How to Live Your Dream Retirement While Your Portfolio Cruises on Autopilot

Put Agent Alpha on Duty… so Your Strategies Run Quietly in the Background While You Golf, Travel, and Truly Unplug from the Markets

From: Dan Murphy

Founder Portfolio Boss

Newport Beach, CA

Picture this…

You disappear for seven straight days.

You play 18 holes on Monday.

You sleep in Tuesday.

You hit the water Wednesday.

You book the steakhouse Thursday and stay fully engaged.

You travel Friday.

You laugh Saturday.

You come home Sunday…

…and the market never once drags you back to your screen.

Because Agent Alpha clocks in.

He runs your strategies. He tracks positions. He handles the grunt work you used to babysit like a job.

So while you’re out living the retirement you actually wanted… your portfolio can still earn.

And you don’t have to “check” anything.

Agent Alpha emails you one simple report—what it did, what filled, what changed—so you can open it whenever you feel like it… not when the market snaps its fingers.

This week's income? A cool $2,131.65

Not every week makes that amount, but here's the promise:

You live first. The plan runs in the background.

Now let me show you what makes Agent Alpha different from everything you’ve seen before…

What Sets this Apart from Anything Else You’ve Seen?

Let me guess…

You’ve seen a hundred trading “solutions” that all boil down to the same thing:

They hand you signals… and then you still do the hard part.

You still watch, decide, click, second-guess, override, panic, tinker.

So retirement turns into… a desk job with worse hours.

Agent Alpha is different because it doesn’t just talk about trading. It does the trading.

It’s the execution layer—the part that normally steals your time, your attention, and your peace of mind.

And it’s not built on the same tired “indicator soup” everyone else is selling.

Most systems live and die on price-only tricks that get crowded fast.

Agent Alpha runs on uncommon edges—the kind most traders never touch—spread across 20+ strategies so you’re not praying one “hero strategy” keeps working.

Here’s the other big difference nobody talks about:

Real trading breaks. Platforms freeze. Data gets weird. Orders get messy.

Most “systems” pretend those things don’t exist.

Agent Alpha was engineered with that reality in mind—so it can keep its footing when conditions aren’t perfect… and you’re not sitting there playing firefighter.

And you’re not forced to give up control to get freedom, either.

If you want, you can run it in check-then-transmit mode—Agent Alpha builds the orders, you glance, you approve.

Or you let it run hands-off and simply read the email report whenever it suits you.

Bottom line:

This isn’t “trade more.”

It’s **trade smarter… by removing the part humans screw up—execution under pressure—**so you can finally live like you’re retired.

Now the obvious next question is…

What does that do for your money—and your peace of mind?

Freedom!

It’s simple:

You get your life back… without putting your money in timeout.

Because the minute you stop “managing trades” like a job, a few beautiful things happen fast:

➡️You stop waking up to that low-grade stress.

➡️You stop timing your day around the open and the close.

➡️You stop dragging your phone to dinner like it’s a life-support machine.

And instead of trading stealing your attention… your portfolio becomes something you check, not something you serve.

With Agent Alpha on duty, you can finally have what most retired traders actually want:

- You want to protect capital first… not gamble for a great story.

- You want steady progress without the emotional whiplash.

- You want fewer headaches and fewer “what did I just do?” moments.

- And you want the freedom to golf, travel, fish, and unplug—while your money still has a job.

That’s the real win here:

You can be out living the dream… and your portfolio can still be working.

And you don’t have to hover to feel “in control,” either.

Agent Alpha sends you a simple email report—what it did, what filled, what changed—so you can read it at your leisure… in the hotel lobby, after the round, or whenever you feel like it.

No alarms. No babysitting. No market clock running your retirement.

Now—those are the lifestyle benefits.

Next comes the question every smart man asks:

Okay… but does it actually hold up when you put it under a microscope?

