Need Help? Email Us Here or Call Us At: +1 (866) 567-4257

Step 1: Download Click, Click, Profit Cheat Sheet...

4.8 out of 5 Stars. Trusted by 5200+ Traders!

Step 2: 72-hour Access to Chapter 1 of my

$1999 7-figure Ai Training

The $6.2 Million AI Discovery That Turned Market Whiplash into Steady, Spendable Income

Dear: Future Top Trader

From: Dan Murphy, Corona Del Mar, CA

Re: The Only Blueprint You’ll Ever Need To Get Consistent Trading Results

A Market Shift Is Happening…

You’ve spent years mastering chart patterns, tinkering with indicators, and devouring newsletters…yet your results feel like a rigged carnival game.

Because the “old rules” of trading are breaking down right before our eyes:

❌ Every edge is public-domain by the time you read about it on Reddit or CNBC.

❌ Indicator soup ≠ edge – RSI, MACD, Bollinger Bands… all calculated on the same public prices robots scrape in micro-seconds.

❌ Cheap commissions created a stampede of hobbyists who move markets with meme-stock mood swings.

❌ And Wall Street’s AI arms race front-runs every earnings release, Fed whisper, and geopolitical tweet while you’re still logging in.

So each morning you pour fresh coffee into yesterday’s chipped mug of frustration…praying this will be the trade that claws back the last one.

Here’s the Good News…

I’ve made trading strategies that have averaged 50% returns for years…

My strategies have pulled in $115,000, even $300k in a single month.

If you’re a little skeptical at this point…

That’s good.

You shouldn’t believe everything you see online… and you definitely shouldn’t believe most of what gets thrown around in online trading “education…”

So I’m going to prove it to you...

Mark Used My Strategy to Add $300k to his brokerage account earlier this year.

This is what makes this different from any other trading information out there:

This is a spreadsheet from my accountant – That’s What Makes This Different.

I’ve poured millions of MY OWN money into developing Ai trading tools.

That’s $6.2 million researching and developing the strategies you’ll discover on this page.

With That Said… Let’s Look At The Numbers...

That’s a screenshot of one of my trading strategies performance…

This strategy was up 19.8% just last month…

That’s not a cherry picked number… honestly this strategy has had better months…

19.8% is just what the returns happen to be as I’m writing this page.

But that’s the beauty of what you’re going to discover today.

You don’t need to fake things into looking better if you’re actually getting good results.

And I can tell you from almost three decades trading… 19.8% in a month is a pretty good result.

It beats out almost every hedge fund and institutional investor out there.

And Here's Another Strategy… Up 44%

And Another at 114%

GAINS OF 114% TRADING JUST 2 INSTRUMENTS A FEW TIMES A MONTH

Building strategies like this CONSISTENTLY doesn’t have to take years to master.

*BEEP* *BEEP* *BEEP*

The alarm rang from my pocket and I knew I had to move fast.

The Microsoft earnings call just ended and I had to place a trade NOW if I wanted to get ahead of the news.

I ran to fire up my brokerage account and place the trade…

As the screen flickered on and I saw the charts my heart dropped…

The news had already been priced in.

I’m sure this is a familiar feeling if you’ve been trading for any amount of time at all.

Sooner or later all traders realize “trading the news,” is just too dang slow.

For me this was my life back in the 90’s.

There was this pager service (go ahead and laugh) that would send you an alert when big news hit…

But even back then, it was too slow…

You see, I didn’t realize it at the time, but institutional traders were using a special kind of AI called “Machine Learning.”

This gave them a huge edge over my (expensive) pager service…

Institutional traders still use Machine Learning.

The only difference is Machine Learning has gotten a lot better in the last 20 years…and a LOT faster.

Nowadays trading the news is absolutely hopeless… markets can react to news in four seconds.

So if you can’t get ahead trading the news, what are you supposed to do?

It doesn’t matter how fast you’re getting info… or what markets you’re trading…

It doesn’t matter if it’s a bull market or a bear market.

If You Don’t Apply the Market Mechanics I Describe on this Page, You Will NEVER Become a Consistently Profitable Trader…

Strategies like these have earned me an amazing lifstyle…

This strategy is an amazing case study of the principles you’ll learn on this page.

The stock lost 70% of its value. But we’re up 114%

My Ferrari Strategy is doing fantastic this year.

UEC is a terrible buy and hold. But one line of code gave us 45% gains.

But before mastering the skills to consistently make strategies like the ones above I was lost like MOST traders are.

I tried everything and anything to find an edge.

- Listening to CNBC…

- Elliot Wave Theory (as if trading could be as easy as counting to five)...

