Dear Reader,

There are 540 billionaires in the United States alone.

Many of them pay little to no taxes due to loopholes created by their lobbyists in Washington D.C.

What else do they know that you don't?

I’ll tell you…

There's a specific window of opportunity in the stock market that perhaps 0.001% of traders know about.

During this "Billionaire Window," winning stocks increased by a whopping 33% on average since 1995.

In other words, this window allows for massive wins over a short period of time.

Three months on average to be more precise.

Who needs leverage when you're practically making a trade with "near perfect" timing right?

And no, "Billionaire Windows" have nothing to do with seasonality of stocks, or any such voodoo.

Seasonality was mined out of existence years ago by computer algorithms.

No, "Billionaire Windows" go much deeper...

...to the root cause of why the markets rise and fall like a yo-yo.

Simply do your buying and selling within these "Billionaire Windows," and hold on tight!

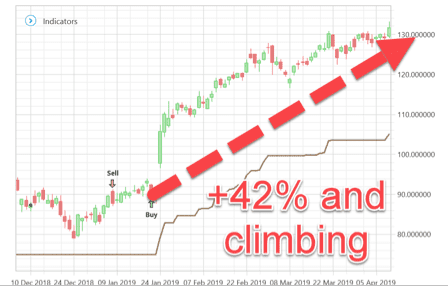

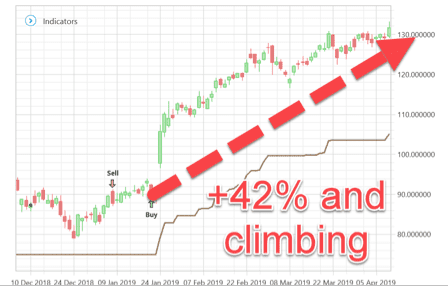

Here’s a snapshot of XLNX during the last “Billionaire Window” that opened in January:

And KEYS which was selling at a massive discount as the “Billionaire Window” opened up:

It's not too late to get into these "Billionaire Window" trades, but the clock is ticking.

You see, AFTER the "Billionaire Window" closes down, stocks tend to under-perform dramatically.

Stocks go from an average winning trade of 33% to a headache inducing -1% annual return after the window closes.

Would you rather:

a) Buy during a "Billionaire Window" and make 33%, or...

b) Lose 1% outside of the "Billionaire Window"?

If you said "a," then continue reading and I'll reveal how you can determine the perfect time to trade stocks with "Billionaire Windows" in four simple to follow lessons.

Deal?

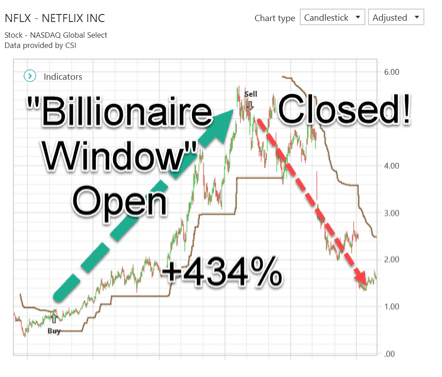

The difference between an open “Billionaire Window” and one that is closed is like night and day.

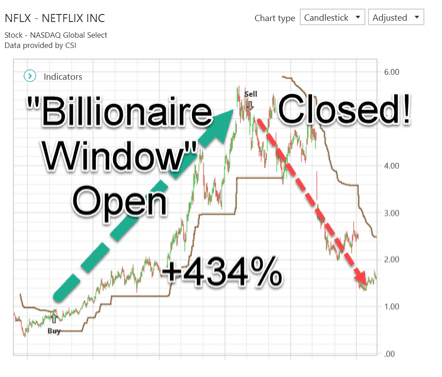

For example, here’s what happened to NFLX before and after the “Billionaire Window” closed:

Before I get into the exact formula behind these “Billionaire Window” trades, allow me to introduce myself…

Hi, I'm Dan Murphy...

Well, I'm pretty sure you already knew that since you've been a Portfolio Boss subscriber for awhile now.

But here's a story you might not know.

Well before writing The Ultimate Crash Detector, and helping over 132,000 investors and traders around the world…

...before calling the 2008 debacle, and 2009 melt-up on camera...

...before calling the top of Bitcoin to the month...

...before having my account audited by a 3rd party CPA (yes, I really trade)...

…and almost two decades before authoring two other books on trading, including a #1 Amazon best seller…

…and what seems like light years before I ran a team of software engineers to extract the secrets of the markets using a supercomputer, I was…well, I’m almost embarrassed to say…

…the worst trader on planet earth!

I strutted into the world of trading acting a little big for my britches, and immediately lost money I couldn’t afford to lose.

Even worse, that money was a cash advance from a high interest rate credit card.

Talk about adding insult to injury.

I would listen to the gurus they marched on CNBC, and I would lose money…

I would pick the latest penny stock all but guaranteed to go up 10,000%, and I would lose money…

I would listen to Elliott Wave practitioners with their wave counts and predictions, and I would lose money.

“They Couldn’t Agree the Sky is Blue, Let Alone a Prediction”

By the way, I’ve never met two Elliott Wave “experts” that could agree the sky is blue, let alone a prediction.

Years later, my team and I used a supercomputer to test every possible price pattern in existence for an edge… those patterns had nothing to do with what’s taught in wave theory.

I continued to run into one dead end after another.

I know what it’s like to get up at 3AM to check futures prices because I’m worried I’m about to lose everything.

I’ve been so ticked off at my trades that I wanted to punch a hole in the wall, but I realized not only would I be broke, but I’d have a broken hand to boot.

It’s a good thing I didn’t have a dog back in those dark days or I might have kicked it and felt so disgusted with myself that I would have quit trading for good.

Like Getting Punched in the Gut By Mike Tyson

It’s like getting punched in the gut by Mike Tyson when you constantly struggle and bleed money.

Perhaps you’ve had similar experiences?

After blowing out three trading accounts, I was finally at a crossroad.

I could either hang up my spurs and invest in a boring index fund, or I could go find someone who really understood this game, made money hand over fist, and simply copy what they did.

Others Routinely Beat the Markets, Why Not You?

You know there are traders out there that buck the odds and routinely beat the markets by a country mile, but how in the heck are they doing it?

Heck, some traders have managed to pull billions out of the markets while you continue to struggle.

You might recall one of the most famous stories on Wall Street:

How Richard Dennis, a pioneer in technical trading, made $300 million trading, and then took an ad out in the Wall Street Journal offering to teach his strategy.

Sign me up!

Problem is… this was back in the early 80’s, and Rich was already retired by the time I started trading.

But Rich did teach several dozen students, which he named “Turtle Traders.”

Many of them went on to fame and fortune.

One Turtle Trader in particular had an online forum jam packed with hedge fund managers, commodity trading advisors (CTAs), family office managers, and private equity managers.

How to Get My Foot in the Door and Learn Their Secrets?

But I had to figure out a plan to get my foot in the door so I could get in and learn their secrets.

One thing I’ve learned over the years is that if you want access to someone, the easiest way is to either pay them or donate to their favorite charities.

A mentor of mine gained access to Sir Richard Branson by doing exactly that.

So I contacted this former Turtle Trader, ponied up some money…

…and the strategy worked! I was in.

Within a single day, I gained access to his forum and dozens of professional traders who were able to consistently make money in the markets with all kinds of oddball methods.

At first, I simply lurked around as a wallflower, soaking up their knowledge like a dry sponge that had never felt a splash of water.

What a godsend this turned out to be.

Would you like to know what these professionals all had in common?

They all used computers to test their trading ideas!

They were 100% systematic in their approach to trading. No guesswork, no lines on charts, no BS.

A computer doesn’t lie. It doesn’t have a bias. It’s the ultimate tool for discovering the truth. In fact, 18 out of the top twenty billionaire fund managers use trading strategies designed with computer software.

Keep Reading, and I’ll Reveal Four Strategies I Learned to Consistently

Make Money During "Billionaire Windows"

Mouth-watering gains like 70% in Autodesk in just under 6 months:

Many of my clients have paid up to $35,000 for the strategies I offer because they’ve been proven by 3rd party audit to work with real money.

However…

Those fund managers in our Turtle Trading group gave me their time. They answered my naïve questions.

They revealed secrets most would never share.

Because of their help, I now live in my dream home near the ocean in Newport Beach, CA.

So I’m going to reveal four of the secrets I’ve learned from four Billionaire Traders so you can combine them, and learn how to maximize your gains during "Billionaire Windows"...and even profit outside of them with a simple, but weird trick.

