Works with: TD Ameritrade®, Schwab®, Fidelity®, E*Trade®, Interactive Brokers®, Tradestation®, Merrill®, and many more! Even in an IRA or 401K.

How a New Breed of Investors Are Quietly Buying Up Bitcoin at Massive Discounts Again and Again

There’s a Little-Known Technique to Buy Bitcoin Below Fair Market Value Right Now. If You’ve Been on the Fence, Now May be the Perfect Opportunity. Hurry, this “Discount Window” is Closing FAST!

“Shadow Bitcoin” Trading at a Discount

“One hell of an invention” – Ray Dalio(Billionaire investor and chief investment officer of the world’s largest hedge fund)

Dear Reader,

Dan Murphy here. I’ve been a trader for over 24 years. I’ve helped more than 132,000 traders and investors around the world.

And in this special report today, I’m going to blow the lid off what Ray Dalio calls, “One hell of an invention.”

I’m going to show you why we could be in for a world of hurt economically, the next few years.

And I’m going to reveal what I believe to be the single best mechanism for protecting your wealth and generating explosive, triple-digit returns over the next few years.

This mechanism generated for investors returns of:

22.84% in April this year

9.58% in December

20.54% in November

5.92% in October.

30.20% in July

22.22% in April

And on, and on.

This newly discovered blueprint for wealth is called a “Discount Window” and it tells traders when there’s an opportunity to buy Bitcoin at a discount using a traditional broker of your choice.

These windows open up about 15 times a year for a very short period of time.Given the popularity of Bitcoin, these windows slam shut very quickly as you can imagine.

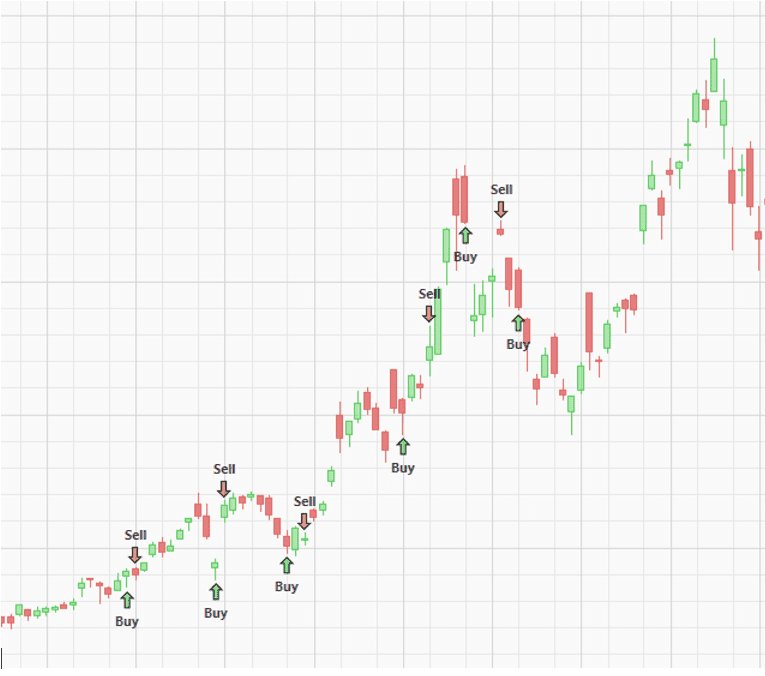

I’ll go into more detail in just a moment, but here’s a little preview of what I’m about to show you.

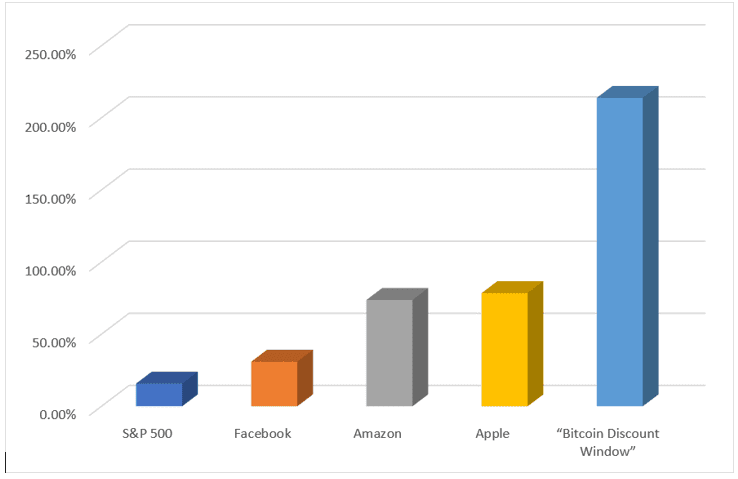

It might not make sense just yet, but stay with me for the next few minutes, because investors who get in during the ”Discount Window” could have made gains of +213.8% in 2020.

To put that into context for you, over the same time period, you could have earned:

Estimated. Before trading fees and slippage

Those are all great returns, of course, but they don’t come anywhere close to what you’re about to see.

I believe the “Discount Window” has the potential to revolutionize the way you trade and keep you safe from whatever happens with inflation and the economy over the next few years.

And you’re about to learn everything.

This is NOT one of those big teases that goes on and end and ends in a pitch to buy a book without telling you anything useful. I promise you that. In the next few minutes, I’m going to reveal:

-Exactly what we can expect from the economy in the next few years and why it could be a rocky road for investors like you-A little-known tool to protect your wealth from inflation that the world’s billionaires are just starting to discover (you’ll be in on the ground floor)-What the “Discount Window” is and how it generates such high returns (no black box here, I promise to show you everything)

By the end of this report, you’re going to know exactly what I’ve discovered, and you’ll have the tools you need to act in only about 10 minutes.All I ask is that you stick with me right to the end, because it’s essential that you get the full story.

At every stage of this report, I’ll reveal new information that you’re going to need to try this technique out for yourself.

America’s Economy Could be in Real Trouble Soon

Like me, you probably weren’t shocked to read that Joe Biden is raising taxes. Angry, but not shocked. After all, that’s what Democrats do.

And with all the trillions of dollars the government is pouring into COVID-19 bailouts, the national debt has reached truly staggering proportions.

The country is now almost literally being crushed beneath the national debt.It’s like the government has no choice but to raise taxes, just to keep America going. (Or maybe that was the plan?)

A truly unprecedented amount of currency has been printed in the last year.

Ok, so the economists use a slightly fancier term, “money-financed fiscal programs.” Basically, the government pays its bills by using non-interest-bearing liabilities… in other words, cash.

In 2020, the US Federal Reserve created a massive amount of money. In one year alone, 20% of all dollars were printed.

M2 Money Stock Source: fred.stlouisfed.org

With numbers this big, it’s hard for us to truly comprehend the impact on our financial system and our democracy, but more and more financial experts are arriving at the same conclusion:

Runaway inflation.

The government isn’t even trying to hide it. When governments print money, they’re literally using inflation to try and finance spending.

In other words, it’s all part of the plan.

Which is great for the government, because it allows the Democrats to buy votes with more and more of your money, making outlandish promises to every special interest group that comes along.

But if you’re the type of person to save your money, or if you believe that a person should be responsible for their own fate…

If you’d rather the government kept their nose out of your business…

If you don’t spend every penny that comes in the second that you get it, because you’re smart enough to save for tomorrow…

Then this is very bad news.

But don’t worry, because there are ways for the average investor to protect themselves, and I’ll reveal them in just a few minutes.

We’re Now Living in the Republic of Debt

I’ve got news for you: we’re now living in the Republic of Debt.

That’s what I’m calling it. We’re no longer the American Republic. Debt has replaced everything we hold sacred. Government debt is totally off the rails, and the money printing presses are running like a bat out of hell.

We’ve seen this kind of behavior before. Governments in the past have tried the exact same thing, and we know where it ends: a currency that is worthless, and the life savings of everyday workers turned into nothing but trash.

Remember those Wiemar Republic Germans pushing wheelbarrows of cash through the streets, just to buy a loaf of bread?

I’m not saying that could happen here, of course. America has a foundation of strength and innovation that makes us unlike any other nation on earth.

But I’m starting to get a little bit worried about tomorrow, and I think you should be, too.

Here’s what we could be facing in the next few years.

America is at a Crossroads: A New Roaring 20s or Rampant Hyperinflation Worse Than the Wiemar Republic

The way I see it, we’re at a potential turning point in the history of our nation.

A crossroads, with two potential futures in front of us.

COVID has thrown the entire world for a loop, there’s no doubt about that.

Whether or not you believe that governments have made the right decisions (have they ever?) and whether or not you wear a mask when you go out to the store, nobody can argue with this basic fact…

The financial world of the last 12 months has been chaotic on a level we’ve never seen before.

I mentioned a moment ago that the US government has taken on a massive, truly unprecedented level of debt. You see, we’re all collectively embarking on a massive social and economic experiment.

One based on a theory called Modern Monetary Theory (or MMT). Under this theory, money simply doesn’t matter. Crazy, right? It simply doesn’t mean a thing. It’s all imaginary.

That dollar bill in your wallet? Believers in this theory would have you believe that it’s basically a figment of our collective imaginations.