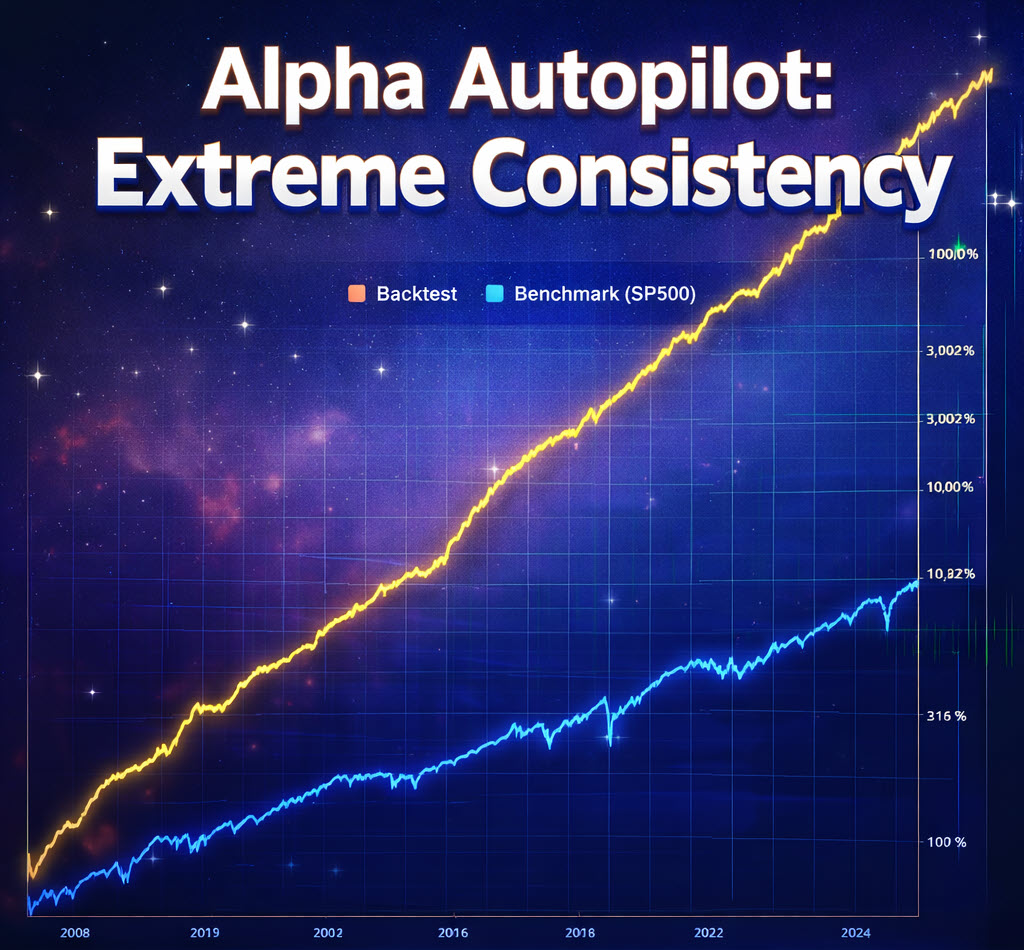

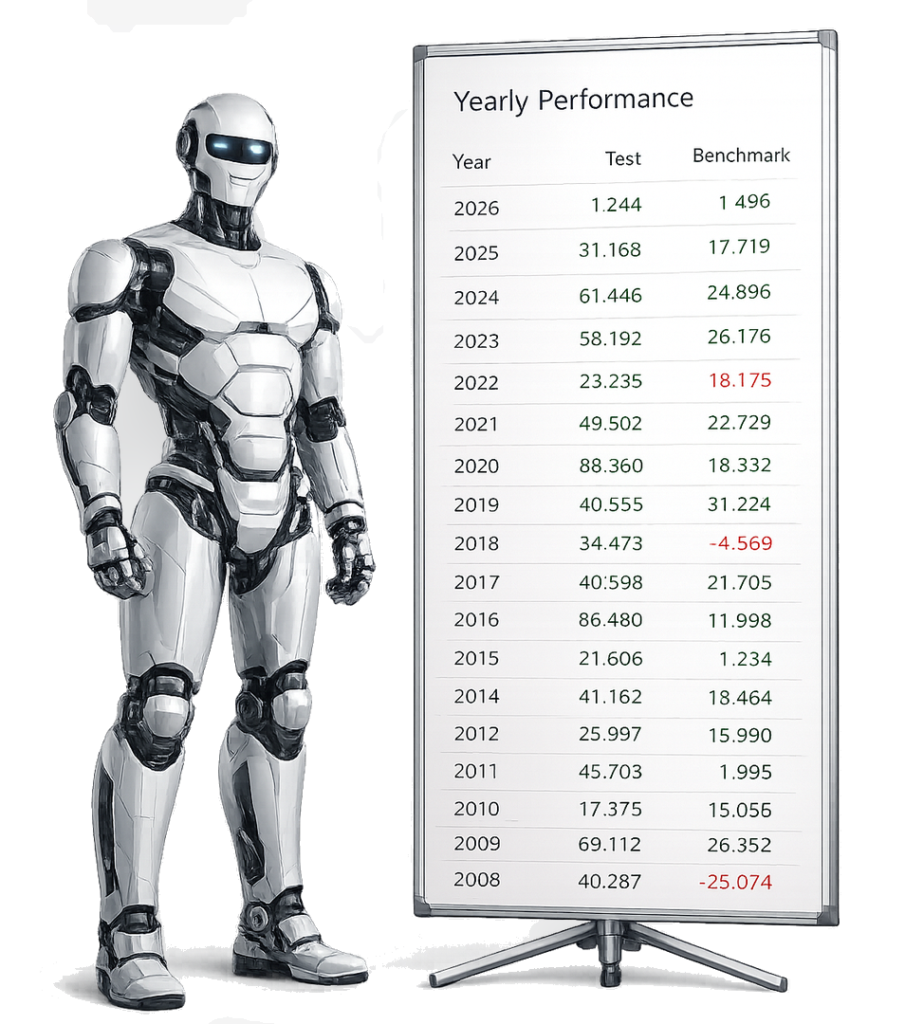

The Numbers: Up to 90% Winning Months, 49% Annual Return, 9% Drawdowns…on Autopilot

Fair question.

Because anybody can talk a good game in this business.

What matters is what happens when you strip away the story… and stare at the numbers.

So let’s do that.

In our historical testing, Agent Alpha has produced the kind of consistency most traders never experience—the “boring” kind you can actually live with in retirement.

Depending on your settings (and how many strategies you choose to run at once), we’ve seen:

- Winning months hit as high as 90% in tests

- Annual returns around 49%

- And drawdowns as low as 9% (again—settings matter)

That’s the difference between a system that gives you a few great months to brag about…