- Paying for newsletters…

- Swing trading…

- Day trading…

- Penny stocks…

- Anything else under the sun…

But none of them worked. Results were hit and miss… any big win seemed like it was followed by a bigger loss.

I’d even taken a cash loan on a credit card… and traded options with the money… obviously I lost it all…

I blew up three separate trading accounts in this period…

These mistakes are how I learned what works and what doesn’t…

But no one should go through that if they don’t have to.

And the great thing is today… you don’t have to go through all of that unless you’re some kind of glutton for punishment.

That’s important, and I’ll get back to it in a bit.

But first I want to show you how I actually got ahead and started making a profit.

Here’s How I Went from Blowing Up Three Trading Accounts… To Funding a $6.2 Million Company with Trading.

Bloodshot eyes illuminated by the dull glow of a computer screen.

Days spent glued to a chair…

At this point in time I had gotten into all of that woo-woo “trader’s mindset” bull$#%… but it wasn’t helping.

I was watching my account balance get lower…

And lower…

And lower.

I couldn’t afford to keep losing money.

I knew there were traders out there, earning a living. They were winning consistently.

That meant making a living trading was possible.

I just had to figure out how they did it… so after blowing up this third and final account I decided…

“It’s time to get serious about trading to WIN”

To start, I worked my way through all of Jack Schwager’s Market Wizard books… where he interviewed the top traders in the world.

This set me on a path that completely transformed my life.

They’re a valuable read, and I’m not going to say you shouldn’t take the time to go through them but…

Here is the number one takeaway from all those trading legends.

Every single Market Wizard interviewed by Jack used a system.

If you want to make consistent profits trading you MUST have a system.

Because at the end of the day…

Your “mindset” doesn’t matter. Having great strategies is all that matters.

Right now, I’m going to show you exactly how I find great strategies. Ones like these…

And the first step is to stop worrying about your account balances, whatever “mindset hacks” you’ve been reading, and anything else that’s getting in your way.

All you should care about is finding systems and strategies that work.

You can’t let best practices or common knowledge get in your way either.

You need to question everything.

Things change in the markets all the time.

In fact, the big breakthrough that led me to the strategy I want to share with you today happened by completely going in the face of conventional wisdom.

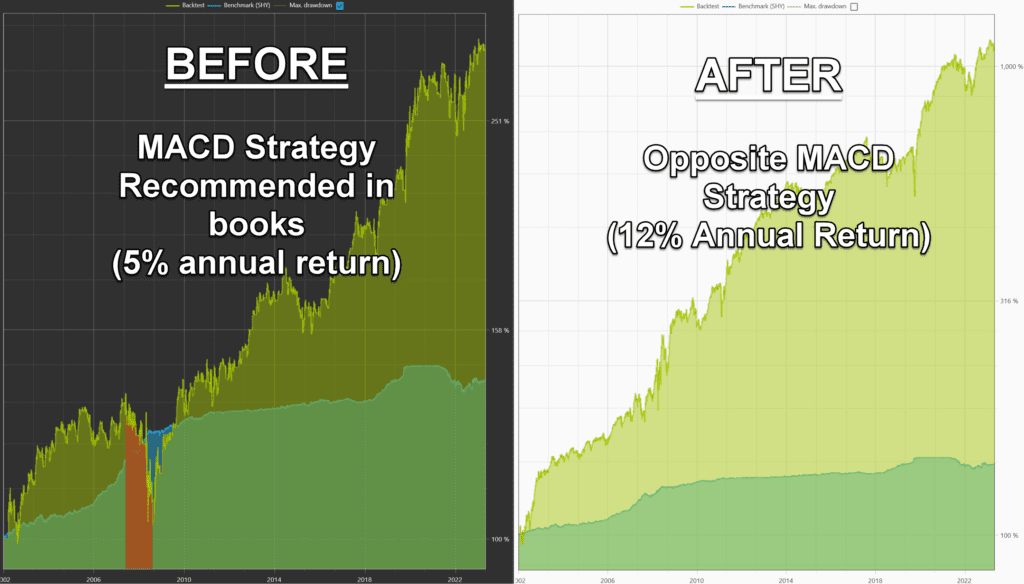

How to grow a trading account to $1 million by BUYING the SELL signals and SELLING the BUY signals.

This was the big break, so to speak.

I started programming my trades on a computer.

Backtesting and analyzing. I wanted to see HOW my trades worked and HOW the market worked.

And I can honestly say I cracked the code.

People who started following me from back in these days are still with me over a decade later.

Through machine testing I realized that MOST technical indicators are “bass-ackwards.”

Meaning for example, you could actually buy the sell symbols and sell the buy signals from a MACD strategy and be better off.

If you’ve been trying technical analysis and seeing big losses… you’re not alone, and bear with me… it’ll make a lot of sense in just a second.