And as a result, the theory goes, the government can make up just about as many of those dollars bills as it wants…

With utterly no consequences.

That’s the theory, anyway. And it’s being put to the test. Democrats like Joe Biden and Janet Yellen are treating us like lab rats in a maze. It’s a big experiment to see just how true this theory is.

If you don’t know, Janet Yellen was a former Fed Chair, and has been selected by Biden to be the next Treasury secretary.

And with the Democrats controlling the senate, there’s nobody to stand in the way of their massive stimulus plans.

As you can imagine, the last few months have made big business a bit… nervous. Investment management company Blackstone Vince Chairman Byron Wien has said that the Fed and Treasury are openly embracing MMT.

And the Fed has announced that it intends to keep interest rates low for years to come. All with one simple goal: to spend more than the government as ever spent before.

And that national debt we used to be so worried about? Anybody remember the Debt Clock? We’re now rounding 3rd base to almost $30 trillion dollars… which the Biden administration would have you believe is simply meaningless, now.

But what happens if the interest rates go up? They can’t stay low forever.What Happens to the Budget if Interest Rates Explode?

How will we be financing payments on that massive $30 trillion dollar debt when interest rates approach where they were in the 1980s?

Young people today have no idea, but back in the 1980s we struggled under sky-high rates of 15% and more.

Of course, many of those young people just so happen to be calling the shots today, like 31-year-old congresswoman Alexandria Ocasio-Cortez, or AOC.

Even now, with super low interest rates, we’re paying almost $400 billion per year in interest. That’s 50% more than we generate from all corporate taxes put together.

It’s how much we spend on Medicaid. It’s almost how much we spend on the entire military. And it’s just interest. It just floats away.

So you can imagine what would happen if interest rates went up even a few percentage points.

At a time when international tensions with China are maybe as high as they’ve ever been, we can little afford to find ourselves unable to pay for the latest weapons that keep America safe.

So let’s cut to the chase. Why does all this make some of America’s most knowledgeable investors want to run for the hills?

Because things are about to get a lot harder for Americans who don’t live on government handouts

Taxes are going to go way up.

And inflation is going to eat away any of the money you’ve saved.

If you’re anything like me, you’re probably angry and frustrated right now at how things are being run. You’re probably shaking your head at the idiots we’ve got in Washington, who seem to be making all the wrong decisions.

Now, let me show you exactly what you need to know to protect yourself from them.

Why are Grains up +72% this Year if the Government Says Inflation is Only 2%?

The problem is, to governments, money just isn’t real. We already saw how debt doesn’t matter to the people running this country.

So they think the same thing about your money. It isn’t real. It doesn’t matter.

You ever hear the old joke, “a billion here, a billion there… pretty soon you’re talking real money?”

It’s a joke that comes from a place of truth. That’s really how the government thinks about the sacrifice you make, when you pay your tax bill.

And no matter how much you’re told “we’re all in it together,” you know that’s not true. It isn’t just because state and municipal governments haven’t sacrificed even one tiny bit while millions of Americans lost their jobs and hundreds of thousands of American shops, gyms, and restaurants were put out of business by the stroke of a pen.

Unfeeling, uncaring bureaucrats, who knew their next paycheck was guaranteed by the American people… the same people whose businesses they were destroying without a backward glance.

In fact, 47% of Americans don’t even pay any income taxes. (Want to guess what party they vote for?)

So when President Biden says “taxes are going up, but don’t worry, because we’re all in it together,” he isn’t telling you the whole story. Not by a long shot.

Let’s put those numbers into some perspective, shall we? The 2021 federal budget was $4.829 trillion dollars. There are roughly 330 million Americans. That means the budget costs us $14,633 per American.

But 47% didn’t pay any federal income taxes, remember. So for those of us who did, it’s more like $27,600 per person.

Do you feel like you got $27,600 worth of service out of your federal government last year? That’s a down payment on a house, or a brand-new car, or heck, one incredible, unforgettable, life-changing vacation trip around the world.

And it’s not once-in-a-lifetime, it’s every single year. And it’s not going to end any time soon.

Investing legend Ray Dalio says he thinks the USA will raise taxes significantly. He issued a serious warning, claiming that the US debt is now so high that the country is entering a “new paradigm.”

In fact, he’s afraid that the USA is getting less hospitable to capitalism…

You know, that system that’s lifted literally billions of people out of poverty and generated more wealth for the world than humanity has ever seen before?

The Biden administration and others like Elizabeth Warren have proposed new taxes that Dalio called “more shocking than expected.”

No wonder it’s so hard for many Americans to get ahead.

Average Americans are Being Attacked on Every Side

The government’s complete inability to control spending is costing us trillions, which leads to higher taxes. That means less money in your pocket every month.

Interest rates are kept at record lows to support that government spending. That means your savings generate almost no returns, forcing you into increasingly risky stock market bets.

And inflation is set to break loose, threatening to completely wipe out any savings you have put aside.

Never mind what it’ll do to prices of things like food. Some places are already seeing increases in the price of things like beans and sugar by 50 or 60%.

According to Ole Hansen, head of Commodity Strategy for Saxo Bank, grains are up +72%, and livestock is up +59%.

Investors are so worried about the risk of rampant inflation that they bought $14.4 billion in inflation-protected investments in a single week in April 2021.

For only one reason: to protect themselves from the exact same inflation that the government tells us will be “gradual.”

It’s all under control, right?

Source

1 – https://www.bridgewater.com/research-and-insights/our-thoughts-on-bitcoin

2 – https://blockworks.co/bitcoin-convert-dalio-bearish-on-american-future-of-free-finance/

Even Some Government Bodies Are Beginning to Admit that Inflation Estimates Are a Lie

The Minneapolis Federal Reserve recently said there’s a 33% chance that consumer inflation in the USA will go above 3% in the next 5 years. How high above 3%? They prefer not to say.

All this means huge uncertainty for the market, especially in the $21 trillion government bond market. Remember, inflation is bad for bonds, because it destroys the value of any returns bonds generate.

And exactly as you’d expect, every time President Biden announces more stimulus spending (in other words, prints more dollars), the bond market suffers.

Recently it went through the heaviest sell-off in four decades. That’s from just one of Biden’s multi-trillion-dollar stimulus programs.

So what do you think investors said, when asked their number one fear?

Not COVID.

Not high unemployment, not low interest rates, not a stock bubble looming.

Runaway inflation.

For Ray Dalio, who runs Bridgefund (the world’s largest hedge fund), devaluation of money is a major risk, and investors now have to focus on finding ways to preserve their wealth and store value.

Let me show you why the government is denying it’s evening happening… and is going to keep denying it until it’s too late to do anything about it.

New Poll: Professional Investors State Runaway Inflation is their Biggest Fear in 2021

You know, there’s a very old saying. “Believe what I do, not what I say.”

When everyone is telling you that everything is under control, and that inflation is under 2%, exactly as planned by Joe Biden and Janet Yellen…

But professional investors and stock traders, those in the know, go running for the hills…

Well, let’s just say some warning bells should be going off.

Luckily, there are a few ways for everyday investors to protect themselves against inflation.

Gold, of course, is a classic. But it has its problems.

Source

3 – https://www.ft.com/content/fd30060f-cb7a-43b1-83aa-410b60a7dc1c

Gold Isn’t Going to Save Us this Time

Michael Saylor, CEO of MicroStrategy says, ““Gold is not a solution, it is not practical to distribute gold in small quantities to five billion people, but bitcoin is a solution.”

Luckily, there’s something even better than gold to hedge against inflation.

I’m not going to tease you here, because it’s all over the news: cryptocurrencies.

Billionaire Wall Street luminary Paul Tudor says he’s not some “crypto nut” but he calls cryptocurrencies the best way to protect yourself against inflation.

And not just any cryptocurrency: “If I am forced to forecast, my best is it will be Bitcoin.” “My best bet will be Bitcoin”

Big banks are behind it too. The price of Bitcoin jumped 12% on a single day in January when JP Morgan issued an extremely bullish forecast of $146,000 per coin.

I promise you, I’m not about to tell you to go off and buy some garbage scam coin that you’ve never heard of. This isn’t that kind of report (you know those are all pump-and-dump scams anyway, right?)

What I’m about to show you is far more than just Bitcoin. It’s about a revolutionary new strategy uncovered by an AI supercomputer using something I call “Cyber code.”

“The best profit maximizing strategy” – Billionaire Investor Paul Tudor Jones

And other billionaires are close behind. Twitter CEO Jack Dorsey is literally maxing out his weekly Bitcoin buying limit in the Cash App. He won’t say how much he has, but the weekly limit is $10,000 so we can make an educated guess.

It’s not just individual investors and billionaires, though.

Square just bought $50 million in Bitcoin.

Source

4 – https://blockworks.co/saylor-diversification-makes-no-sense-in-bitcoin-vs-gold-debate/

5 – https://decrypt.co/29229/from-elon-musk-to-mark-cuban-9-billionaires-who-own-bitcoin

Tesla bought an eye-popping $1.5 billion in Bitcoin.

(And they accept payments for their cars in Bitcoin, too.)