…and a system that lets you plan your life without feeling like you’re walking on thin ice.

And I’m not going to ask you to “take my word for it” with one cherry-picked trade.

I want you to see the whole story—month after month—on one clean curve.

One more thing that matters (especially if you’ve been burned before):

We don’t just run a backtest and declare victory.

Every strategy is machine-built… then double-verified on two separate out-of-sample datasets before it ever earns a spot in the lineup.

Because retirement money doesn’t need hype.

It needs proof that holds up when you push on it.

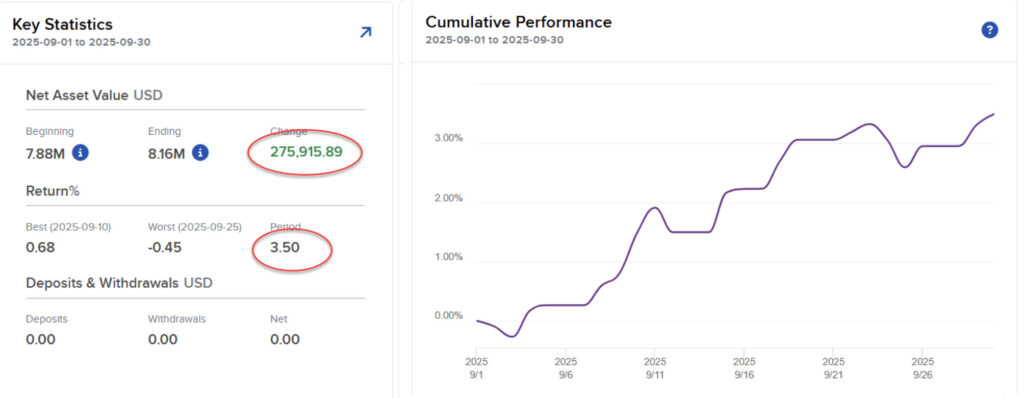

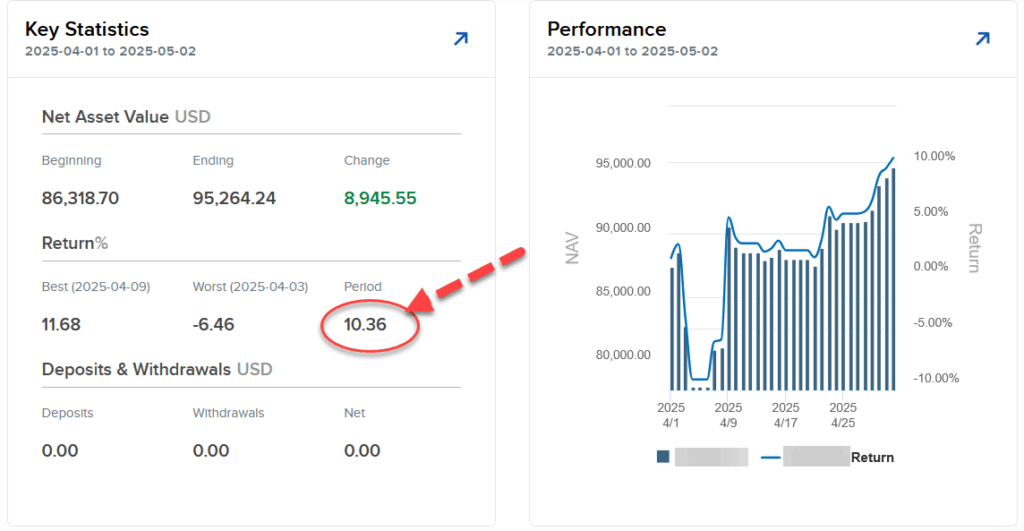

Real Accounts, Real Money on the Line

Back tests help, but how are the results of these edges in the real world where you and I live? Last I checked, you can't go to the bank and cash a backtest.

