What is going on? Well, it's been a long time since I've done a podcast. And I'll tell you what? Something

marvelous happened, and so I'm not going to do my usual rigmarole. We're actually going to get right into

it. And I want to tell you some behind-the-scenes things that happened in the past few months. I have

decided to totally revamp the show when it comes to artificial intelligence, trading, and building trading

strategies that work very well. Not only these backtests, but in the future as well. I'm going to start (this

is basically the reboot of the show), talking about Bitcoin.

Oh boy! Yes, it's all the rage right now. Here it is, March 2021, and I think it's been on fire. Of course,

there are lots of reasons to get in with the money printing, and so on and so forth. But I want to tell you a

story about what happened. I was very content to keep on doing the show, and we have built all these

trading indicators. Then the artificial intelligence the machine learning with evolutionary search

algorithm goes in and just breeds together producing the best strategies and kills off the rest using

traditional trading indicators.

Well, I'm calling right now the death trading indicators. So, I appreciate John Bolenja, and a lot of those

guys that were here before us. We do stand on the shoulders of giants, but something amazing has

happened. I call it “cyber code”. What is that? Well, the computer… the AI in the cloud, we have 3500

cores now, actually builds trading strategies using “C-Sharp Code.” That is C-Code from scratch, no

indicators, it puts all this stuff together by itself.

What a heck of an adventure it's been over the past few months getting this all tested and activated, and

getting to a point where I really trust it now. Because, as Elon Musk said; “you know they could be like

summoning the demon.” Now, there is a big insight that I can tell you right now before I get into this

bitcoin strategy.

What we’ve actually found…it’s really knocking my socks off and is really amazing. Now of course Elon

basically says; “well, you know when you have the artificial intelligence… unless you can completely

encase it in all these different rules that it oftentimes will do things you didn't mean for to do.” And I

think maybe it was Nick Bostrom, one of those guys that actually set… had an analogy about telling a

superintelligence that you wanted to make as many paperclips as possible, as efficiently as possible. And

then it turns the whole earth and the universe into paperclips, right? So that's kind of an extreme

example, but it's kind of interesting nonetheless and for a while there that's what I was finding, and so we

had to go through discover where it could mess up and do things that you don't want us to do. And have

special rules in place to go ahead and keep it trapped in that sandbox of what you want, right?

Not that this thing is going to escape and form some kind of “Skynet” or something like that. Well, that's

not what's going to happen. But we want to do things that make sense, right? Now, one of the things

about cyber code that I can reveal is that I’m glad that we didn't go towards neural networks, because of

the whole summoning the demon thing. We really were able to look in there, I don't know-how in the

world you can get really good out of sample test results, it must be really complicated because some people

are doing it in hedge funds and so forth but these neural networks I can see why they're overfitting to the

past and very rarely will work with data going forward. Unless you're you know really doing some insightful stuff.

Now here's the reason why. Well, what we found was that when we use real prices, instead of adjusted

prices that account for corporate actions and so forth, you know like stock splits, dividends, things like

that. That it could actually exclude periods of backtests mostly when you are doing a single example like

we're doing here with bitcoin you know when you start trading a basket of hundreds or maybe even

thousands of stocks that pretty much disappears. But nonetheless, I found it to be very fascinated.

So, Ok… Let's talk turkey, let's talk Bitcoin, we'll get right into it, we will jump right in with both feet here.

What the heck is this thing doing that's making the moolah?

So, I'm going to go ahead and I'm going to enable this divine engine here which is the boss, as I think I

caught the super AI strategy builder, and as I said in the beginning of this, we now are up to 3500

computer cores, which cost me an absolute fortune every month with Microsoft. You're welcome Bill

Gates, as if you're not making enough with the vaccines and everything else. Anyways… oh I should say

that word, and now I'm going to get banned. Ok, hopefully, I said it fast enough to escape the tractor beam

of deletion here. Ok, so I'm going to show you something that's really wild, it is going to look kind of

confusing on a computer screen at first. I promise that people this is my version, so it's not going to look

like this when it comes to commercial, but I just want to kind of show and share with you what this cyber

code generator looks like.

Some of the stuff behind the scenes to where I'm so glad that we are not using neural networks, so it

looks like a bunch of gobble ego here, kind of interesting stuff. And then I'm going to share with you what

the edge is, that it found which is really cool. And we can see here that there is this adjusted open high

low close, and all that. And I have zeroed open, high, low, and close, because we found that it was

summoning the demon. So there's your case in point, and we have all these different probabilities for

choosing different mathematical expressions, things like this. This is all behind the same stuff that no

one's going to have to worry about when it comes to the commercial version. You know like Max

operation chain length and that's how many different loops that we could have, and boy… good thing that

my team combined is a whole lot smarter than me, that's for sure. And they took this and ran with it in a

great direction that really made a whole lot of sense to me.