Remember Michael Saylor, CEO of MicroStrategy? His company is the first publicly listed company to convert a portion of its cash reserves into Bitcoin.

“The time has come to pass the torch from gold to bitcoin,” according to Saylor.

It’s no wonder that the popularity of crypto currencies like Bitcoin have exploded in the last few years.

Imagine, something that government policy can’t touch. Completely independent. And immune from inflation caused by poor fiscal policy

It’s exciting, to say the least.

Even Traditional Hedge Fund Managers are Switching Over from Stocks to Bitcoin.

Hong Fan worked at Goldman Sachs since 2008, but recently left for a big opportunity in crypto. She’s the CEO of OKCoin now.

Her story is a compelling one. An immigrant and an American success story, Hong Fang is a huge fan of the free markets and the exceptional qualities that you can only find one place in the world: the United States of America.

“The US’s glory, greatness and all that is really built upon the idea of free markets,” she says.

And nothing is better for the free market than something out of reach of the government.

“But the beauty of Bitcoin is that it is actually a network that doesn’t have any third party, any individual organization that can control it that is profiting off it. I think that is the most fundamental difference and it will take some people a lot of time to wrap their mind around that.”

Investors who recognize the potential of Bitcoin have generated massive profits, too.

And it’s almost hard not to when Bitcoin is up 10,734% in the last 5 years.

Like Erik Finman, who bought $1,000 of Bitcoin at the age of 12. Back then, that got him 446 of the coins. Today, that same number is worth roughly $25 million.

Source

6 – https://www.cbsnews.com/news/bitcoin-millionaires-100k/

7 – https://blockworks.co/gone-crypto-why-i-left-goldman-sachs-for-okcoin/

Gabriel Abed, 34, is an entrepreneur from Barbados and has a similar story. Back in 2011 he had 800 Bitcoin, which is now worth about $48 million at the current price.

Or Stefan Thomas, a German-born programmer in San Francisco, who was given his first Bitcoins back in 2011. They’re now worth a mind-blowing $220 million.

Now for the shocker: despite these incredible Bitcoin stories of rags-to-riches…

I am Not About to Tell You to Go Out and Buy Bitcoin

Although I strongly believe in the future potential of Bitcoin, and expect it to reach probably $250,000 in the next few years, what I’m about to show you is an even better investment strategy.

And trust me, it’s not to buy some shady coin named after a dog, either.

Why am I making this warning to you now? Because there’s a dark side to owning Bitcoin that nobody’s talking about.

Remember Stefan Thomas, and his $220 million in Bitcoin?

Well, he forgot the password to his digital wallet. He wrote it down somewhere and lost the piece of paper.

Who hasn’t done that once or twice in their life?

But for Stefan, it cost him a literal fortune. His wallet gave him 10 guesses, and he’s already used up 8 of them.

And Gabriel Abed, the 34-year-old entrepreneur? He lost his access key when a friend reformatted his laptop. That means that Gabriel’s $25 million fortune is now permanently out of reach for him.

Can you imagine the stress if that happened to you? I think I’d tear my own hair out.

But it’s actually pretty common.

About 20% of all Bitcoins are estimated to be lost or locked in wallets people can’t access.

And what about hacking?

Most Bitcoins are stored in something called a “hot wallet.” That’s basically a digital bank account. They’re connected to the internet, to help facilitate buying, sending, and receiving tokens.

But hot wallets are potentially extremely vulnerable to hackers (and no wonder, with literally billions of dollars on the line).

Source

8 – https://www.businessinsider.com/who-is-erik-finman-bitcoin-investor-millionaire-2019-8

9 – https://www.nytimes.com/2021/01/12/technology/bitcoin-passwords-wallets-fortunes.html

Recently, Altsbit, KuCoin, Harvest Finance, and Exmo were all hacked.

Don’t Make this Mistake! Your Bitcoins are Surprisingly Easy for Hackers to Steal if You Store them Yourself

These are crypto exchanges, and what did they all have in common? They all used hot wallets to store the coins that were stolen.

It’s a huge headache. And very expense. Roughly $1.8 billion of crypto was hacked or stolen in a cyber attack in the first 10 months of 2020 alone.

And hacking isn’t the only risk when you store your own Bitcoin. If you store them on an exchange where the CEO is particularly important, what if he disappears?

It sounds far-fetched but that’s exactly what happened at OKEx, a crypto exchange founded in 2017.

A little while ago, the founder went missing… and it turns out, he was the only one with all of his users’ private access keys. Nobody else could access all those Bitcoin!

Even if everything goes right, buying Bitcoin is a headache. You have to choose an exchange (and choose carefully, because as we just saw, many exchanges are insecure or poorly run.)

Then you have to connect that exchange to your bank. And once you actually buy the crypto, you have to store it in your digital “wallet” and make sure that you have control over the key.

And most security experts will tell you it’s a bad idea to store your crypto in the exchange, so that last part isn’t really negotiable if you’re dealing with more than pocket change.

Don’t even get me started on reversing that entire process if you want to actually spend the things.

If you’re a gambler, a hacker, or a computer expert, then buying Bitcoin directly might be a good idea.

But what about the rest of us?

The average investor who just wants to protect his wealth and save for tomorrow?

There’s a better way. And I’m going to show you exactly what it is.

This Investment is the Far Better Choice for Most Traders

Source

10 – https://www.nasdaq.com/articles/3-key-takeaways-from-last-years-biggest-crypto-hacks-2021-01-19

Remember when we talked about crypto exchanges like OKEx where the founder just disappeared?

That showed the world that effective governance, control, and compliance means a lot when you’re buying crpytocurrency. It’s important that it’s not just one guy who holds the key to everything. You need a professional organization.

A few of the big banks have recently started to offer Bitcoin to their clients. But it’s not exactly accessible. Morgan Stanley requires you to have $2 million in assets with them first, and they cap Bitcoin at 2.5% of your net worth. Who are they to decide that for you?

I’m going to show you a much better option.

I call it:

“Shadow Bitcoin”

Grayscale Investments was founded in 2013 and has become a leader in cryptocurrencies. With $40.3 billion in assets under management (AUM), they’re the world’s largest digital currency asset manager.

And they’ve come up with a very clever solution to the problems we just discussed. It’s something called the Grayscale Bitcoin Trust.

It’s the world’s first publicly tradable ticker symbol… made entirely of Bitcoin.

The way it works is simple: The Trust buys Bitcoins and stores it. Then investors can go into their stock-trading app of choice, and simply buy a share of Grayscale Bitcoin Trust.

Right now, the stock price is hovering around $40.

It’s that simple. You now own a piece of the trust that only holds Bitcoin. When Bitcoin goes up, the stock price goes up.

You’re suddenly part of the crypto-revolution, and you bypassed every single step and risk we just talked about.

Remember hackers? We saw how “hot wallets” are connected to the internet for convenience but are vulnerable to thieves.

Grayscale Bitcoin Trust uses cold storage, which is entirely offline and nearly impossible to hack. It’s all cold-stored with the Coinbase Custody Trust Company.

All those exchanges that were hacked? Not a single one of them lost a penny from a cold wallet.

Source

11 – https://www.investors.com/research/gbtc-stock-is-grayscale-bitcoin-trust-a-buy-now/

12 – https://blockworks.co/grayscale-filing-to-convert-gbtc-to-etf/

You can buy instantly, and you can sell instantly. Even better, you can dump it into a tax-protected account like your 401K.

(And for those of you who want to buy Bitcoin as a way of avoiding taxes altogether, I have news for you: that ain’t gonna work, I’m afraid. Nobody can avoid the taxman forever.)

It’s undoubtedly the fastest and easiest way for investors to get exposure to Bitcoin, without actually having to go through all the trouble and risk of buying it yourself.

And investors are piling in.

Here are just a few major investors who have already started to buy shares in Grayscale Bitcoin Trust:

-Rothschild Investment Corp -Edge Wealth Management LLC -FNY Capital -Bryn Mawr Trust Co -Fist Midwest Bank -Capital management Associates -ARK Investment Management LLC

And this is just to name a few. There are a total of 62 institutional owners of Grayscale Bitcoin Trust.

Millennium, a US-based alternative investment management firm is drawn to Grayscale right now, but nobody knows exactly how much.

One commentator noted that Millennium might be “the largest asset manager yet to emerge in the crowded Grayscale trade, likely a bullish indicator for Bitcoin.”

None of these are small players, either. Capital ManagementAssociates bought 18,000 shares recently. Rothschild Investment increased its holdings by another 8,000 shares to a total of 38,346. And ARK Investment owns 7.9 million shares, at last count.

If ARK Investment sounds familiar, by the way, that’s because it’s Cathie Wood’s $50 billion dollarinvestment firm. She’s made a name for herself investing in disruptive innovation tech like artificial intelligence, 3D printing, and of course, the blockchain.

Her 1-year return right now? +177.10%.

Source

13 – https://news.bitcoin.com/another-hedge-fund-gets-crypto-exposure-via-grayscales-gbtc/

14 – https://www.thestreet.com/crypto/bitcoin/hedge-fund-millennium-traded-gbtc

15 – https://fintel.io/so/us/gbtc

We talked about how much easier and safer it is to buy Grayscale Bitcoin Trust than it is to buy actual Bitcoins, but how’s it doing in the markets?