Billionaire Blueprint #1: The “Suicidal” Way to Profit in the Stock Market

Ironically, the Multi-Billionaire featured in this first blueprint doesn’t believe the stock market can be timed.... even though he says he doesn't time the market!

Ironic right?

But I don’t blame him.

Some call it “suicidal” to try to time the market.

A study published in Institutional Investor found that less than 1% of mutual fund managers consistently beat the market.

The New York Times reported that only 2 out of 2862 mutual funds routinely beat the market.

Those are absolutely horrible odds to overcome considering these are professional managers, so that is why in no way do I blame our first billionaire – even though it was his words that led to the discovery of a way to time the stock market.

I’ll share the shocking story with you in just a minute.

About Billionaire #1: 99% of His Wealth was Generated AFTER the Age of 50

But first, more about our Billionaire fund manager…

His father was a US congressman.

He was rejected by Harvard University.

99% of his wealth was earned after the age of 50, which goes to show you the power of compounding your wealth.

He once bought a company just so he could fire the CEO.

And he loves cheeseburgers and cherry Coke.

He is…

…Warren Buffett.

It might seem strange that Warren Buffett of all people – someone who absolutely abhors market timing (at least on the sell side...he absolutely times the market on the downside by buying dips)...

...inspired me to create a scientifically proven way to time the market with what I call "Billionaire Windows."

In 1986, Buffett famously lambasted Wall Street, calling it a casino.

He specifically called out products like the S&P 500 futures market which allow traders to trade a basket of the 500 largest companies in the United States with leverage of up to 23:1.

Just a tiny fluctuation of 5% could wipe you out if you’re leveraged up to the gills.

Even worse, the operators of the Wall Street casino allowed for the trading of options on these leveraged products.

Now you have leverage on leverage. Insanity, right?

Just a Year Later, the Stock Market Crashed!

Just a year later in 1987, the stock market crashed in spectacular fashion.

My researched showed it was from those S&P 500 index futures as investors were forced to liquidate when there was little liquidity.

Do to their massive leverage; they are the tail that wags the dog.

What you might not know is that these wildly popular S&P 500 futures are closely monitored by a government alphabet agency called the CFTC or Commodity Futures Trading Commission.

Every week, they publish a report, called the Commitment of Traders or “COT” for short, detailing seven different types of traders, and how many contracts they own.

They Tried to Ban the Report!

The COT is such a powerful document that the trade association that represents financial institutions, investment managers and banks, went to court to try to keep it out of the hands of investors like you and me.

The association claimed that if we got hold of it, the COT would give small investors a “competitive advantage” by allowing us to trade ahead of their members.

Damned right it would!

Fortunately, the association lost and that information is available to anybody who wants it. It’s even on the Internet at cftc.gov.

The CFTC forces anyone with over 100 contracts of emini S&P 500 index futures to report their positions every Tuesday for release on that Friday.

100 contracts is worth a cool $13.7 million at this time. Not exactly chump change right?

But let’s go back to Warren’s 1986 warning that Wall Street was now a casino.

Who wins at the casino?

The house right?

That’s how they can afford to build a miniature Eiffel Tower in the middle of the friggin’ desert right?

At first I thought I could simply follow what the house or “commercial” traders did and time the stock market… in fact that’s what others said to do, including a famous author who wrote a book about the COT report.

He was dead wrong!

Allow me to explain because this is the key to "Billionaire Windows".

Who is it at the casino that loses money?

You’ve got Aunt Betty hootin’ and hollerin’ at the slot machine losing her money a quarter at a time.

Then there’s the wannabe Rainmain trying to count cards as the waitresses ply him with drinks all night. Those “free” drinks aren’t very free am I right?

So he ends up flying home with a smaller bank account and a hangover.

Then there are the whales that fly in on their private jets to try their luck.

There’s a reason the casinos want these high roller’s business so bad – they lose too!

Most of these big wigs would be better off digging a hole in their backyard and burying their money than trying their luck against the casino.

At the end of the day, all three types of gamblers are thrill seekers looking for a rush.

Wait a second… that sounds like one of the groups of traders in the COT report!

What if we simply do the opposite of what they do?

Earlier, I talked about the forum hosted by one of the Turtle Traders that famed trader Richard Dennis had trained back in the 80’s.

The group is full of hedge fund managers, CTAs, and private equity managers.

I ran the idea by them, and they encouraged me to code the idea into a computer.

The year was 2006, and little did I know how much this observation would change my life forever.

So I locked myself in my office, collected all the historical COT data I could get my hands on, and then wrote a simple trading strategy that sells when the “gamblers” buy in mass, and buys when the “gamblers” sell like crazy.

Here's a screen grab of the computer code:

Sure enough, it worked!

It’s like this group of traders have a cloud over their head when they act in unison.

They aren’t just wrong, they’re completely wrong at almost every turning point in the stock market.

Buffett was right, the stock market really is a casino designed to make everyday folks part with their money.

From high frequency trading bots collocated at the exchange stealing pennies from your orders, to leveraged futures, to options, to the credit agencies rating products as AAA when they’re in truth ticking time bomb.

The whole machine is designed to make you fail.

No wonder you’ve struggled at becoming the successful and consistent trader you want to become.

Here’s what buying when the “dumb money” sells like crazy, then selling when they act like lemmings and buy in unison:

A 1,490% gain when what I call the "Billionaire Window" is open for business!

That's nearly 15 times your money in this simple test of doing the opposite of everyday traders.

Not exactly chump change, but we can do better.

Remember, we're looking for fat, juicy gains like these:

Obviously, we're not going to have all winners like in the above animation, but I want you to get a sense that these are not small "base hits" we're going for in these stocks.

These are "doubles", "triples", "home runs", and the occasional "grand slam."

Now let’s keep this lesson in mind, and move on to Billionaire Lesson #2…

Billionaire Blueprint #2: The Asset that Earns You Income as the Stock Market Implodes

This trading vehicle made money as the stock market tanked in 2008. On average, there’s a mini selloff in stocks every 3-4 months.

By getting into this asset, you can make money while the market declines, then jump right back into stocks at a discounted price.

Before I reveal the lessons from this asset and the 2nd Billionaire, let’s see if you can guess who he is…

He is a Vietnam veteran.

He used to play blackjack professionally in Las Vegas.

He’s donated over $800 million to charity.

He was the co-founder of one of the largest funds in the world with over $2 trillion in assets.

He is legendary bond trader, Bill Gross. They call him the bond king.

Bill was known for garnering a lot of attention to himself and his fund, Pimco, in my home town of Newport Beach, CA.

In 1997 he called for stocks to perform horribly.

The subtitle of his popular book was “How to profit in the coming post-bull market.”

Self-serving if you ask me since he’s a bond guy.

It might sound like he was one of those one in a million super-humans that can soak in every piece of information and determine which way bonds could go – he seemed so unstoppable.

In truth he used computer models to trade bonds.

That was his secret weapon.

Unfortunately, he had a falling out with Pimco and subsequently a fund he managed from Janus.

Even the Bond King is human and ended up getting divorced.

Rumor has it that he put dead fish in the walls of his wife’s house (which she took in the divorce).

Why? She allegedly stole one of his Picassos from what I heard.

Despite the fall from grace, his lessons of amassing a fortune taught me three things:

- You can make a giant fortune in bonds if you have a winning strategy for picking them.

- Bonds go up when stocks go down, and are much safer.

- Bonds pay you every month, so you gain a nice little income.

A few years ago, when I had the epiphany of using bonds to make money when the stock market when the "Billionaire Window" shuts down, I took a long look at bond futures.

Would they behave the same as S&P 500 futures?

In other words, can I buy bonds when the wrong-way traders were selling?

Was the bond market a casino as well?

I took a long look at the bond market.

There are several different types of government bonds:

Fed futures that last just a few months. 2-year bonds, 5-year, 10-year, 30-year…plus some other ultra bonds.

I decided to check on 10-years bonds because they’re the most popular.

In fact, as I write this, there are $378 billion with a ‘B’ worth of these contracts.

By this time, I had a team of programmers, so the answer came quickly.

The strategy was awful. No edge was to be found by going against the smaller traders that don’t have to report to the CFTC.

But then I looked at the required reporting level – that’s where it’s mandatory for the firm to report what they’re holding to the government.

I was shocked…the minimum number was a whopping 1000 contracts.

So basically, you don’t have to report unless you own about $120 million worth of these bond futures.

