How did you do in July?

Corona Del Mar, CA

Howdy Friend,

Did you know that the S&P 500 Index is a trading system? It's not a 100% mechanical system, but there are rules to get listed:

This isn't a particularly amazing trading system, but check this out:

The S&P Indices Versus Active (SPIVA) Scorecards provide ongoing data comparing the performance of actively managed funds to their relevant S&P index benchmarks. According to the SPIVA U.S. Year-End 2020 Scorecard, over a 10-year investment horizon, 88.78% of large-cap fund managers failed to outperform the S&P 500.

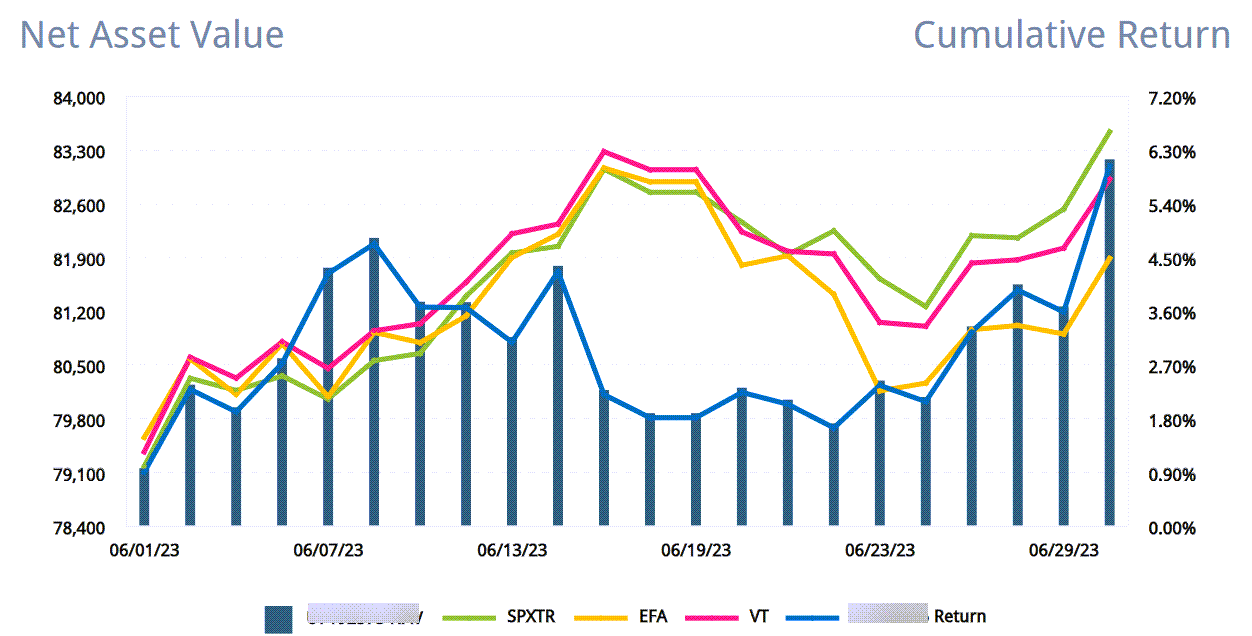

There's likely a survivorship bias in that data (because crappy managers get fired before 10 years), so I suspect the numbers are much worse. Now consider this…all those endless hours of research on companies, economic data, and whatever voodoo these hacks did couldn't even beat a simple market cap system (of all the rules, the biggest filter is clearly market cap). Since my star pupil, Josh Jarrett (who took #3 out of 18,000 traders at Fundseeder), started sharing his Top 100 strategies created with The Boss SuperAi…I've decided to create our very own Josh 100 Index. Check it out: |

