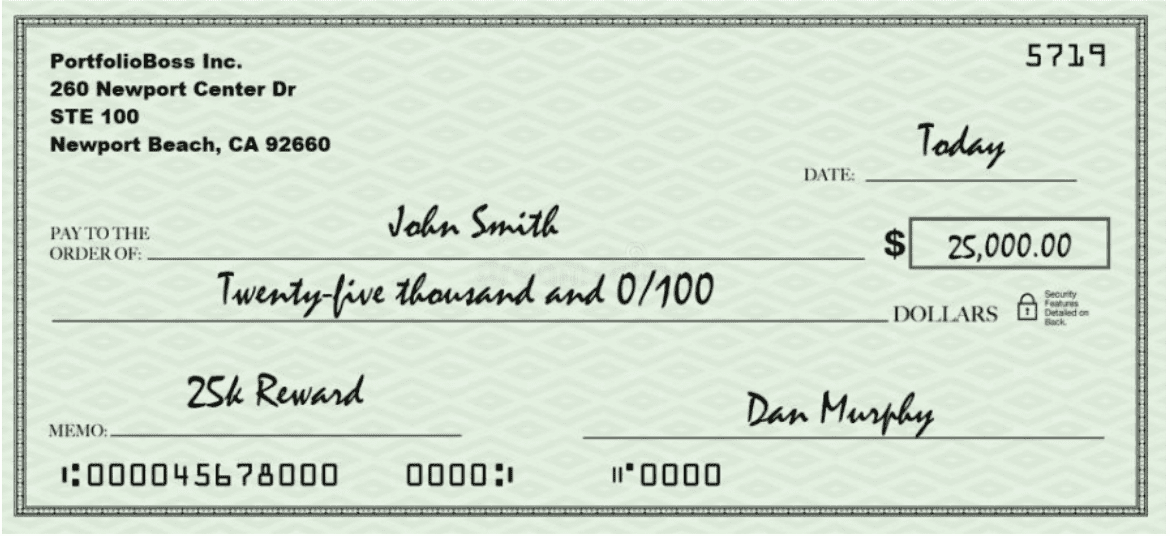

“$25,000 Says You've Never Seen Anything Like This!”

New Breakthrough in Simple ETF Pair Trading Allows You to Generate Multiple Streams of Revenue During Stock Market Crashes, Wild Swings in Food and Fuel Prices, Deflation, and Even an Economic Implosion!

25-Year Veteran Trader Reveals His Secret “$2.7 Billion True Asset Price Formula” for Hyper-Consistent Weekly Gains in Stocks, Bonds, Gold, and Commodities as they Move Up or Down… in Less than an Hour Per Week

“I had no idea every ETF is constantly mispriced”“Efficient Market Hypothesis debunked in one chart”“Like [billionaire] Ray Dalio’s fund on ’roids”“I’ve never seen anything like this in 20+ years”“Like collecting 10 paychecks from 10 different jobs”

Dear Skeptical Trader,

Let’s make a deal…

If I can show you something entirely new…

…that could put money in your pocket in the next minute…

…will you read this letter carefully?

In fact, I’m so certain you’ve never seen anything like this that I’m willing to wager $25,000.

It’s something so incredible that it could steadily double your money over the next year even if…

…the stock market crashes, wiping out everyone else’s retirement accounts…

…gas prices explode to the moon and grind the gears of the economy to a halt…

…the supply chain cracks, leaving supermarkets with bare shelves…

…AND it’s so simple that it’ll take you less than an hour per week to implement.

Do we have a deal?

OK, the clock is ticking so let’s get right to it…

We both know Exchange trade funds (ETFs) have been around for decades and are traded by millions of folks just like you.

iShares, the largest ETF provider, has over 100 million clients worldwide.(Source: https://www.ishares.com/us/literature/whitepaper/inaugural-report-on-investor-progress-en-us.pdf)

They make it easy as cake to buy baskets of stocks, gold, silver, oil, Bitcoin, natural gas, commodities, food, even uranium…

It makes sense that these wildly-popular ETFs move up and down with the assets they hold right?

It would be weird if they didn’t.

***CUE SPOOKY MUSIC***

For example, if the gold ETF (ticker: GLD) holds nothing but gold bullion, then it should rise as gold goes up, and fall as gold goes down, right?

NEWS FLASH: It doesn’t.

Take a look at this chart:

It shows the difference between GLD and the 35 million ounces of gold it holds in vaults around the world.

If GLD exactly tracked its gold bullion, then there should be a horizontal line going across the chart at “0%.”

Instead, you can see with your own two eyes that GLD is constantly selling for a premium or a discount ranging from -2% to +2%.

I was speechless as a Mime in a straight jacket when I first discovered this.

Next up, I'm going to show you a chart that shows you how irrational traders can get.

You've probably heard by now that there are supply problems with food.

Well, there was such a stamped for wheat that the Wheat ETF (ticker: WEAT) was selling for 8% more than it was worth!

Take a look:

Would you pay 8.77% more for bread when you could easily buy a loaf from the store across the street?

This is pure stupidity from traders willing to get in at any price.

Within a week, the price had fallen 18%.

Not only does knowing the T.A.P tell you if you're buying at a discount or paying full retail…

…it can even point out tops and bottoms.

That's why you should always, always, always check the True Asset Price (T.A.P) before placing an ETF trade.