That’s 10 times the level of reporting for the S&P 500 futures market.

That’s not exactly a mom and pop operation is it?

Can you think of what I did next? I bet you can… I ended up using the same exact rules, but in reverse.

Maybe these traders were smart.

Holy cow, it worked like crazy!

These traders are actually good at timing bonds.

They tend to avoid the big losses, which is exactly what you want to do when you’re looking to change gears from stock trading to safety.

The strategy ended up being 74% accurate in my testing.

Now we have another "Billionaire Window" in our arsenal!

What a great compliment to the "Billionaire Window" for stocks right?

Here’s a chart of what that looks like versus buying and holding bonds:

A 514% gain is much better than sitting on your hands waiting for the next "Billionaire Window" right?

Remember: The goal of this presentation is to combine all the lessons into the “Ultimate Trading Strategy”...

Mouth-Watering Gains like: 44% in NFLX, 165% in NVDA, 259% in CCI, 23% in AMD, 138% in AMZN, 65% in XLNX, 65% in HOLX, 18% in GOOG, 99% in AMAT, 353% in CBRE.

Billionaire Blueprint #3: The Tobacco Smoking Market Wizard

Who Didn’t Hit it Big Until After Age 50

Not too long ago, the stock market was acting up and dropped around 15%.

One of my buddies told me he was liquidating his entire stock holdings. Yikes!

Buying when the market is down 15% from its highs is actually a winning strategy.

In fact, in this particular case the market only sank 4% lower than where he sold before it ended up blasting off.

When pressed further about why he sold, my friend told me he used to hold through all these dips that are extremely common in the market, but since the 2008 disaster where stocks dipped 58%, he can’t stay the course.

He’s effectively shell-shocked a decade later.

Even Warren Buffett was down 56% from peak to trough, so it’s not like he was alone right?

How much did you lose in 2008?

So selling early is the symptom…

He thinks the cause is the 2008 debacle.

But in fact, the root cause of his lack of consistency in the market is due to the absence of a trading strategy…

…If your idea of a strategy is selling when the market is causing you anxiety, and buying when the coast is clear, that’s not a strategy, that’s a recipe for disaster for you and your portfolio – I’ve got news for you…

...that’s how your dreams of being financially independent and beholden to no one get bashed against rocks, and sunken at sea.

You’ve worked hard for the money you’ve saved. Why piss it away on half-baked ideas?

Even our third Billionaire fund manager – my favorite of them all – used to believe that you could use the fundamentals of a company to time a stock… and economic data to time the overall market.

He Finally Saw the Light

After a few years, he saw the light, and ended up retooling his hedge fund using nothing but scientifically proven trading strategies from a team of engineers he poached away from IBM.

They used statistical models to beat dozens of trad-able markets.

By the year 2000, they were trading 60 different markets.

Nowadays, with over $80 billion under management for just one of their funds, they trade every market they can get data for.

We’re talking hundreds of strategies in over 100 markets around the world.

This multi-billionaire is what I’d call a late convert to the science of trading even though he was a code breaker for the military.

In fact, he didn’t really become uber-successful until after the age of 50 when he fired one of his managers, re-tooled his hedge fund, and decided to conquer the markets using pure scientific rigor.

He taught math at both MIT and Harvard.

Those Who Can’t Teach…But Not This Guy

There’s the old saying that those who can -- do. Those who can’t -- teach. Well, he’s definitely one of the exceptions to the rule.

He never hires economists or Wall Street types.

Like me, he only hires software engineers, physicists, and mathematicians.

He nearly doubled his money during the 2008 crash, and if he can cut back on his chain-smoking habit, could end up being the world’s richest man in a few years.

He is…Jim Simons, the founder of Renaissance Technologies, where he and his team of nearly 300 people have quietly become one of the most profitable hedge funds in history.

When I was learning the ins and outs of running a fund in our Turtle Trading group, one thing kept popping up over and over – you should be trading multiple strategies.

Results Smooth Out With This Formula

Your results smooth out by the square root of the number of trading strategies you employ.

This was new to me, and perhaps this is new to you. I felt like a fish out of water.

You see, I’ve been a penny stock trader, stock option trader, oex option trader, emini day trader, high frequency tick trader, a leveraged etf trader, and a stock trader.

I kept reinventing myself because I could never get the consistency that I craved in any one discipline.

There are simply times when any one strategy either falls apart or you’re better off taking a vacation because there are no opportunities to profit. Know what I mean?

I kept thinking about Bruce Lee’s quote about being the master of one kick instead of mediocre in a thousand.

This is How Fights Really Go Down

But then I thought about how real fights actually go down.

Being a master of one kick is great at a distance from your opponent, but what are you going to do with that kick once you get taken to the ground?

You better be skilled in grappling right?

Even if you’re on your feet, you can’t kick if you’re in close.

You might want to throw a Mike Tyson style uppercut to smack your opponent upside his head right?

If you’re going to survive in a fight, you better be prepared for every circumstance or you’ll be beaten to a bloody pulp even if you’re the greatest kicker in the world.

I found that to be an undeniable truth in the markets as well.

You Don’t Need Billions

But you and I don’t have billions of dollars to spread around dozens of markets.

In fact, perhaps you only have enough capital to trade in one or two markets at a time.

Like what you read about in the first two Billionaire Lessons:

One strategy for trading the S&P 500 index, and one for trading long-term bonds during their "Billionaire Windows."