Well, in the last year it’s up about +455%.

But we can do even better.

Why Buy and Hold is Dead

Let’s take Cathie Wood and ARK as an example. Their goal is to invest for 7+ year time horizons.

But how often do you think they actually buy and sell stocks?

They do around a dozen different trades, every single day. And this isn’t a secret, either. ARK publishes all their daily buys and sells. In March, over 100 different trades were made. And in April they did even more than that.

Why?

Simple. Buy and hold is dead.

I’m not about to criticize the Oracle of Omaha. Warren Buffett is an investing legend, without a doubt. And in the last year, his company, Berkshire Hathaway returned roughly +47%. An extraordinary outcome, but it’s not +177.10%.

The difference between 47% and 177%?

Here’s an easy way to put that into perspective.

If you start with $1,000 and get 47% a year for 10 years, without contributing another single penny, you end up with $47,116.54.

If you start with the same $1,000 at 177.10% a year? You end up with… $26,691,025. That’s $26 million dollars.

I hate to even mention it, but what about just grabbing an ETF, socking your money away, and waiting. Why even buy stocks?

ETFs are designed to auto-buy successful companies. And because there are so many ETFs out there now, they all auto-buy the same few companies – Apple, Microsoft, Amazon.

That means that every ETF is essentially contributing to the same stock bubble.

ETFs are a Ticking Time Bomb for Their Investors

Those passive investment vehicles are actually a ticking time bomb for their investors, because they have an inherent, massive, self-destructive flaw: they all want to buy overvalued stocks.

Source

16 – https://www.kedglobal.com/newsView/ked202103150009

They don’t buy because anybody is studying the companies. ETFs buy companies that other ETFs are buying… which pushes the prices higher for everybody, based on absolutely no foundation whatsoever.

Can you see the danger here?

Can you see the enormous opportunity in doing the opposite of what most other passive, boring, risk-avoidant saps are doing, when they brainlessly hand their money over to the bank, month after month?

Let’s take a moment to pause here and review.

Here’s What I’ve Shown You so Far in this Report

So far, we’ve discussed:

-Why inflation is a monster waiting in the wings. If you leave your retirement savings in cash or bonds, you might end up with nothing.-Bitcoin is the best way to fight inflation and generate powerful returns, but it’s difficult to buy and very risky to hold. -Grayscale Bitcoin trust is much easier to buy, but if you just buy-and-hold, you’re leaving money on the table.

With me so far?

Because if you walk away right now, you’ve gotten your money’s worth out of this free report.

Just as I promised, I showed you the easiest and fastest way to protect your wealth and grow it through whatever happens economically.

If you’d taken that path, you’d have made a very nice 455% return over the last year.

But I’m not done yet.

Because now I’m going to show you how you can take the Cathie Wood approach to investing, so you can get returns that blast buy-and-hold out of the water. Maybe even double or triple those returns.

It all comes down to the “Discount Window.”The Future of Investing… and Pretty Much Everything Else in the World for the Next 50 Years

I don’t think I have to sell you on just how revolutionary computers are. After all, they’ve been revolutionizing the world for decades now.

And they’re not done yet.

Scientists at Oxford University estimate that computers, robots, and artificial intelligence (AI) will cost 20 million jobs in the next 10 years.

The stock market is no different.

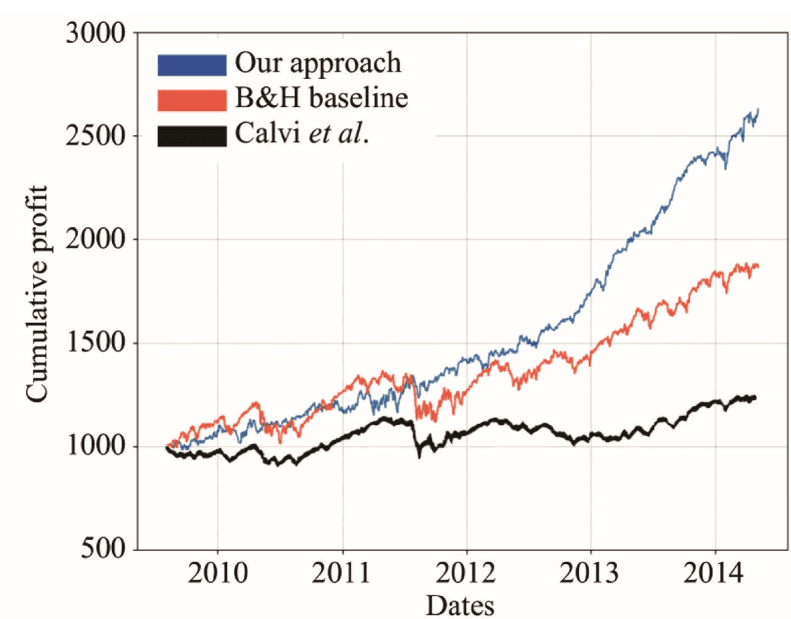

Researchers in Italy used AI to help them forecast the market with more gains and fewer losses than a human trader would experience.

When they compared their results with real-world data from the S&P 500 between 2009 and 2016, they found that “When we lose, we tend to lose very little, and when we win, we tend to win considerably.

I think this chart of their results where an AI told them what to buy and when says it all. Look how the results compare to a baseline return.

Source

17 – https://techxplore.com/news/2020-06-ai-stock-simulation.html

Deep Learning and Time Series-to-Image Encoding for Financial Forecasting

The big banks and investment firms have used AI programs and advanced software for years now. And they’re expanding all the time.

The Royal Bank of Canada (RBC) is one of the world’s largest banks, with 86,000 employees. In 2011, it was Canada’s largest company by both revenue and market capitalization.

And it is going all-in on stock trading with AI software.

In October 2020, they launched their first AI stock trading program using tech called Aiden. Developed by RBC Capital Markets and Borealis AI, it’s designed to learn from its own mistakes in real time.

It’s big money, as you can imagine. This kind of software is extremely expensive.

TD Bank spent $100 million in 2018 to buy its own AI trading software, a company called Layer 6.

These programs have revolutionized trading. Using deep reinforcement learning, the AI crunches data at a literally superhuman level.

We just can’t compete. There’s no shame in admitting that a computer is better than the human brain at this.

Source

18 – https://www.rbccm.com/assets/rbccm/docs/news/2020/rbc-launches-its-first-ai-stock-trading-program.pdf

It finds exactly the right time to buy and to sell.

But the big banks like TD and RBC aren’t sharing this technology with the average investor like you and me.

RBC is only going to offer its brand new AI trading software to hedge fund managers. Like they don’t already have enough advantages on their side.

The big banks and hedge fund managers want to keep their edge. They don’t want “fair.”

They don’t want a “level playing field.”

But I do.

One of the World’s Most Powerful Supercomputer Network Levels the Playing Field for Ordinary Investors

Let me introduce you to “The Boss.”

It’s what I call an AI engine that’s plugged into the world’s most powerful supercomputer network. It’s used to build trading strategies from scratch.

Just like we saw with the big banks, “The Boss” tells investors what to buy, and when.

Human traders, like the rest of us, are limited by a few basic rules. We get frustrated, we get tired. We make mistakes, we miss things.

AI doesn’t do any of that.

Which is why I’ve switched my trading over from trusting humans to using AI.

I’m not the only one.

Jim Simons first hooked up AI to a supercomputer in the 1990s, back in the days of floppy discs and MS-DOS. Pretty soon, his investment firm was making 66% a year in returns, before fees.

He’s worth about $25 billion now (that’s with a B) and he’s been described as the “greatest investor on Wall Street,” and “the most successful hedge fund manager of all time.”

The secret to his success? His company, Renaissance Technologies, replaced old-style traders with math geniuses and supercomputers.

When I started out as a trader 20+ years ago, I was inspired by Jim Simons, and “The Boss” owes a lot to what he showed the world.

I first started researching the potential of AI in building trading strategies back in the 1990s, and I discovered evidence of enormous success, even then.

I found one of the greatest stock trading track records of all time, 15 years into a 30-year streak generating 70% returns. Called the Medallion fund, these traders used complex mathematical formulas to trade entire strategies of stocks, instead of just single stocks.

The Medallion fund, of course, is a portfolio of Jim Simons.

I admit, after I spent over $2 million developing my own stock trading AI, I had no reason to be charitable. I wasn’t intending to share it with anyone.

But then one day I was out shopping with my gorgeous girlfriend. We were in my Range Rover in sunny Newport Beach.

Bam!

The next thing I knew, I was in the hospital. It’s hard to believe, but almost meeting your maker really does change a man. It gives you a new perspective.

Developing “The Boss” has allowed me to help tens of thousands of everyday traders improve their lives and make the world a better place.

As we saw, big banks already offer AI trading strategies to the super rich. And many investment groups offer market research and buy signals, too.

Did you know that you can sign up for buy signals from JP Morgan Chase & Co for $10,000?