Or how about the ProShares 20+ year Bond Fund (ticker: UBT)?

In March, 2020, you could have bought the fund at a 6.3% discount compared to its bond holdings.

If you could buy a $1 bill for 94 cents, you’d do that until the cows come home right?

Damn right you would!

Still not convinced ETFs are constantly out of whack with their holdings?

Here’s the most popular ETF in the world…

The granddaddy of them all…the S&P 500 SPDR Fund which holds all 500+ stocks in the S&P 500 (ticker: SPY).

Do you see a straight horizontal line which would mean the fund trades in sync with its holdings?

Me neither!

Once again you see that the fund cycles back and forth between selling at a discount to its holdings or selling for a premium.

SPY is H-U-G-E: It has $422 billion under management yet it still gets out-of-sync with its holdings ALL THE TIME.

Every single ETF — all 7,600+ of them — are consistently mispriced an average of $2.7 billion EVERY. SINGLE. DAY.

Are you thinkin’ what I’m thinkin’?

Cha-ching!

You could make a fortune buying these ETFs when they’re on sale, and selling when they’re marked up full retail.

It’s like a year-round Black Friday sale on your favorite investments.

Isn’t that Amazing?!

Let’s pause for a second…

Did you just learn something new you didn’t know a minute ago?

Did I keep my end of the bargain?

Now imagine knowing my True Asset Price (T.A.P) formula so you can get in at a discount before these stocks, bonds, gold, or commodities soar…

…and even make a killing as they implode using inverse funds.

You’ll look like a genius while others are left scratching their heads.

Imagine having the smoothest, most consistent returns you’ve dreamed of while taking up less than 5-minutes a day.

Imagine using my simple 1-page do-it-yourself checklist so you can add new revenue streams on demand.

OK, lean in and buckle up because this could be the most exciting letter you’ve ever read.

Futures are Being Replaced with these…

Over the past few decades, exchange Traded Funds (ETFs) have attracted over $5 trillion in assets.

In fact, they’ve become so popular that retail traders are moving away from the futures market in droves.

The beauty of the futures market is that it allows you to trade on leverage and grow your account fast.

The ugly part of futures is that you need a much larger account, and you have to deal with additional complexity like which contract month to buy, when to roll over, what hours to trade, contract size, and more.

Now there are dozens of leveraged ETFs to choose from, making the complexity of futures trading easy as pie.

For example, ProShares has a 3x leveraged NASDAQ 100 ETF (ticker:TQQQ) that trades 90 million shares per day on average.

If the NASDAQ 100 index goes up 1%, this fund should go up 3%.

You can even buy the -3x inverse fund (ticker: SQQQ) that moves up as the NASDAQ 100 index declines.

Pretty awesome to make money when tech stocks decline, right?

Here’s a graph of a strategy I created that switches between TQQQ and SQQQ pairs.

By “switching” I simply mean that you trade TQQQ when stocks are expected to rise, then when stocks are expected to fall, you buy SQQQ.

How does the strategy know when to switch between TQQQ and SQQQ?

It uses the True Asset Price (T.A.P) formula you read about earlier (in just a minute, I’ll reveal the formula).

Let’s check out another pair.

This time in the 2x leveraged long-term bond pairs (Tickers: UBT & TBT).

Normally, bonds are boring…not with this pair!

You switch back and forth between UBT/TBT like a metronome.

Or how about this next strategy…

It switches between the 2x leverage gold ETF (ticker: UGL) and -2x inverse gold ETF (GLL).

These are simple to execute trades.

You might hold UGL for a week, then move your money into GLL to make money as gold declines.

There are also leveraged ETF pairs on oil, energy, commodities, natural gas, stock indices, stock sectors, and more.

OK, now hold onto your hat because this next chart is going to blow you away.

Something amazing happens when you start trading these ETF pairs together.

I call it the Voltron Effect after the 80’s sci-fi cartoon.

In order to defeat the evil monster in every episode, all the robots would have to combine together to form Voltron.

When these strategies are traded together, not only does your growth rate shoot to the moon, the consistency of your gains is as close as I’ve ever seen to going to an ATM and punching in your code for cold hard cash.

See for yourself:

Smoother then glass on silk.

Frankly, when I saw these results, I thought I messed something up.

So, I recruited 12 of my best students to see what they could come up with using the T.A.P formula on ETF pairs.

At first, all I heard from our group was crickets.

I felt like I made a mistake. Maybe they couldn’t find a dang thing and just didn’t want to disappoint me.

But within a week, the dam broke, and the results started to flood in.

Here’s a natural gas ETF pair from one of my students:

It switches between the 3x leveraged natural gas ETF (BOIL) and the -3x inverse ETF (KOLD).

A 227% growth rate? That beat the strategies I was making by a country mile!

Once again, the signals come from the T.A.P formula which I’ll reveal in this letter.

My beta testers (I call ‘em the Dirty Dozen after the WWII flick) reported that same Voltron effect I noted earlier:

When you combine the ETF pair strategies together, the consistency gets better than anything they’ve ever experienced.

Normally, you can go several months without hitting new highs in your trading account…this is more like the clockwork consistency of a paycheck.

Who wouldn’t want that?

Case Study:

Here's a message I received from one of my students, Danny.

He ended up building 10 different ETF Pair strategies and saw the Voltron Effect first hand.

Just look at those numbers I circled:

Imagine making 167% per year with a maximum drawdown of a tiny 10%!?