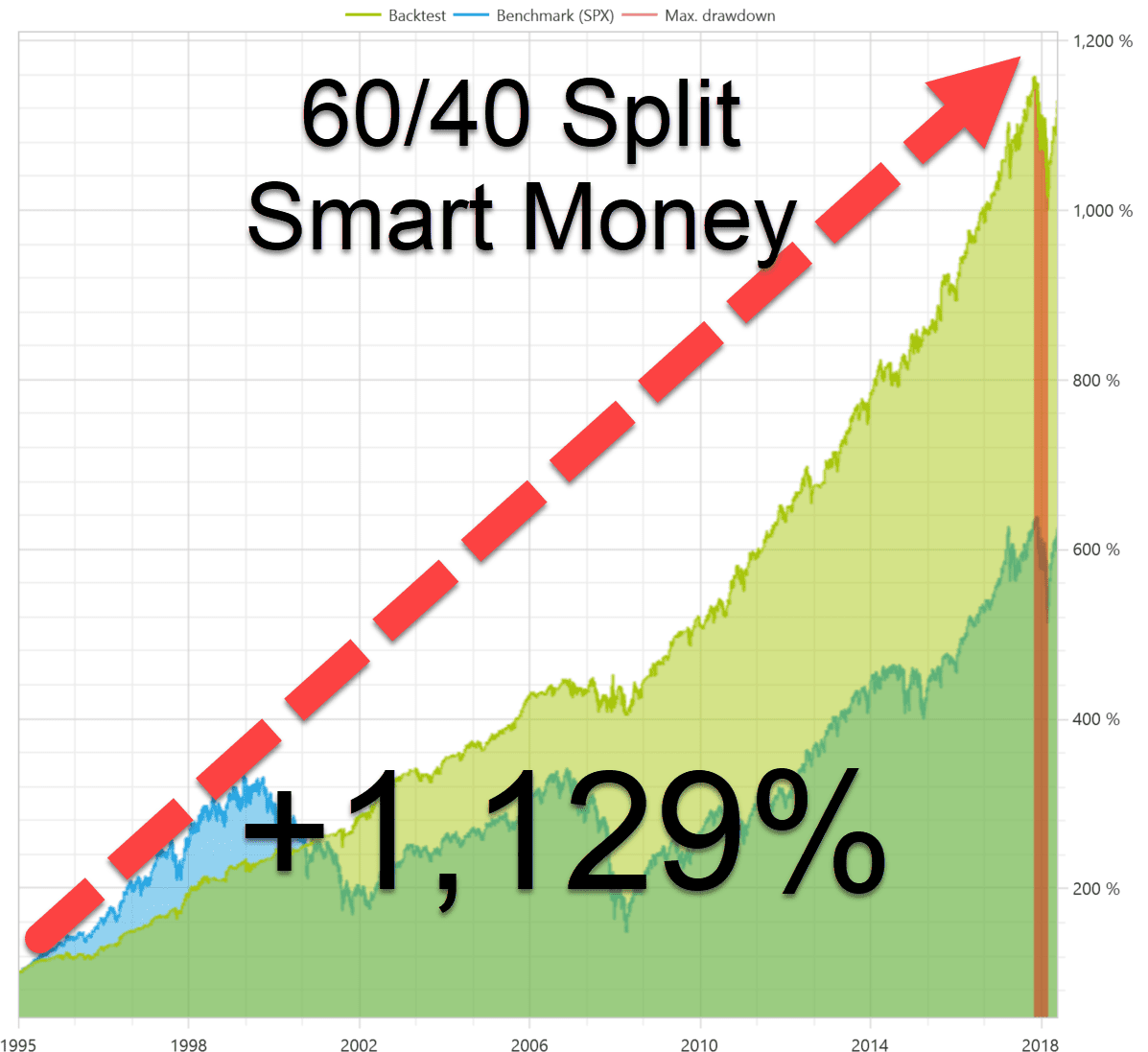

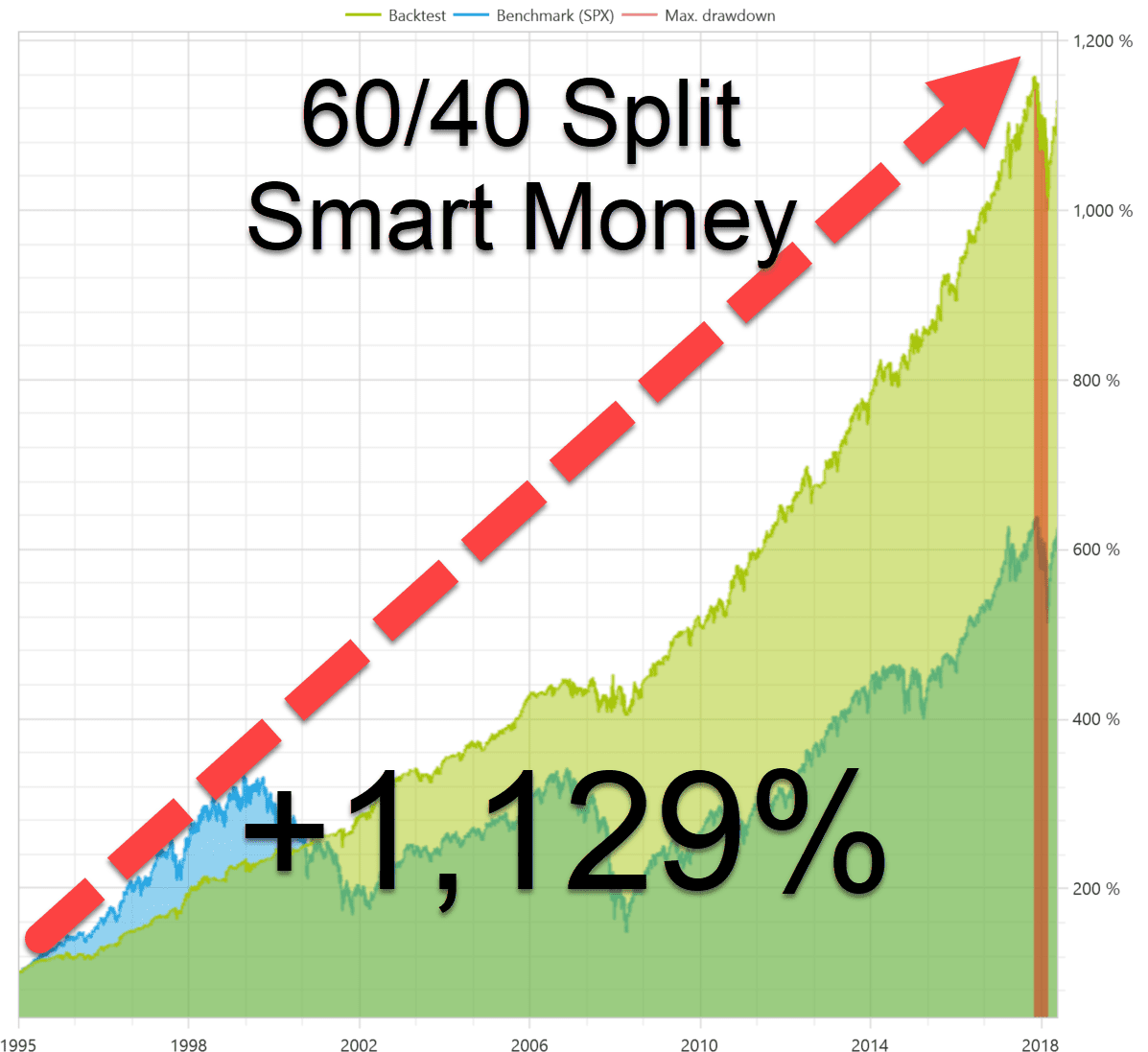

Here’s what happens when you combine market timing with stocks and bonds in traditional 60/40 split:

A bit boring for me, but much better than your average professional investor.

First of all, I'm looking for knockout stocks during these "Billionaire Windows" but we have to crawl before we can walk right?

Secondly, the results could be better with a minor tweak.