The “Rubber Band” effect that makes your stop loss lead to BIGGER losses…

If you’re using a stop loss based on technical support levels, you’re almost certainly leaving a ton of money on the table.

The reason for this is something called “Mean Reversion.”

Picture it like a big rubber band.

When the price of a stock rises it goes up and up and up until it meets resistance.

Once this resistance gets too high the price shoots back down.

Look at the “rubber band” effect as Lululemon shoots down then up, before settling at the average.

Alternatively, when there’s a sudden bout of selling the same exact thing happens…

But in reverse.

When this rubberband gets pushed to its limit, it’s going to snap STRAIGHT back up.

NORMALLY, this happens right after a support break. Which means by selling support breaks, you actually end up missing the up spike the very next day.

I discovered this “rubber band” effect back in 2006.

I thoroughly backtested a strategy based on it and let me show you exactly what I discovered.

Hundreds, if not thousands of traders are trading with OLD info that doesn’t hold up to testing.

February 16, 1982 began just like any other Tuesday but something happened that would fundamentally transform the markets forever.

You see, on that day, the CFTC approved the first futures contract based on a stock index.

If that sounds like gibberish, or you don’t see why it’s important… don’t worry…

No one else seemed to have noticed either.

Nobody except Warren Buffett, who wrote a letter to his U.S. representative warning of the changes it would cause..

“At least 95% of the activity generated by these contracts will be strictly gambling in nature.”

Well… what does gambling add to a market?

Choppiness.

The markets still moved in trends, but the smaller time frames were taken over by the “rubber band effect” I explained above.

You can track it to the day.

This tested strategy 10X’d my trading account, despite going against “common knowledge.”

Just look at what I discovered with your own eyes. This strategy is backtested to 1926.

It’s a super simple strategy… buy the 20-day lows, and sell the 5-day highs.

Up until 1982 this strategy would have been suicide.

But for the last 42 years it has been a clear winner.

That day in 1982, everything changed.

But people were still giving advice based on the OLD information.

Unless you have a time-machine, trading with OLD information will get you nowhere…

All the proof you need is in that graph above.

I took this TESTED, NEW strategy and used it to make even better strategies.

I started a website called MillionDollarTarget.com to document my progress of turning $100k into $1 million dollars.

I had my journey audited by a third party and shared it with the public.

I called it…

“The Million Dollar Target”

But I didn’t stop there.

If making a million dollars was as easy as testing this one idea… maybe I could find more strategies, and more ideas…

I began to question EVERYTHING I had been taught about trading with the goal of starting my own hedge fund.

The main rule was simple…

Take nothing for granted, if it’s not TESTED it’s not TRUE.

The $300k FAILURE That Led to the Best Strategy I’ve Found

If you’ve been trading for any time at all you’ve probably heard rumors that subjective Technical Analysis, such as chart patterns and trend lines, has been disproven.

Well I can confirm that, because I’m the guy who disproved it… completely by accident.

After my million dollar win, the goal was to test every last possible chart pattern… looking at 6,000 different stocks since 1986… and mathematically find the best patterns to trade.

Makes sense right?

There were trillions of combinations to go through.

I ended up hiring two employees to help and investing in cloud computing so we could run the calculations day in and day out.

In total it cost $300k… took 18 months… we tested every which way possible to objectively define chart patterns…and this was the fruit of our labor.

That’s right… the results were completely random.

Try trading that and see where it gets you.

What my team discovered, completely by accident, was that there are ZERO consistently profitable chart patterns. Subjective technical analysis was essentially no better than Astrology.

A FREE Lesson For Beginners and Traders Who Can’t Seem To Get Technical Analysis Right

This lesson cost me a third of a million dollars, and I’m giving it to you for free. So pay attention.

Seeing $300k go down the drain… I have to admit it was a bit disheartening.

But to learn objectively that chart patterns are an illusion…

That trend lines, “support” levels, and “resistance” are muddy at best and almost impossible to quantify…

That trading based on these OLD ideas wasn’t going to get me to start my hedge fund…

That was PRICELESS.

This $300k failure is what led me to the most successful trading strategy I’ve ever come across.

All I had to do was think in terms of what was completely NEW.

Making Profits in Today’s Markets Requires TODAY’s Methods

At the start of this letter I mentioned hedge funds using AI in the 90s. It let them react to news faster than any regular trader…

Turns out, the best hedge funds are still using that same type of AI today.

The type of AI is called Machine Learning and it’s exceptionally good at picking up patterns.

Especially when fed massive amounts of data.

It can turn a jumble of raw data that looks impenetrable to us into perfectly ordered… easy to follow trading strategies.

Until very recently regular traders couldn’t access the data or computing power needed to get the same advantages as the big players.