Sadly, without the T.A.P formula, having this much consistency is just a pipe dream.

Case Study #2:

Of course, hypothetical results are trumped by real-world trading. Here's what Gary H. had to say:

Why Virtually Zero Chance You’ve Heard of this?

It’s not your fault…

There’s virtually zero chance you would have heard about the predictive power of True Asset Pricing before today.

Just collecting this one piece of unusual data costs me $6,000/year.

And 99% of traders would dismiss the work my team put into this venture…

…they are either stuck trading on the news or they’re drawing lines on charts and using outdated price-based indicators.

Very few will stray too far from what the crowd is doing.

There’s safety – and mediocrity – in numbers.

They say that you can tell who the pioneers are by the arrows in their backs.

Then again, fortune favors the bold.

Countdown to Doom?

Here’s a picture of a countdown timer I have in my office:

April 1st, 2023. 354 days until zero.

What happens at zero you ask?

This is the amount of time I’ve given myself to get all my ducks in a row.

There was a yield curve inversion between the 2-year note and 10-year bond.

These yield curve inversions have always led to a recession.

I suspect all hell is going to break loose.

Before that happens, I’m going “all in” on ETF pair trading.

That way I can make money if stocks continue going up or down.

I can make money with bonds – up or down.

Gold. Doesn’t matter. Up or down.

Commodities. Up or down.

Natural gas. Up or down.

Chinese stocks. Up or down.

Bank stocks. Up or down.

S&P 500. Up or down.

You get the picture.

Dunning-Kruger Effect: One of the Most Common Portfolio Killers

Allow me to introduce myself properly.

I’m Dan Murphy, the founder of Portfolio Boss.

You probably know me from reading one of my books or free reports.

I’ve given away over half a million of those puppies over the years.

When I started trading, I was as over-confident as they come.

After reading a couple books, I thought I was an expert.

But the markets will call you out on your nonsense by making you go broke.

I suffered from what’s known as the Dunning-Kruger Effect.

It wasn’t until I went broke three times that I finally wised up and sought out help.

I got lucky.

I was able to secure a spot as a beta tester to some hardcore trading software.

That’s where I got my taste of what winning looks like.

It was started by one of the original Turtle Traders.

He had studied under Richard Dennis and Bill Eckhardt back the early 80’s.

Those guys ended up making about $1 billion in today’s money.

Funny how we’re seeing the same economic situation right now — rising interest rates, a decline in assets, and fuel and food prices going through the roof.

They say that history doesn’t repeat, but it sure rhymes.

I ended up learning a massive amount from that group, and started putting together winning year after winning year.

That was night and day difference compared to how it used to be.

I ended up posting my brokerage statements online and attracted a large following (These days my students do the talking for me by posting their results).

Who would have thought I’d go from a know-nothing failure to teaching hundreds of thousands the proper way to trade?

What’s the proper way to trade you ask?

The only way I ever make a trade is if it’s based on exact trading rules…

…and only if they have been rigorously tested by computer.

Sorry, but we humans have too many biases that will obliterate any test done by hand.

That’s why scientists are forced to do double-blind studies in medicine after all.

These days, I’m in charge of a team spread out over six countries.

I spent $4 million out of my own pocket to develop machine learning tools and a network of 3,500 computers to beat the markets…and boy oh boy has that paid off.

As you’ll soon discover, feeding True Asset Price (T.A.P) data into the machine learning caused a massive commotion at my company.

True Asset Price (T.A.P) Formula

So, what is T.A.P and how is it calculated?

Here’s the equation: Last close / (AUM / Total Shares) – 1

Every ETF is required to tell you how much their assets are worth.

As I write this, the gold fund, GLD, has $68.41 billion in assets under management.

You simply divide that number by the shares outstanding, which is currently 375.7 million.

($68.41 billion in assets / 375.7 million shares) = $182.09 per share

Now we look at the closing price of GLD which is: $182.37

To see how mispriced it is, we enter: (182.37 / 182.09) – 1 = 0.15%

GLD is actually over-valued by 0.15% today…not a big deal, but there are times where it’s over-valued by 2%…which IS A BIG DEAL.

Check out this series of trades from early 2021.

But instead of trading GLD, you could have traded its 2x cousin: UGL

There were five T.A.P trades…four out of five were winners, including a 10.9% gain.

Are you starting to see the power of T.A.P as it allows you to tap into profitable trades while others would have been clueless?

Every single ETF trader and investor should be checking the T.A.P before they buy or sell.

It’s that important.

But they don’t…because they don’t know…but now you do.

See the Lightning, Feel the Thunder

Imagine if you’re the only person in the house that sees a bolt of lightning.

When the house shakes, and everyone else feels the thunder, you’re sitting there calm as a cucumber.

You know that thunder follows lightning just as every inhale is followed by an exhale.

It’s the same thing with ETFs…

…so buy an ETF when you see the lightning strike (T.A.P is mispriced), and sell the thunder as price rockets upward (T.A.P is back to normal).

People will look at you like you have some sort of magic ability to predict the future.

You and I know it’s not magic… it’s simple math that they don’t know exists.

Enter “The Boss SuperAi” Machine Learning

Now that you understand T.A.P, let’s discuss how to build winning trading strategies with it.

At one time, I used to program a computer with trading rules to come up with profitable trading strategies.

