Attention: If You're Trading with More than $50,000 this Letter was Written for YOU!

"It's a Trading Miracle!"

"World's Most Stubborn Trader" Loses 17 Years in a Row...

And Thanks to a Little-known Bible Verse, He Went on to Place Bronze in a Trading Challenge (out of over 17,981), Make Back the $351,000 in Losses, and has Profited Every Quarter Since.

Here’s How to piggyback off his success and launch your own Automated A.I Trading Juggernaut for Under $300…

Over the next few minutes, I’m going to reveal the secret about how I went from losing money 17 years in a row to taking 3rd place in a trading challenge with over 17,981 contestants.

That way you too can have a fighting chance at making serious money in the markets even if you’ve spent years losing like I did…

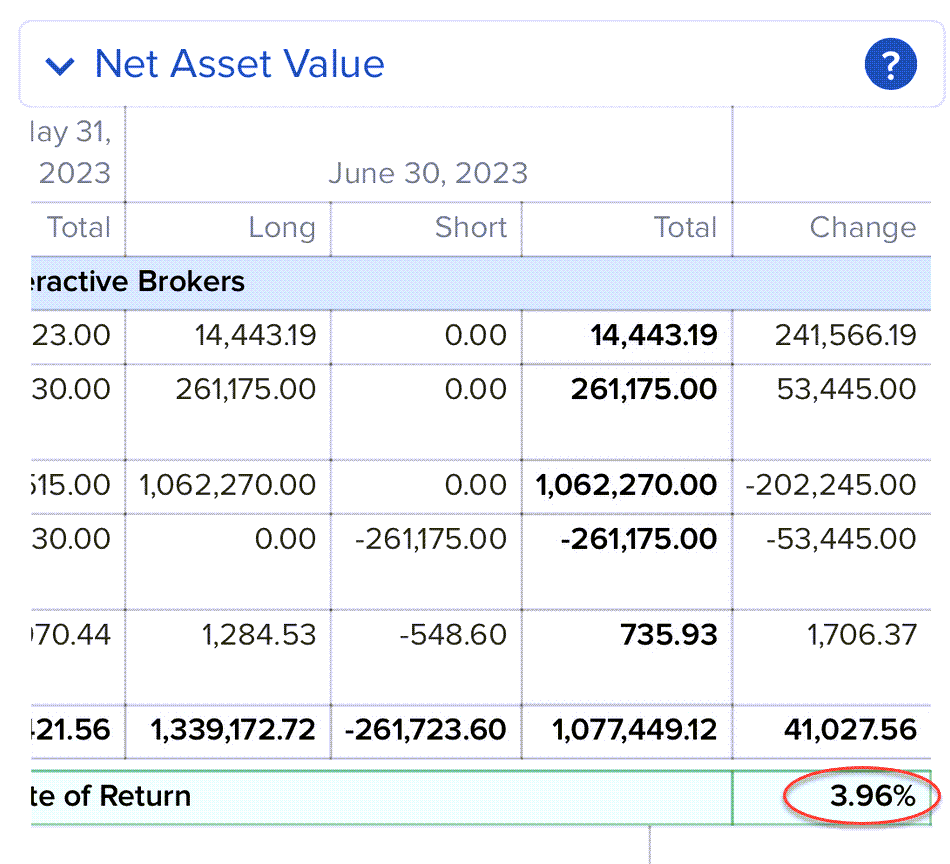

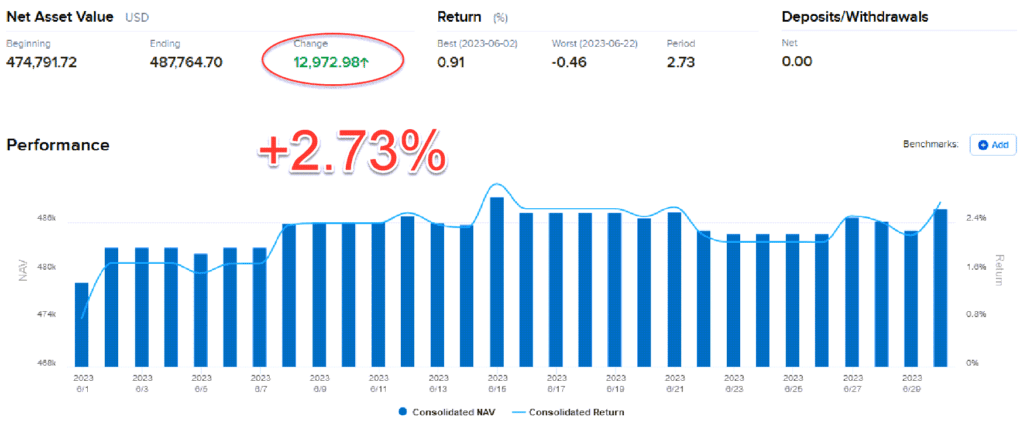

Fundseeder results. 3rd in accounts over $500,000

…and I’ll show you how to get started for under $300.

Not only did I make back the $351,000 in losses over that terrible 17-year stretch, I’ve been making money every single quarter since.

Here’s proof from my audited $618,000 account at Fundseeder:

And thanks to a spark of inspiration from the Holy Bible and its strange connection to three revolutionary breakthroughs (which I’ll reveal in a minute), I suspect I’m going to win virtually 100% of months going forward.

What’s the secret to this trading miracle?

As you might suspect, I’m stubborn as a mule.

Thankfully so because that allowed me to try everything under the sun to figure out what doesn’t work…before finally stumbling upon the insights that I’m about to reveal to you.

I know it sounds inconceivable to have such a dramatic turnaround after a 17-year losing streak.

Heck, I have to pinch myself to believe it’s true.

The Story I was too Embarrassed to Tell...

Back in the old days, I was just another cog in the relentless machine we call the stock market.

From the moment I had thrown myself into the crazy world of trading, I was trapped by the allure of financial freedom.

It was a heady mixture of optimism, naivety, and sheer determination that guided my every step.

The beginning was not too different from anyone else’s. I was seduced by the glut of newsletters, promising quick riches, and revealing ‘secret' strategies that would pave the path to untold wealth.

They spoke in hushed whispers of impending boom and doom, promising inside information to anyone who'd pay their fee.

I was enamored by their confidence and plunged headfirst, the weight of my dreams dragging me deeper into the abyss.

Like most, I lost money.

My next victim was binary options, presented as the magic bullet to my financial woes. They were shiny, new, and intriguing, with just two potential outcomes: earn a fixed amount or lose a fixed amount.

It was the simplicity that got me… it was almost too good to be true. The flame of hope reignited within me, promising a brighter future. But as the flame grew, so did the shadow of disappointment.

Once again, I lost money.

Not one to be deterred, I decided to tread the waters of Elliott Wave Theory. It was pseudoscience, yes, but I had seen others make it work. Or at least, I thought they had.

The patterns were confusing, like reading hieroglyphics without a Rosetta Stone, but I was determined.

You guess it. I lost money.

I studied charts until my eyes ached, trying to discern patterns and predict the market's next move. But no luck… each prediction proved to be more inaccurate than the last.

The relentless wave of losses battered my spirit, and yet I clung on, hoping for a change of tide.

Gann charts appeared as my next savior. They carried an air of ancient wisdom, promising to unlock the mysteries of the market through geometry. The theory seemed implausible, but it was the unlikeliest of methods that often worked. Or so I thought.

The reality, however, was less forgiving. As the losses piled up, my dreams of financial freedom seemed more like a mirage, shimmering tantalizingly in the distance but remaining ever out of reach.

Yup, I lost money.

Economic data, Fed’s minutes, every potential clue was scrutinized, dissected, and agonizingly pondered upon. Yet, the only constant in my life was the inevitable disappointment that followed each investment.

Each loss was not just a reduction of numbers in my trading account, but a blow to my self-esteem.

I lost more than just money, I lost sleep, I lost peace, and most damningly, I lost myself. I was spiraling downwards, drowning in a sea of despair.

During those dark times, I felt the chilling shadow of failure constantly looming over me. The whispers of disappointment echoed in my ears, while the disdainful looks from my gym clientele seemed to sear my skin.

I was not the charismatic, confident gym owner anymore. I had become distant, aloof, lost in my own world of misery.

Will She Take the Kids and Leave?

The thought of my young children's futures, potentially ruined by my failures, was a weight too heavy to bear. I feared my wife would take the kids and leave, tired of the relentless cycle of hope and disenchantment. The look of disappointment on her face was a constant reminder of my failures.

Then, one day, as I was mired in despair, I stumbled upon a webinar by Dan Murphy, the founder of Portfolio Boss. He stood out to me. Not just because he published three books on trading, but because he showed his monthly brokerage statements as proof he knew what he was talking about.

I listened intently as he spoke about how they were using their $4 million supercomputer network to build trading strategies with AI.

“You’re not going to get rich trading one strategy,” he said.

“You get rich by trading dozens of them. That way when some fail, the others pick up the slack. Even the best strategies can churn sideways for a year. Most traders end up quitting within six months without seeing a new high-water mark. They’ve simply been burned too many times to stick around.”

His words were a beacon in the dark, promising a way out of my misery.

However, years of disappointments had hardened me, and I found myself skeptical, teetering on the brink of clicking off the webinar, and going back to the drawing board.

Just then, a Bible verse flashed across my mind:

Ecclesiastes 11:2 NIV

“Invest in seven ventures, yes, in eight; you do not know what disaster may come upon the land.”

It seemed like a divine intervention. The biblical advice was clear – don't put all your eggs in one basket. Diversify.

The synchronicity of Dan's advice with this verse was uncanny. He wasn't peddling another one-trick pony, but emphasizing the importance of multiple strategies, of diversification.

I decided to stick around, to listen to his words of wisdom, hoping they could prove to be my salvation.

Even though he was talking to an audience, I felt like he was talking directly to me.

Do You Have Any of These Symptoms?

He asked the following:

- “Are you afraid to open your monthly brokerage statement?”

- “Are you constantly hopping from opportunity to opportunity?”

- “Do you find yourself constantly watching the news or checking quotes during the day?”

- “After a winning month, do you end up giving back all your profits and then some?”

- “Do you hold on to a loser, and think to yourself: ‘I’ll sell when I get back to breakeven?’”

Every time he asked a question, I found myself nodding my head “yes” in response.

The Diagnosis…

He said something that will always stick in my brain like glue:

“If you have any of these symptoms, it’s because you suffer from Performance Mismatch Syndrome (PMS). That’s where there’s a massive gap between the results you were promised, and your actual trading. The bigger the gap, the worse you’ll feel. The worse you feel, the more likely you will quit and move on to the next thing.

I'm not saying you're an opportunity seeker. If you could punch in a couple numbers and $100 bills spit out of your computer every single time like an ATM, then you would punch those numbers in from here to eternity. You would never look for another trading method.”

He continued:

“What inevitably happens is that you trade a strategy or some guru’s picks for a while, then you end up quitting after a few months when it goes on a losing streak. Then you hop to the next strategy, and the next, and the next because none of them match what you expected. Pretty soon, your account looks like this:”

“So, the most important thing you can do as a trader is close the gap between expectations and reality. You do that by getting as close to 100% winning months as possible. I’ve been developing trading strategies since 1997. Hundreds of them on just about every market you can imagine. Even the best strategies can falter for six months to a year.

One of my oldest and most popular strategies, the Smart Money Indicator, has 68% winning months. It has outperformed the markets since 2006. Yet for many, it's impossible to stick with it, so you’re off to the next strategy, and the next, and the next.”