Or Goldman Sachs for $30,000?

Or Barclays for an eye-popping $455,000?

These kinds of services have always been out there for the super-rich, but the rest of us have been treated like second-class citizens in the financial system for too long now.

That’s why I’ve made it my life’s mission to develop trading software that everyone can afford.

Because I believe in a level playing field. In giving everyone the same set of tools and the same fair fight.

Until now, the only way to gain access to “The Boss” was to buy a software license. I’ve tried to make it as affordable as possible. I want it to be accessible to everyone.

Yet I knew there was more I could do. And you’re about to get an exclusive preview that nobody else has seen before.

Then I Discovered the “Discount Window”

You see, the way “The Boss” works is that it invents trading strategies. It combs over enormous amounts of data stretching back literally more than 100 years. It examines stocks in dozens of baskets, every industry, every vertical.

Source

19 – https://www.bloomberg.com/professional/blog/put-price-investment-research-2/

It builds entire formulas for trading, and then it generates buy and sell signals.

Sometimes, these signals are obvious. And most of the times they’re not.

For instance, “The Boss” once generated a NASDAQ 100 stock trading strategy with the most bizarre non-price stop I’ve ever seen in my life.

It’s a high-speed swing trading strategy using what I call “dropout stocks.” And it’s wildly profitable.

How does “The Boss” build a trading strategy? I won’t get too techy, but it uses a process called “Evolutionary Search,” with a touch of genetic programming mixed in.

I just call it AI, for short.

It uses a massive amount of computing power. So much computing power that it’s hooked into the world’s largest supercomputer network.

This network is built on millions of dollars worth of computers in secret datacenters around the country.

Over the years, it’s built a number of successful trading strategies for subscribers.

Like the famous “DB Transaction” strategy back in 2014 that’s hitting new highs to this day.

Or its “Dropout Stocks” strategy, that ranks assets by volatility, moving average, and percentage gains to pick stocks. In 2020 it returned 37.47%, 20.313% in 2019, 24.725% in 2017, 26.527% in 2016, and on.

Until now, I’ve never turned the AI super computer “brain” onto the challenge of crypto.

It’s not that I wanted to, but there simply wasn’t enough data. AI works by “learning” from as much data as you can give it. And the more data, the better the results.

A lot of cryptos (especially all those joke coins) just haven’t been around long enough to build a trading strategy around.

And of course, because you can’t buy and sell cryptos on the stock market, that made it even harder.

Until Grayscale Bitcoin Trust. That changed everything.

You’re going to want to keep reading, because when I say it changed everything, I mean it changed everything for every average investor looking for returns.

When I saw hedge funds making a killing buying Grayscale Bitcoin Trust, I was intrigued.

When I saw the track record of data that would be needed for AI (Grayscale has been around since 2013), and I was excited.

When I saw the incredible opportunity for Bitcoin in the next few years, I knew I had to act.

JP Morgan is so bullish on Bitcoin that the predict it will reach $146,000.

Imagine combining that insane potential for growth with the computing power of AI.

Instead of buying Bitcoin and holding it while it goes through wild swings in value…

(I love Bitcoin, but there’s no question it’s erratic. It can gain or lose 20-50% in a single day for weeks on end.)

Instead of going through that up and down cycle, what if “The Boss” could trigger buying signals that would tell investors exactly when to buy Grayscale Bitcoin Trust, and when to sell it?

When to get in, and when to get out?

All the upside with none of the downside.

That’s when “The Boss” discovered the “Discount Window.”

It’s a trading strategy that nobody else in the world has access to or has ever seen.

Using Linear Genetic Programming, the “Discount Window” plots a totally unique formula around Bitcoin that tells investors exactly when to buy, just before Bitcoin starts to climb in price… and when to get out.

And because I believe in full disclosure, I’m going to tell you exactly how the “Discount Window” works, and what the Boss has discovered.

How the “Discount Window” can Generate 200%+ Returns in a Year

There’s nothing I hate more than a trading program that’s a “black box.”

That means it’s based on some special, secret algorithm that I can’t check on my own.

Any reasonable trader wants to be able to do his own research, so he knows the science behind the magic.

Which is why I’m giving you the power to do exactly that.

The “Discount Window” occurs when Grayscale Bitcoin Trust behaves in a certain way.

You see, historically many investors were paying a premium to buy Grayscale. That means that, because it was so much easier and safer to buy Grayscale than it is to buy Bitcoin, investors were willing to pay more for that privilege.

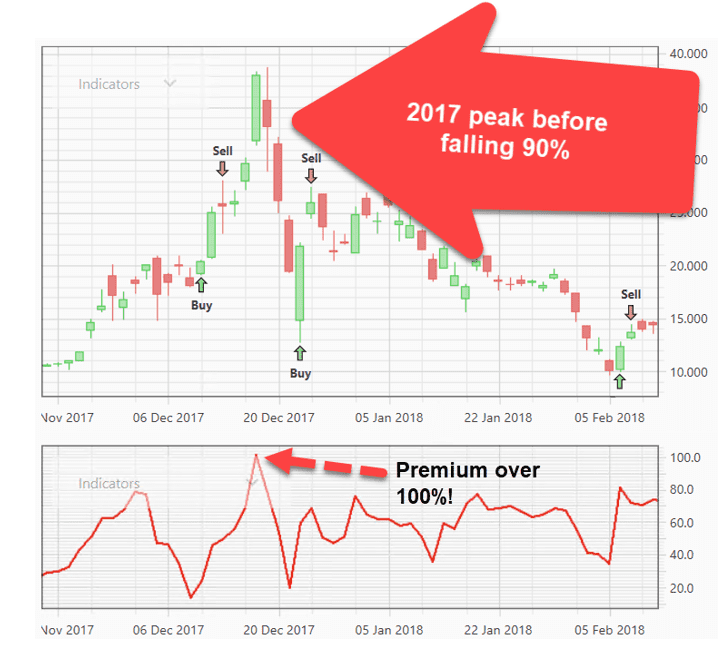

At its 2017 peak, that premium was 101% above the actual price of Bitcoin.

Source

20 – https://www.fool.com/investing/2021/01/05/heres-why-grayscale-bitcoin-trust-popped-today/

By Valentine’s Day 2019, it fell 90% to $3.66 per share!

Talk about a massacre for those that were drinking the “buy and hold” Kool-Aid.

The premium fluctuates depending on a range of factors: the price of Bitcoin, the number of people buying or selling it at any given time, and so on.

What the incredibly powerful Boss “SuperAi” discovered is that the spread between the price of Bitcoin and the price of Grayscale (the size of the premium) can actually help us determine when Grayscale is under-valued and ready to explode upward.

The “superAi” runs the Bitcoin Premium through a series of equations, and determines if Grayscale is selling inside a “Discount Window.”

And when that happens, subscribers get an email notification immediately, telling them to either buy Grayscale, or sell and move to cash.

The typical “Discount Window” lasts about a week.

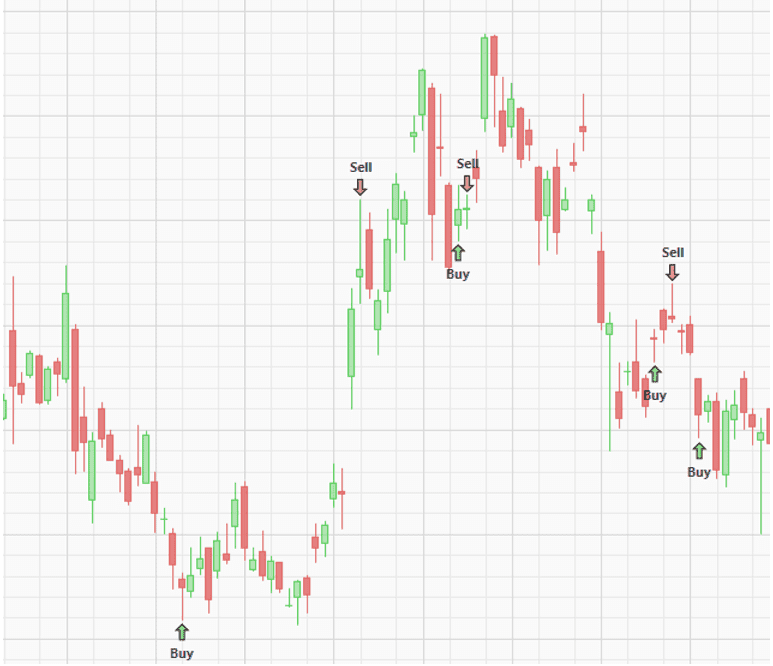

Here are some of its most recent notifications:

Introducing the Bitcoin Discount Window

When I saw the previous chart, I knew “The Boss” had discovered something incredible.

Of course, full subscribers to “The Boss” software have access to the “Discount Window” and many other trading strategies.

But what about investors who aren’t ready to make that kind of commitment yet? After all, access to The Boss is $25k.

My mission is to help as many investors and average American as possible. That’s why I created a way to allow every investor to profit off the “Discount Window.”

It’s called the Bitcoin Discount Window. Subscribers receive an email alert when the “Discount Window” opens, telling them to head over to their trading app of choice and buy Grayscale or sell and move into cash.