I would burn the midnight oil testing different indicators.

These days, I never write a single line of code.

I simply tell the A.I what I want to trade, how much I want to make, how smooth the results should be…

…and press start.

Then up to 3,500 computers whirl to life and begin writing ‘C code’ all by themselves.

“It’s not Skynet about to vaporize humanity”

Most of the strategies are junk, so 50% are killed off without mercy.

The other 50% have their code bred together to form offspring.

Take a look at this quick animation to see how it works:

Over about 100 generations, this process creates winning trading strategies that run circles around most programmers.

It’s not that it’s smarter…it’s not Skynet about to vaporize humanity… it’s just REALLY fast and can try more ideas in a short period of time.

My team ended up feeding a bunch of T.A.P data into the supercomputer network.

“Let’s see what this ‘sum bitch can do!”

I pressed start, and within a couple minutes I had an answer…

…the strategies were mediocre at best.

If you had to depend on them to eat, you’d be so skinny you’d need to stuff an anvil in your pants so you don’t blow away in the wind.

I sat there for a minute scratching my head.

Then I scratched it some more.

What Goes Up Must Come Down

Quick story: My New Year’s resolution was to build a bunch of strategies that made money as the stock market went down.

My rational was simple: The gubmint threw trillions at the markets and showered the plebs with stimmy checks.

With the party over, the stock market would likely go down.

I told “The Boss SuperAi” that I wanted to trade the -2x inverse S&P 500 ETF (SDS).

If the strategy wasn’t in SDS it went to cash.

But then I got to thinkin’…I don’t just want to make money when the markets go down.

I want to make some fungolas when it goes up. Duh!

I told “The Boss” to switch between SSO (the 2x ETF) and SDS (-2x ETF)…what I call an “ETF pair.”

Then I pressed the Start button.

Thousands of computers whirled to life, and within minutes, I had a working strategy.

The first strategy built showed a 53% annual gain.

First swing of the bat.

Now we’re cookin’ with gas!

I was hooked.

You might be asking: “Why was pair trading so much more accurate?”

I believe the answer is in how severely punished the strategy would be if it mistimed getting into an inverse fund.

Think about it: If the strategy is off by a little going from buying the S&P 500 to cash…it’s no big deal.

But if it’s switching from long to inverse – timing has to be damn near flawless as a Hope diamond.

I ended up creating 16 of these ETF pair strategies.

Here are a few I haven’t mentioned yet:

DBC/UBT Commodities pair so you can make money as gasoline, oil, zinc, wheat, corn, and more go up or down in value. How does a 31% annual gain sound? It's already up 31% in 2022 and the year just started! The way things have been going…this could be a triple-digit year.

YINN/YANG China 3x pair so you can make money as Chinese stocks rise. Or if it turns out to be a Paper Tiger, you can profit from its decline. So far, an 80% annual gain. Sprinkle a little bit of this leveraged fund into your account.

UDOW/SDOW Dow industrials 3x pair. Put a portion of your money into this fund pair to make money if the Dow goes up or down. This leveraged pair has shown a 63% annual return.

FAS/FAZ leveraged 3x financial stocks pair. Huge 97% average annual return. This pair is very popular.

SSO/SDS S&P 500 2x pair. 55% annual gain. Did a wonderful job during the 2007-2009 bear market.

SPY/SH non-leveraged S&P 500 pair. 25% annual gain with perhaps the fewest rules I’ve ever seen in a strategy: 2 lines of code! Only machine learning can simplify a strategy like this.

SOXL/SOXS semiconductors pair. Massive 114% average annual gain. A little bit can go a LONG way in this pair!

UPRO/SPXU S&P 500 pair. How does 78% annual gain sound? I know of a few fund managers who would kill for these kind of returns!

TECL/TECS technology pair. 85% annual gain as popular tech stocks rise or fall.

QLD/QID NASDAQ 100 2x pair. 55% annual gain from this popular pair. Who needs to trade futures? Life is much easier trading ETFs.

That’s 16 revenue generators and counting in either up or down markets.

My New Year’s resolution was accomplished in three months!

Just combine a few of these strategies together, and watch your gains and more importantly – consistency – soar.

My “Dirty Dozen” beta testers have created even more strategies, including the Natural Gas switching strategy with a 227% annual growth rate.

Here’s what “The Dirty Dozen” are saying:

“

Hi Dan,

“This is insider information made public?”I never thought it possible to achieve such high returns with low risk. Back testing a bunch of these pairs simultaneously produced 250% [per year] returns. More importantly the losses were low.

I'm turning 55 later this year and retiring from my day job. Finally I will be able to trade in my hail damaged car, LOL.”

Daniel – (Dirty Dozen Member #7)

“

“This approach is different in that it taps into a little-known source of signal that is very unlikely to be exploited by many players. It is also unique because it captures non-typical edges that allow to successfully trade a wider array of markets as well as their short side, thereby increasing de-correlation and risk-adjusted returns.

Aside from the odd strategy pulling returns passing the +200% annualized bar, I am consistently seeing superior MAR ratios in the 3-4 range on individual strategies, which was a target only reached by diversifying strategies in a portfolio up until now. This alone speaks for the power of the signal generated.However, the magic really comes alive when stacking these NAV strategies. It is not uncommon to see MAR ratios in the vicinity of 8-10, which is totally unheard of.