Dan’s words of wisdom hit me like a freight train. There I was, laid bare by a man I'd never met in person, my failures dissected and exposed for all to see.

My journey had been one of hoping, guessing, jumping from one “foolproof” method to another. In Dan's voice, I could hear the echo of my own past mistakes.

The Solution

Dan continued, “Your trading is not a game of chance. It’s not about hope, fear, or greed. It’s about making money as consistently possible. Think of having 100 traders on your payroll. You would track their performance, right? If they sucked, you would fire them. If they do well, you would give them a raise. Now instead of hiring traders, you create 100 AI trading strategies. They work for you five days a week. They all have a proven edge. You know all their stats. They never call in sick, and they never complain. If they stop performing, you fire them. Now that’s a trading business.”

That’s when the 1000-watt light bulb turned on for me. I had been looking for the “Holy Grail” strategy to match my expectations. But that simply doesn't exist.

What I needed to do was trade dozens of strategies at the same time. I needed to treat trading as a business — minus the time commitment and all the headaches.

Embracing Dan's advice was not easy. I was breaking away from years of ingrained habits, charting a course through unknown territory.

But the promise of salvation, of financial freedom, was a powerful motivator. I clung onto his words, and soon, I found myself a beta tester of his software.

So I got to work.

Now this is total overkill, but over a period of 9 months, I ended up creating 189 trading strategies using his supercomputer.

Keep in mind I’m not a programmer.

The AI builds them from scratch. In fact, Dan informed me that I used 410,000 hours of compute time. That’s like setting up a normal desktop computer to crunch numbers for 46 years.

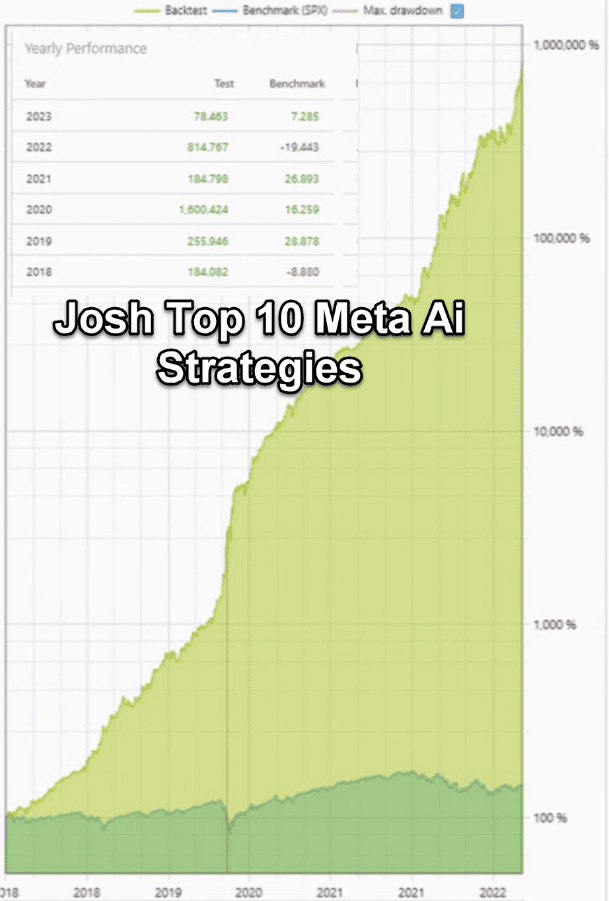

Here’s a backtest of what it looks like to trade them all at once. Don't worry, there's a new invention that allows you to trade a small amount of strategies with the same benefits. More on that in a minute:

That's an amazing 60.7% annual return with a tiny 3.4% drawdown.

What you may not notice from the chart is that the test shows 89% winning months. That's a massive jump in consistency.

For comparison, the S&P 500 has gone up 62% of months since 2000, and has experience up to a 58% drawdown. No thanks!

The Turnaround

The turnaround wasn't immediate…but it was much faster than I could have hope. With each step, I journeyed further away from my past failures.

With time, my losses turned into profits, my debts into assets. I not only recovered the $341,000 I had lost over that 17 years of agony, but I started making money every year, every quarter, and getting closer to my goal of making money every month.

My life now is nothing short of a dream.

The whispers of disappointment have been replaced by words of admiration. My gym clients no longer find me distant — they find inspiration in my journey. My children's future is secure. Their college funds are steadily growing.

The relief in my wife's eyes is a sight I will cherish forever. The shadows of doubt and fear have been replaced by the light of success. We now indulge in the luxuries that seemed impossible in the past – fine dining, vacations, a sense of security.

Every month, I take a portion of my profits, celebrating my victory over my past failures. Each dollar spent is a testament to my transformation, a testament to the power of diversification and perseverance.

Reflecting on my journey, I can't help but be reminded of the biblical verse that turned my life around.

“Invest in seven ventures, yes, in eight; you do not know what disaster may come upon the land.”

It now serves as a testament to my struggle and eventual success. From the depths of despair to the heights of success, it has been an arduous journey, but every step was worth it.

The biblical verse that had once been a lifeline is now a guiding principle, a reminder of the power of diversification. Today, I am not just a successful trader but also a beacon of hope, a living testament to the transformative power of perseverance and the right guidance.

My journey is a testament to the fact that anyone, no matter how down on their luck, can turn their fortunes around.

All it takes is the courage to step off the well-trodden path, the persistence to keep going, and the wisdom to seek guidance when lost.

I want you to experience a dramatic turnaround in your trading. I want to pay forward what Dan did for me.

That’s why I’m going to show you:

- The BIGGEST edge for trading nearly every market…that you’ve never heard of. Without this, I would have been stuck in mediocrity instead of at the top of one of the most popular trading competitions.

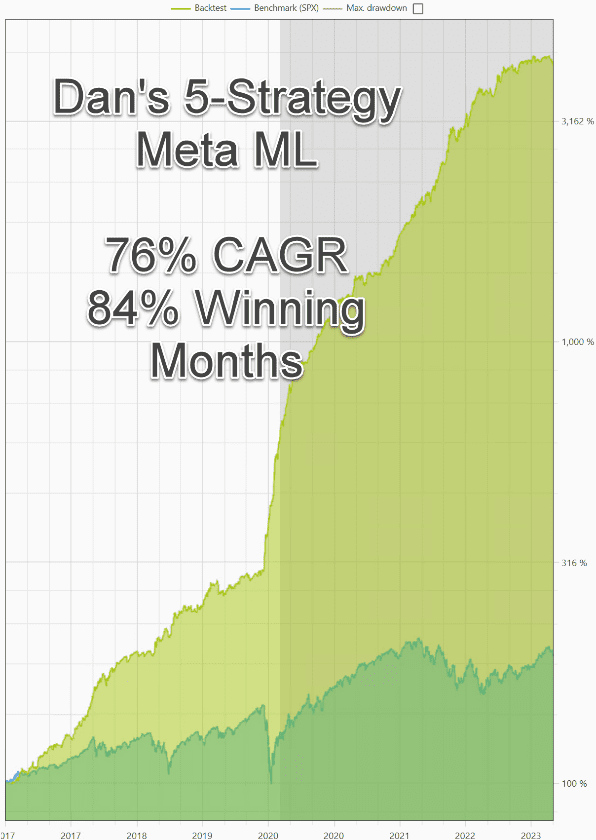

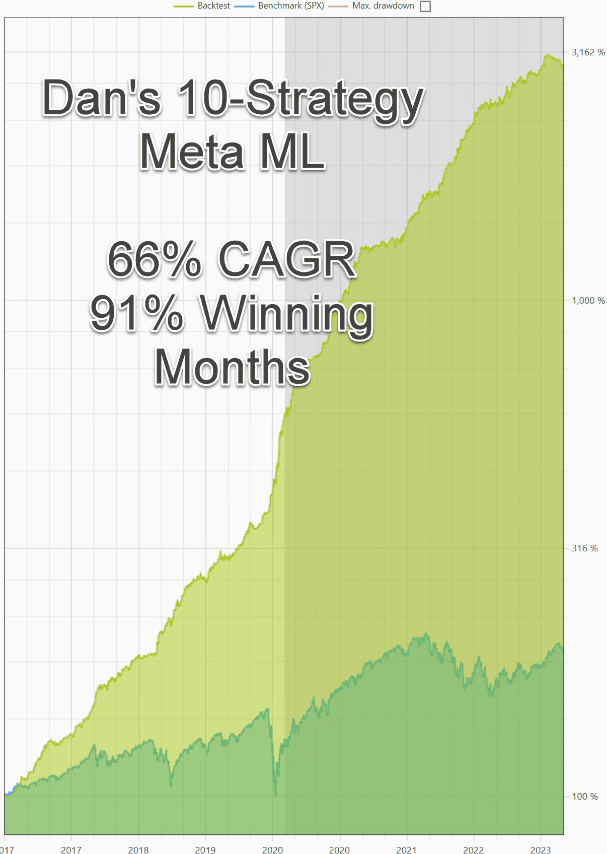

- How to use machine learning to select which strategies to trade every month. This is like having a top-tier scout select the best players from every baseball team, and having them play for your personal All-Star team. You’d steamroll the competition! This is your key to unlocking up to 100% winning months.

- How you can get started for under $300. That’s less than I spent on my last Callaway driver. And let me tell you something – that stick isn’t making me any money.

So, keep reading, and all will be revealed.

Deal?

Your Adventure Begins with a Fingerprint…

They say the first step to solving a problem is recognizing that you have one.

After watching Dan Murphy's webinar, I was confronted by the enormity of mine.

Even though I had a history of developing models for insurance companies, the prospect of programming dozens of strategies was as daunting. I felt like I was standing at the foot of Mt. Everest, the summit shrouded in clouds, the path treacherously winding around a cliff.

Yet I was invigorated by the truly revolutionary aspect of this technology – it was truly an unorthodox approach.

Instead of relying on conventional price data, it delved into the intricate world of Exchange Traded Fund (ETF) mispricing.

In all my years of trading, I had never known ETFs were mispriced to the tune of billions of dollars every trading day.

There are $7 trillion in assets held by ETFs. According to an article in the Financial Analyst Journal, the average mispricing is 6 basis points.

That means ETFs are mispriced to the tune of $42 billion on average each and every day! That's nearly the entire market cap of the massive gaming company, Nintendo.

Did you know that?

Every Exchange Traded Fund (ETF) is legally obligated to tell you the difference between how much their assets are worth, and how much the ETF is valued on the open market. It’s like having a used car salesman tell you how much he’s charging for the vehicle, and the actual price he bought it for.

By analyzing ETFs from across the globe, Dan and his team saw patterns emerge like fingerprints on a stolen bar of gold — each one unique and telling its own story.

The real twist came when our small group of beta testers discovered that the ETFs generating the best trade signals were sold by one company – BlackRock…

…an incredibly controversial firm, notorious for its overwhelming influence in global markets.

Some even claim they are trying to take over the world. Their sprawling reach means that they control over $10 trillion of wealth. In essence, their fingerprints are smeared all over global markets.

It was like unearthing a conspiracy — one that held the potential to turn my fortunes around.

I didn't know why the machine learning had discovered these patterns, or what their implications might be on a broader scale. However, my immediate concern was to stay afloat in the turbulent seas of trading.

As I started applying these strategies, the results were nothing short of astonishing. The roller coaster of losses and gains I was used to started evening out into a consistent, upward trend.

It was like watching the sun emerge after a devastating storm, the first rays of hope after an endless night of despair.

Here’s an example of these BlackRock fingerprints predicting the recent action in Nvidia:

It seemed like everyone was foolishly bearish on the stock market. They said that Nvidia was overcooked.