Here are member's actual brokerage statements:

Russell's account was up 3.5% in September, 2025 while the talking heads said Septembers are down months. Good thing he didn't listen or he would have missed out on $275,915 in gains. (Not typical. He has a large account).

John made $36,028.86 with our strategies. That's a 6.39% gain over a 30-day period.

Yvonne, a brand new trader, was able to bank 10.36% and $8,945.55 during April 2025's tariff fiasco. That's more than her regular job ever paid in a month.

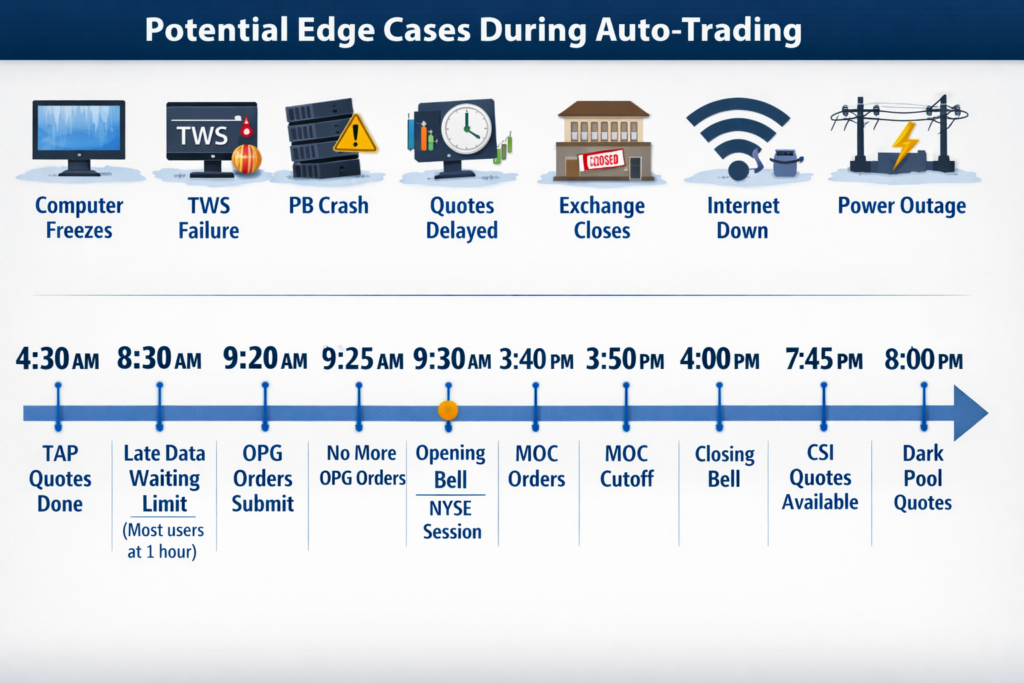

Now… if you’re thinking, “Okay, but what about the stuff that blows up auto-trading in the real world?” — perfect.

That’s exactly what we tackle next.

Murphy's Law

If you’ve been trading with me long enough, you already know the real fear isn’t “Will this make money?”

The real fear is: “What if something goes wrong… while I’m not watching?”

After all, my last name is Murphy. Murphy's Law is anything that can go wrong will go wrong.

‼️What if TWS hiccups.

‼️What if the internet blinks.

‼️What if an order gets weird.

‼️What if I’m on the 12th hole… or 30,000 feet in the air… and the market decides to get spicy.

And there’s another fear most guys won’t say out loud:

“If I automate this… do I lose control?”

No.

When Agent Alpha goes live, you’ll have two ways to run it:

You can run Co-Pilot—Agent Alpha prepares everything, you glance, you hit Transmit.

Or you can run Autopilot—and let Agent Alpha handle execution while you just read the email report at your leisure.

Now about the “what if it starts going sideways?” worry…

That’s exactly why it includes a Dead Man’s Switch—so a strategy that isn’t behaving doesn’t get to keep digging.

And the “what if trading breaks?” worry?

We didn’t build this assuming perfect conditions.