Combining NAV strategies with my current portfolio of strategies is expected to smoothen my overall performance by materially shortening the time between new highs. As someone whose trading profits provide for a major portion of my family's income, this is a tremendous upgrade to my arsenal of trading tools and one that may prove to be the most significant improvement in my quality of life and mental peace as a regular trader.”

Sebastien – (Dirty Dozen Member #2)

“

“What a sense of empowerment!

Every day now, I power up “The Boss” and see what edges it can find for me. Its like having my personal gold mine, I just need to tell the computer where to dig.

Thank you so much for creating this amazing tool!”

Randy – (Dirty Dozen Member #5)

“

“It's like putting a bet on at the races and having odds stacked in your favour. “

“This new data has enabled me to produce strategy's across many different markets that have very high compound annual growth rates in excess of 100% with very little draw down on average approximately 12 -15% which was very encouraging. The thing that really shocked me was that when you combined these strategy's in a mutli strategy the results dramatically improved again. producing a smoother equity curve.”

Richard – (Dirty Dozen Member #8)

Let’s Recap What You’ve Learned Today…

- ETFs are mispriced by billions of dollars everyday

- Leveraged ETF products are causing retail traders to leave stocks and the futures market in droves because it makes trading multiple markets easier than ever before (No more figuring out which contract month to buy…ETFs trade like a stock)

- Tap into profits by calculating the True Asset Price (T.A.P) of an ETF

- Use machine learning to automatically generate profitable ETF pair strategies so you can make money in up or down trends

- Combine them together to activate the “Voltron Effect” so you can generate ultra-smooth income like this:

Let me ask you a few questions:

Did you learn something with me today?

Does making money from ETF mispricing make sense to you?

Do leveraged ETFs seem easier to trade than futures?

Does this seem like an edge no one else is talking about?

Does using a machine to automatically generate trading strategies sound easier than programming them by hand?

You’re at a crossroad today.

You can’t unlearn what you’ve read, right?

You can’t put that genie back in the bottle.

So at this point, you have three choices:

1) You can do nothing with what you’ve read today. Life will continue as it has.

2) You can do the same thing you’ve already been doing and expect to make money as the market declines and food/fuel prices skyrocket.

Although the definition of insanity is doing the same thing over and over and expecting different results.

You could:

- Keep absorbing every piece of news in an effort to spit out trading signals – even though you know the news doesn’t have your interests in mind.

- Continue your search for the Holy Grail price indicator even though they produce mediocre results (and rarely generate a profitable strategy to make money when prices fall)

- Draw trend lines on charts and find those “magical” patterns like “head and shoulders” and “double bottoms”, even though you now suspect they never worked in the first place.

- Jump from “can’t lose” opportunity to opportunity only to find out that it can lose.

3) Or option three…you switch to ETF pair trading

Now Recruiting: “The Dirty Dozen” 3.0

Now that I’ve seen success, and my original 12 “Dirty Dozen” beta testers have seen success, I’d like to launch a second wave offensive against the markets.

If you’re seeing this letter, it means you been selected to become part of “The Dirty Dozen” 3.0 and start generating income from a variety of ETF pairs in under an hour per week.

No complex options, no risky futures trades, no strange hedging…no BS. Simply follow the buy and sell signals and you’re good to go.

“The Dirty Dozen 3.0“

Access to “The Dirty Dozen” 3.0 beta test group has its benefits:

- Lifetime 24/7 access to “The Dirty Dozen” forum where we share pre-made strategies, tips, and settings to build winning strategies on a wide variety of ETF pairs.

- Lifetime access to “The Boss SuperAi.” This is the network of over 3,500 computer that builds you trading strategies from scratch.

- My 1-page checklist for building the ultimate pairs strategies with The Boss. One page? Is that a typo? Nope, it’s that easy to get started.

- 12 “Just press start” power templates to start building strategies in seconds.

- Video library to learn every aspect of building strategies with The Boss SuperAi in just minutes. Leave your graphing calculators and protractors in the drawer while I explain everything in detail without the complexity.

- Weekly group calls where you and your fellow ‘Bosses can get your burning questions answered. Plus you’ll get insider info on all the latest discoveries from me and my team.

- Kick gluteus support from my team. You can call or email, and we’ll get you up and running in no time. If it’s a more complex issue, your support ticket will be kicked up to my developers. We leave no one behind. 866-567-4257

- Automated “hands free” trading. Why trade by hand when the computer can do it for you? Coming Q2 2022.

Picture this…

You wake up and grab a cup of your favorite coffee.

You check for an email describing the trades to make this morning.

“Ah…it’s time to buy bonds and take a profit in your NASDAQ 100 trade.”

With a few clicks, you log into your broker and place the orders so they execute automatically near 9:30AM Eastern.

Then you grab your clubs and head out for a round of golf.

Instead of reading news articles that tick you off, you’re calm and ready to face the day.

No need to constantly check quotes all day because your strategies don’t require it.

You’re no longer trading by the seat of your pants: You’re an evidence-based trader that can make money in just about any asset class – up or down.

You think to yourself: “This is how trading was meant to be.”

How to Get Started…

Access to “The Dirty Dozen” 3.0 is by application only. The last group was handpicked by me, and I’m very protective of the group’s time.

So let me tell you who this NOT for…

- This is NOT for traders with smaller accounts. The minimum account size is $50k.

- This is NOT for brand new traders. You must have been trading for at least two years. That’s usually enough time to understand that trading is not as simple as they make it out to be.