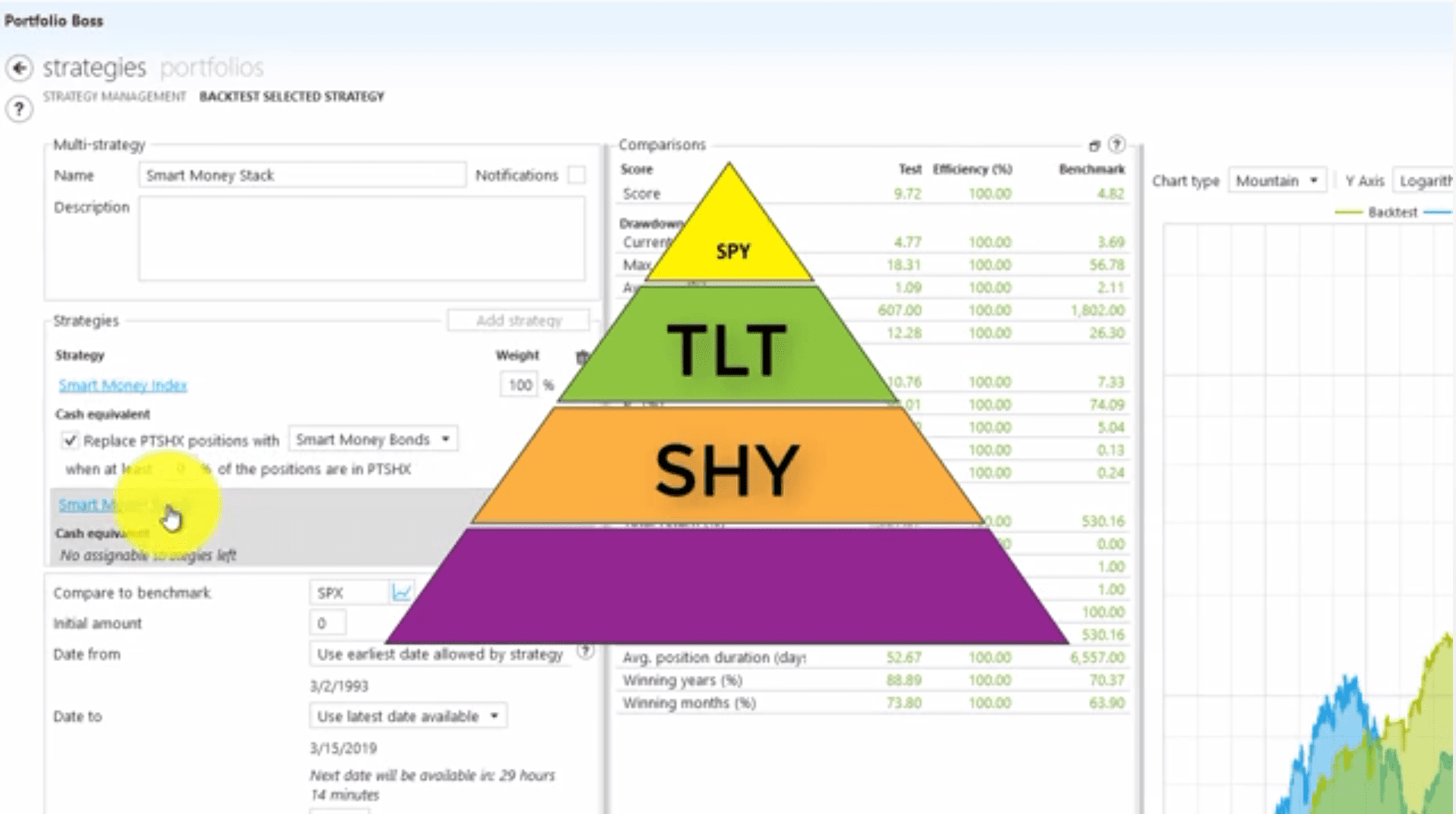

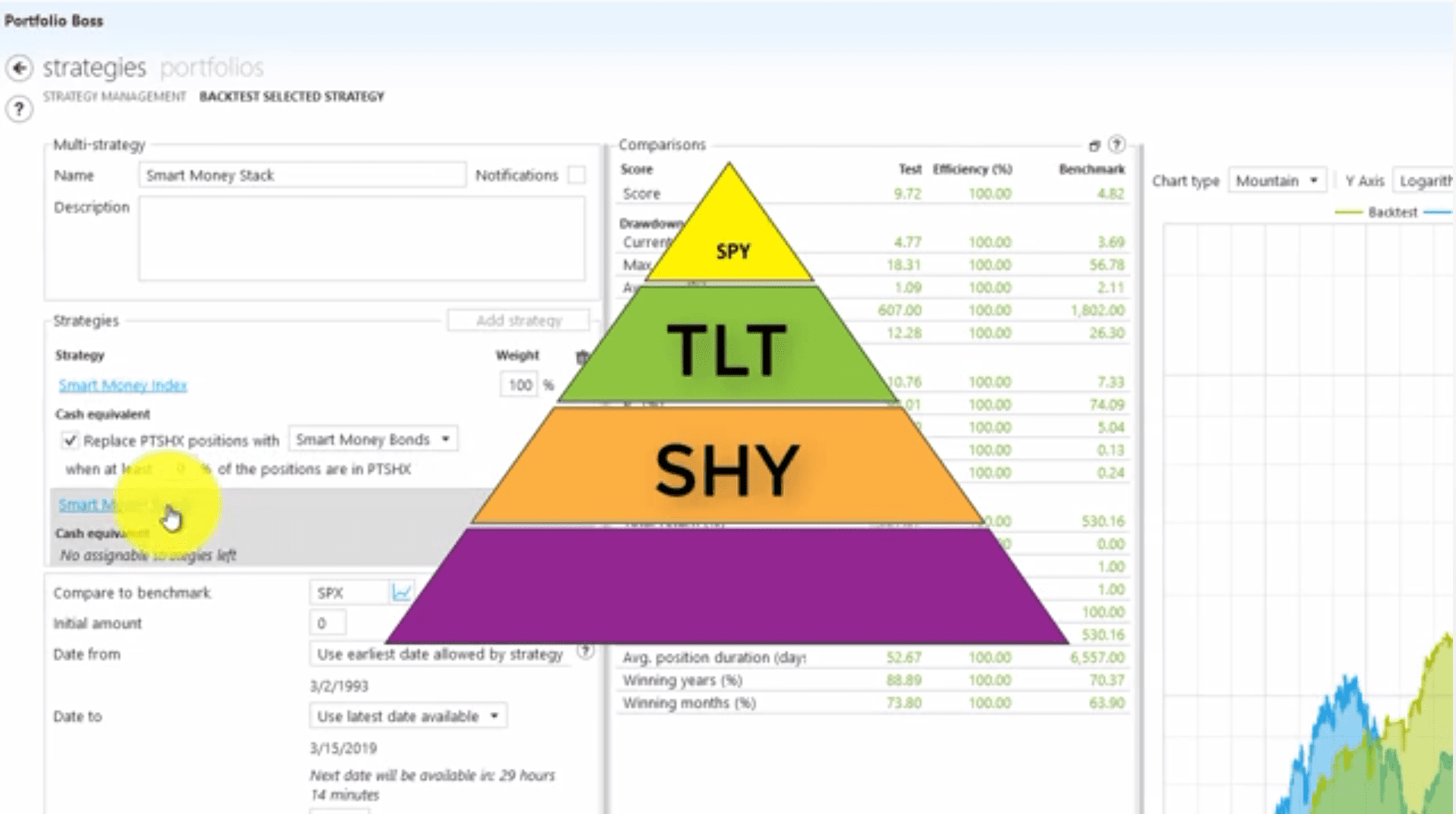

Instead of mixing the two with a fixed percentage, let’s try using what I call Strategy Stacking.

That where 100% of your money goes into the S&P 500 when the "Billionaire Window" is open for business.

That's the top of the pyramid below:

Then when the "Billionaire Window" closes, you get into long-term bonds like TLT so you can make money in down markets.

Remember: The average stock declines -1% when the "Billionaire Window" closes.

I suppose you could go take a vacation from trading when the Billionaire Window closes, but all you have to do is park your money in bonds with a few simple clicks of the mouse.

Next...

If the "Billionaire Window" for long-term bonds closes, the next layer down the pyramid is short-term bonds that trade under the ticker symbol SHY.

You simply get into safer and safer trades as uncertainty rises.

Now here’s a test of using this strategy instead:

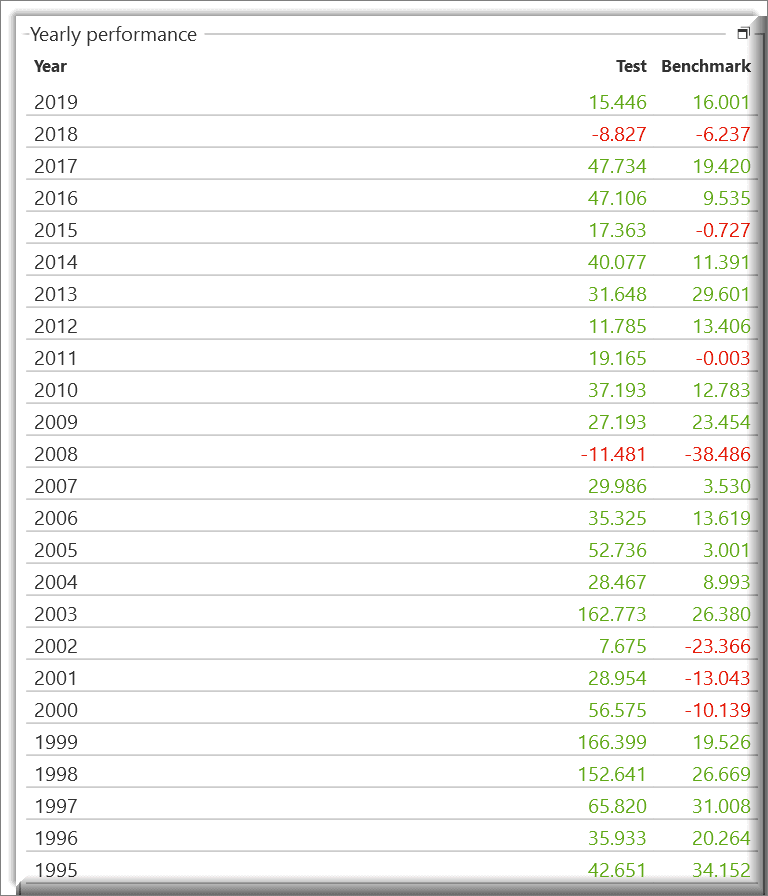

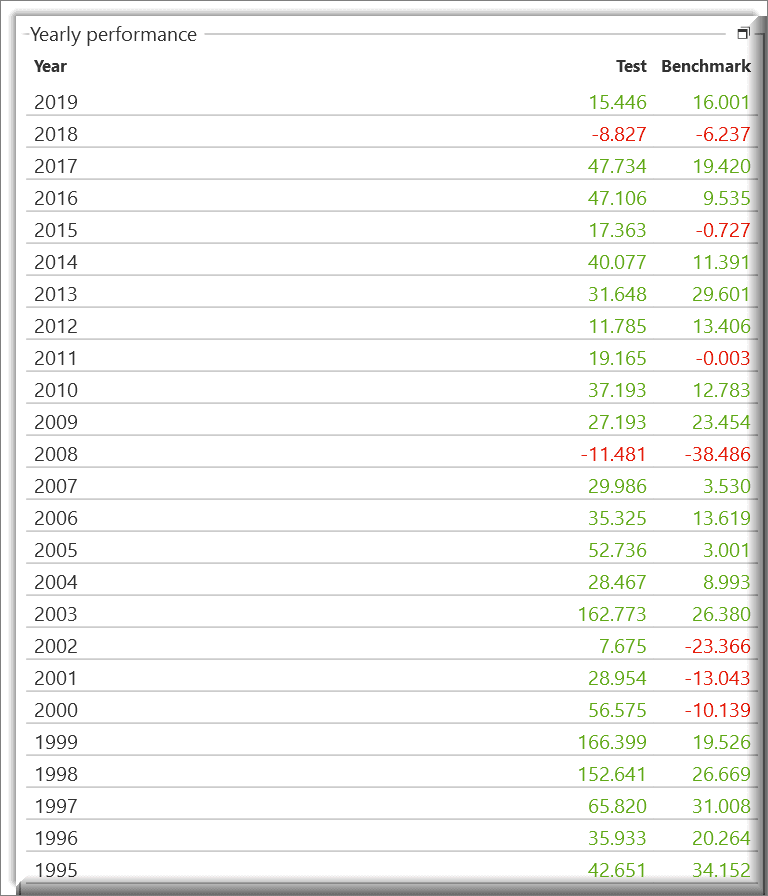

Now that’s some smooth sailing! 52X return in this test.