Every time “The Boss” issues a buy alert or sell alert for Grayscale Bitcoin Trust, I’ll immediately send that alert out to everyone who signs up, regardless of whether they have a software license.

Simply open up the trading app you have on your phone or computer and follow the instructions. Think of the “Discount Window” as a lit-up bat in the sky.

Signals are sent out the night before, so there’s plenty of time to get your order in by the open (9:30AM Eastern).

It couldn’t be simpler, or easier.

214% Gains Last Year For“Discount Window” Subscribers?

The “Discount Window” looks for very specific conditions in the market. And of course, it’s not God. No trading service is ever 100% accurate, and I won’t sit here and tell you that every single trade was profitable.

If I said that, you’d close this report right now, and be right to do so.

I always appreciate honesty and I know that’s important for you as well. So I’m going to break down the latest trade signals, to really give you a feel for how the “Discount Window” performs, and why I’m so excited about sharing it in my new Bitcoin Discount Window service.

Back on January 24, 2020 (right before COVID began), the “Discount Window” opened up, signaling a “buy.” 6 days later, on January 30, the window closed, and it issued a “sell.”

The total gain? 23.59%. In less than a week.

Let’s fast forward to March. A “buy” notification was sent on March 17 and then a “sell” notification was sent 2 days later on March 19 when the “Discount Window” closed.

The gain this time? 31.02%.

Of course, they’re not all winners. That would be impossible. And I won’t hide those losers from you either. You deserve to know the full track record.

On April 8, the “Discount Window” generated a “buy” and then a sell” 8 days later on April 16 that led to a 1.93% loss.

But on April 21, the “buy” notice came again, and 3 days later on April 24 the “sell” notification generated a 22.22% gain.

The overall results for 2020? An astonishing 213.80% gain.

If you had invested $10,000, your investment would now be worth $31,380.

It would have turned $100,000 into $331,800.

And $500,000 would have turned into a mind blowing $1,569,000.

In the same period, if you had bought index funds of the S&P 500 you’d have made a paltry 16%.

Or a sad 31% if you’d bought Facebook. Even Amazon and Apple only generated returns of 74% and 78% last year.

They don’t come close to the 214% enjoyed by subscribers to the Bitcoin Discount Window.

Sign Up to Receive the Bitcoin Discount Window Alerts and get Instant Notifications of When to Buy and Sell Crypto from Your Trading Account or 401k

Knowing what stocks to buy is hard. And know when to buy or sell them is even harder. Even professional traders struggle.

The “Discount Window” takes the work out of trading. It takes Grayscale Bitcoin Trust, the easiest and fastest way for investors to get into the hot crypto market, and shows traders exactly when to buy, and when to sell.

Sign up to be notified, and you’ll automatically receive about 30 notices a year with Buy or Sell signals, emailed to your inbox.

Just open up your trading app and follow the instructions. It takes only minutes to get started.

- So easy! Buy and sell signals are sent directly to your phone, no app required!

- Forget about cold wallets, crypto exchanges, and all the other trouble that comes with buying Bitcoin

- Buy directly in your current trading account, or use tax-sheltered accounts like your 401K

- No more buy-and-hold through the roller coaster. The “Discount Window” tells you when to buy in, and when to get out

- No “The Boss” software subscription required. All you need is a phone or computer to receive the trading signals

- Never worry about being hacked or losing your precious Bitcoin access keys

- Protect your precious savings against inflation from government money printers running wild

- Faster and easier than buying gold

- Take full advantage of the incredible gains seen by Bitcoin in the last few years… even JP Morgan predicts it will reach almost $150,000

It’s the easiest and fastest way to quickly gain exposure to the extremely lucrative digital asset market. And it’s all powered by “The Boss” Supercomputer AI.

What Members are Saying About “The Boss”

Many traditional traders are skeptical of computers. Can artificial intelligence really beat out good old human instinct and common sense?

It’s a fair question. And rather than answer you directly, I’m going to let Portfolio Boss Founders Club Members tell you a bit more.

That’s what we call traders who have been using The Boss AI from the very beginning. Their amazing stories of financial success tell the story better than I ever could.

(As you read, don’t miss their Founders Club Member plaques in their photos. Many of our customers are so loyal, they couldn’t imagine trading without The Boss!)

Here's What Other's Say…

Last Year I Made 72.91% in Trading Thanks To “The Boss”

I came across Dan Murphy while surfing the internet. He made a lot of sense – Test don’t guess. Use the computer to make your decisions. I followed him for months before I bought PortfolioBoss in 2014.

I tried many service before Dan, some were good, but most were worthless, and none of them seem to be worth the money they charged. Portfolio Boss took all the anxiety, worry and guess work out of making trades. Using the computer and backtesting strategies made sense – Tested analysis. Portfolio Boss has allowed me to find the strategies that fits me and my trading style.

I’m retired and only trade as a hobby, but a very profitable hobby. In July 2020, I become a member of ’The Boss’ Supercomputer Trading Group. Last year I made 72.91% in trading thanks to ’The Boss’. My biggest concern with PortfolioBoss are taxes. I’m making too much money. The Government seems to want a large share of it . . . lol.

Steve Crowther

Portfolio Boss Founders Club Member

❝

I've Had a Lot Of Success With Portfolio Boss

I’ve had a lot of success with PB. I use three strategies concurrently. Allthree beat the NASDAQ last year. My favorite is Stocks Under 5. It was upover 100% last year and doing very well this year! All I can say is that it’s great being a founding member. Thank you for all that you do!!!

Thomas Buckhouse

Portfolio Boss Founders Club Member

❝

You Have Taught Me So Much About Investing The Right Way and It Has Paid Off Big

Thank you for the Founder’s plaque. It was my honor to be able to be one of the first on the team. I have been watching you and reading your soundadvice since 2011. I was that investor you show in the progression fromcaveman investor to AI. I progressed through each of those steps in mytrader evolution and made all the mistakes along the way. Then I found“Million Dollar Target” and have been with you ever since. You have taught me so much about investing the right way and it has paid off big with PortfolioBoss and “The Boss”, in particular. This past year I doubled my investment and 401K accounts and have been able to help both my Adult children’s families through this tough economic time. In addition, I have been able to continue my charitable giving and am on a trajectory tofulfill my plan to retire this year (2021) so I can dedicate more of mytime to my family and volunteer more of my time to my non-profit interests. I look forward to the cyber code and intraday trading enhancements to PortfolioBoss and our continued trading success.

Skip Miller

Portfolio Boss Founders Club Member

❝

It Is The Next Generation and It Is Here Now!

Dan, I'm a very long time member going back to your early strategies. I'veseen all the progress along the way in both knowledge and my portfolio size. When you described the use of Artificial Intelligence, I knew it was the logical way to grow and compete in the constantly changing investment world. It is the next generation and it is here now! ”Grow or Fall Behind“. I am very anxious to work with the cryptocurrencies, BitCoin in particular.I have traded some Grayscale [GBTC] and done very well. The excitement of trading is very stimulating! I want to help my son buy his first home and this appears to be a very good way. THANK YOU for this opportunity!

Arthur Allen

Portfolio Boss Founders Club Member

❝

I'm Very Blessed To Be Part Of The Founding Members

Aloha Dan and team! I'm very blessed to be part of the founding members! I'm also thankful to Adam, who worked with me during an acute medical issue, to make sure I was a member. Ironically when I first learned about you, Dan/the relaxed investor, I thought you were too prideful and hesitated to buy any of your programs. But after reading through your free reports, attending seminars, and listening closely to your investing nuances and experience it became clear that we both shared similar things … one of which is PROOF! Honestly I believe it is priceless to have an evidence-based trading system that can also be updated as necessary to verify its algorithm/strategy is still working efficiently. I have purchased a different company's product years ago, and even though it is also algorithm-based and capable of backtests, it is NOT in the same league in regards to customizations, testing and real results … and that's prior to salivating over the 1/2hr data and cyber code coming soon. My desire for truth has led me to improve in many areas of my life and now has led me to you and my financial growth… and my trade account has been growing quickly. I am now cautiously optimistic. Aloha and God bless.

Isaac Kama

Portfolio Boss Founders Club Member

❝

I Very Much Admire Your Approach and Love Your Tried and Tested Strategies

Hi Dan, My portfolio is only small and frankly i did not do very well.I more and more stepped out of the market and let the bank manage my money. Only recently, using the Portfolio Boss Devine Engine i shrugged off some of the fears and got back. Back into this crazy market we are in right now. And i am very happy that i did. My portfolio gained 9.8% in the first 6 weeks of 2021, even while i am only 60% invested. I am not the day trader type and stick to a strategy with periodically switching. I very much admire your approach and love your tried and tested strategies. Thanx for your commitment!