|

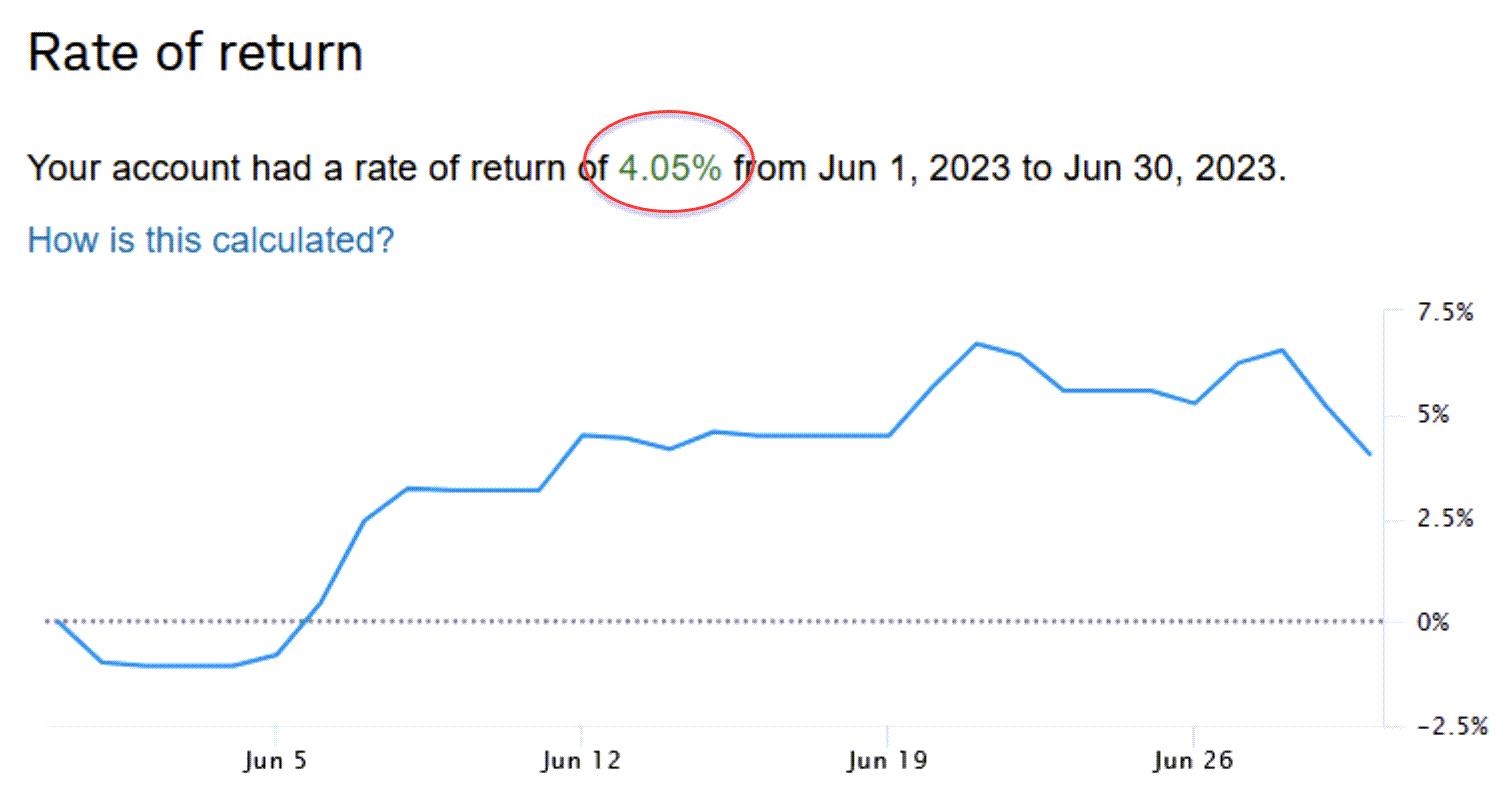

And this one from Peter:

But one of our non-Josh 100 buyers shared his statement, and it was down double-digits.

That tells me something went wrong in the development process because it's an outlier. I suspect over-fitting to the past was the culprit. The prescription I suggest is to stick with what I teach, and not go wondering too far off.

You can always tell who the pioneers are because they have arrows in their back. Now of course, trading 100 strategies at once is overkill. What you do is have the A.I select the top 5, 10, 15, 20, 30, or however many strategies you want at once. More strategies = less risk.

Can you imagine having a pool of 100 strategies to pull from every month? How do you think that would improve your results? Are you making money darn near every month? If so, good for you! If not, then maybe it's time to grab Josh's Top 100 strategies, and start trading like a battle-hardened hedge fund manager.

P.S. If you're on the fence, now is the time to join. I won't be teaching this stuff personally if I end up starting my own hedge fund…and I'm actively researching taking the plunge.

|

|

Disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.

Insert Image

Responses