But now, thanks to progress in the worlds of AI and Cloud Computing…

That same AI is available for home traders to use.

And you don’t need to learn how to program to take advantage of it.

That’s because something called…

“Genetic Programming” is leveling the playing field.

It goes like this.

How Genetic Programming Turns Big Data into Trading Strategies

With Genetic Programming… everything changes.

Suddenly you can test so much faster.

It’s nothing to reduce and simplify large batches of raw data. Resulting in simple elegant trading strategies.

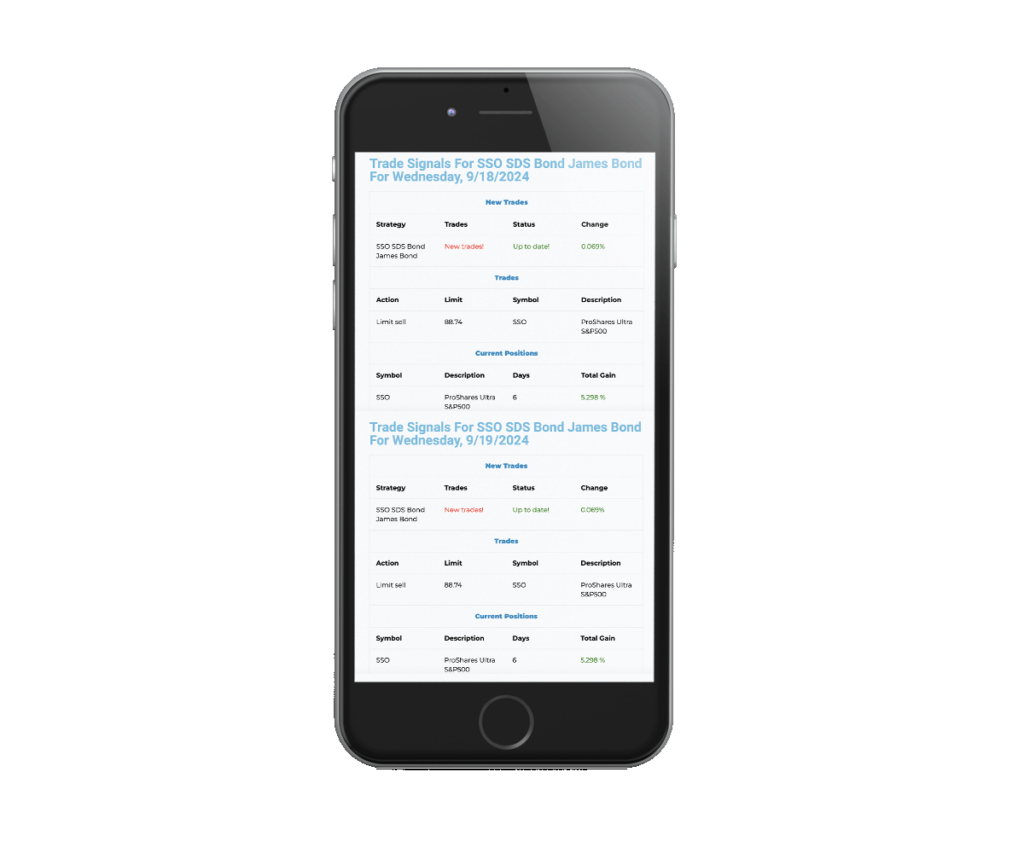

Strategies like this “James Bond” strategy. This is just a few lines of code… but it delivers incredibly powerful results, seeing almost 20% returns last month alone.

Today, for the first time, machine learning and the data it needs are accessible to home traders.

The best part is… genetic programming has AI do all the coding for you.

Today I want to give this strategy to you for FREE.

But there is a catch. I only want to give this strategy to people who want to learn how to use Genetic Programming to make strategies for yourself.

It’s the cutting edge of trading innovation and it’s behind many of the most effective, consistent strategies in the world.

Don't worry, you can use my template, so building strategies is as easy as hitting the Start button.

If you’re wondering why I’d share my edge with you… I’ll get to that in a minute.

But first…

I want to deliver on my promise and reveal something even more shocking and effective than Genetic Programming.

This is the #1 trading edge I’ve found after spending $6.2 million on trading strategies.

This $4 Billion Mispricing Glitch predicted stocks more accurately than anything in my 27 year trading career.

Have you ever looked at how much an ETF is valued at… vs how much the assets it represents are actually worth?

Don’t go running off to check. I’ll tell you right here.

They don’t match up… and it’s pretty weird…

Just glancing at one ETF I trade I found a $12 million “rounding error.”

That’s a lot of money on the table, and this is just one ETF.

When I started looking into it I found you could find little “rounding errors” like this in almost any ETF you looked at.