They were wrong!

They missed out on great gains of 8.8%, 14%, 4.8%, 1.8%, 2.2%…and then a massive 35% as NVDA blew through expectations, reaching over $1 trillion in market cap.

And then it just kept going and going like the Energizer Bunny.

What was the critical information others were missing out on? Why were they so wrong?

They were missing ETF mispricing data from Hong Kong and other countries.

I don’t blame them too much. These fingerprints are nearly impossible to see without using machine learning to find them.

Here are the results of using BlackRock’s global fingerprints to generate buy and sell signals on Nvidia (NVDA) over the past 24 years:

Using The Boss SuperAi and BlackRock’s global fingerprints to come up with individual stock strategies was just the beginning. It works on just about every market.

Here’s one for the NASDAQ 100:

And easy to trade bond ETFs:

Natural gas:

Pretty soon, I was cruising along at a faster and faster pace, using the supercomputer network to build strategy after strategy.

Take a look at the wide range of markets:

YINN/YANG China 3x pair so you can make money as Chinese stocks rise. Or if it turns out to be a Paper Tiger, you can profit from its decline. So far, an 80% annual gain. Sprinkle a little bit of this leveraged ETF strategy into your account.

UDOW/SDOW Dow industrials 3x pair. Put a portion of your money into this fund pair to make money if the Dow goes up or down. This leveraged ETF pair has shown a 63% annual return.

FAS/FAZ leveraged 3x financial stocks pair. Huge 97% average annual return. This ETF pair is very popular.

SSO/SDS S&P 500 2x pair. 55% annual gain. Did a wonderful job during the 2007-2009 bear market.

SPY/SH non-leveraged S&P 500 pair. 25% annual gain with perhaps the fewest rules I’ve ever seen in a strategy: 2 lines of code! Only machine learning can simplify a strategy like this.

SOXL/SOXS semiconductors pair. Massive 114% average annual gain. A little bit can go a LONG way in this pair!

UPRO/SPXU S&P 500 pair. How does 78% annual gain sound? Fund managers would kill for these kind of returns.

TECL/TECS technology pair. 85% annual gain as popular tech stocks rise or fall.

QLD/QID NASDAQ 100 2x pair. 55% annual gain from this popular pair.

Surprisingly, these strategies are easy to build even though I’m not a programmer. I just modified some templates, pressed start, up to 3,500 computer cores roared to life, and The Boss SuperAi programmed itself in C code.

It’s a modern miracle.

Dan calls it Linear Genetic Programming. I call it my cash cow.

In fact, here are 100 different strategies I created and their annual returns so far:

Here’s what it looks like combining all 189 together:

The Machine Learning Breakthrough of a Lifetime

I loaded all 189 strategies into the Portfolio Boss trading app, and began following their trading signals religiously.

As you might imagine, there was a flurry of activity, but I managed to place all my orders within 15 minutes, then get back to my day job of running two gyms.

After several months, I linked my trading account to Fundseeder, and then ended up taking 3rd place in trading accounts over $500,000. I worked HARD for that money, so my #1 concern was making the gains as smooth as possible. Otherwise I'd be right back where I started: a trader hopping from strategy to strategy with no end in sight.

Then something remarkable happened. Our beta tester forum was buzzing with excitement. There was a new AI technology that was rumored to show 100% winning months in testing — the Holy Grail of trading!

Dan and his team had invented a new tool that allowed for much fewer strategies to be traded at once.

That way you don’t have to place dozens of orders everyday like I used to when I was trading 189 of them.

Yet the profits were much higher, and much more consistent. In fact, this new Meta ML technology beat the old method in 83.6% of months. My strategy went from excellent to Crème de la crème.

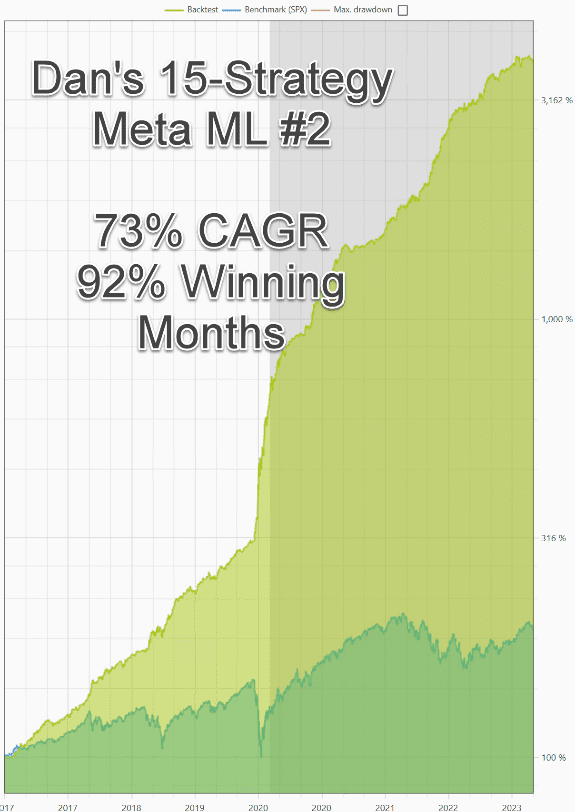

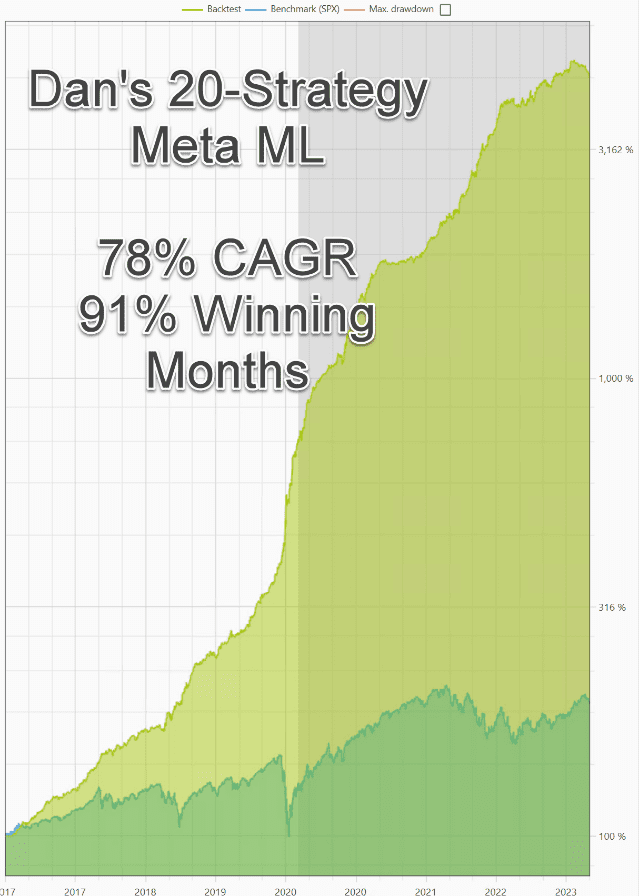

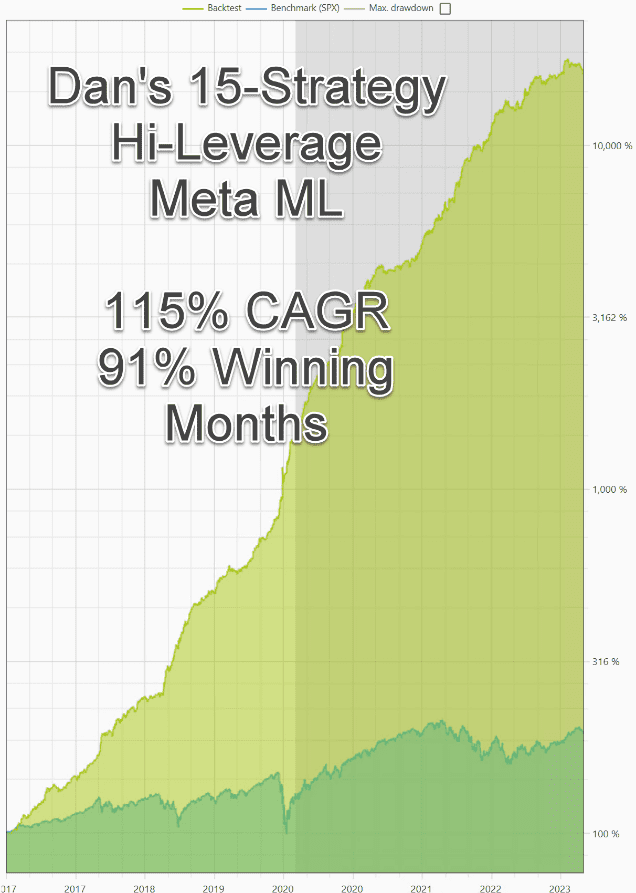

Take a look:

Meta ML beats the old method in 83.6% of months

You’d have to go back to Jordan’s 1995 NBA Bulls basketball team to witness such a lopsided victory (72-10…an 87.8% win percentage).

The question in your mind should be “why?” Why is this new method so much better? What did the AI figure out? I was using the same strategies…why was it milking even more money, more consistently than before?

Dan and his team perfected a method to let the AI predict the top strategies that were most likely to outperform for the month.

That way I only had to trade the top 10, 20, 30, 40, or in my case 50 strategies at once vs 189. This makes trading extremely easy. Even a 10 year old could wake up in the morning. Place a few trades. Then go to school.

The AI (called Meta ML) acts like an experienced baseball scout who picks the top players of your very own All-Star team. You might even say it picks your very own Dream Team of strategies.

The Big Reveal: Strategy Cycles

Alright, strap in and hold onto your hats. Remember when I whispered to you about a revolutionary approach to maximizing your profits, reducing those heart-stopping volatility moments, and moving towards 100% winning months?

Well, now's the time for the big reveal.

Let's break it down. When you build a trading strategy, the computer is going to give you statistics like profit factor, win rate, and dozens more.

Stick with me here: imagine over a decade, your strategy's win rate hovers around 50%. Some months? It's a grim 30%. Other times? You're laughing all the way to the bank with a smashing 70%. The catch? These numbers are like a wild dance, seemingly unpredictable and constantly in motion.

But what you’ll notice is that when the win percentage is too high, the strategy tends to underperform the next month.

Take a look:

So here's the trick: cash out if the strategy is performing too well, and buy when the strategy has been under-performing. You’re looking for the Goldilocks Zone right smack dab in the middle.

Hard to believe, right? Even the crème de la crème of trading strategies aren't immune to these ups and downs.

You might have experienced this before where your favorite money-maker was on a hot streak, and then gave back a fat chunk of the profits. Or right as you start giving up on the strategy, it miraculously shoots straight up like a rocket. Why? Strategy Cycles.

Student Becomes the Master

When Dan discovered I had placed #3 at Fundseeder, he asked me on his podcast to reveal exactly how I did it. I told him the story I’m telling you now. The next morning, I received an overnight FedEX.

I picked it up, and looked at the sender address. It was from Dan.

My curiosity got the better of me, and I ripped open the envelope. Inside was a letter. It was a proposal asking if I’d provide the other beta testers in our group with 100 of my best-performing strategies. In exchange I’d receive royalties.

You see, without dozens and dozens of strategies to choose from, beta testers wouldn’t be able to take advantage of Meta ML and Strategy Cycles. There just wouldn’t be enough strategies in their optimum Goldilocks Zone.

After thinking it over a bit, I agreed. The ETFs and stocks my strategies trade are enormously popular, and have loads of liquidity.

