From: Dan Murphy

Newport Beach, CA

Re: Dark Pool Live Event

Before I get into what the live, in-person event is all about, we’ve got a seismic shift in the markets that I need to talk to you about ASAP.

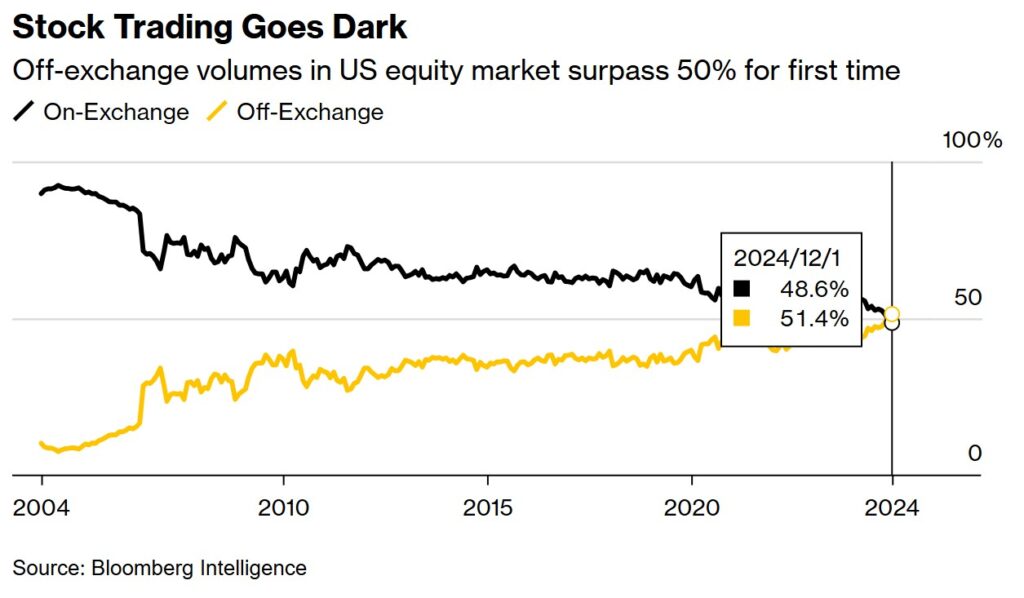

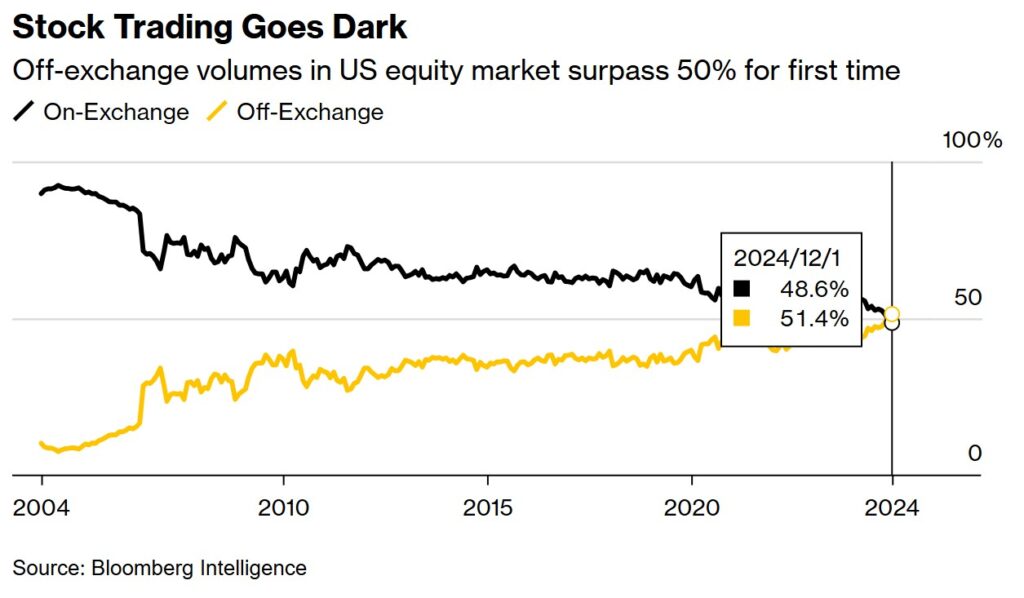

When I read this, I about fell out of my chair… for the first time in history, Dark Pool exchanges had more shares traded than the NYSE, NASDAQ, AMEX, and the rest combined.

A whopping 51.8% of all volume this January.

But while some are worried, rightfully so, about transparency disappearing from the markets, I smelled opportunity.

I searched the net to see if I could get my hands on any Dark Pool data. As you know, we’ve had massive success using “weird” data to build trading strategies. True Asset Pricing (TAP) has been a game changer.

It just so happens that regulators require these Dark Pools to show the number of shares being bought and shorted at these exchanges…on ALL stocks and ETFs on a daily basis.

So I put the team to work, fed the data to The Boss SuperAi, and hit Start. I watched as the AI built me a strategy to trade Tesla (TSLA). I did this on purpose because I’ve never been able to make a Tesla strategy.

Well, that sure changed QUICK. Take a look at the returns. A 228% return last year in out-of-sample testing.

TSLA Dark Pool strategy.

Like I said, I absolutely could not build a working strategy on Tesla, but then it built a banger of a strategy on my first swing of the bat with Dark Pool data.

To make sure it wasn’t luck, I entered Meta. Like Tesla, I was never able to build a working strategy on this social media empire. My luck changed again:

Meta/PSQ Dark Pool strategy

Then I built more and more and more. I’ve built around a dozen so far, and intend to test the top 200 stocks and ETFs by market cap.

The edge is practically universal across stocks and ETFs. And yes, they use inverse ETFs so they can make money when the market takes a dive.

And it’s true that adding this new breed of strategies to Metas boosts returns AND smooths out the returns. As it should. It’s a whole new paradigm for generating trade signals.