But what is the edge in that chart that we're looking at? Well, one of the new data inputs that were we

have, and we're going to have a whole lot more going forward is the premium of the Grayscale Bitcoin

Trust, to Bitcoin itself. Now normally that trades at a nice premium, and basically one of the rules was

looking at the overvalued amount of premium. So, when the premium got too high, it's time to sell out of the

grayscale which is what this is trading. If you look at the symbol here, it's the grayscale GBTC greyscale

Bitcoin trust, which you can trade in most stock trading accounts… not on… it's over the counter at this

time, and it will not trade on Robin Hood, but Interact with Brokers and so on, and so forth. You could

trade it pretty easily just like it was a stock or an ETF.

So that's cool, you know it's on a bicycle right now as of March here, interesting… And to me this makes a

whole lot of sense as out of… what was it? John McAfee was saying that he would eat his sing-song on

national TV. if Bitcoin didn't hit a certain price. This makes a whole lot more sense to throwing out dumb

predictions, I hope he got some catch up with that at least and so we can see a bunch of trades on here

and really it's one of the big factors especially when it comes to selling, is when there's too much

premium. So that actually makes rational sense right when the premium is too high then you go ahead

and sell out of your position. Of course a lot of the secret sauce too in this is the when you buy. And you

could see this is actually pretty rock steady in a lot of its trading here. And it makes you think… here's

this big decline, I'm showing right here in 2020, it sees a quick buy signal and it sells out and lets a sucker

decline for quite a ways before getting in.

Well, here’s this one; in June 2020 great buy signal, and then sells very much near the peak over there.

And that's really the power of not using trading indicators anymore, what I've seen on a lot of different

strategies is I don't want to give too much away on this to his podcast. But what was really interesting to

me was that a lot of trigonometry would come into play, late sign, and co-sign, and a lot of those different

function exponential function square roots would be all part of the mix. Let me show you a

demonstration here Savva code, kind of what it looks like here. Some to get back into strategy

management here in portfolio boss…

All right, and we'll just find something pretty simple here, maybe a big bit Suzy Q. I think I was having fun

the other day. But this one unfortunately I couldn't put my stamp of approval on because it did have that

summoning of the demon I believe in the 1st few years, maybe months or years of trading or something

like that would decline, where it was using real prices and set up an adjusted or it just at prices so I had

to step back for a while from this whole project and this kind of let it marinate a little bit my head and

then come back at it full force while the guys in the background all the engineering team was kicking

some gluteus maximus.

Let's go have a look at it and see what is what exactly is this cyber code? Well, like I said, it’s C-Code. It’s

got these variable declarations, right? There are billions of statements, right? Adjusted closes, is less than

equal adjusted close and that's true. But some of it doesn't make sense, we still need to clear up what are

called introns, so they are just you know useless code bloat that doesn't do anything right. So that's on

the high priority to do list for sure. But you can see they’re all kinds of mathematical adjustments. It still

does some weird stuff in this particular trading strategy, you know it doesn't make any sense to compare

the close with the volume or the low with day of the week. So there's still some introns that we need to

get out of here. But overall, this is what it looks like.

So it's indicator-less trading, it's coming up with a computer code by itself. And it uses decision making

and if something doesn't work, it’s killed off. And then over time and we have lots of things, we’re sure

we don't get too much code bloat and things like that. Well over time, this thing is building amazing

trading strategies, and one of the reasons I think that I want to share with you the bitcoin strategy is it

was impossible for me after several tests and you don't want to keep on going crazy with overfitting

Intel, you finally get something that works out of sample, because you know if you start doing thousands

of tests, eventually your added sample is going to be good, but based on just random probability. Doesn't

mean in the future that you and I will… but it is going to be a good thing, right? But very interesting to me

that what this is doing that we can go ahead and breed trading strategies using computer code, c-Code

instead of pre-built indicators… and here's a big reason why is you know I am not a believer of tabula…

like you know a blank slate theory that human beings can be just brought to think anything.