My pack of 100 strategies was exactly what was needed… our beta test group began to see phenomenal results.

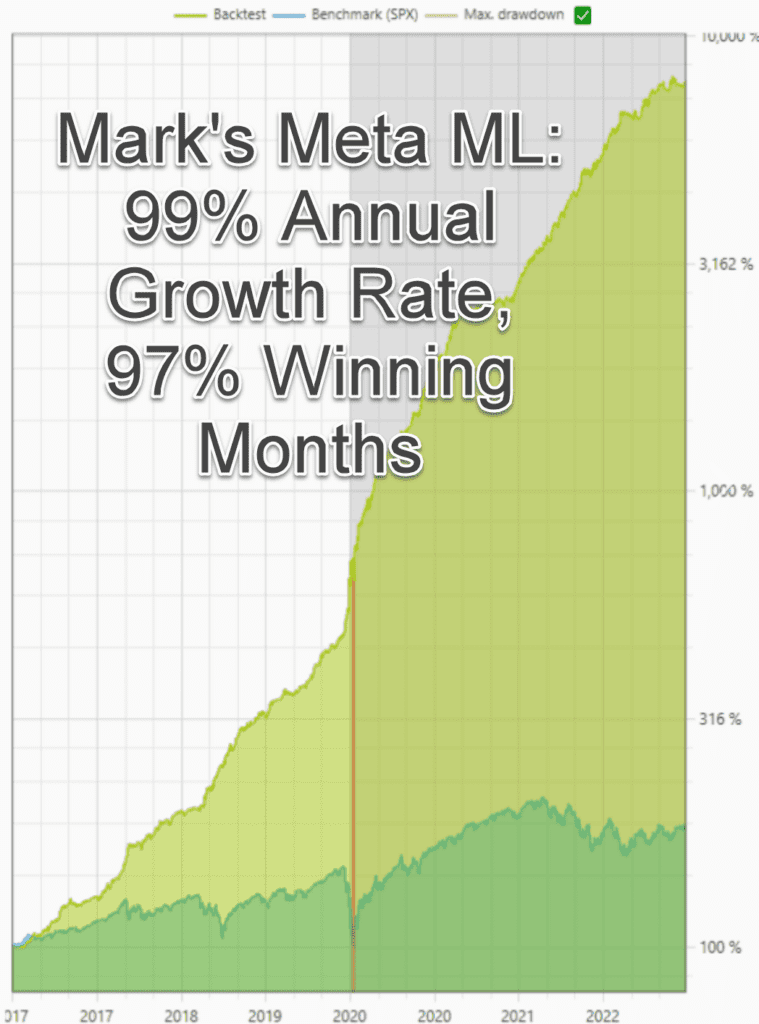

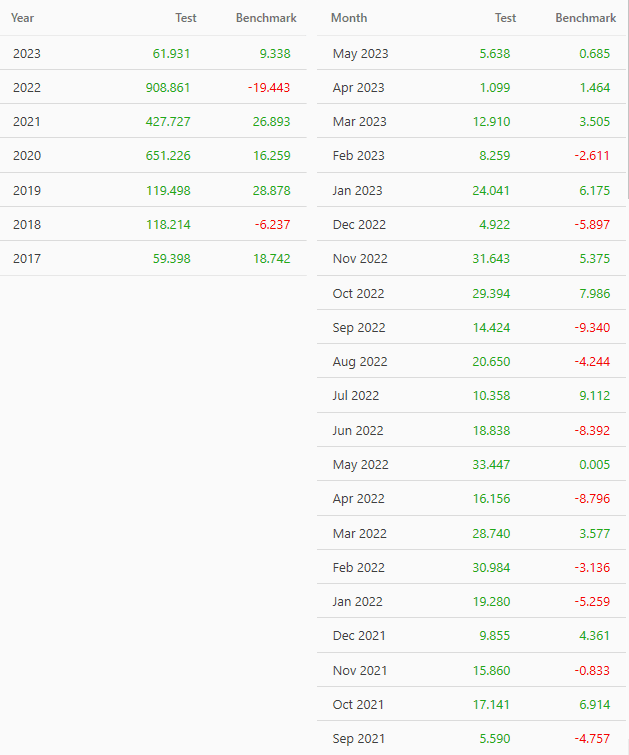

Here’s a Meta ML from Mark showing a whopping 99% annual growth rate, and 97% winning months. All he did was use my strategies inside a template, press the Start button, and about 30 minutes later, the AI built this Meta strategy:

Not to be outdone, Jay created a Meta ML with a 279% annual growth rate, and 97.4% winning months:

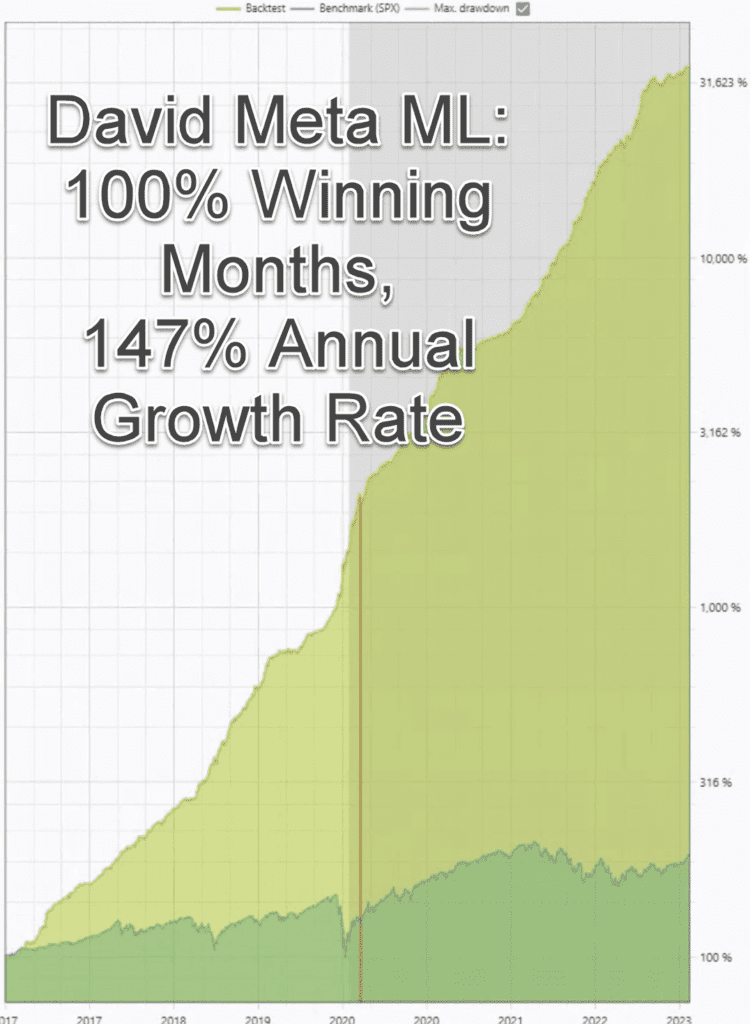

David managed to hit the “Holy Grail” of 100% winning months, and 147% annual growth rate with his Meta ML. Now we’re cooking with gas!

More and more of us started to achieve 100% winning months as we mastered this new technology.

You Can’t Cash a Back Test

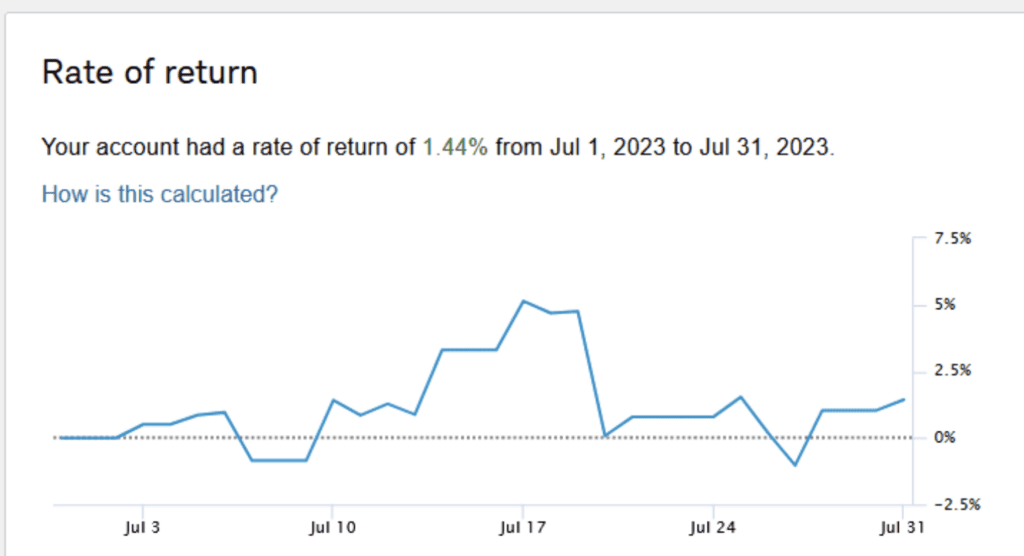

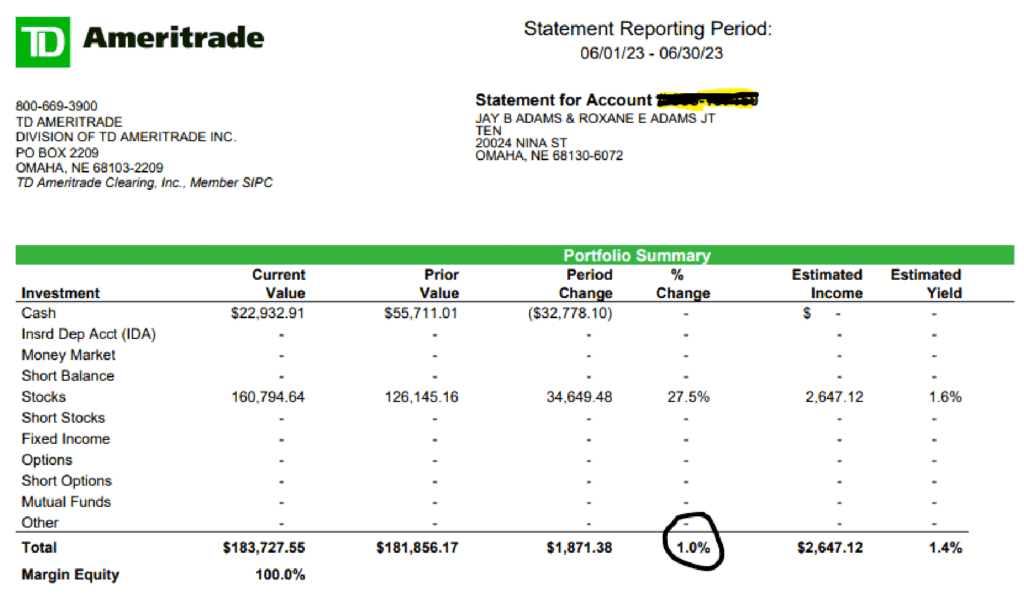

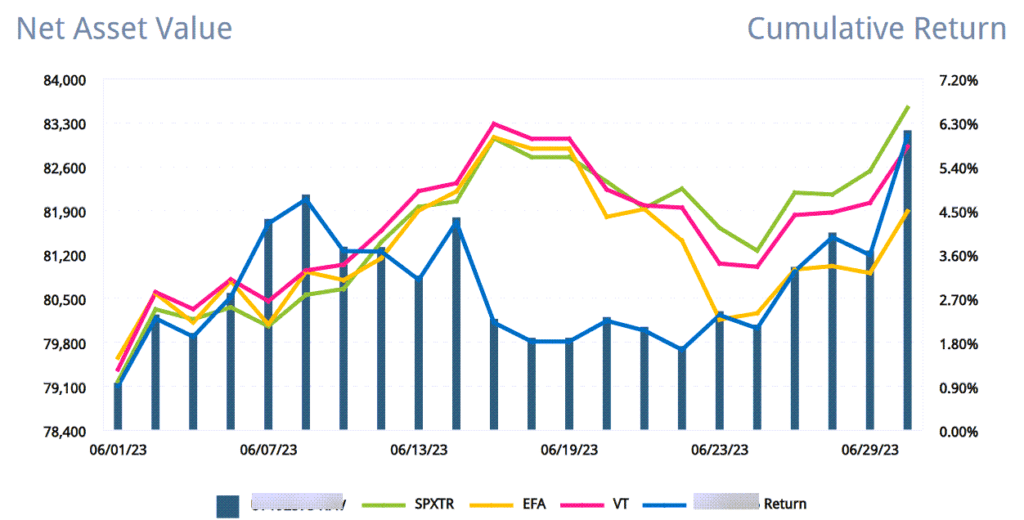

Yet as you may have observed, these are back tests on a computer. And although you’ve already seen my audited results from the Fundseeder competition, you’re probably wondering how the rest of the beta testers doing with real money, not hypothetical?