Not only that, but nearly every year is a winner in this historical test.

Take a look at the yearly performance of buying the S&P 500 index when the "Billionaire Window" is open, then switching to bonds when the "Billionaire Window" slams shut:

But we're just getting started.

Those massive stock gains are what we want.

Let’s continue our Billionaire Blueprint training with Lesson #4:

Billionaire Blueprint #4: The ONE Strategy That Has Stayed Consistent for This Billionaire Throughout the Years

Take a look at this object...

You might be wondering what this strange little device is, and how it can help you “hack” your way to consistently pulling money out the markets, and into your trading account.

But before I reveal what the heck this device does, let’s talk about what you’re on the verge of learning in this 4th and final billionaire inspired trading lesson.

We’re going to wrap up all that you’ve learned in the first three “Billionaire Blueprints”, and apply that knowledge to picking stocks that are most likely to explode in value during the next "Billionaire Window."

Remember: We're looking for gains like:

44% in NFLX, 165% in NVDA, 259% in CCI, 23% in AMD, 138% in AMZN, 65% in XLNX, 65% in HOLX, 18% in GOOG, 99% in AMAT, 353% in CBRE.

It’s what I promised you at the beginning of this letter, and I keep my promises.

You’re going to learn an unconventional way to pick the best of the best stocks during "Billionaire Windows", inspired by a legendary trader worth an eye-popping $8 billion.

Here are some more examples:

In Part 1 of this “Billionaire Blueprint” training, you learned how you can time the S&P 500 by doing the exact opposite of smaller traders identified in the Commitment of Traders report from the CFTC.

That's how to determine when the "Billionaire Window" is open for business.

But you have to ask yourself:

Why Trade Every Stock?

Self, why would I want to trade every stock in the S&P 500?

Some of them are duds.

That’s exactly what one of my employees asked way back in 2006 when I was explaining how the indicator worked.

I’m kinda ticked off I didn’t see that obvious question, but that’s why God gave us two ears and one mouth right?

Years went by with no answer to that nagging question.

There had to be a way to rank every stock in the S&P 500, and then only buy the top 10, 15, or 20 stocks.

But I couldn’t find a tool that could easily do such a task – so I ended up hiring a programmer to build the first version of Portfolio Boss.

Here’s the Answer After Two Years of Frustration…

Little did I know it would take nearly two years of programming and sometimes downright frustration to find an answer.

In just a minute, I’m going to share what we discovered with you in a grand finale fireworks style show, so stay on until the end.

Deal?

But First…

First, let’s get back to that strange little device I showed you at the beginning of this lesson.

I'm holding a quad-band radio.

It effectively allows you to hack the airwaves so you can chat it up with Bubba down the block, or eavesdrop on campers and hikers up to 6 miles away.

In many ways, it’s very similar to what we’ve been doing to create the “Ultimate Trading Strategy” for trading during "Billionaire Windows."

But instead of listening to four separate radio frequencies, two UHF and two VHF, we’re listening to the futures markets for the S&P 500 and 10 year bonds to see if their "Billionaire Window" is open.

We’re listening to short-term bonds.

We’re listening to the LEADERSHIP ranking of each and every stock in the S&P 500 on a daily basis.

Combine All Four Ingredients, Turn on the Afterburners, and Stand Back

By combining all four ingredients, we’ll have a strategy that can turn on the afterburners when the "Billionaire Window" is open and ready for action, and then get into safer assets when it's closed.

Simple as that.

While no trading strategy if perfect, this combined strategy can survive and thrive in the toughest of market conditions such as the 2008 financial implosion, or the tech wreck of the early 2000’s.

Those bear markets usually leave investors bruised and bloodied, and suffering a form of PTSD.

You can’t sleep, you’re grouchy, you’re uncertain about your future.

The only cure is to sell out at what will likely be a buying opportunity for someone like Warren Buffett.

The real cure is to have a plan in place – a strategy – so you don’t end up in these life-shattering predicaments.

Who is Mysterious Billionaire #4?

With that in mind, let’s go ahead and talk about our fourth and final billionaire trader, and his blueprint for hacking the markets.

He was taught how to trade by his grandmother, who was a very successful investor.

His first trade was in a stock that blasted up 300% in a matter of months.

He made $500 million a month during the 2008 financial crisis while most were losing their shirt.

He was featured in Jack Schwager’s book, Hedge Fund Wizards.

He Told Soros to Go Pound Sand

He told George Soros to go pound sand when Soros asked him to manage $1 billion for him.

You see, Soros was demanding half his normal management fees, which are 20% of the profits, and 2% no matter what.

He is the co-founder of Bluecrest Capital Management which has $40 billion in assets under management.

He is Michael Platt.

Michael is much like our billionaire market hacker, Jim Simons, who was featured in the last training module… in that he hires mostly scientists.

About that, he said: “I hired an economist once, which was the biggest mistake ever. He lasted only a few months. He was very dogmatic. He thought he was always right.”

Sounds familiar right?

Just turn on any financial TV show, and they’ll be dying to give you a bombastic prediction.

This Simple Observation Made Platt Billions

About the markets, he said: “It’s shocking how little you know for certain in financial markets. One of the only things I could say with certainty was that markets trend.”

That simple observation has made Michael Platt billions of dollars, so don’t take it lightly.

Knowing this fourth and final insight will forever change the way you view the stock market.

You can’t un-ring a bell right?

The key is to buy stocks going up the fastest…

…the exact opposite of Warren Buffett.

You see, Buffett is looking for multi-year declines, which by definition only occur every few years.

However, the majority of the time, there are stocks going up in at least one sector of the stock market.

So what Platt would do is give every stock a score based on its Leadership, and then buy the stocks with the top scores, and forget the rest.

Easy peasey right?

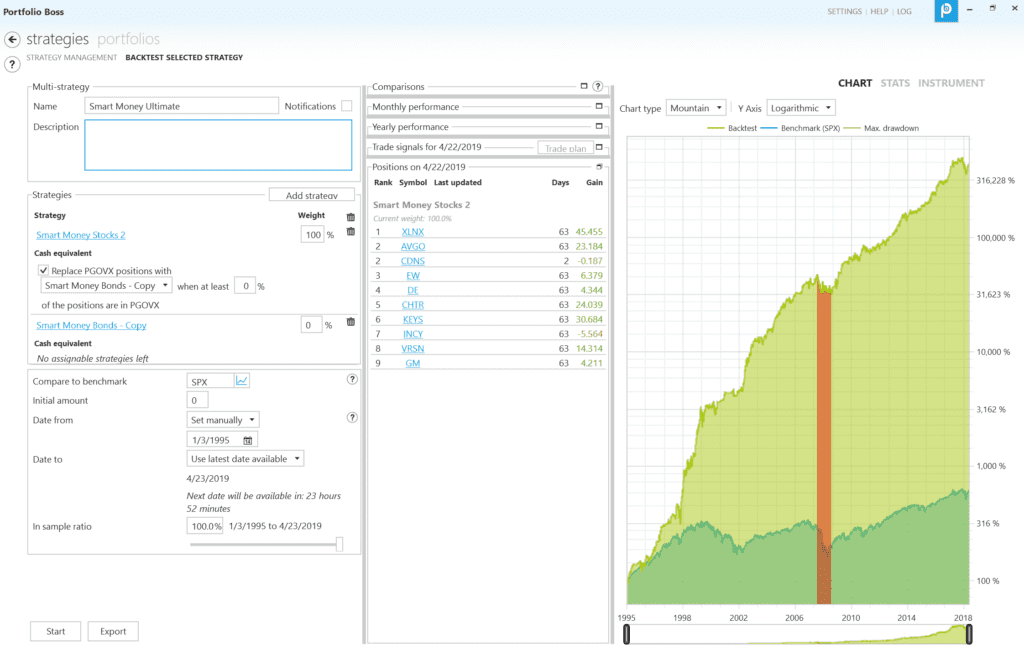

Inside my testing platform, Portfolio Boss, we have a Leadership Ranking Score that automatically ranks every stock you throw at it on a daily basis.