We war-gamed the ugly stuff—disconnects, late data, orphaned orders, platform freezes—because that’s what destroys most auto-trading dreams in the real world.

And if your last objection is, “Okay… but I’m not technical” —

You won’t be left alone with a manual and a prayer. You get a concierge walk-through… plus access to the 100% Club so you’re not figuring this out in a vacuum.

So the real question becomes…

Do you want the market to keep control of your schedule…

…or do you want your portfolio to finally run like it’s got a professional operator on duty?

Attention Tax

Here’s the part most people get wrong…

They blame themselves.

“I’m not disciplined enough.”

“I overthink.”

“I should just be tougher.”

No.

That’s not the real problem.

The real problem is you’ve been handed a trading model that quietly turns you into an on-call employee.

It trains you to believe that “being a good trader” means being constantly available… constantly watching… constantly reacting… constantly fiddling.

So the market’s clock becomes your boss.

And every time you do what you’re “supposed” to do—check, tweak, second-guess, babysit—you pay what I call the attention tax.

Not in commissions… in mistakes.

A late click. A bad fill. A hesitation. A panic exit. A “let me just adjust this one thing” that snowballs into something bigger.

And none of that is a character flaw.

It’s human nature colliding with a machine-speed environment.

You’re trying to run a 24/7 operation with a human nervous system… while the industry keeps selling you “systems” that still require you to sit there and be the system.

So if you’ve ever felt like trading stole your peace of mind…

Good. That means you’re sane.

Because the default way people trade is built to keep you chained to the screen.

And that’s exactly what Agent Alpha is designed to break.

Stop Living on the Market’s Clock

Because this is the fork in the road.

Either you keep living by the market’s clock like it’s your J-O-B…

…or you let Agent Alpha punch the clock and you live your life.

And here’s what makes this decision heavier than most people admit:

Time isn’t just time.

➢It’s the rounds of golf you almost enjoyed.

➢The trips you took with one eye on your phone.

➢The dinners where you were physically there… but mentally at the open.

And every extra month you keep doing it the old way, you keep paying the same hidden costs:

- The attention tax

- The stress tax

- The “human error” tax

Retirement is supposed to be the season where your money works harder… so you don’t have to.

So the real question isn’t “Should I wait?”

It’s:

How many more weeks are you willing to donate to the market’s schedule… before you take yours back?

Why should you put your trust me?

Because I’m not the guy who discovered a “hot setup” last year and slapped a logo on it.

If we haven’t met yet…

I’m Dan Murphy, founder of Portfolio Boss. And before my company ever existed, I did everything the gurus preach…and blew out three trading accounts proving them wrong.

I chased news and got whipsawed.

I covered my charts in Elliott Waves and Fibonacci lines that looked “elegant” right up until they emptied my account.

I tried every indicator mash-up under the sun — MACD, RSI, Bollinger Bands, trend lines… if it flashed on a screen, I tried to trade it.

Options, penny stocks, “can’t-miss” tactics that missed in spectacular fashion.

After the third meltdown, I made myself a promise:

Never place another trade I couldn’t test with a computer first.

I’ve been trading rules-based systems since 1997 — through booms, busts, crashes, and those miserable sideways years that chew up “genius traders” and spit them out.

And I’m defensive by nature. I don’t care about exciting… I care about surviving and compounding. Retirement money doesn’t need a legend. It needs a process that holds up when the market stops cooperating.

That’s why I went down a road most people won’t even start:

- Written four trading books, including The Relaxed Investor (over 500,000 copies out there in the wild).

- Ran the Million Dollar Target project in public—real money, real trades, no place to hide.

- Had my returns audited by an independent CPA before rolling those profits straight back into research.

…and then I put my money where my mouth is and invested $6.2 million building Portfolio Boss and its machine-learning research engine—because I refuse to risk real capital on ideas that haven’t earned the right through testing.

We don’t “feel” our way into trades. We prove our way in.

We chase original research and non-price edges because the obvious stuff gets crowded, copied, and crushed.

And if you’ve ever noticed how Wall Street loves to romanticize guys like Jesse Livermore… that’s exactly my point: dramatic stories sell. But blow-ups are the part they whisper about. In retirement, one blow-up can change your life.

So no, I’m not here to sell you a thrilling trading identity.

I’m here to hand you a machine-built, verified, defensive approach… so Agent Alpha can do the work without you having to live like an on-call employee.

Next question—and this is where it gets practical:

How does Agent Alpha actually work day-to-day?

How it Works: 4 Edges, 24 Strategies, Meta ML Conductor

Here’s what happens behind the curtain when Agent Alpha is on duty…

First, it doesn’t start with, “What does price look like today?”