If you’re not sure what ETF mispricing means for the average trader… just bear with me for a second while I put in perspective how strange this is.

In total…

ETFs are mispriced an average of $4 billion on any given day.

I thought there had to be a way for traders to create a system to take advantage of this.

So obviously I fed as much data as I could about these ETFs to our machine learning.

And what happened was amazing.

The Results? The NEW Mispricing Glitch Strategies Consistently Beat The Markets (Any Market) By as much as 102%!!

Commodities

ETFs

Stocks

Inverse Funds

Do you know ANY other trading method getting results like this?

I’ll show you how to use this strategy and 27 years of hard earned trading lessons in the Seven Figure AI Trader.

The Seven Figure AI Trader is jam-packed with everything I've learned in 27 years of trading, and $6.2 million spent developing Ai tools.

Over the course of four chapters I’ll take you from the ground up. Guiding you every step of the way.

From the basics of solid trading strategy in today’s world…

All the way to building strategies using complex AI.

(Don’t worry, complex AI = easier for you.)

And remember, unlike all those trading systems and gurus you may have been misled by before…

The Seven Figure AI Trader is different because it’s based on what’s really working TODAY… Not on outdated information from decades ago.

You can simply follow the methods you're shown, and use it to create an entirely new PROVEN strategy of your own in less than a day.

And you don’t need ANY previous trading experience at all.

You get the benefit of my 27 years in the markets.

Now, just as a disclaimer, results, as you see on the screen here are not typical. Most people who purchase an informational trading product will NEVER put it into practice.

And my strategies get above average results… because I test them and put them into practice.

The traders who are sending in their brokerage accounts are getting above average results… because they test their strategies and put them into practice.

Most people buy a course and don't do anything with it. So they don't get any results at all.

But for those who are willing to actually use the methods in this course… I can show you how I’ve beaten the markets… funded a tech company… and the life of my dreams… all with trading.

The reason I'm so confident is because I've used the methods you’ll learn to do it time after time, after time.

Sometimes just applying one concept you’ll learn in the Seven Figure AI Trader can improve results significantly…

- “Strategy Stacking”. This multi-strategy technique has resulted in a 16% boost in annual growth rate, with lower drawdowns and more consistent returns.

- A proven Income strategy that has doubled like clockwork with a 24.8% CAGR by trading Warren Buffett's fund.

- How to beat the markets without having to understand them using “Evidence Based Trading” (in fact, trying to know too much makes you miss out on easy wins.)

- You’ll learn how to come out 2% ahead on every trade you make. This technique saves you from a hidden “tax” most new traders pay. Starting with a $100,000 account that 2% could add up to $2,000 MORE dollars in your pocket at the end of the year.

Use This Seven Figure Ai Trader To Jump Start Your Trading Career

But first, read this disclaimer…

I’ve been studying the markets and actively trading for close to three decades.

The “average trader” loses 90% of their money in 90 days… and most people who buy “how to” information get jack for results.

(Of course most people are just looking for a magic pill… and it’s hard to get results when you don’t put in the work.)

IF you decide to put the strategies you’re going to learn today into practice your results WILL vary.

It’s all going to come down to your background, experience, and most importantly…

Your work ethic.

All trading includes risk, and past performance doesn't guarantee future results. That’s the price you pay if you want outsized returns. Trading also takes time and energy. If you want to beat the markets you’re going to have to learn how they work. There’s no two ways about it…

If you can’t accept that, DO NOT PURCHASE THIS COURSE.

Believe me… it took years of my life and millions of my dollars to learn everything I’m sharing with you today.

The goal of the Seven Figure AI Trader is to speed up your learning curve… a lot. But it’s not a magic pill… there’s no beating around the bush. You’re gonna have to roll up your sleeves, put in the work, and get your hands dirty.

So, to sum everything up…

Today I want to offer you a course I’m calling the Seven Figure AI Trader…

It’s not just a primer on getting an edge with AI trading.

This is a collection of everything I’ve learned over 27 years and millions of dollars spent trading.

Important skills you won’t see taught anywhere else, like…

- Test first, trade later. I reveal methods and secrets behind making sure a strategy works BEFORE you put real money behind it. (If I’d learned this earlier in my career I would have saved myself a lot of losses and heartache.)

- The Semi-Retired Trader Model — you’ll have more free time in your day-to-day and you’ll won’t have to sacrifice nights, weekends, or family time.

- The “Wheat Signal.” That’s right wheat! This reliable “Wheat Signal” has allowed savvy traders to rake in tidy 8.77% profits on a single trade.

- How to use hard data to see through the Fake News and trade with the Smart Money.