Then you simply buy these stocks when the "Billionaire Window" is open, and sell when it's closed.

Cha-ching!

All of these solutions we’ve discussed today are built right into Portfolio Boss, my trading platform built from the ground up to leverage these “Billionaire Windows.”

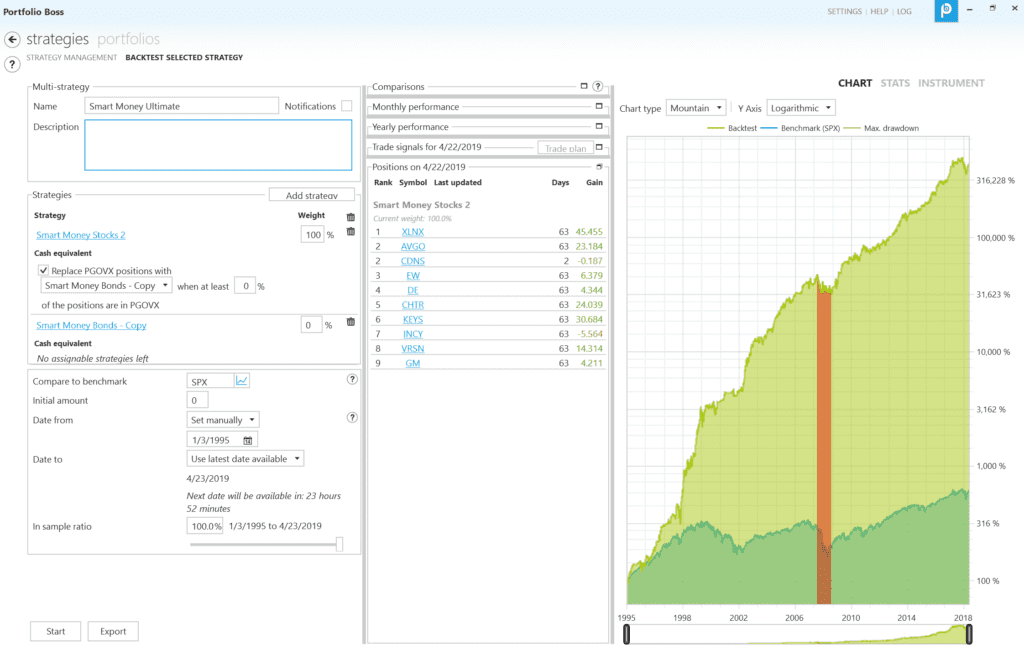

Here’s what happens when you combine all that you’ve learned today into the “Ultimate Trading Strategy.”

The returns are simply out of this world.

Granted, past performance doesn't guarantee future results, but what if you even did only half?

Keep in mind that I discovered these "Billionaire Windows" way back in 2006 when I programmed the rules into a computer.

This strategy is based on rules that I've been trading and refining for over a decade with my personal money.

What amazes me is how simple this strategy is to trade.

Most of the time when the "Billionaire Window" opens, you simply buy the top 10 stocks and hold until the window closes.

There's very little trading going on.

Now after all you've learned in this presentation, tell me: when would you rather trade?

When "Billionaire Windows" are open or closed?

I hope you said "when they're open!"

Quick story...

In 2013, I started building the trading platform I build all my strategies in -- Portfolio Boss -- to become the best tool on the market for combining trading strategies.

Since releasing it to the public in 2014, I've had hundreds of traders turn around their trading.

I've even been told by one embarrassed (and grateful) trader that he was finally profitable after losing for over 20 years straight!

Here's just a handful of the hundreds of comments I've received over the years...

I made over 100% in the last 12 months and I couldn’t have done it without PB so I wanted to say thanks for it.

I’m also really looking forward to all the advances you’ve been posting about recently and for project 88. Happy Thanksgiving!

Skirted the 2008 Debacle With Just a "Small Loss"

I have been following you for over 12 years. I can't say I always listened, but I respect your thoughts. You seem to have changed horses a few times over the years, but it has usually been for a better horse. I went to 90% cash on your first warnings and believed like you, there was a correction coming and I would rather be safe than sorry (like I was in 2000 to 2002). I was out of the 2008 with a small loss. I hope your new project is a great success. Take care.

"Now I Beat the Market Every Year"

Dear Dan, I am an original PB member since 2014. You have no idea how grateful I am to you. Very very grateful. So appreciative. I believe that you have invented the best trading strategy or one of the best trading strategies that has ever been created. So simple yet it is genius. I was a loosing trader before I met you. Now I beat the market every year and have total confidence and I can relax and stop worrying. And the very thing best thing is that you keep giving of yourself to those us who paid a one-time fee 4 years ago. The emails that you send to us with your very accurate and insightful assessment of the Market is invaluable. Especially the SMI signal that you share with us. I, like you, love to give back to others, because humanity certainly needs help right now. You are selflessly giving to us and I will never take it for granted. I hope you will allow us to follow you for the rest of your trading days. Thank you Dan, you are very smart man and a very good person. The best to you always.

A 48% Return and the Year Isn't Even Over

Things are going great. My strategy is at 48% return YTD. Gotta like it! I look forward to the next updates. Thanks.

PB has been a blessing for me. I manage two charitable trust accounts using strategies that PB has allowed me to back test and refine. PB has helped me sleep at night. Thanks to you and your team. Blessings

Hi Dan, my main focus is buying NDX-100 and NXTQ-50 stocks selected using a strategy developed in PB.I am up just over 28 pc ytd.

I started trading it in 2015 and my numbers are +7 (2015), +42 (2016) and +44 (2017).PB is the best investment I ever made.thanks to Dan and thanks to Sir Ruud Hermanns best system programmer in the known Universe!

Retired for 10 Years and Trading Strong

Dan,I am one of the original purchasers of Portfolio Boss and have been using it ever since. I must be a conservative investor since I am 73, retired for 10 years, and no new major sources of income. In 2016 I made 14.7% and 27.4% in 2017. It has helped buy a newer boat and a fancy fish finder.

Designed from the Ground up to Work in All Market Conditions

Imagine knowing what to do at all times with your trades because you are finally trading a true strategy designed from the ground up to work in all market conditions.

And this isn’t some rapid-fire trading system.

The average trade lasts about 2 ½ months.

The Commitment of Traders report that the market timing relies on is only updated once a week after all.

Portfolio Boss sends you an email alert everyday as it constantly scans your trades.

It knows if the "Billionaire Window" is open and ready to make you money, or closed shut so you can stay away from stocks.

You simply open your email, and Portfolio Boss gives you exact instructions on what to tell your broker.

With a few clicks of your mouse, you do your buying and selling and consistently grow your account without any guesswork.

You’re not hesitating above your keyboard with a bead of sweat dripping down your forehead.

You’re calm and collected while everyone else is scared to pull the trigger.

Imagine the day comes where you’re making a profit in a bear market for once.

Instead of being the Oracle of Omaha like Warren Buffett, you’re the Oracle of ________ [Insert your city’s name].

Portfolio Boss was built from the ground up to trade multiple strategies at once.

That’s your key to clock-work consistency so you’re not beating your head against the keyboard in frustration by getting blindsided by a bear market.

Even better, you can prioritize which strategies to trade using Strategy Stacking as I showed you earlier with the billionaire inspired trading lessons.

Inside Portfolio Boss

You also have access to three "Billionaire Windows" indicators based on the proven signals from the U.S government’s COT reports:

Two "Billionaire Windows" for timing the S&P 500.

And a "Billionaire Window" for timing long-term U.S. treasury bonds.

You can simply add them to any trading strategy you build.

Speaking of which, Portfolio Boss requires no programming!

The Portfolio Boss strategy builder is point and click easy.

Leave the programming to us… my team of engineers is constantly coming up with unique indicators, filters, and ranking algorithms so you can test them with just a few simple clicks.