But for reasons I’ll let you in on in a moment, I’ve decided NOT to teach this new technique online.

What are Dark Pools Anyway?

Dark pool exchanges are the shadowy, off-the-record trading arenas of Wall Street—the hidden back rooms where the big players get their deals done without broadcasting every move.

Unlike traditional exchanges where every trade lights up the board, dark pools let institutional investors, hedge funds, HFTs, market makers, trade anonymously, keeping the real action out of the public eye.

This secrecy can skew market signals, giving insiders an edge while leaving retail traders in the dark about the true state of liquidity and price movements. In short, dark pools are where the real power plays happen, far from the glare of the trading floor.

Over the past 20-years, their share of volume has quietly grown from just a fraction, to taking up the majority of U.S market share.

Big players have flocked to Dark Pools in order to reduce market impact from their trades. For you and I, this isn’t a problem in your normal open auction “lit” marketplace. But it is a problem for some…

The dramatic migration of trading volume to dark pools has thrown a wrench into the machinery of price-based trading models that rely on the visible order flow and liquidity from lit platforms like NASDAQ and NYSE.

Some quantitative funds have noted that their models—originally fine-tuned on lit exchange data—are now underperforming.

To these HFT firms, I say…

…Boo freakin’ hoo! They’re a bunch of thieves in my opinion.

Their loss is our gain because Dark Pool data is shining a light on a whole new way to trade.

Better to buy “support” breaks after 1982 whenS&P 500 pit futures introduce

Back in 1982, something astonishing rocked Wall Street—pit-traded S&P 500 futures stormed onto the scene.

Overnight, this powerhouse with its mind-boggling 500:1 leverage seized control, becoming the proverbial tail wagging the dog.

And suddenly, everything you learned from those dusty old trading books became worthless.