- I show you exactly how I put a leash on a raging bull in a china shop like NVIDIA with 44% volatility. So I could see the big gains while avoiding the losses and potentially even make a tidy profit off the crash.

I’m presenting all of this and more here for you for just $1999 $7…

No hard sales pitch, you can take it or leave it, but it’s here for anyone who is ready to take their trading to the next level.

I’m barely charging enough to cover the cost of putting this offer in front of you.

Here’s how it works:

So, why am I selling the Seven Figure AI Trader?

By selling the Seven Figure AI Trader and teaching people how to really make money trading I’m going to have an audience of traders built up.

People who trust me, and know how to trade themselves. Who will see the value of the way I trade using an evidence-based approach… and I want those people to use my Ai trading platform.

This is about building a network of educated and capable traders who know the best ways to trade in TODAY’s markets.

I’m only charging the $1999 $7 to separate the people who are serious about becoming better traders from those who aren’t.

Plus, you receive a FREE 30-day trial to Portfolio Boss Ai Builder. The same tool I use to build strategies I mentioned above, and trade them with 99% automation.

You’ll Also Get A Series Of QUICK ACTION TIPS Throughout the Course to Help You Achieve Your Trading Goals 10X Faster

Episode 1 — Laying the Groundwork

The 82% Signal: How layering five micro-strategies pushed monthly win-rates from “pretty good” to an eye-popping 82% – without day-trading, leverage, or staring at charts all day.

51% Per Year… On Autopilot: Why a back-tested CAGR that Wall Street would kill for quietly compounds while the S&P limps along at 9%.

The 27-Year Myth-Buster Experiment: Dan’s one insanely expensive test that shredded 90% of mainstream technical indicators in a single afternoon.

The Wrong-Way Money Detector: Billions of dollars in clueless futures positions telegraph exactly when the crowd is about to get steam-rolled (hint: do the opposite).

Fibonacci? Moving Averages? Forget ’Em: See the data-driven proof that 1940s “slide-rule” indicators are sabotaging modern traders—plus the two metrics that still matter.

Mexico vs. T-Bills? The bizarre cross-market “tug-of-war” that tips off explosive ETF moves 5–10 days before they hit CNBC’s ticker.

The Quick-Win Hack: A 90-second setup that can add an extra digit to your growth curve—shown in Chapter 1 so you’re banking gains before the real deep-dive begins.

Proof, Not Theory: Why every tactic in the course had to survive a 3,500-CPU torture test before it earned a single slide.

Why AI Loves Boring Countries: The counter-intuitive reason Austrian and Mexican ETFs keep front-running U.S. mega-caps (and how to hitch a ride).

Chart-Free Trading: The surprising neuroscientific edge you gain when you never have to decode another squiggly line again.

Episode 2 – The 7-Figure AI Trader

LGP vs. Bollinger Bands — why Linear Genetic Programming shredded 70 years of human-made indicators in one afternoon of testing.

Parameter-LESS Profit: how killing every tweakable knob slashed max drawdown to ~20% and left curve-fitters crying into their spreadsheets.

The 50-Child Rule: why half your “model offspring” are executed at birth, and why that mercy killing could double your CAGR.

Market-Maker Mispricing Hack: the one-click scan that piggybacks on clueless liquidity providers—and pays you each time they reset their quotes.

The Drawdown Diet: how one invisible 2.4% limit order quietly shaved 38 percentage points off worst-case losses.

No-Chart Neuroscience: discover the cognitive edge you gain when you trade lines of code instead of squiggly lines of ink.

Price-Blind Precision: the paradoxical reason ETF NAV gaps forecast megacap rallies better than any candlestick pattern ever will.

Episode 3 — “Free-Lunch Formula”

Straight-Line Profit Hack: How flipping from one strategy to three instantly ironed out the equity curve—and why letting the AI juggle five sent winning months rocketing past 80% while most traders still ride roller-coasters.

MetaX in Seven Words: The brutally simple ranking rule that decides which strategy gets the cash each month—no human votes, no overthinking.

Two Numbers that Nuke Over-Fitting: A 60-day reality check and a “total trades per rule” threshold that vaporize curve-fit miracles before they blow up real money.

Wall Street’s Only Free Lunch… Served Hot: Watch win-rates climb from 66% to 78 % to 82%—all by letting the machine layer uncorrelated plays while you sleep.

Million-Dollar Mistake Avoider: The guardrail that stops you from plowing everything into a single “can’t-miss” idea right before it bombs.

Scale-Up Blueprint: Why the fastest path from a five-figure stake to six isn’t leverage.

Zero-Gray-Hair Growth Plan: The “no-charts, no-noise” routine that replaces emotional decisions with monthly clicks—freeing brain RAM for life.