It starts with edges most traders never touch — because most traders are stuck in the same small sandbox: price charts + common indicators.

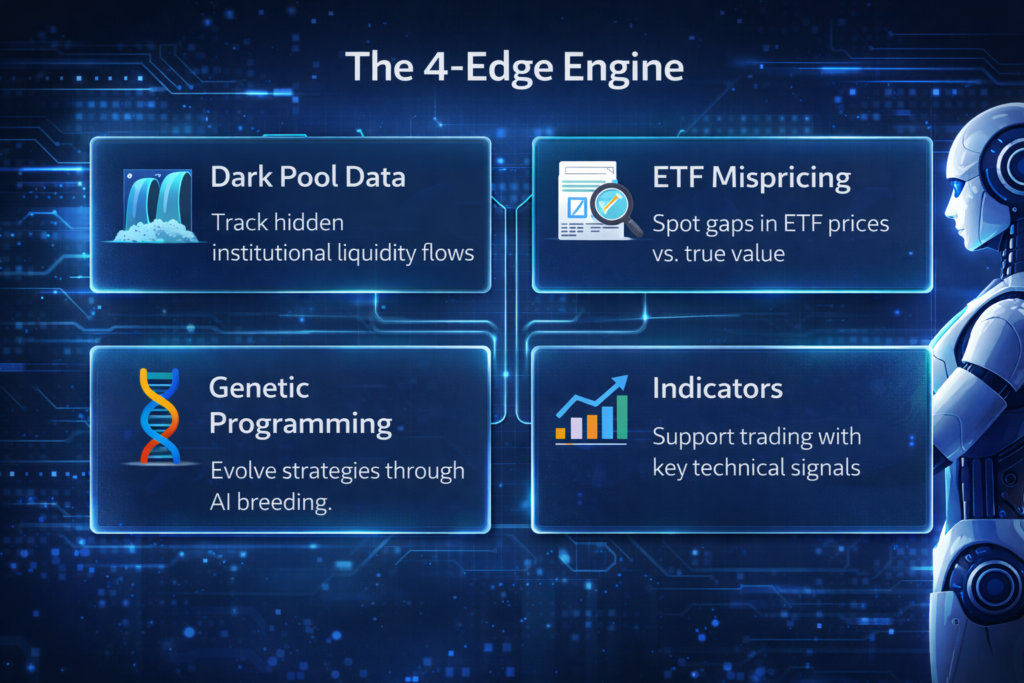

Agent Alpha runs a 4-Edge Engine:

- Dark Pool data — a window into institutional-style activity that doesn’t show up the same way in regular prints. Instead of guessing what the big money might do, you’re tapping a signal designed to track where that “hidden river” of liquidity has been flowing.

- ETF Mispricing data — when an ETF’s market price drifts away from the value of what it actually holds. That gap doesn’t last forever. It tends to snap back. Agent Alpha treats those dislocations like a repeatable mechanical edge — not a “story trade.”

- Genetic Programming — instead of hand-designing one strategy and praying it survives, strategies are evolved. The machine breeds and refines rule-sets the way nature refines traits: keep what works, discard what fails, iterate relentlessly.

- Indicators — yes, they’re in the mix… but they’re not the whole meal. They’re used as supporting structure, not as the fragile “one magic signal” everything depends on.

These edges trade only the most popular and liquid stocks and ETFs like Nvdia (NVDA), SMCI, Bitcoin (GBTC), KLA Corp (KLAC), Etheriem (ETHE), gold (GLD), Tesla (TSLA) and more.

That way you're not trading illiquid penny stocks, volatile options, or risky futures. They can also be traded in an IRA.

Second, Agent Alpha doesn’t trade one “hero strategy.”

It has 24 strategies total — built to behave differently in different conditions. That’s the point: you’re not betting your retirement on a single personality.

And you can choose how broad you want the engine running.

You can trade as few as 5 strategies at once if you want to start tighter and simpler. Hsitorical tests still show 53% annual returns and 80% winning months.

Or, if you’ve got $50,000+ and your priority is stability, lower risk, and consistency, you can run more — even all 24 — because spreading the work across more independent strategies is how you smooth the ride.

Third comes the “conductor.”

Meta ML acts like the conductor of an orchestra: every month it looks at the full lineup and predicts which strategies are most likely to perform best next… then it brings those to the front and sidelines the rest.

Some months, a few strategies carry the melody.

Other months, a different section takes over.

You don’t have to guess. The conductor does.

Fourth, execution is handled through Interactive Brokers — and you choose the comfort level:

- Co-Pilot: Agent Alpha prepares the orders → you review → you hit Transmit.