- This is NOT for whiners that complain and blame everyone but themselves for their failures.

Normally, access to just “The Boss SuperAi” alone is well into 5-figures.

However, I’m dropping the price as long as you promise to share your results with me over the next few months (I will respect your privacy and not include your name if you wish).

You can also receive applied credit if you’ve bought other trading strategies from me in the past.

All you need to do is click the Apply Now button and get started.

You Also Get My Kickass “$25,000 Triple Guarantee”

After seeing how the program works… Show me anywhere else where this level of T.A.P trading exists and if you think this is fluff or woo woo nonsense, I’ll write you a check for $25k.

If for some reason you can’t build winning trading strategies (even though The Boss builds ‘em for you), then I’ll personally get on a Zoom call with you and show you how it’s done 1-on-1.

Still can’t get it to work? I’ll give you all 16 of my personal ETF pair strategies.

How’s that for a guarantee?

Celebrating 25th Year of Trading $5,000 Mega-Bonus…

Since we’re celebrating my 25th year of trading, I want to give YOU a gift.

I’m putting $5000 towards your first trade.

That way you have more money in your pocket when you’re ready to place your first winning order.

With this mega-bonus, I fully expect ALL spots to fill up before June 30th, so make sure you schedule a call with Adam.

After three attempts, I have instructed him to move on to the next applicant because we have more apps than spots available.

Which One Are You?

There are two types of people in this world…

Those who only dream about achieving their financial goals without ever taking any action to make it happen…

And those who are ready to take action when the opportunity presents itself.

Most people will tell you they want to retire rich.

But we both know very few actually make it happen.

It's a natural law of financial wealth…

The classic tale of the willful and the wishful.

Most people will keep dreaming.

While the few who are actually serious about their financial future will take action.

Since you've read my entire letter this far, I think you're one of the few special ones…

One of the 12 people I'm looking for.

If I'm right and you're still with me…

I'm ready to send you that email with the subject line: “Welcome to The Dirty Dozen 3.0”

The Magic Behind the Curtain…

Over the past several months, we’ve been building extremely profitable ETF pairs on just about every asset class you can think of.

You will of course want to know more about how that’s possible so you can do it for yourself and your family’s sake.

So come shadow me on The Dirty Dozen forum…

…and very shortly, it’ll be like discovering how the magician does his tricks.

We all know it’s not magic. It’s the opposite of magic. It’s cold, calculated science.

It’s the result of tens of thousands of man-hours spent perfecting our craft.

It ain’t magic, but it sure feels like a miracle.

If you invest your time and resources with us, you’ll be behind the curtain with me, my staff, and your fellow like-minded TAP traders…

…all hell-bent on discovering strategies that beat the markets by a country mile.

All the mysteries are revealed.

Nothing is kept secret from you.

But only you can decide.

Press the apply now button below. After you fill out the application, I will review your application personally.

If you qualify, Adam Kaye, my Director of VIP Client Relations will reach out to you via text and email to schedule a call as part of the review process and go over any questions you might have.

There are only 12 spots available. They might get filled in a day. Or maybe a week. When they’re full, that’s it.

Trade Smart,

Dan MurphyCEO PortfolioBoss, Inc.

P.S. If you’ve skipped down here, shame on you! Kidding. Here’s what you missed:

Let’s Recap What You Skipped…

- ETFs are mispriced by billions of dollars everyday

- Leveraged ETF products are causing retail traders to leave stocks and the futures market in droves because it makes trading multiple markets easier than ever before (No more figuring out which contract month to buy…ETFs trade like a stock)

- Tap into profits by calculating the True Asset Price (T.A.P) of an ETF. This could completely change your life.

- Use machine learning to automatically generate profitable ETF pair strategies so you can make money in up or down trends

- Combine them together for ultra-smooth income

P.P.S. Now go back up and read this letter carefully. $25,000 says you’ve never seen anything like this. The clock is ticking…

See What People Are Saying About The Boss “SuperAi” Strategy Builder…

“

I'm Very Blessed To Be Part Of The Founding Members

Aloha Dan and team! I'm very blessed to be part of the founding members! I'm also thankful to Adam, who worked with me during an acute medical issue, to make sure I was a member. Ironically when I first learned about you, Dan/the relaxed investor, I thought you were too prideful and hesitated to buy any of your programs. But after reading through your free reports, attending seminars, and listening closely to your investing nuances and experience it became clear that we both shared similar things … one of which is PROOF! Honestly I believe it is priceless to have an evidence-based trading system that can also be updated as necessary to verify its algorithm/strategy is still working efficiently. I have purchased a different company's product years ago, and even though it is also algorithm-based and capable of backtests, it is NOT in the same league in regards to customizations, testing and real results … and that's prior to salivating over the 1/2hr data and cyber code coming soon. My desire for truth has led me to improve in many areas of my life and now has led me to you and my financial growth… and my trade account has been growing quickly. I am now cautiously optimistic. Aloha and God bless.

Isaac Kama – Portfolio Boss Founders Club Member

“

I Very Much Admire Your Approach and Love Your Tried and Tested Strategies

Hi Dan, My portfolio is only small and frankly i did not do very well.I more and more stepped out of the market and let the bank manage my money. Only recently, using the Portfolio Boss Devine Engine i shrugged off some of the fears and got back. Back into this crazy market we are in right now. And i am very happy that i did. My portfolio gained 9.8% in the first 6 weeks of 2021, even while i am only 60% invested. I am not the day trader type and stick to a strategy with periodically switching. I very much admire your approach and love your tried and tested strategies. Thanx for your commitment!