Final Frontier Goal-Post: The horizon keeps shifting, but the endgame is a 100% winning-month record—and the curve already looks dangerously close.

Episode 4 — Execution & Scaling

REL-Order Piggyback: The one-word Interactive Brokers command that latches onto high-frequency sharks-in-the-water—so your buy shows up inside the spread while amateurs overpay by nickels.

Opening-Auction “Cash-Grab”: How a 9:29 a.m. OPG ticket can dump an entire position before Wall Street’s opening bell—and instantly free IRA buying power.

Accumulation-Distribution Autopilot: The algorithm that slices a six-figure order into dozens of baby trades—so even seven-figure accounts slip through Level 2 without a ripple.

Basket-Trader Blast-Off: Drag-and-drop one CSV and TWS fires a fleet of smart orders—relative buys, OPG exits, even staggered limits—while you sip coffee.

“Fartcoin vs. Ferrari” Test: The eye-opening demo that proves liquidity—not hype—decides whether your limit order is a sniper shot…or a kamikaze crash.

Relative-Order Secret Sauce: The hidden offset sweet-spot that HFT firms won’t discuss in public—but Portfolio Boss bakes in by default.

Scaling from 5→8 Figures: The counter-intuitive rule that says add strategies, not size, once you cross six digits—so you grow like a hedge fund without moving the tape.

Three-Project Productivity Hack: The CEO trick Dan uses to juggle software dev, trading, and scaling—without letting a single ball hit the floor.

BONUS EPISODE

- 2025 is the year to remove “Asymmetrical Risk” from your vocabulary. This impromptu recording was made for the Portfolio Boss inner circle. I let them in on the BEST tips for hedging, risk reversal, and making a huge gain. I had to record it and release it quick because this information is timely to the markets RIGHT NOW.

You’ll also receive helpful exercises… self assessments… and example strategies to help you skyrocket your trading returns and consistency in record time.

We've helped thousands of people make millions of dollars.

And I guarantee…

The Seven Figure AI Trader is unlike anything you’ve ever seen…

…The method you’re about to discover is completely different, because…

- We DON’T teach you how to draw patterns on charts…

- We DON’T give you a list of suggested trades or tickers with no explanation.

- We DON’T teach time intensive techniques like Scalping.

- We DON’T focus on any one market.

- We DON’T study indicators with arbitrary timelines attached (like 90 day moving averages and most Technical Analysis gurus teach).

In fact: we rarely (if ever) use any form of traditional Technical Analysis. Tested Analysis has been so good to us, that the most we do with other indicators is come up with an idea and test it properly with Machine Learning.

Instead, We Built A System That Forces You To Become A Better Trader With Every Trade You Place...

If you’re looking for something that can transform your trading look no further. The Seven Figure AI Trader will revolutionize the way you look at the markets.

I know this for a fact…

Because it transformed not only my life… but the life of those I’ve shared it with as well.

I'm excited to announce that we're able to lower the investment for 7-figure Ai to only $7. You also receive a full 30-day trial to Portfolio Boss Ai Builder. The same Ai software I use to automatically build strategies from scratch.

Within minutes of downloading, you simply click on my pre-made template and press the Start button. Your PC will automatically start building trading strategies from scratch. No crazy learning curve.

Get The SEVEN FIGURE AI TRADER Right Now And You Will Receive These 5 Bonuses… FREE

BONUS #1 – “Bond, James Bond” SSO/SDS Trading Strategy: Made with the principles and tools you’ll discover in the Seven Figure AI Trader, this strategy is a masterpiece of effective simplicity. It trades only two assets and saw gains of 19.8% last month (as of writing this.)

BONUS #2 – Live Trade Signals: You’ll get access to a private website with trade signals for your free strategy automatically updated as soon as they come in. This means you can start trading TODAY. Getting all the benefits of the knowledge in the Seven Figure AI Trader instantly, even before you work through the course.

BONUS #3 – 30-Day “Portfolio Boss” Test-Drive: Fire up every tactic you learn in the course—no coding, no duct-taped spreadsheets. Portfolio Boss is our plug-and-profit AI engine, already wired to the same high-level data streams and machine-learning muscle behind our seven-figure strategies. Sure, you could stitch together other tools, but this 30-day pass lets you skip the tech hassle and start placing smarter trades before your coffee even cools.

Within minutes of downloading, you simply click on my pre-made template and press the Start button. Your PC will automatically start building trading strategies from scratch. No crazy learning curve.

After the 30-day trial, it's just $97/month. You can cancel anytime, but I don't think you're going to want to after seeing your results.

BONUS #4 Access to the Seven Figure AI Trader Community: You’ll become an inaugural member of the Seven Figure AI Trader forum. A private group for like minded traders to come together and share everything they’re learning.