After all, last I checked, you can’t go to your bank and cash a back test.

Instead of being afraid to open their monthly statements, beta testers happily provided Dan their actual brokerage statements. Now that’s how trading should be.

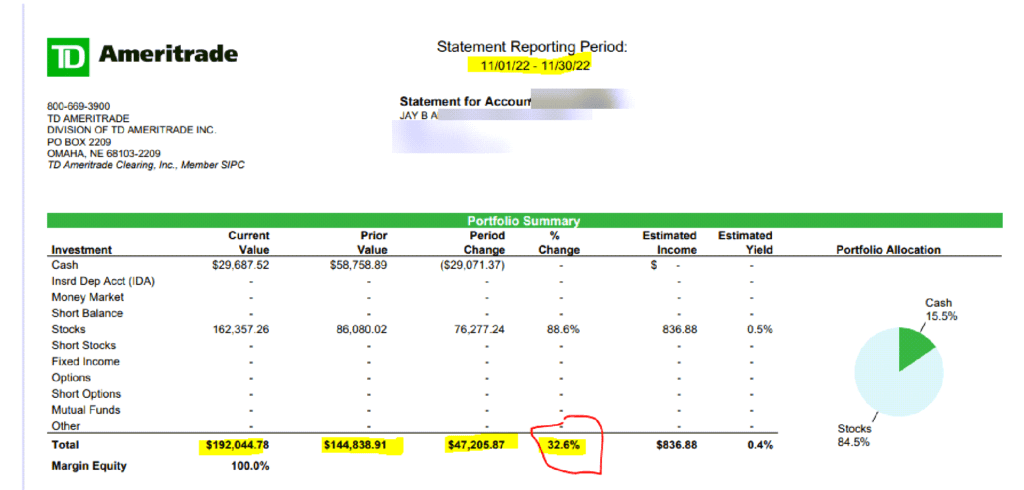

Here’s 100% Club member Jay Adam’s actual brokerage statement. Notice he was up 32.6% during a pretty crummy trading environment. That resulted in $47,205 in cold hard cash.

Next, we have Tod’s real-money account showing a $22,000 gain:

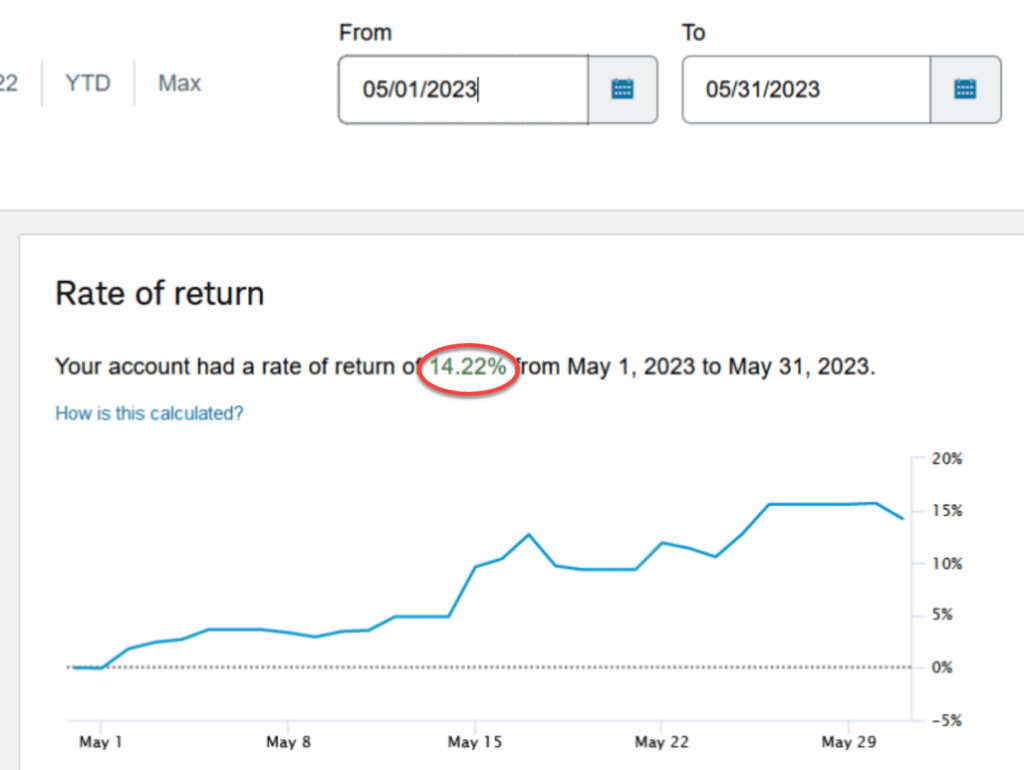

Here's Peter with a 14.2% gain for the month:

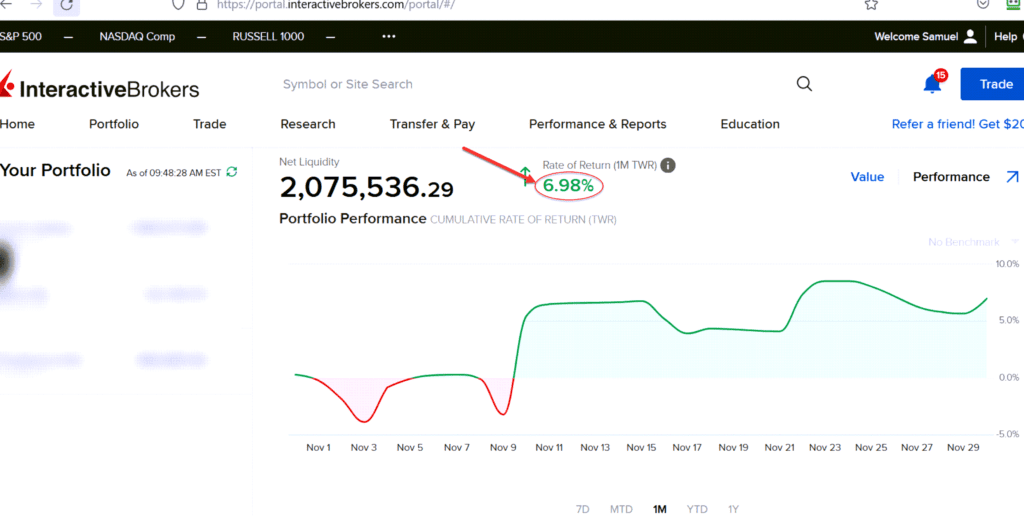

Here's Dan another member with a 18.15% gain:

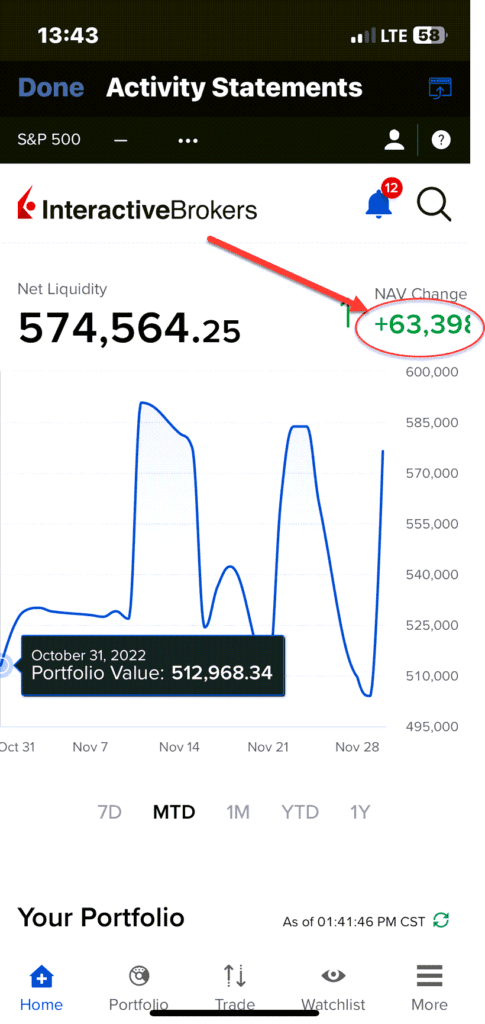

And here we can see a smartphone screenshot of a $63,398 gain from David Grigsby:

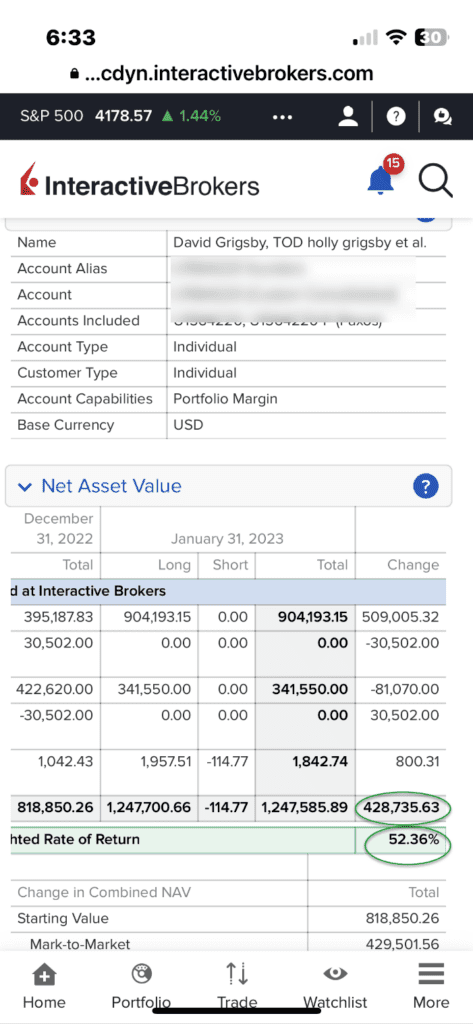

Not to be outdone by his previous month, David made an insane $428,735 (52%) in January. Dan’s team double-checked with him to verify that number. That takes him to seven figures. Clearly, he’s going’ for it. Operation Warp Speed retirement!

Member Skip Miller didn't skip a beat, and had a fantastic November…

…up $135,420.