Wim Fleuren

Portfolio Boss Founders Club Member

❝

It Is Amazing What You and Your Team Have Accomplished In a Short Amount Of Time

Good morning Dan. Nice job on the call yesterday. I am very excited for the cyber code deployment. It is amazing what you and your team have accomplished in such a short amount of time. You have given the small investor a chance to make money consistently and safely. Before purchasing Portfolioboss I never had a strategy. I was consistently moving from one shiny thing to another. Buying access to strategy after strategy, news letter after news letter. I had come to the realization that no matter what I did the cards were stacked against me. Then on day, I stumbled across your website “million dollar target”. For whatever reason, I started to following your posts and blogs. Always looking forward to the next. They resonated with me. They were so different from everything else that was out there at the time. I slowly started subscribing to your solutions over the years and slowly started building confidence and most importantly, making money. Oh how far you have come! As a member of Unite and Founders Club, I feel there is no limit of what we can accomplish together. The only fear I have, is there a world that you sell Portfolioboss to a hedge fund or private investor, and me and the other founders lose access? I know you have said that you would never do that, but the thought is always on my mind. 2020 has been a banner year! With the launch of founders club and the ability to let the “Boss” create the strategies for me, I have made about $80,000. Recouping my investment in the Boss and much more. From a percentage standpoint I am up about 80% for the year. Need I say more. Dan thank you for everything!

Craig Strong

Portfolio Boss Founders Club Member

❝

So Got Back On The Horse Like Seabiscuit Closed The Year Up Over 30%

So when I purchased the initial BOSS ( before AI added) I was was very conservative – using smaller amounts traded DB transactions, Oracle , SMI (SPY) SMI Stocks – Anyway made back in the 1st year the cost of subscription. 2020 turned out to be a GREAT GREAT trading year although FEB again made me have my doubts- but had faith in the concept and models, back testing and consistence over the years of what was possible. So got back on the horse and like Seabiscuit closed the year up over 30%. Would have been even larger but did not cease trading SMI and SMI stocks which held me back since was in Bonds when the market took off . Also only invested a fixed amount rather than reinvesting winnings.. However from Dec 1 2020 through today have made $50,000 each month ( including FEB) in 3 days. A couple of reasons – DB transaction was gang busters, I for some reason started using ATLAS orders again, and I created using the Boss a couple of my own models using a created portfolio ( from another service who list 26 relative best performers each month ( If we have the 1 on 1 can give you more info.) So from using only $400,000 ( added about $200,000) towards end of 2020) have made over $250,000 in 13 months. I continue to trade 7 strategies now, some trade once per month, others every day. The key is fully trusting that in some models' there was no losing years or very few and that allows me the confidence to look at the long rule. One final thing – you asked if your folks if they were not making money – if they followed the models they should have – unless they got locked into the SMI indicator and other models that uses SMI.. I dropped using SMI and related models when you provided Boss 100 and Boss 100/500 models which I switched to. Anyway thanks to you and the team for what you do , for the training you provide and hopefully will report to you by end of year that we made FY money. Stay safe.

Bobby Dietz

Portfolio Boss Founders Club Member

❝

I Honestly Can't Imagine Not Having Portfolio Boss In My Life

I honestly can’t imagine not having Portfolio Boss in my life—and pray it never goes away—since it has made such an impact on my trading success. I have a robust 29 strategies running that gives me the peace of mind that even in a crazy volatile market, I can count on stable returns for as long as I’m alive. I love that Portfolio Boss continues to evolve and provides the opportunity to continue creating strategies that pull money from the market!

Josh Jarrett

Portfolio Boss Founders Club Member

❝

Hi Dan, Happy Groundhog Day From The Snowy Suburbs Of Chicago!

2020 was truly a breakout trading year for me: 72% in a Roth IRA – giving thanks to God for William Roth! Tax-free! I have also been trading an SPY/QQQ multi-strategy using micro e-minis with ever so slight leverage. I have been burned in the past using too much leverage. I'm very curious to see whether the cyber code can find some tradable SPY and/or QQQ strategies. I have started working on a framework for increased charitable giving and very excited about the possibilities. Looking forward to 2021. Thank you for the Founders Club plaque and for a truly tremendous trading tool, Dan and team! Best regards.

Chris Daniel

Portfolio Boss Founders Club Member

❝

I Couldn't Be Happier Working With Portfolio Boss

Dear Dan, I couldn't be happier working with Portfolio Boss. I have been with your team since its inception. I go way back and I can tell you that I have had many subscriptions and many money managers throughout my trading career of over 30 years. What I learned from all of them combined pales in comparison to what I learn from you.

I love your core ideas of:

– Relaxed Trading– Rigorous BackTesting– AI evaluation – Portfolio & Strategy Switching (with so many levers to tweak and experiment with.)– Addition of new Instruments like Crypto Currency & BitCoins– While continually honing in on efficient trading by minimizing draw-downs and maximizing returns.

I get far better sleep and am even pursuing my PhD in Quantum Integrated Medicine while trading with your fabulous tool and incredible observations that you continue to share with us. Thanks is too small a word – but since I can't come up with much else. So, I'll just say many thanks. Also, I've attached a copy of my picture with the founder's plaque your team sent me. Warm Regards & Best Wishes to everyone on your team and most of all to you.

Nalini Uhrig

Portfolio Boss Founders Club Member

❝

More Than Happy With The Current Results and The Performance / Results Achieved To Date

Hi Dan, Am currently trading a couple of Systems that “THE BOSS” came up with, And am more than happy with the current results and the performance / results achieved to date. Trading as a business, and as in any having the correct tools makes all the difference. Find the type of trading that suits you, whether it’s day trading in chat rooms trading stocks like Gamestop. GME, or whether a slightly longer term approach works for you. A funny story there is a company on the ASX ( Australian Stock Exchange ) with the same stock code as Gamestop (GME.ASX) this company is not related in anyway in to Gamestop. In fact this company Mines Nickel and yet this stock almost doubled just because it had the same ticker GME as GameStop and had to be placed in a trading halt. My point I prefer to be removed from the daily NOISE of chat rooms and the like. When I came across Portfolio Boss the thing that intrigued me was that the software was different It had the ability to rank Stocks based on different criteria. The rest as they say is history. Thanks Dan, keep up the good work.

Richard Coombe

Portfolio Boss Founders Club Member

❝

I Certainly Owe You After All The Money You Have Helped Me Make Over The Years

Hey Dan, Here is a quick photo of me with my plaque. I also have been meaning to send you a note about my story, which I certainly owe you after all the money you have helped me make over the years. When I started trading with you a few years ago I had never bought or sold a stock on my own before. Back then you were doing swing trades on the S&P, and that got me started with some very clear signals that earned me some nice early profits. I continued following your services as you evolved over the next few years from the S&P focus to trading various indexes and stocks with programs like Crash Canary and Atlas Order and finally landed on DB Transactions, which has served me well for several years. Then you came up with Portfolio Boss and I learned how to use it to generate my signals and saw my profits get more consistent. My trading moved to the next level when I decided to join the Unite program and become a member of the Founder’s Club. That opened up the full set of PB tools and all your available programs for me. I started trying them out over time with good results and a few ups and downs with the market the last couple of years. This past July I decided to ramp up the focus on my trading by tracking my daily progress across all my strategies. The timing couldn’t have been better as the market was just taking off after the COVID crash. I experimented with a few different strategies until I landed on one that stood out above the rest and focused my efforts on it for the remainder of the year. The results were amazing. I saw my account increase by 50% between July and December. I actually made significantly more money during this time from trading than I did from my regular job, which pays quite well itself. I know it was a unique time in the market with the central banks blowing a very big bubble, but the point is that by applying The Boss I was able to turn that event into a stunning profit. I am now seriously considering the possibility of retiring soon and just focusing on trading if I continue to see results like these. I would not have thought I would be in that position yet, and it is thanks in large part to these tools that you have so generously shared. Dan, I really can’t thank you enough for the financial difference that you have made for me and my family. All the best!

Anthony (Tony) Russell

Portfolio Boss Founders Club Member

❝

Been Doing Very Well Following The Boss

Hi Dan, Big shout out from Canada eh. Been doing very well following The Boss. I used The Boss to build a strategy that trades the Canadian Index TSX for part of my account. Its been doing very well averaging 18-20%. As we know the DB strategies, Ping Pong, and others are killing it, with returns over 40%. On a personal note, I retired in 2020, after successfully hitting my number. Thanks to Portfolio Boss. In March 2020, during that drop in the market, we had some losses in February and March, I stopped trading because I was so close to retirement. I didn’t want to suffer heavy losses. That said I missed the summer and fall rally. I deviated from a winning strategy and missed part of the most amazing rally ever. It is tough trying to ignore those pesky personal biases. Thanks The Boss Team for all you do.

Greg Shende

Portfolio Boss Founders Club Member

❝

Thank You For Your Willingness To Help Others and Your Dedication To Them

Dan, I have been following you for quite a few years. I struggled along most of those years but your videos and letters gave me hope and guidance. Since the boss has come out things are a lot more consistent but I am still very cautious and limit my exposure. Too many hard lessons learned in the past I guess. I wish I was the profit machine some of your members are but… I run a business of my own so can’t dedicate as much time to your training as I would like or need but I am confident when I retire soon that a constant income will be there. Your DB Platinum is working great. I try to develop my own strategies but have now found the right set up yet. It is fun to try though. Thank you for your willingness to help others and your dedication to them.