It’s also where you’ll find my team and I for help and support. You’ll find the latest trading tips from us inside this group. Nothing is held back in this community. We believe a rising tide raises all ships and expect this attitude from community members as well.

BONUS #5 30-minute 1-on-1 Walk-through: In this call, one of my team members will show you the ropes on getting the most out of Portfolio Boss FAST.

You'll build your first strategy, and see exactly how easy it is to start trading the right way with unique edges discovered by machine learning. No more guess-work. Just follow the signals.

We'll show you how to export the trades so you're not keying orders in with your broker. Let the tools do the work.

The 30-Day “Trade-It-or-Trash-It” Money-Back Guarantee

Put the Seven-Figure AI Trader system through a full market cycle—paper-trade it, back-test it, even run it with real capital if you like—for 30 calendar days.

If at any point you decide it’s not:

boosting your confidence

simplifying your decisions, or

stacking the kind of returns you came here for

Simply email or call my U.S.-based support team and you’ll receive a 100% refund—every dollar, no questions asked, no hoops to jump through.

Keep the cheat sheet, the strategy blueprints, and every bonus module as a thank-you for giving the program an honest try. In other words, the only way you can “lose” is by walking away from the upside.

How a Gym Owner From Ohio Went From 17 Years of Losses To A $618,000 Account In Just 15 Minutes A Day — An Audited Trader’s Success Story

“The reality was that I lost money 17 years in a row, over $350K, not counting the money I spent on all the books and courses, blowing up trading account after trading account. There were years when I would start doing well, but one bad trade, often caused by emotions and not wanting to be wrong, wiped me out.

It wasn't until I removed my emotions and started taking an evidence-based approach that I started making money—by building trading models that could be backtested and checked on out-of-sample data before trading them with real money.

At this point, I've built over 200 trading models with Portfolio Boss. Having multiple models ended up being what made all the difference because not all models do great all the time. Another favorite quote of mine is, “All models are wrong, but some are useful,” and by using Meta AI, I can increase the probability my money is invested only in the models that are useful at that point in time.

I can now finally and honestly say I finally reached my dream of generating income from the markets!

I have recouped everything I lost and more.” — Josh Jarrett

I want to introduce you to Josh… Josh Jarett is one of many who have used Portfolio Boss to give their trading careers a complete 180. But unlike most, Josh’s journey is audited.

What do I mean by audited?

When I say audited, I mean a neutral third party has monitored Josh’s results with Portfolio Boss every step of the way.

Josh has been following my work since (2008) where I published my own audited journey to grow a trading account to seven figures.

He’s is a salt of the earth guy from Ohio with three small children. After 17 years of struggling with his trading… Josh joined a beta test for Portfolio Boss and all the weird new data we’ve been feeding the AI.

This beta test transformed his trading career in just 15 minutes of trading a day. He grew his account to 618,000 and treats it as a business. Taking a monthly draw on his account so he can spend less time working at the gyms he owns, and more time with his family.

There’s a word for that… SMART!

You can see Josh’s audited results in the chart above.

Frequently Asked Questions

This is fundamentally different from any other trading resource out there.

Instead of teaching you HOW to trade a specific strategy that could stop working at any minute… we teach you how the markets actually work.

This is a subtle but transformational difference.

Most trading services out there do one of two things.

Either they give you a bunch of strategies and tactics that seem great… but are outdated the second you get your hands on them…

OR…

They give you a bloated newsletter. Filled with a couple thousand words of fluff and a few trade alerts that they’d have been better off keeping to themselves.

(This isn’t to mention the “Bots” out there that take your money and run it into the ground the second something doesn’t match their algorithm.)

While either of these methods might get you a few small wins here and there…

It’s like picking up pennies in front of a steamroller!

The ONLY way to truly become a better trader is to learn how the markets work… and how traders are getting an edge in the modern day.

There is no other resource filled with this information that is specifically designed to show you how the markets really work… and you don’t need to take my word for it.

Nobody else has our track record. Nobody else has the same number of reviews, or testimonials… and most importantly…

NOBODY else would EVER give you the same insider information for such a ridiculously cheap price… backed up with a no-questions-asked 30 day refund guarantee.

This level of information is only available in the Seven Figure AI Trader.

Masterminds, group lessons our forums and even 1-on-1 work for more personalized trading training are all available. This training has helped thousands of people from around the world dramatically improve their trading efforts with cutting edge techniques and resources.

Everything included in the Seven Figure AI Trader is designed to help you go from starting or struggling to successful trader on your own… This is all delivered in a pre-recorded video course that you can access at any time.

If you want more personalized or one-on-one help to reach your goals, please reach out to our team who will be happy to walk you through our advanced programs designed to take your trading skills to the next level.