The Dow, once a predictable trend-follower’s dream, flipped upside-down, transforming into a mean-reverting monster.

What used to spell disaster—those dreaded “support breaks”—turned into golden buying opportunities. And ever since, the game has stayed flipped on its head.

No wonder so many traders drowned in bad advice and faulty predictions over the decades.

Lightning Strikes Twice

Then, like lightning striking twice, another seismic shift shook the markets in 2010.

Electronic E-mini futures swept away the old-school pit traders almost overnight.

ES Emini S&P 500 futures takes over from pit traded futures

The shift was so swift, so fierce, it blindsided countless seasoned pros.

Suddenly, my Smart Money Indicator was flashing green when it should’ve screamed red. Luckily, I spotted it fast, adjusted course, and sidestepped disaster.

But now—right now—I’m seeing something even bigger brewing beneath the surface.

Dark Pool trading is quietly overtaking the familiar exchanges like NASDAQ and NYSE, snatching liquidity and reshaping markets right under our noses.

Hardly anyone sees it coming, and fewer are talking about it.

But this isn’t my first rodeo—I’ve navigated massive market shifts before, and you can bet I've already mapped out the path to profits. Stick with me. I’ve got you covered.

All is Revealed at Our Live Event September 13th

Here’s the deal: I’ve decided this Dark Pool breakthrough is too hot for me to put this on the Internet. So I’m going to teach it live to a small group of your fellow Boss’s here in Newport Beach, CA.

It’ll be the first Portfolio Boss live event. History in the making. Honestly, I should have held one years ago, so this new breakthrough gives me the perfect excuse to get you over here.

Well, there’s another reason for me to host a live event…

The #1 Trading Problem I’m seeing in 2025

…I’ve been monitoring the trading of veteran and new Portfolio Boss members alike, and a pattern has emerged. It makes me concerned because it can seriously eat into profits.

It’s what’s been holding you back from the returns you should be getting. Have you ever found yourself saying any of these things?…

- “I know I should follow the signals, but I get busy with work/life.”

- “I second-guess the system, especially during drawdowns.”

- “I make silly mistakes entering or exiting trades.”

- “Managing multiple strategies feels overwhelming; I stick to a few, even if more are recommended.”

- “I want the returns, but I don't have the time or mental energy to execute perfectly.”

My girlfriend has been missing some trades and it cost her. My personal trainer uses PB, and he’s had some problems staying square with his positions. Heck, I’ve seen the numbers, and even some veteran PB’ers have had lower monthly returns than they should due to this problem.

It’s not that you’re lazy. No, that’s not it. It’s that you’re…

BUSY!!!!

The real culprit is something I call The Busy Trader Trap.

You’re not alone. Busy has consequences on trading effectively:

- A well-known concept in behavioral finance is “limited attention.” In a widely cited paper by Hirshleifer and Teoh (2003), they discuss how investors have only so much bandwidth and inevitably miss opportunities or misreact to news.

- A 2020 study by Barber, Huang, Odean, and Schwarz on Robinhood users found that attention-induced trading spikes caused many traders to enter or exit positions after a delayed reaction—often at suboptimal prices.

- According to the 2019 FINRA Investor Education Foundation National Financial Capability Study, over 60% of retail investors balance market participation alongside full-time jobs. This creates time constraints for monitoring the market and placing trades.

- US adults now spend an average of 3–4 hours per day on smartphones, according to eMarketer (2018). Getting “alert fatigue” from countless news apps, social media, and streaming services means many traders cannot give the market real-time attention, even on a daily data time frame.

- Slippage (the difference between a trade’s expected fill price and the actual fill price) can become a big hidden cost. Research by Angel, Harris, and Spatt (2015) points out that even minor timing delays in placing orders can lead to higher price impact and lower returns.

- Real-world brokerage data from various discount brokers often show retail investors place trades hours or even days after initial signals, frequently missing the optimal price window.