Wim Fleuren – Portfolio Boss Founders Club Member

“

It Is Amazing What You and Your Team Have Accomplished In a Short Amount Of Time

Good morning Dan. Nice job on the call yesterday. I am very excited for the cyber code deployment. It is amazing what you and your team have accomplished in such a short amount of time. You have given the small investor a chance to make money consistently and safely. Before purchasing Portfolioboss I never had a strategy. I was consistently moving from one shiny thing to another. Buying access to strategy after strategy, news letter after news letter. I had come to the realization that no matter what I did the cards were stacked against me. Then on day, I stumbled across your website “million dollar target”. For whatever reason, I started to following your posts and blogs. Always looking forward to the next. They resonated with me. They were so different from everything else that was out there at the time. I slowly started subscribing to your solutions over the years and slowly started building confidence and most importantly, making money. Oh how far you have come! As a member of Unite and Founders Club, I feel there is no limit of what we can accomplish together. The only fear I have, is there a world that you sell Portfolioboss to a hedge fund or private investor, and me and the other founders lose access? I know you have said that you would never do that, but the thought is always on my mind. 2020 has been a banner year! With the launch of founders club and the ability to let the “Boss” create the strategies for me, I have made about $80,000. Recouping my investment in the Boss and much more. From a percentage standpoint I am up about 80% for the year. Need I say more. Dan thank you for everything!

Craig Strong – Portfolio Boss Founders Club Member

“

So Got Back On The Horse Like Seabiscuit Closed The Year Up Over 30%

So when I purchased the initial BOSS ( before AI added) I was was very conservative – using smaller amounts traded DB transactions, Oracle , SMI (SPY) SMI Stocks – Anyway made back in the 1st year the cost of subscription. 2020 turned out to be a GREAT GREAT trading year although FEB again made me have my doubts- but had faith in the concept and models, back testing and consistence over the years of what was possible. So got back on the horse and like Seabiscuit closed the year up over 30%. Would have been even larger but did not cease trading SMI and SMI stocks which held me back since was in Bonds when the market took off . Also only invested a fixed amount rather than reinvesting winnings.. However from Dec 1 2020 through today have made $50,000 each month ( including FEB) in 3 days. A couple of reasons – DB transaction was gang busters, I for some reason started using ATLAS orders again, and I created using the Boss a couple of my own models using a created portfolio ( from another service who list 26 relative best performers each month ( If we have the 1 on 1 can give you more info.) So from using only $400,000 ( added about $200,000) towards end of 2020) have made over $250,000 in 13 months. I continue to trade 7 strategies now, some trade once per month, others every day. The key is fully trusting that in some models' there was no losing years or very few and that allows me the confidence to look at the long rule. One final thing – you asked if your folks if they were not making money – if they followed the models they should have – unless they got locked into the SMI indicator and other models that uses SMI.. I dropped using SMI and related models when you provided Boss 100 and Boss 100/500 models which I switched to. Anyway thanks to you and the team for what you do , for the training you provide and hopefully will report to you by end of year that we made FY money. Stay safe.

Bobby Dietz – Portfolio Boss Founders Club Member

“

I Honestly Can't Imagine Not Having Portfolio Boss In My Life

I honestly can’t imagine not having Portfolio Boss in my life—and pray it never goes away—since it has made such an impact on my trading success. I have a robust 29 strategies running that gives me the peace of mind that even in a crazy volatile market, I can count on stable returns for as long as I’m alive. I love that Portfolio Boss continues to evolve and provides the opportunity to continue creating strategies that pull money from the market!

Josh Jarrett – Portfolio Boss Founders Club Member

“

Hi Dan, Happy Groundhog Day From The Snowy Suburbs Of Chicago!

2020 was truly a breakout trading year for me: 72% in a Roth IRA – giving thanks to God for William Roth! Tax-free! I have also been trading an SPY/QQQ multi-strategy using micro e-minis with ever so slight leverage. I have been burned in the past using too much leverage. I'm very curious to see whether the cyber code can find some tradable SPY and/or QQQ strategies. I have started working on a framework for increased charitable giving and very excited about the possibilities. Looking forward to 2021. Thank you for the Founders Club plaque and for a truly tremendous trading tool, Dan and team! Best regards.

Chris Daniel – Portfolio Boss Founders Club Member

“

I Couldn't Be Happier Working With Portfolio Boss

Dear Dan, I couldn't be happier working with Portfolio Boss. I have been with your team since its inception. I go way back and I can tell you that I have had many subscriptions and many money managers throughout my trading career of over 30 years. What I learned from all of them combined pales in comparison to what I learn from you.

I love your core ideas of:

– Relaxed Trading– Rigorous BackTesting– AI evaluation– Portfolio & Strategy Switching (with so many levers to tweak and experiment with.)– Addition of new Instruments like Crypto Currency & BitCoins– While continually honing in on efficient trading by minimizing draw-downs and maximizing returns.

I get far better sleep and am even pursuing my PhD in Quantum Integrated Medicine while trading with your fabulous tool and incredible observations that you continue to share with us. Thanks is too small a word – but since I can't come up with much else. So, I'll just say many thanks. Also, I've attached a copy of my picture with the founder's plaque your team sent me. Warm Regards & Best Wishes to everyone on your team and most of all to you.