David Light

Portfolio Boss Founders Club Member

❝

The Structure In Your Trading System Would Help Any Trader

Hi Dan, I have been significantly distracted because of covid from learning all the possibilities of the Boss, but what I have used and learnt helped me to have my best 7 digit year! What impresses me most is that I was able to do this while only being 2/3 invested at one anytime. I bought my first shares 43 years ago at the age of fifteen. Over those years I have found to be a successful trader it requires a disciplined approach to all the various steps in a trade. Your simplest SPY system helps me deal with my largest trading weakness and that is to stay in the trade until it’s done. The structure in your trading systems would help any trader. Thank you!

Russ Lang

Portfolio Boss Founders Club Member

❝

So Many People Using The Portfolio Boss To Improve Their Trading….

And Even More Testimonials From Our Clients….

![]()

In Less Than 2 Months My Portfolio Is Up 42%

RANDY BALCOM – PORTFOLIO BOSS USER

Dear Dan, After I lost 30% of my retirement in 2008, I vowed not to let that happen again and embarked on a long education process. I have tried 10different trading programs, hired 3 “gurus” and even allowed someone fromChicago to trade my money. I have traded everything from options, futures, forex and even cryptos. My guess is that I have spent over $100,000 in my “education” mostly from trading losses. I know traders that make consistent money, but I just never could find the right fit for me. I believe I have found that fit with The Boss. In less than 2 months, my portfolio is up 42% with a strategy developed by the supercomputer that trades emerging technology stocks. The trade signals are exact, there is no guesswork. But honestly this is what I like even better…The supercomputer is designing a complete trading plan for me that can avoid those massive losses I experienced when the next pullback in the markets happens. Thank you for creating this product and giving me peace of mind for my future!

![]()

![]()

The equity curve is certainly looking exponential.

MARK SUFFRON – PORTFOLIO BOSS USER

Here are my results as of close today 1.20.21 tradingthe Portfolio Boss since August 2014.Baseline $110,868Balance 1.20.21 $480,444+333.3% Return.The equity curve is certainly looking exponential.

![]()

![]()

I thank you from the bottom of my heart.

PETER MITCHELL – PORTFOLIO BOSS USER

I want to tell you a story of an Australian Guy who has been trying to trade successfully, Profitably for over 21 years. He has blown up most of his money and countless trade accounts in that time, and yet he has never given up on becoming a profitable trader, so as to support himself. He keeps another plaque above his desk that is a quote from Sir Winston Churchill.“Success is based on countless failures without losing inspiration.” This Guy has been a follower of Dan Murphy since his Facebook Million Dollar challenge, and has always kept in touch with Dan Murphy in some way via social media. This Guy had put down serious money to purchase Dan Murphy's latest “Portfolio Boss” programme back in late 2019. He had saved some more cash left over to trade after working as a truck driver for 35 years. Since his first trades using Portfolio Boss he has for the first time inhis life been profitable. He now has enough money to place his 91 year old Father in a Nursing home, and is only driving 3 days a week. This Guy owes his good fortune for staying with his beliefs, and also for never giving up on his dreams of becoming a successful trader who can support his Family now. That is my story. I Thank You Dan from the bottom of my Heart.

![]()

![]()

I am proud to be a part of this journey with you.

SEBASTIEN GARCIA – PORTFOLIO BOSS USER

As a math nerd I have been knee-deep into algorithmic trading for thepast 20+ years, all the way back when using command lines instead of acool UI was the go-to solution to process market data! So I sawimmediate value in Portfolio Boss back in 2014 as a way to streamline agood portion of my work process. But what made me take a leap of faithwith you was undoubtedly how genuine you were about the whole project.And Dan, people like yourself are rare enough in this business to stickwith. The Unite upgrade was the best of all for my use case. My message to you is two-fold. First, performance is REAL. And I mean true performance, not just the headline return or money number, but the risk-adjusted kind. Second, as a person who has been trading for a living for a long while, I can testify to the fact that Portfolio Boss is not just a valid trading solution catering to the retail trader with an aim to open the opaque doors of algorithmic trading. It is also a powerful solution for professionals who will find value in it to complement, sharpen and enhance their existing suite of trading systems like I did. I have been in this business long enough to tell you that Portfolio Boss' processing power and speed are top notch and a testament to Ruud's programming work. I have been holding Ruud in extremely high-esteem since we all started 6 years ago. This gentleman knows his craft. He is a gem to your company. Try processing in Amibroker just a portion of the daily data crunched in Portfolio Boss and you will see.No contest. Your Cyber Code upgrade definitely picked my curiosity and I cannot wait to take it for a spin. I guess the only two (much more basic) things that I have been looking forward to is PB merely saving the tabs layout after closing it! And the ability to import custom (static) instrumentsfor research purposes. As in, get the Open/High/Low/Close data in a CSVfile and import it as a custom non-updatable instrument. That feature alone would allow to expand backtesting to more obscure instruments that your users would have static historical data for such as currencies, cryptos and foreign equities, without your company having to incur any extra data cost. Anyways, my last words will go to your team. I have dealt directly withRuud, Ellen and Adam in the past and have nothing but good things to sayabout them. Portfolio Boss is what I came for, but no joke, your andyour team's ethics and honesty is why I am sticking around. I am proud to be a part of this journey with you all and I truly came to consider you Dan as a partner rather than just a guy selling a piece of software. You deserve every bit of success that is coming at you and I wish you and your team nothing but the very best. You all have a great weekend.

![]()

![]()

You have no idea how grateful I am to you.

PETER S. – PORTFOLIO BOSS USER

I am an original PB member since 2014. You have no idea how grateful I am to you. Very very grateful. So appreciative. I believe that you have invented the best trading strategy or one of the best trading strategies that has ever been created . So simple yet it genius. I was a losing trader before I met you. Now I beat the market every year and have total confidence and I can relax and stop worrying. And the very thing best thing is that you keep giving of yourself to those us who paid a one-time fee 4 years ago. The emails that you send to us with your very accurate and insightful assessment of the Market is invaluable. Especially the SMI signal that you share with us. I, like you, love to give back to others, because humanity certainly needs help right now. You are selflessly giving to us and I will never take it for granted. I hope you will allow us to follow you for the rest of your trading days. Thank you Dan, you are very smart man and a very good person. The best to you always.

![]()

![]()

I made over 100% in the last 12 months!

DAVID G. – PORTFOLIO BOSS USER

I made over 100% in the last 12 months and I couldn’t have done it without PB so I wanted to say thanks for it. I’m also really looking forward to all the advances you’ve been posting about recently and for project 88. Happy Thanksgiving!

![]()

![]()

Clear and Easy to understand.

PORTFOLIO BOSS USER

Clear and Easy to understand. This is perfect for 401K trading. 401ks usually have SP500 and US treasuries as options for your money and you can change the percentage. You could do this yourself and not have to pay someone a percentage to do it for you when you retire.

![]()

![]()

Knowing there is a way to predict downturns and upturns in the market.

PORTFOLIO BOSS USER

Knowing there is a way to predict downturns and upturns in the market. I feel confident you have a good strategy and it has been well tested. I liked the smart money and dumb money information. I appreciated you telling us who is the smart money and who is the dumb money. This is excellent information.

![]()

![]()

You're a Genius.

PORTFOLIO BOSS USER

You're a Genius. I never would have thought the [REDACTED] COT Category. You're a generous man sharing this. I read it right through… glued in. Well written. Many millionaire followers to be made. God Bless.

![]()

![]()

Your description of an amateur trader was right on the mark.

PORTFOLIO BOSS USER

Your description of an amateur trader was right on the mark. I read I listen to so called experts to only find myself more confused and I make poor investment decisions.

![]()

![]()

You described it perfectly.

PORTFOLIO BOSS USER

I fall into that category of investor that tries to figure out what the market is going to do by exploring charts and gathering data, unfortunately, I barely keep my head above water and have always wondered why the market goes in a direction that the charts don't clearly indicate which leaves me scrambling to save what I can. You described it perfectly.

![]()

![]()

Easy read. Sound methodology

PORTFOLIO BOSS USER

Easy read. Sound methodology – I really like that you are using a very different source of data from the norm – hence its power.

![]()

![]()

I like hearing your story…

PORTFOLIO BOSS USER

I like hearing your story of your original theory/idea and discovery of the Z point and verification; p. 16-19. It has all the elements of a great story – a quandary, the inspiration, the hard work, the success (ta-da!).

![]()

If You’re Worried about Inflation and are Curious About Bitcoin, it’s Time to Act Now

Many of us are worried that the US Dollar could lose a lot of value in the next few years. With the rate of money printing happening in Washington, there’s a strong chance that inflation could spiral out-of-control faster than anybody wants to admit.

If you need a way to protect your assets (cash is like a melting ice cube on a hot day) then gold has traditionally been the best answer.

But there’s a reason why Bitcoin has been called “digital gold.” It’s a powerful way to hold value, no matter how many dollars are printed every month.

And if you’ve watched on the sidelines as Bitcoin has shot up hundreds of percent in the last year alone…