And finally… A 2017 paper in the Journal of Behavioral Finance reported that “information overload” led to worse decision-making in 56% of the investors studied.

And as you’ve seen, being busy comes with real consequences—missed trades, delayed executions, sub-optimal entries, and the heartbreak of watching your potential profits slip away.

Auto-trading to the Rescue!

That’s why I’m saving the final part of our live event getting you 100% dialed in with auto-trading.

Because once we fix the Busy Trader Trap, you’re no longer missing out on signals. You’re no longer babysitting the screen. You’re free to live life—and still get the market returns you deserve.

Think of it: No more frantic order entries… no more half-missed trades… no more stress from daily monitoring. Instead, an automated system that executes each trade for you, so all you do is log in once a week to confirm. That’s it.

I realize not everyone is like our good friend of PB, Chris Daniel (who helped tremendously with TAP data and BasketTrader…I owe you a beer). Chris is like a machine and uses BasketTrader religiously. That’s why his slippage and commission fees are .15% per month so far in 2025.

But I bet if given the option, he’d jump at the chance to auto-trade. Who wouldn’t? Probably a masochist accountant that likes entering numbers into a computer.

That frantic, ‘too-busy’ feeling? Gone. The anxiety of missing signals? Gone. Instead: Calm confidence, because your trades fire off automatically, while you’re out fishing or on vacation. That’s what auto-trading can do.

No more being part of that 60% juggling a career + investing. Now, your day job is never a barrier to capturing the best signals. You can finally rest easy—and watch your portfolio do the heavy lifting for you.

What will you do with the time savings?

For me, the big difference will be when I travel. According to a 2019 AARP survey, travel is the top aspiration for Americans over 50 (jeez, I’m turning 50 this year), so being “hands-off” with trading is a significant benefit.

In short, it’s the ultimate solution to the Busy Trader Trap. Which is why I’m pulling back the curtain on auto-trading at our upcoming live event—so you can see, step-by-step, how to put your trades on autopilot.

OK, so here’s what is going on at our live event:

==> When?

September 13th after Labor Day. It’ll be a one-day event. You’re busy, and I’m going to get your trading dialed in with this super-profitable new method (and a whole lot more). You fly in on Friday the 12th, 8-hour power day on Saturday, leave Sunday the 14th.

==> Where?

Newport Beach area near John Wayne Airport. At the Marriott. I will be covering your room so you don’t have to mess with booking it. Just get your sweet patootie over here. Lunch, snacks, drinks, coffee are on me. I want this to be an experience you’ll never forget, so I’ll make sure to pay attention to the smallest of details. Deal?

==> Who is this For?

At this level, I suggest you’re trading with at least $100,000. I highly suggest you bring a laptop with Portfolio Boss installed. That way we can go over your setup, get you dialed in and ready to make more money than ever with your trading.

==> What’s Being Covered?

Session 1: The Big Setup

In our morning session, I want to get you settled in. This is where I do an overview of what we’re going to cover. Meet and greet your fellow Boss’s. You should bring a laptop with Portfolio Boss installed so I can help you dial in settings. We will also be building strategies during the session with templates I provide in advance.

Session 2: The Dark Pool Reveal

Next, we’ll jump into the biggest change in the markets in decades: Dark Pools. Here I’ll give you the background of Dark Pools, how they work, the major players, and more importantly…

…how Dark Pool data gives us practically inside information of what the big whales are actually doing in practically every stock and ETF in the country. Hint: Short selling volume is the key here.

Notice how this new technique was able to build a strategy on META (Facebook) and the massive drawdown practically disappeared like it never happened. This is when I knew I was onto something.

META Dark Pool strategy. What happened to the decline?

Session 3: Building Dark Pool Strategies with the Divine Engine

I will be providing you with strategies we build using the new Dark Pool data, but let’s review exactly what I’m doing to build these money-makers.