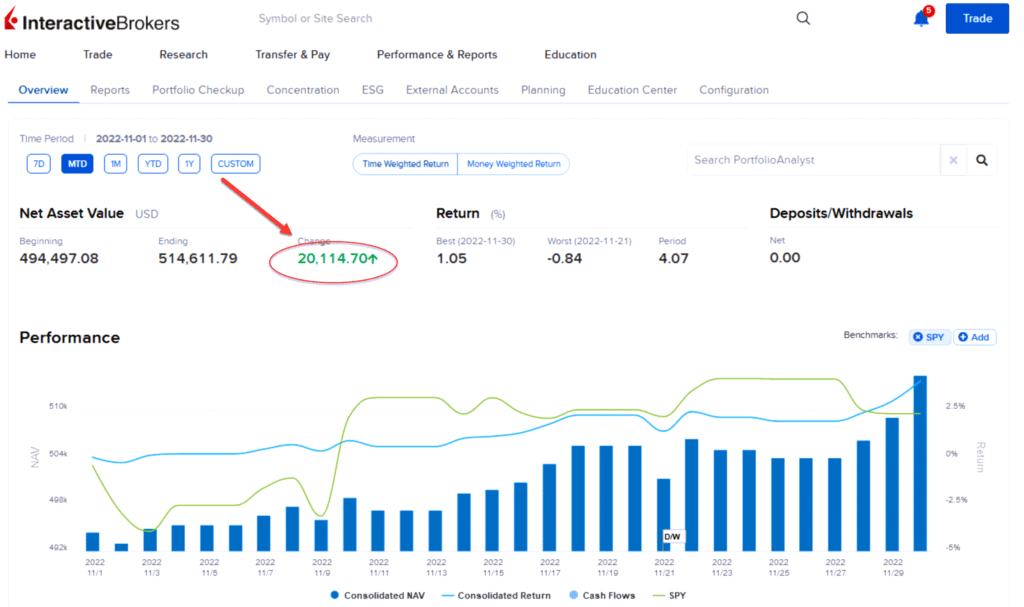

Here's a $20,114 gain from long-time member Chris Daniel:

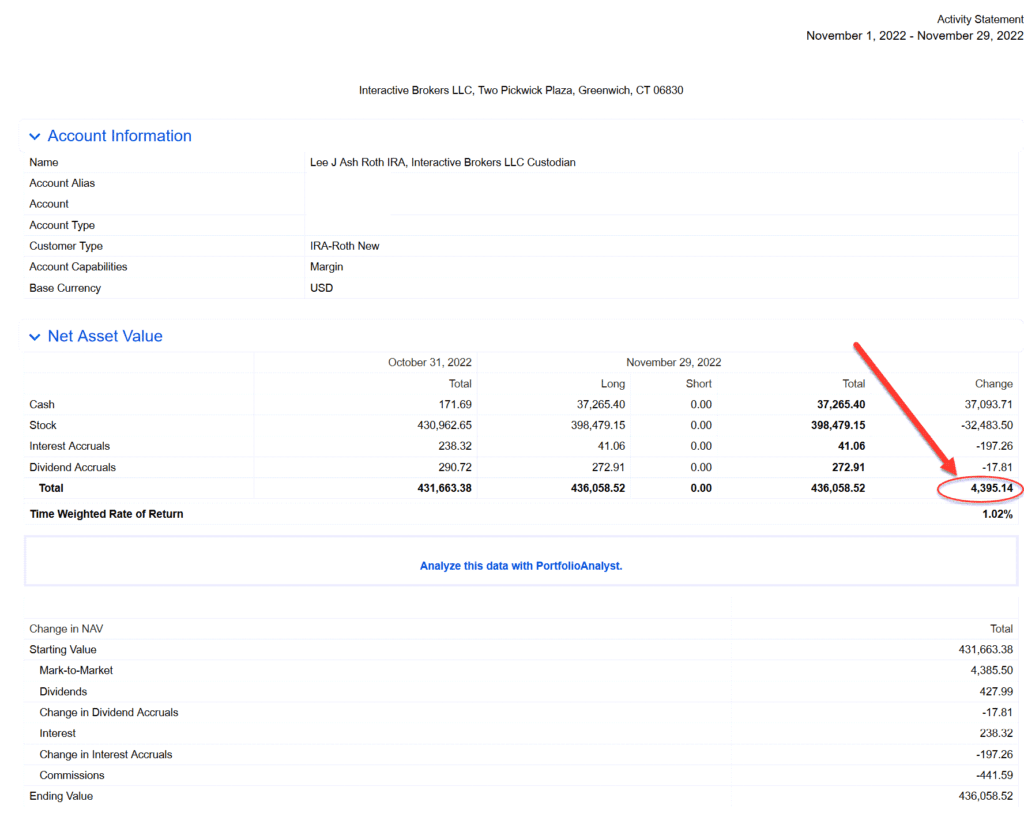

Not everyone is focusing on big gains. We have many retirees that focus on low volatility and high consistency. Here’s a $4,395 gain from Lee:

Here’s a $15,198 gain from Gary’s Schwab account:

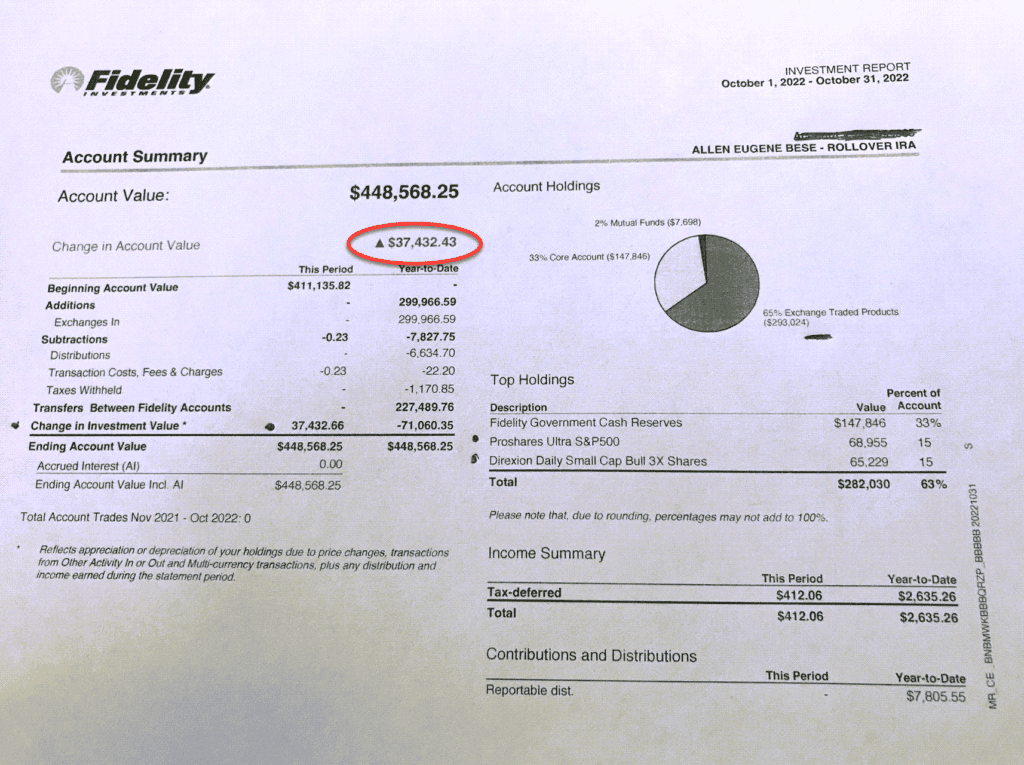

Allen is focusing on high gains for his Fidelity account, and was up a whopping $37,432.

Jay is up a solid 8.1%

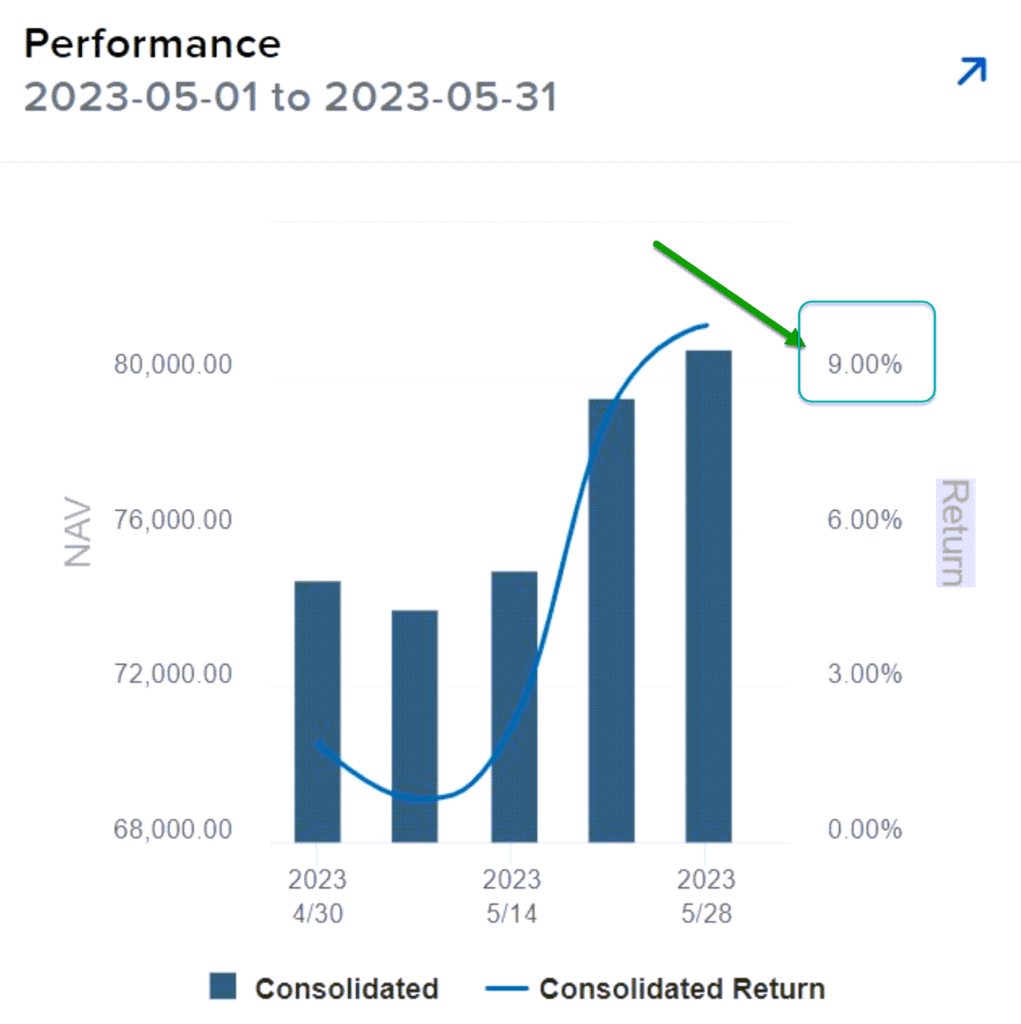

Richard is up 9% for the month:

Mark another user is up 11.48%…

Let’s Talk Crystal Clear Transparency…

Dan asked me to provide full transparency and disclosure about these gains: He and his team at Portfolio Boss are still trying to determine an average income statistic. Clearly there are several factors at play.

#1 being the amount you have in your account. I makes sense that the gains are directly related to how much money you’re trading with. That’s why percent gain is a much better statistic to look at than raw dollar amount.