Most of my students like to tinker with Portfolio Boss to suit their needs. I’ve seen strategies producing average gains as high as 200% per year using small cap stocks.

Wow!

The Lifeblood of a Trading Strategy…

Accurate historical data is the lifeblood of any trading strategy, so I spend multiple 5-figures per year for the most accurate, most complete database in the world.

We track de-listed stocks as well, which virtually zero back testing software does.

The public normally doesn’t have access to this database (it’s reserved for hedge funds), but with Portfolio Boss, it’s built in.

If you don’t have perfect data, your trading strategy is based on a house of cards, and will implode in actual trading.

Heck, most databases don’t even account for bond ETF dividends correctly. When a stock has a dividend, you subtract the price of the stock by the size of the dividend.

When a bond ETF has a dividend, you add to the price of the ETF. So simple, but I’ve seen database after database mess this up.

That’s like the bank taking money out of your account instead of paying interest.

Not that the banks even pay you interest these days!

The vampires are too busy sucking you dry with fees on top of fees, right?

Let the Tools do the Work

One of the most unique features of Portfolio Boss is Dynamic Portfolios.

We maintain indices like the S&P 500, NASDAQ 100, Russell 2000, Russell 3000, and over a hundred more automatically.

You see, these indices are constantly being updated… almost on a daily basis.

In order to be extremely accurate with your testing and real-life trading, you need to maintain these portfolios constantly.

If you don’t, you’ll miss out on new high-flying stocks that get added… which means you’ll make less money.

It’s like a baseball team failing to recruit rookie players.

Why maintain them manually when you can have Portfolio Boss do that for you automatically?

You want the tools do the work, right?

Here’s What You Get:

Normally, I sell individual trading strategies for $5000. But you're not getting just one strategy.

The "Billionaire Window" offer includes:

- The "Billionaire Window Ultimate Stock Trading Strategy”

- "Billionaire Window" Stocks Strategy

- "Billionaire Window" Index Strategy

- "Billionaire Window" Bonds Strategy

A few years ago, I would have sold you the "Billionaire Window" Ultimate strategy for $5000, and it would be worth every penny at that price because it could easily make you many multiples of that investment.

Since then, we’ve added many new features such as the most accurate and complete historical stock and ETF database…

…it even includes delisted stocks which I have to pay tens of thousands of dollars for every year.

Most testing platforms are like a Swiss Army Knife – they make you find your own data, trading ideas, and tools… and then try to hook into connect them all together.

In my experience, it just turns everything into a mess.

Portfolio Boss has everything you need built in… a one stop shop so you don’t go crazy trying to manually make corrections to crummy data.

Many data providers don’t even account for bond ETFs correctly.

They treat them like any ‘ol stock which they are certainly not (one of the biggest trading platforms makes this mistake…I won’t name names, but they have tens of thousands of subscribers who aren’t getting good data).

I could easily charge $75/month for this kind of historical data alone because it makes testing your trading strategies deadly accurate.

And now with Dynamic Portfolios, you have the most accurate indices available ($39/month value).

Clean data is the lifeblood of a trading strategy.

With Dynamic Portfolios, Portfolio Boss now manages additions and deletions to indices like the Russell 2000, S&P 500, and NASDAQ 100...which saves you a ton of time and headaches.

Imagine trying to keep track of hundreds or even thousands of stocks as they move in and out of the indices on daily basis?

Why do that when I pay 5-figures a year to do it for you?

Let the tools do the work as they say in golf right?

Plus, we now include access to the "Billionaire Windows" Indicators for both stocks and bonds, which can’t be duplicated on any other platform.

In addition, we built Portfolio Boss from the ground up to be a multi-strategy platform so you can have the kind of consistent profits that you can’t get from a single strategy.

There’s nothing like Strategy Stacking on the market, and my growing team of software engineers are constantly adding new features.

Instead of Charging $5000...

The Portfolio Boss "Billionaire Window" offer includes:

- The "Billionaire Window Ultimate Stock Trading Strategy” $5000 Value

- The cleanest historical data on the market $900/Year Value

- Dynamic Portfolios (Automatic upkeep of stock indices) $348/Year Value

- "Billionaire Window" Stocks Strategy Included

- "Billionaire Window" Index Strategy Included

- "Billionaire Window" Bonds Strategy Included

- Strategy Builder (Design and test your own strategies) Included

- Strategy Stacking Engine (Combine multiple strategies) Included

- 4-Part "Billionaire Window" Training Videos Included

- Divine Engine℠ (Automated strategy creation) Coming Soon!

Total Value: $6248

But you're not going to pay $6248.

You're not going to pay $5000.

This Memorial Day Weekend, I'm rolling back the clock to 2014 prices as my way of saying "thank you" for being a long-time client.

You get instant access to all these strategies when you invest just $5000 $1997.

That's over 60% off the regular price.

A savings of $3000!

No other fees.

But you must act now before this offer expires.

I’ve spent well into 7-figures building out Portfolio Boss, plus multi-five-figures per year for the cleanest data, including de-listed stocks which are the difference between life and death of a trading strategy…

…not to mention the team of six engineers (and growing) that are constantly adding new indicators and features so you design your own strategies.

If you make 40% on your money this year from the "Billionaire Window," that's an $8000 profit on a $20,000 account.

$20,000 profit on a $50,000 account.

$40,000 on a $100,000 account.

And all you need to do is key in ten stocks, send the order to your broker, rinse and repeat about every 2 1/2 months on average.

It'll take about an hour a year max.

That's like making $20,000 per hour if you have a $50k account.

You’ll also get my 30-day unconditional money back guarantee. Give Portfolio Boss a look. If it's not the greatest money-making tool you've ever used, shoot me an email within 30 days, and I’ll give you a full and prompt refund.

You don't even need to decide now. You've got a full 30-days to take the "Billionaire Windows" strategy for a test run. Put it through the paces.

Go ahead and click on the subscribe button below to get started.

This Special Offer Ends Soon!

What to do Next...

When you fill out your information on the next page, and within seconds you’ll have access to the “Billionaire Windows Ultimate Trading Strategy” inspired by four billionaires with a combined net worth of $113.7 billion.

Just download Portfolio Boss, and the strategies mentioned today will instantly pop up into your “Licensed Strategies” folder, and you’ll be able to trade them right away.

Just click on the “Smart Money Ultimate” strategy, click “Run” in the lower left corner, and you’ll be up and running.

There’s no reason to wait for a new signal to place the orders with your broker.

Some of the stocks will likely already be up big, but as Michael Platt said, those are the stocks that just keep going and going like the Energizer Bunny.

“Over-valued” comes when mom and pop traders all jump on the band wagon.

That's when the music stops, and the "Billionaire Window" slams shut.

That often doesn’t happen for months, or even a year while the "Billionaire Window" is open for business.

Meanwhile, these stocks can keep soaring higher like a rocket blasting into orbit.

So you have two choices:

You can either continue to do the same thing you’ve been doing, which is no where near the consistency you've been craving so desperately for.

You'll be stuck wondering when the next bear market is going to reveal its ugly head like it did in 2008 when investors lost trillions... a decade's worth of gains gone in months...

…or you can take a calculated risk and jump into a strategy that’s based on decades of cold-hearted truths on how the markets work.

Go ahead and click on the subscribe button below and let’s get started before this offer – and massive savings -- expires.

Portfolio Boss Ultimate

Get instant unlimited access to the Portfolio Boss software now.

$ 1997 one-time investment for the "Billionaire

Windows Ultimate Trading Strategy"

-

Unlimited access to Portfolio Boss

-

Includes Portfolio Boss video training series

-

Access to Portfolio Boss user community

-

Lowest price for Portfolio Boss software

-

Unlimited software updates

-

Safe and secure transaction

This Special Offer Ends Soon!

100% MONEY BACK GUARANTEE

Give Portfolio Boss "Billionaire Windows" a look. If it's not the greatest money-making tool you've ever used, shoot me an email within 30 days, and I’ll buy back your copy of Portfolio Boss. No hard feelings. You don't have to decide now if you want to keep "Billionaire Windows" strategy. You've got a full month to take her for a test drive.

- Dan Murphy

The clock is literally ticking on this offer.

Pricing for the “Billionaire Windows Ultimate Trading Strategy” are about to go up $3000 when the countdown timer hits zero.

Hit the subscribe link below, and let’s get started today.

Trade Smart,

Dan "Prince of Proof" Murphy

This Special Offer Ends Soon!