Nalini Uhrig – Portfolio Boss Founders Club Member

“

I Certainly Owe You After All The Money You Have Helped Me Make Over The Years

Hey Dan, Here is a quick photo of me with my plaque. I also have been meaning to send you a note about my story, which I certainly owe you after all the money you have helped me make over the years. When I started trading with you a few years ago I had never bought or sold a stock on my own before. Back then you were doing swing trades on the S&P, and that got me started with some very clear signals that earned me some nice early profits. I continued following your services as you evolved over the next few years from the S&P focus to trading various indexes and stocks with programs like Crash Canary and Atlas Order and finally landed on DB Transactions, which has served me well for several years. Then you came up with Portfolio Boss and I learned how to use it to generate my signals and saw my profits get more consistent. My trading moved to the next level when I decided to join the Unite program and become a member of the Founder’s Club. That opened up the full set of PB tools and all your available programs for me. I started trying them out over time with good results and a few ups and downs with the market the last couple of years. This past July I decided to ramp up the focus on my trading by tracking my daily progress across all my strategies. The timing couldn’t have been better as the market was just taking off after the COVID crash. I experimented with a few different strategies until I landed on one that stood out above the rest and focused my efforts on it for the remainder of the year. The results were amazing. I saw my account increase by 50% between July and December. I actually made significantly more money during this time from trading than I did from my regular job, which pays quite well itself. I know it was a unique time in the market with the central banks blowing a very big bubble, but the point is that by applying The Boss I was able to turn that event into a stunning profit. I am now seriously considering the possibility of retiring soon and just focusing on trading if I continue to see results like these. I would not have thought I would be in that position yet, and it is thanks in large part to these tools that you have so generously shared. Dan, I really can’t thank you enough for the financial difference that you have made for me and my family. All the best!

Anthony (Tony) Russell – Portfolio Boss Founders Club Member

“

Thank You For Your Willingness To Help Others and Your Dedication To Them

Dan, I have been following you for quite a few years. I struggled along most of those years but your videos and letters gave me hope and guidance. Since the boss has come out things are a lot more consistent but I am still very cautious and limit my exposure. Too many hard lessons learned in the past I guess. I wish I was the profit machine some of your members are but… I run a business of my own so can’t dedicate as much time to your training as I would like or need but I am confident when I retire soon that a constant income will be there. Your DB Platinum is working great. I try to develop my own strategies but have now found the right set up yet. It is fun to try though. Thank you for your willingness to help others and your dedication to them.

David Light – Portfolio Boss Founders Club Member

“

More Than Happy With The Current Results and The Performance / Results Achieved To Date

Hi Dan, Am currently trading a couple of Systems that “THE BOSS” came up with, And am more than happy with the current results and the performance / results achieved to date. Trading as a business, and as in any having the correct tools makes all the difference. Find the type of trading that suits you, whether it’s day trading in chat rooms trading stocks like Gamestop. GME, or whether a slightly longer term approach works for you. A funny story there is a company on the ASX ( Australian Stock Exchange ) with the same stock code as Gamestop (GME.ASX) this company is not related in anyway in to Gamestop. In fact this company Mines Nickel and yet this stock almost doubled just because it had the same ticker GME as GameStop and had to be placed in a trading halt. My point I prefer to be removed from the daily NOISE of chat rooms and the like. When I came across Portfolio Boss the thing that intrigued me was that the software was different It had the ability to rank Stocks based on different criteria. The rest as they say is history. Thanks Dan, keep up the good work.

Richard Coombe – Portfolio Boss Founders Club Member

“

Been Doing Very Well Following The Boss

Hi Dan, Big shout out from Canada eh. Been doing very well following The Boss. I used The Boss to build a strategy that trades the Canadian Index TSX for part of my account. Its been doing very well averaging 18-20%. As we know the DB strategies, Ping Pong, and others are killing it, with returns over 40%. On a personal note, I retired in 2020, after successfully hitting my number. Thanks to Portfolio Boss. In March 2020, during that drop in the market, we had some losses in February and March, I stopped trading because I was so close to retirement. I didn’t want to suffer heavy losses. That said I missed the summer and fall rally. I deviated from a winning strategy and missed part of the most amazing rally ever. It is tough trying to ignore those pesky personal biases. Thanks The Boss Team for all you do.

Greg Shende – Portfolio Boss Founders Club Member

“

The Structure In Your Trading System Would Help Any Trader

Hi Dan, I have been significantly distracted because of covid from learning all the possibilities of the Boss, but what I have used and learnt helped me to have my best 7 digit year! What impresses me most is that I was able to do this while only being 2/3 invested at one anytime. I bought my first shares 43 years ago at the age of fifteen. Over those years I have found to be a successful trader it requires a disciplined approach to all the various steps in a trade. Your simplest SPY system helps me deal with my largest trading weakness and that is to stay in the trade until it’s done. The structure in your trading systems would help any trader. Thank you!

Russ Lang – Portfolio Boss Founders Club Member

Dirty Dozen 3.0 Application

Complete the form below to be considered for the Dirty Dozen 3.0 program.

"*" indicates required fields

Government required disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

© {tcb_current_year} PortfolioBoss, Inc. All rights Reserved.