#2 is how much volatility you’re willing to take. Some beta testers like David wanted to crank up the annual gains, so they’re willing to take on full positions in leveraged ETFs like the 3x leverage NASDAQ 100 ETFs. Or the 2x leveraged natural gas ETFs. Volatility is a double-edged sword.

For me, I like to throttle back these leveraged ETFs and trade them with smaller dollar amounts. I worked very hard to get my trading account into high 6-figures, and I would rather have rock-steady gains than swing for the fences.

I have however created Meta ML strategies with up to 489% annual gains and 100% winning months, but I’m not comfortable with that level of volatility in my trading accounts.

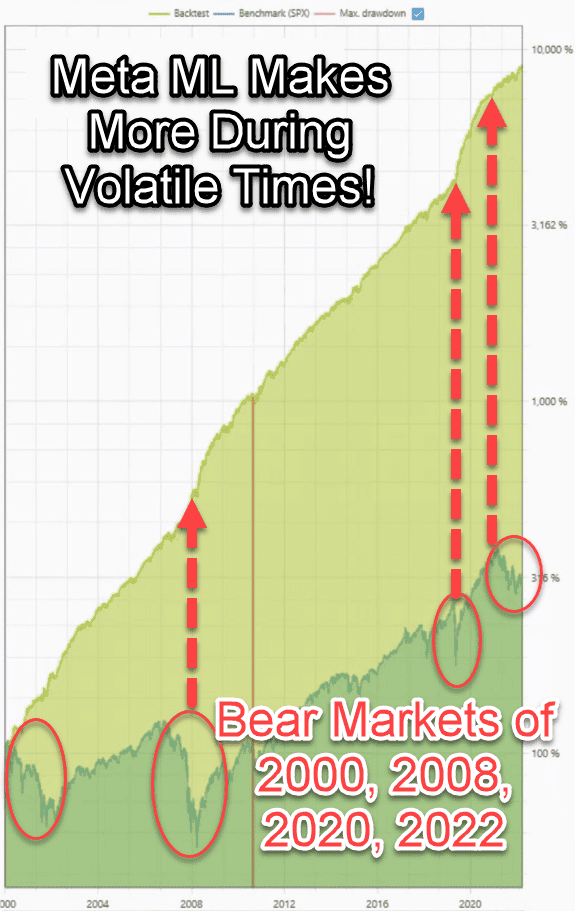

And bear markets? I love 'em because much more money can be made in volatile times. Check out this long-term Meta ML chart. Notice how the profits spiked during bear markets?

Now instead of being a worry wart if the Dow falls more than 5%, I look forward to the next bear market.

There's the old saying “what have you done for me lately”

So here are the latest brokerage statements as I write this letter:

🔎 Click To Enlarge Statements

Recap of What You’ve Learned so Far:

- The key to consistent results is to trade a bunch of strategies on a wide variety of markets. That way if a few falter, the others pick up the slack

- Most traders suffer from Profit Mismatch Syndrome (PMS). There’s a huge gap between what they expect to make, and what they actually make. That’s why they hop from strategy to strategy to strategy

- The best strategies often use little-known methods. It turns out following the fingerprints of BlackRock country ETF mispricings is highly predictive for hundreds of stocks and ETFs

- All strategies go through Strategy Cycles. The key is to trade only those in the perfect Goldilocks Zone of profitability. If you have dozens of strategies to choose from, then you can use Meta ML to select which strategies are predicted to make you the most money. In my testing, Meta ML outperformed traditional multi-strategy trading 83.6% of months.

Now that I’ve been using The Boss to build strategies for several years, and I’ve thoroughly vetted Meta ML technology — and have an audited account to back it up — Dan asked me what the ultimate trading package would look like.

That way a new member would have the highest chance of following in my footsteps and dramatically turn around their trading.

I gave him several pieces of advice from my experience with the program:

- Give a trial period so they can check it out for a small fee. I would have taken the plunge sooner if I didn’t have to pay 5-figures

- Lower the up-front pricing so more can afford it

- Bundle everything into a package so they get the full experience and can start making money right away

- Show them exactly what to do step by step so there’s no guess-work on what to do next

- Provide members with ready to go Meta ML strategies. That way they can get started fast, and then create custom Metas and strategies as they become more comfortable

I also told him based on my experience who they should NOT let in:

- Anyone with less than $50,000 in their trading account ready to go

Meta ML requires that you trade a minimum of 5 strategies at once. Personally, I think 10 is the minimum, and you’d want to put about $5k into each strategy. Trading 10 strategies at once is where I’ve seen the monthly win percentage as high as 100% in my testing. I don’t want a new member to suffer from Profit Mismatch Syndrome (PMS) and quit because they were under-funded.

Dan and his team listened to everything I recommended, and even exceeded my expectations. I give it my full stamp of approval.

That’s why I’m proud to present to you the…

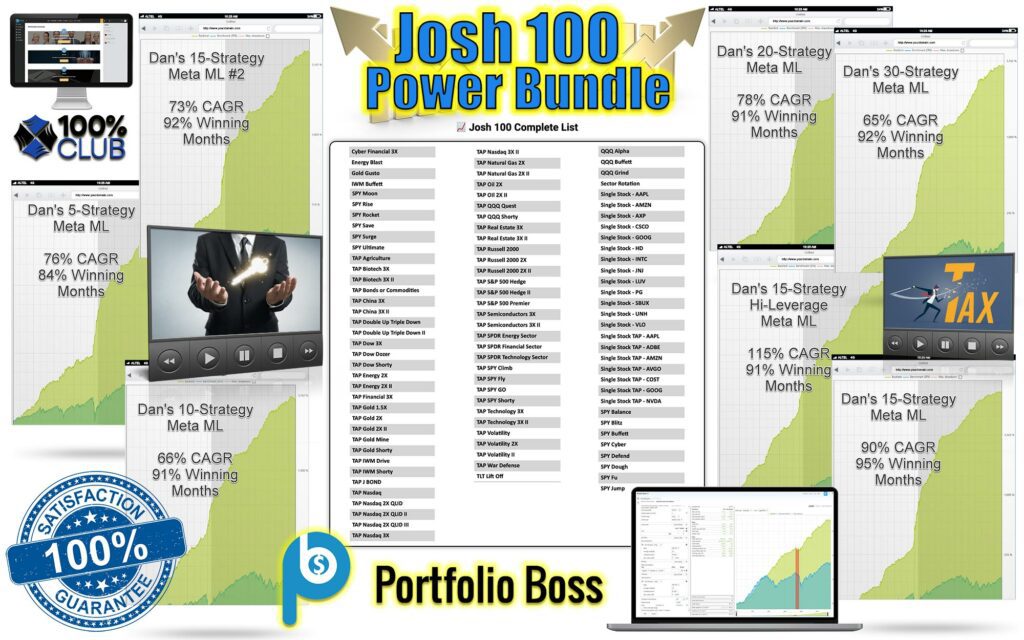

Josh 100 Power Bundle!

Here’s what’s included:

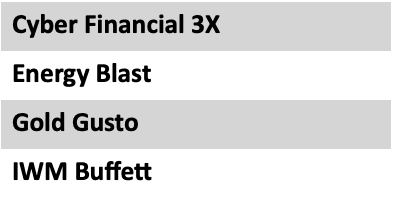

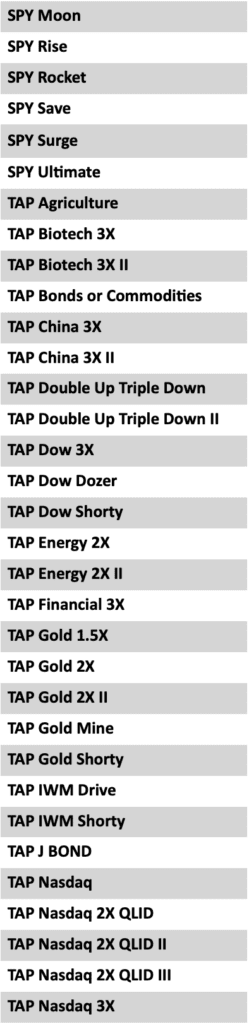

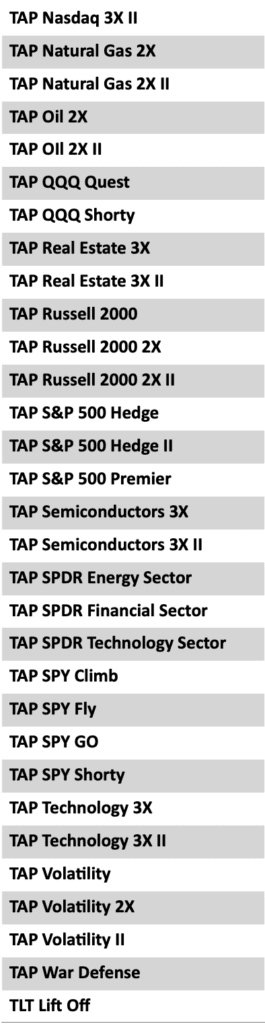

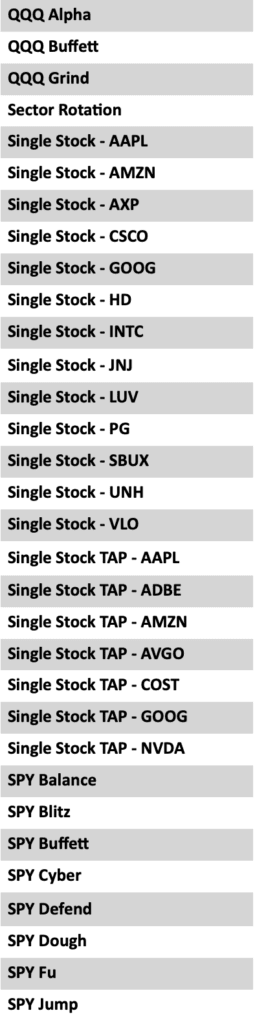

Josh 100 Strategy Pack: You get 100 of my top performing strategies. I trade these every day. The same ones I used to place at the top of Fundseeder. These are not watered-down versions. Dan has sold similar strategies for $1999 each. They trade everything from the NASDAQ 100, natural gas, gold, oil, S&P 500, commodity ETFs, bonds, financial sector, real estate, semiconductors, individual stocks like NVDA, HD, INTC, LUV, AAPL, and more. Here’s the full list:

📈 Josh 100 Complete List

These strategies run on the Portfolio Boss trading platform which is included for free. Daily quote updates and ETF mispricing data are included in the package.

Total value: $25,000

Meta ML: The secret to consistent returns is to trade lots of strategies simultaneously. Better yet, let the AI pick which strategies to trade over the course of a month. My testing showed Meta ML beat the common multi-strategy method in 83.6% of months. I can verify that nothing else like this exists anywhere else for any price. This absolute gamechanger is unique to Portfolio Boss.

You also receive an Instant Start Josh 100 Meta ML template. Just press start and the AI will build you one from scratch. No programming required. Yes, it’s that easy. That way you can build your own custom Meta ML that is unique to your desired yearly gain, volatility, and other specs. Most of my Meta ML’s were created by the computer within 1-3 hours.

Also included is the 9-episode training with Dan on how to use Meta ML so you can master consistency with your trading.

Here's a taste of what is revealed inside:

• Ever wondered what lies beyond the typical trading strategies? Uncover the game-changing tool, “Meta AI”, an innovation that revolutionizes the trading world. Its power? Only to be revealed at minute 32.

• The 5 Deadly Sins of Trading – Seemingly innocent habits that might be leading you towards a financial disaster. Could you be a sinner? Find your answer in Video #8.