Now, we do have instincts just like other mammals, asking mother and her suckling baby, and so it's

really important to me that we have something that doesn't have any internal bias. I looked in Wikipedia

and human beings have 99 biases. Whereas c-code, (which I'm just calling it for fun… sounds kind of cool

right? So futuristic Star Wars and Star Trek kind of thing) so I'm calling the c-Code cyber code because it

sounds cool, and it doesn't have any biases. So let’s just throw everything at the wall to see what finally

sticks. So right away, within the very 1st push of the button, it did find good strategies for trading

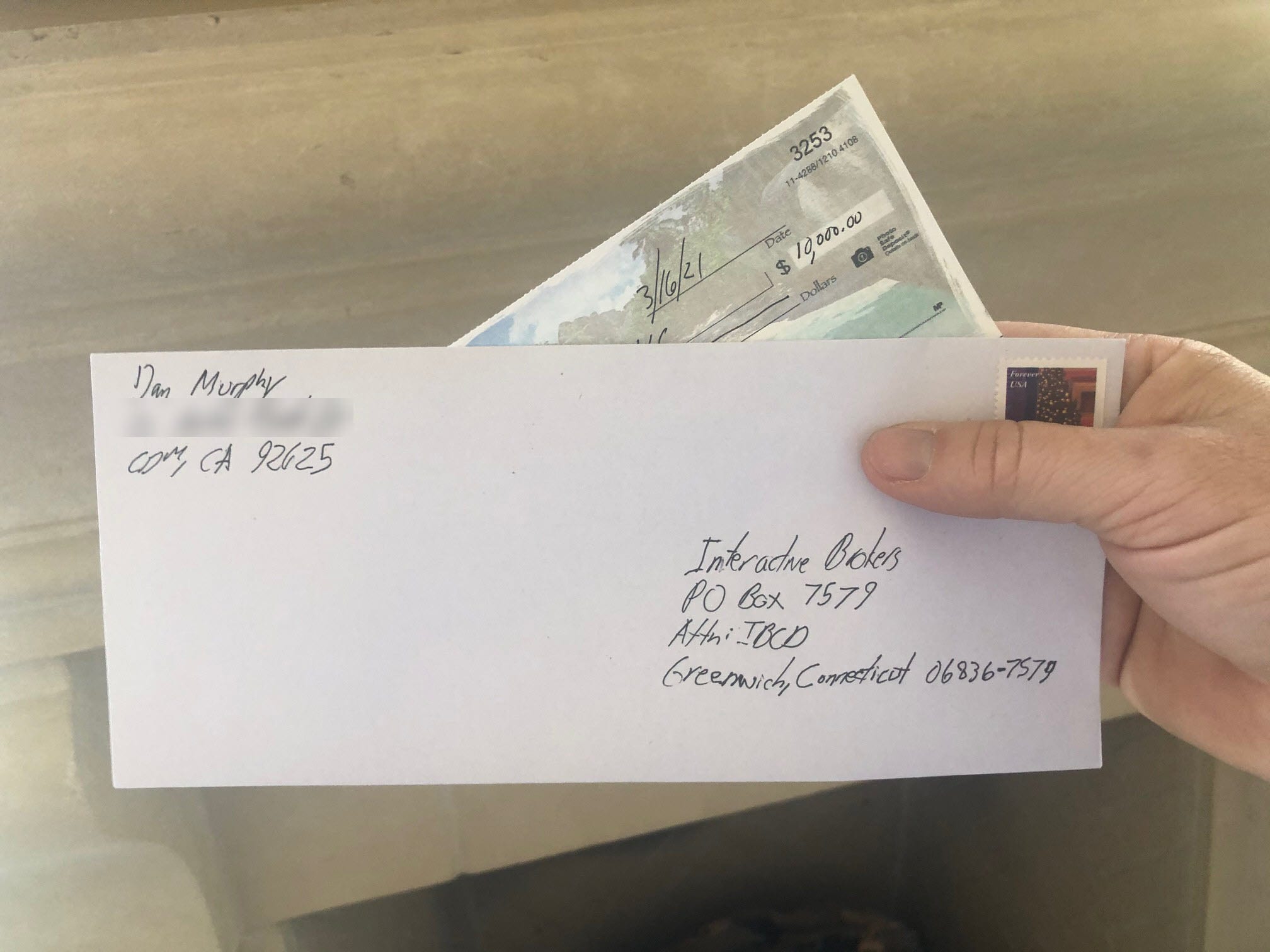

bitcoin. They work really well out of sample as well as in the sample. I actually put up just a little bit of lunch

money here.

I'm going to start trading this strategy with real money, and you know it’ll be kind of fun to kind of report

back and see how we're doing. And in every episode of this podcast which I promise now, that I've kind

of figured things out, and we just leapfrogged the industry here. I'm going to go ahead and start doing

more of these because I think that we could even revisit some of the old strategies that we developed

before and you know the sky's the limit at this point. This is looking really cool, and the development

costs a whole lot of money (well into 7 figures on this whole thing) but it looks like the fruits of

everyone's labor is sure paying off. But anyway, so that's enough from me, you have a great day, make a

whole lot of moolah, and just crush it in the markets, and I'll catch you later.

This is Dan Murphy, sign it out.