- Autopilot: Agent Alpha transmits automatically.

Fifth, the Dead Man’s Switch stays on watch. If a strategy starts degrading, it doesn’t get to keep trading out of stubbornness — it gets disabled.

And finally, Agent Alpha doesn’t just place trades and walk away. It monitors positions and orders and is built to handle the edge cases that blow up fragile automation — so you’re not forced to sit there “just in case.”

That’s how it runs like a real operator… not a toy.

Who Alpha Autopilot Is Really For… (and Who Should Skip It)

Let me save both of us some time.

Agent Alpha is not for everyone. It’s not supposed to be.

Probably not your cup of tea if…

❌ You want meme-stock fireworks and casino thrills. If your goal is to brag about 300% overnight wins and you don’t care what happens the next week, you’re going to hate how rational this is.

❌ You refuse to let rules overrule your gut. Agent Alpha, the Dead Man’s Switch, the portfolio rules—they’re there to keep you from doing something stupid on a bad day. If you know you’re going to override them every time your stomach flips, don’t bother.

❌ You’re not ready to treat your trading like a business. Businesses have processes, rules, and infrastructure. If you’re still in “wing it and see what happens” mode, this program will feel like overkill.

Still here? Awesome—because this is who does thrive:

Perfect fit if…

✅ You can comfortably allocate $25K+ and want it compounding, not collecting dust.

✅ You’re tired of single-system roller coasters. You’ve already seen what happens when you bet the farm on one “perfect” strategy… or three “different” ones that all puke on the same Fed day. You want a portfolio that was designed for smooth results.

✅ You think in terms of process, not lottery tickets. You like the idea of a machine that’s been tested, audited, hammered out-of-sample—versus chasing the hot stock of the week.

✅ You want to understand enough of what’s under the hood. You don’t need to derive the equation… but you like knowing there is one. The strategy rules are fully revealed so you’re not trading blind faith.

If you see yourself in those lines, you’re exactly who I built this for.

What happens when you join?

Meet Alpha Autopilot — the complete package built to fund your dream retirement without the daily grind of managing trades.

Let’s do this the right way.

Instead of dumping a pile of “stuff you get” on your lap and making you wonder if you’re signing up for homework…

Here’s what actually happens when you become part of Alpha Autopilot.

First, you’re not buying “a strategy.”

You’re stepping into a complete trading operating system — built so your portfolio can keep working without you living by the market’s schedule.

So the moment you join Alpha Autopilot, you’re not staring at a checklist thinking, “Great… now I have to learn all this.”

You’re thinking, “Finally… this is handled.”

Here’s the experience:

You get the full lineup of 24 strategies…so you’re not betting your retirement on one fragile “hero strategy” You can start with as few as 5 at a time, or if you’re sitting on $50,000+ and you want more stability and consistency, you can run a broader mix, because spreading the load across more strategies is how you smooth the ride.

Then Agent Alpha steps in and does the part that usually steals your life: the execution and day-to-day monitoring. He doesn’t get distracted. He doesn’t hesitate. He doesn’t second-guess. He just runs the plan.

And above him is Meta ML — the conductor. Each month it evaluates the full orchestra, predicts which strategies are most likely to play well in the current environment, and brings those forward. You’re not stuck manually rotating and guessing. The conductor handles the rotation.

Now layer in the part that makes this feel safe instead of scary…

If something starts to degrade, the included Dead Man’s Switch doesn’t “hope it comes back.”

It benches the laggards. That’s how you keep a small problem from becoming a long, annoying drawdown.

And while all of that is running, Alpha Autopilot is also watching the real-world stuff that breaks most automation — positions, orders, edge cases — so you’re not sitting there like an unpaid hall monitor “just in case.”

Finally, the human side: you’re not left alone with a PDF and a prayer.

You get Concierge Setup, so we walk you through getting it running correctly.

You get a live group training class with me on Zoom, so you understand what you own, how it behaves, and how to run it with confidence.

You get access to 100% Club, so you’re surrounded by people doing the same thing (instead of trying to figure it out in isolation).

You get access to the Divine Engine strategy builder so you can build strategies — just like me — if you want to. All four edges including Dark Pool data, ETF mispricing, indicators, and cyber code with easy to use templates.

You get Strategy Mill access, so you can copy & paste hundreds of tickers into Portfolio Boss and have it automatically build strategies across the entire list…hands-free.

And yes—quotes and continuous software updates are included so the system stays current.