A new template will be provided, so you’ll expend minimal effort building brand new strategies. The more strategies the better because it gives more chances for the computer to discover those with the perfect setup…which equals more money in your pocket, more consistently than ever.

For example, going from the old way, multi-strategy trading, to the NEW way, Meta ML, resulted in a 40% boost to CAGR using my strategies of the month.

Lunch Break: Let’s break for lunch as the Divine Engine builds strategies for us

Lunch is on me. Don't miss this opportunity to connect with your tribe, absorb the collective energy, and build a network of Portfolio Boss users who can help you maximize your results and dominate the market like never before. It's a pit stop on the road to riches – a chance to sharpen your edge and amplify your profits.

Session 4: Dark Pool Strategy Review

Let’s take a look at the strategies we’ve built. Which ones to keep, which to throw out. If you’re willing, we can all share the strategies we built in class so we have even more weapons in our arsenal.

Session 5: Building Killer Meta Strategies

Let’s build killer Meta strategies. These are like the conductors of an orchestra, picking which strategies to trade for the month to maximize gains, minimize drawdowns, and boost consistency to a new level. I suspect with the new Dark Pool strategies, you’ll see a serious boost to all three.

Session 6: Using the New Dashboard

An all-new trading dashboard is being built out, so we’ll go over how to use that like a racecar driver looks at his instruments. This saves you time because everything is in one spot inside Portfolio Boss.

Session 7: Auto-trading for Passive Income

Here’s where we dial you in for passive income. Let Portfolio Boss run your account on auto-pilot. We’ll cover order types to reduce slippage…this is very important because the move to Dark Pools is reducing liquidity.

A report by the European Central Bank (2015) summarized academic literature on this topic, noting that some studies argue dark pools remove liquidity and information from mainstream platforms where price formation occurs. This removal can lead to lower depth, increased trading costs, and higher volatility on lit venues.

But if you use the correct order types, we can easily dodge this problem. This is especially true for IRAs, so we’ll go over auto-trading with IRAs as well.

After Hours activities

Depending on the venue, I’ll set up some fun activities after a long, but fruitful and worthwhile day.

Trading Isn't Just Numbers. It's People.

Sure, you can swap tips in online forums. But let's be honest – it's not the same, is it? Clicks and avatars don't build the trust and camaraderie that comes from looking fellow traders in the eye.

We bring ‘Boss Traders' together, in person. To build real friendships, not just usernames. In this strangely disconnected, “always-on” world, finding your tribe – your real tribe – isn't just nice… it's essential. We could all use more of that.

Plus, you’ll be away from all distractions so I can practically do a Vulcan mind meld with you and hook you up with Dark Pool strategies, get your Metas built, and auto-trading into set it and forget it mode*

*Don’t forget to log in once a week.

And studies are constantly showing in-person beats every other metric for learning, retaining what you learned, and completing the job. Let’s face it…it’s way more fun too.

Bonus #1: Dark Pool Strategy Pack (??? value)

My team and I have been building all new strategies with Dark Pool data the past few weeks. You will receive all those strategies built from now through our event in September (for example, the Tesla strategy with 90% CAGR and the META strategy with 60% CAGR).

We are combing through the Top 200 stocks and ETFs in the US by market cap.

You will receive ALL Dark Pool strategies that pass my tests. By the way, here are the results through February 13, 2025 (that’s the cutoff date for our test data):

META/PSQ Dark Pool strategy results. All monthly returns are out of sample

Here’s a brand new AAPL/PSQ strategy created just on dark pool short selling volume. Again, while others will be scrambling, trying to figure out what happened to their volume strategies to the Dark Pool shift, we’re ahead of the game, blazing the trail. Take a look:

Brand new (March 27) AAPL/PSQ strategy based solely on Dark Pool short selling volume

We’ll also have all new Meta ML strategies so you can combine the strategies to work in harmony. This has shown a 40% boost to profits, and a higher percentage of winning months because the strategies aren’t as correlated to each other. This is Wall Street’s one and only free lunch.