Recap of What's Included:

- Agent Alpha + 24 Strategies… $15,000 value

- Meta ML Conductor… $2,000 value

- Dead Man's Switch… $1,500 value

- Concierge Setup… $300 value

- Live Zoom Training… INCLUDED

- 100% Club Access…. INCLUDED

- Divine Engine Strategy Builder… $2,500 value

- Strategy Mill Access… $500 value

- Quotes + software updates… INCLUDED

Total Value: $21,800

Yours today for: $12,500

But right now—because we’re opening this as a pre-release Founders Membership—you receive an instant $2,500 discount until the countdown timer hits February 21st.

-$2,500 Founders Discount

$10,000 one-time investment.

And one more option, because Alpha Autopilot is new and we’re building the first wave of real-world stories:

If you’re willing to be a documented case study — meaning we capture your setup process and your experience using Alpha Autopilot (and we only share what you approve) — then the Founders investment is discounted even further (call Adam 512-220-8221 to discuss).

That’s for a small group. It’s not for everyone. But if you’re comfortable being featured, it’s the best deal.

Also: if you’ve earned store credit from referrals or prior purchases, you may qualify for further reduction of what you pay.

So what’s the next step?

You call Adam, my Director of VIP Client Relations. 516-220-8221

Adam will make sure you’re a fit, help you pick the right starting setup (5 strategies vs a broader stability approach), apply any credits you have, lock in the best pricing you qualify for, and get you scheduled for concierge setup and the live Zoom training.

One call… and you’re on your way to the whole point of this product:

Making money while you live the dream—without turning trading into your new job.

Call Adam now: 516-220-8221

Are You Ready for Your Dream Retirement?

Let me bring this back to where we started…

That week you wish you could take—without sneaking peeks at futures in the hotel lobby.

The round of golf where you’re actually present on the back nine… not half-thinking about your positions.

The fishing day where your phone stays in your pocket.

The dinner where you’re laughing… not “just checking something real quick.”

Because that’s the real cost nobody puts on the table:

It’s not just money.

It’s your retirement lifestyle getting quietly swallowed by the market’s clock.

And if you’re thinking, “Yeah, but what if autopilot goes sideways?”

Good. That’s a smart question.

That’s why you don’t have to start hands-off.

You can begin in Co-Pilot mode—Agent Alpha prepares everything, you review it, you hit Transmit. You ease into it with your eyes open, at your pace, until you’re comfortable.

So what do you actually have to lose?

Worst case? You take a serious look, talk to Adam, and decide it’s not for you.

But the bigger risk—the one that sneaks up on a lot of retired traders—is this:

➢You do nothing… and a year from now you’re still living the same way.

➢Still “managing” trading like it’s a job.

➢Still paying the attention tax.

➢Still planning life around the market instead of the other way around.

And the kicker?

Those are the exact years you can’t buy back.

Now, financially, we’ve made it dead simple:

If you want to own it, the lifetime license is $12,500.

-$2,500 Founders Discount

$10,000 one-time investment

Until the countdown hits February 21st.

If you’re willing to be a documented case study (only what you approve), it’s even less (call Adam 516-220-8221 for details).

If you’ve banked credits from referrals or past purchases, you may be eligible to knock the price down even more.

So the decision really isn’t complicated.

Either you keep punching the clock…or you put Agent Alpha on duty inside Alpha Autopilot…

…and you finally let retirement feel like retirement again.

If you want to lock in Founder's pricing (or see if you qualify for the case study price), call Adam.

He’ll walk you through the best starting setup, apply your credits, and get you scheduled for concierge setup and the live Zoom training — so you can stop “running trading”…

…and get back to running your life.

516-220-8221

Read What People Are Saying

Trade smart,

Dan Murphy

P.S. The promise is simple: you get to live your retirement and keep your portfolio working. Alpha Autopilot is how that happens—Agent Alpha executes, monitors, and reports… while Meta ML picks which strategies to trade so you’re not guessing, rotating, and babysitting.

You can run as few as 5 strategies to start, or if you have $50,000+ and want smoother consistency, you can run a broader mix—up to all 24—for more stability. And the results we’ve seen in testing (settings matter) are exactly why this matters: ~90% winning months, ~49% annual returns, and drawdowns as low as ~9%.

P.P.S. Founder's Membership is $10,000 through February 21st. When the timer hits zero, that price disappears. If you’ve got referral or prior-purchase credits, you may qualify for further discounts — so ask Adam to run the numbers for you.

Call Adam now: 516-220-8221.

LEGAL & EARNINGS DISCLAIMER

Past performance does not guarantee future results. Trading involves risk, including the possible loss of principal. Examples are provided for illustrative purposes only and do not represent a guarantee of returns. The Alpha Autopilot™ service is educational… it does not provide personalized investment advice. Consult your financial professional before investing. All trademarks are property of their respective owners

Government required disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.