LISTEN: Between now and September, my team and I will be working tirelessly to discover every possible way to squeeze the most money out of Dark Pool data.

More importantly, my goal is to combine all of our edges to get as near to 100% winning months as possible.

Yes, that's one of those goals where the status quo might call me crazy…

…but they fail to understand that the more unique trading methods we use, the closer we get to that goal.

Bonus #2: Meta X 2025 ($15,000 value)

I want you to have our best strategies right away, so you’ll have instant access to Meta X 2025 and start making money. It’s a pack of over 60 of my best strategies. It comes with three pre-built Meta strategies to choose from. That way you can get started now. The computer selects the top 10,15,20 strategies to trade every month. Meta ML technology boosts results up to an additional 40%, and it’s only available at Portfolio Boss.

Fast Action Bonus #3: Private calls with me ($7,500 value)

For the first 10 ticket holders…Three 1-hour calls with me. You can schedule calls with me before and after the live event. We typically go over goals, which Meta(s) to trade, multiple account trading. This is where big breakthroughs (and potential fires are put out). I love seeing clients scale their IRA. We’ve got some tricks built into Portfolio Boss so you make money tax-free in minimal time.

Bonus #4: Setup Your Virtual Machine for Auto-trading

This is optional, but after seeing so many natural disasters in L.A, Maui, and the South East, I think it’s a great idea to run your trades off a VM in the cloud. I’ve been doing it for years. The power is always on, they have generators, insane Internet speeds. I’ll have Alexander hook you up with a virtual machine on Azure or Amazon. Imagine having Portfolio Boss on auto-pilot passively making money for you. The monthly fee (through them) is well worth it in my experience. (I once played a round of golf when I relied on auto-trading on my laptop, and it totally crashed, costing me a few grand).

Money-back Guarantee & Cancellation Policy

10-day Guarantee: I want you to feel confident in your registration, and we all know stuff happens. That’s why I’m offering you a 10-day 100% money-back guarantee from the date of purchase.

No-show or Last-minute Cancellations: After the 10-day guarantee period has passed, all sales are final. Like I said earlier, stuff happens. So you can request credit towards the next event, or towards other services such as 1-on-1 with me. I like to be flexible in these situations, and I’ll take care of you.

Event Postponement or Cancellation: The weather here in Newport Beach is nice pretty much year-round. It hasn’t snowed here since 1949. But if something happened like an earthquake, or reasons beyond our control, all purchased tickets will be honored at the rescheduled date. If you are unable to attend the new date, you can request a credit for future programs, services, or events. Again, I’m in this business for the long haul, so I’ll take care of you. We’ve got a 4.8/5 star rating for a reason.

What to do next?

Call Adam, my Director of VIP Client Relations. He’ll also be at the event, so you can finally meet in person. Since I need to know the size of the venue, you’ll get a fast-action discount if you act TODAY. Unite members and private clients also receive a discount. I’ll be raising prices every month starting April 1st because I don’t want to have to keep changing venues at the last minute as more people sign up.

==> Call Adam at: 516-220-8221 <==

Trade smart,

Dan “Prince of Proof” Murphy

P.S. Join me for the first (and maybe the last) live event here in beautiful Newport Beach, CA on September 13th. We’ll be going over our new edge (and much MORE) as the Dark Pool paradigm shift changes how markets work.

Act now because early bird pricing goes away April 1st.

Call Adam: 516-220-8221

Q: Will the event be recorded?

A: Not a chance. Sure, I might have cameras rolling for promotional shots—but the real meat, my Dark Pool discovery, stays strictly off the record. Why? Because 99% of traders out there haven't got a clue what's happening beneath their feet. They’re blind to the seismic shift from transparent lit exchanges to private, hidden Dark Pools—and I'd like to keep it that way.

© Copyright 2025. All rights reserved. Government required disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.