• Witness the unveiling of the 3 Enigmatic Secrets of Stock Strategy Expansion. Capacity has its limits, but we've found a detour. Curious? Video #2 holds the key.

• Leverage – a double-edged sword that can build or annihilate fortunes. One wrong move and the consequences could be dire, akin to the Flash Crash of 2010. What's the right move? Only minute 38 knows.

• iShares ETFs – an oasis in the desert of stocks, yet missed by many. What's their secret? A mystery to be unraveled starting at minute 44.

• 11 Undisclosed Triggers that Meta AI employs to skyrocket your profits. Is AI the genie or the demon? Decide for yourself inside.

• Unmask the elusive relationship between energy sector premiums and EWO country ETFs – a tantalizing game-changer. Minute 68 beckons the curious minds.

• The secret language of the Market Titans – ever wished to crack their code? It's your ticket to the billion-dollar club. Video #2 will initiate you.

• The Silent Revolutionizer that made Jim Simons change his stance. What's the fuss about AI and machine learning? To understand, you must journey to Video 5.

• The fine line between financial success and failure – are you striding on it? The recipe for avoiding missteps is hidden at minute 91.

• And many more secrets to uncover inside…

Total value: $5,000

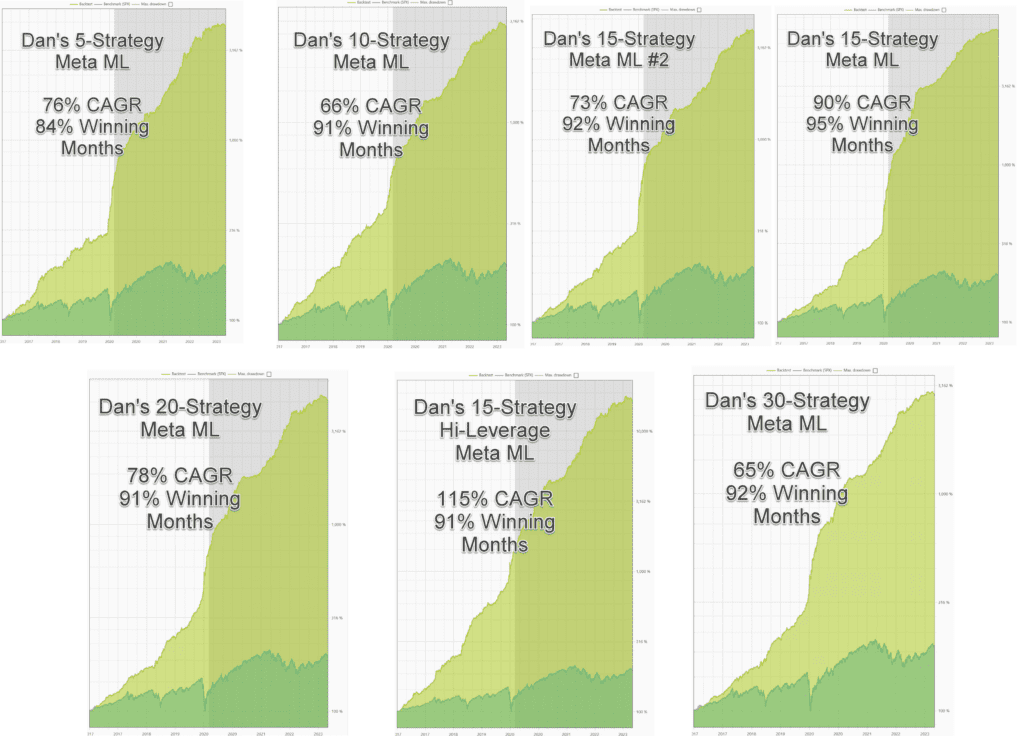

Dan’s Meta ML’s: These were built by the founder of PortfolioBoss. He’s also a veteran trader who programmed his first trading strategy in 1997. The collection consists of seven (7) Meta ML’s ranging from 5, 10, 15, 20, and 30 strategies traded at once. He also went in and adjusted the volatility up and down to give you a wide variety to choose from.

From Dan: “Before you go off on your own with Meta ML, I want to show you the meat n’ potatoes of Meta ML. There is built in Black Swan protection as well just in case a strategy decides to go haywire. Learn the basics first, then go exploring.”

Here are the stats from all seven Meta ML’s:

🔎 Click To Enlarge Reports

🔎 Click To Enlarge Reports

Total value: $3,500

100% Club: This is the forum where your fellow Meta ML’ers discuss their latest trading techniques, discoveries, and breakthroughs. Both Dan and I are either lurking or posting there most days. Trading is tough enough even with the latest and greatest tools at your disposal. That’s why it’s so important to have a group of likeminded folks to talk to.

Total value: Priceless

Bonus: 1-on-1 Ignition Session. You receive a 30-minute strategy session with Adam Kaye, Dan’s Director of VIP Client Relations. He’ll ask you a series of questions to help make your goals crystal clear, and show you ready to use Meta ML’s. I’ve talked with him many times, and he’s very helpful.

Total value: $300

Bonus: Free Traders Tax Guide. Now that you’re making profits in the markets instead of losses, don’t get stuck paying the tax man more than your fair share. This guide will walk you through the options you have for saving on taxes, and setting up a trading business.

Total value: $39

Bonus: 30-minute call with leading traders tax expert. I’ve worked with this company before, and they helped me elect the correct trader tax status. Dan has partnered with this firm exclusively to help members avoid any pitfalls.

Total value: $299

Bonus: Auto-trading (coming October). Letting the AI trade the signals for you will help free up some time, and make your trading business darn-near passive. It takes me about 15-minutes a day to make the trades. I honestly want to be first in line when Dan and team release this feature.

From Dan: “We’ve had a full-time employee on this project all year. I can’t wait to show it to you because any tool that makes your life easier is a tool worth using. In fact, my girlfriend asks me constantly when it will be ready. Yes, she trades too.”

Total value: $2000

Super Bonus: The Boss SuperAi. I saved the best bonus for last. You get FULL access to The Boss SuperAi – a monster 3,500-core supercomputer network. I used over 410,000 hours of compute time on this bad mama jama to build hundreds of strategies. Even to this day, I continue to build strategy after strategy. Why? Because the more my Meta ML’s have to choose from, the more likely the strategies I trade will make money.

You also receive full access to The Boss video training on how to best use The Boss SuperAi, the secrets behind BlackRock global mispricings and their massive predictions. There are four chapters and 24 bite-sized lessons. You can get through the whole training in a few hours.

You also receive access to all 64 (and counting) group calls where Dan broke down how to build strategies with The Boss step by step. These calls were all done live. Make sure you hop on the next Boss group call to learn the ins and outs from the man himself. I’ll likely be there too! It’s included as part of the bundle.

Included: Over 20 Instant Start Templates so you can simply press the start button, and The Boss will start building strategies for you.

Total value: $25,000

Holy cow, now this is a package…

Grand total value: $61,136

If you had a $200,000 account, and DOUBLED your money in a year, would $40,000 be worth it?

Of course it would.

Heck, I LOST $351,000 before making it back, so I would have gladly paid $40k in hindsight.

And let me ask you this…

How much would it be worth to you to reverse the chances of running out of money in retirement, reclaiming the financial freedom and security of your prime?

How much would it be worth to you to wake up each day fully recharged and confident in your financial decisions, needing less time to analyze the market than ever before, thanks to the AI-powered tools in the Josh 100 Power Bundle?

Just think about that for a second.

How much would those extra hours each week, each month, and each year be worth to you? Extra hours to enjoy life, to spend with family, friends, loved ones, or whomever you please? To live more life on your terms, any way that you want, and doing so with the financial security provided by the Josh 100 Power Bundle. Would it be worth $20,000? $50,000? $100,000?

How much would it be worth to you to have the peace of mind knowing that your retirement is secure, your children's college funds are growing, and your financial future is bright, all thanks to the Josh 100 Power Bundle?

If you could bypass the stress and uncertainty of financial markets, and instead have a reliable, AI-powered strategy that consistently delivers profits, how much would that peace of mind be worth to you?

I paid well over $20,000 to get access to The Boss, Meta ML, tools, and training.

But like I told Dan, it took me months before I pulled the trigger and spent tens of thousands for The Boss.

He asked me what I thought about charging $997 for a fully functioning 30-day trial with all the bonuses.

I said “that’s great! I wish you had that option back then.”

“But can you do better?”

Dan said “yes”.

You’re going to LOVE this.

You receive the full Josh 100 Power Bundle:

- Josh 100 Strategy Pack: You get 100 of my top performing strategies

- Meta ML: Let the AI pick which strategies to trade every month. Meta ML templates, and Meta ML training included

- Dan’s Meta ML’s: The collection consists of seven (7) Meta ML’s ranging from 5, 10, 15, 20, and 30 strategies traded at once.

- 100% Club: Don’t go it alone. This is where your fellow traders hang out and discuss tips and tricks with the goal of 100% winning months.

- Bonus: 1-on-1 Ignition Session. You receive a 30-minute strategy session

- Bonus: Free Traders Tax Guide. These simple tips could save you money

- Bonus: 30-minute call with leading traders tax expert. Have an expert help you set things up right

- Bonus: Auto-trading (coming October)

- Super Bonus: The Boss SuperAi. You get FULL access to The Boss SuperAi – a monster 3,500-core supercomputer network to build your own tailor-made strategies from scratch, and over a dozen Instant Start templates.

And don't forget…all you have to do is choose one of these seven pre-built strategies and you can start trading right away.

🔒 Select Your Option To Get Started

Click the button below to claim your 30-day trial:

Note from Dan: We currently have the capacity to onboard 75 new members. Our cloud provider typically takes 30-60 days to do a credit check in order to increase the number of computers we rent for The Boss SuperAi. We may quickly fill all 75 spots due to the nature of this offer.

Ironclad Triple 100% Money-back Guarantee

- Profit or Pay Nothing: If you don't pocket a minimum of $299 during your trial, we'll rush you a full refund. With our Meta ML's boasting a staggering 90%+ win rate in multi-year testing, we're confident in your success.

- Perfect Fit Promise: After your Ignition Session call, if either you or Adam feels it's not the perfect match, we'll instantly return your investment. No questions asked.

- Dan's ‘No Strings Attached' Pledge: If for any reason you decide to step away, Dan guarantees a swift and full refund. As Dan says, “The $299 is simply there to ensure you're fully invested in giving the trial the attention it deserves.”

USA-Based Support

Need help? Call Monday-Friday 8-5PM. 866-567-4257. Their team members are in California, Arizona, and New York. You can email 24/7. I have spoken directly with Ellen and Adam, and they have been very helpful. Even their engineering team has answered my questions when the topic was more advanced. A+

They also have an advanced ChatBot that has been trained on the entire Portfolio Boss User Guide (over 1 million characters) that is available 24/7/365. It’s actually very good if you need help with the software.

The 100% Club forum is also up 24/7, if you have questions for me or your other fellow traders.

Get paid $300 to learn?

Get paid $300 to watch some videos? Have you ever heard such a thing?

In order to get the maximum benefit from the Josh 100 Power Bundle, there are a few steps Dan would like you to complete. That’s why he’s willing to reward you for your participation. Go through the courses and apply up to $300 towards purchase of the Josh 100 Power Bundle within 30 days.

The steps are very simple:

1) Download and install the Portfolio Boss software: $75 reward

2) Go through the Meta ML training: $75 reward

3) Watch The Boss training videos: $75 reward

4) Attend your Ignition session with Adam: $75 reward

Each step means $75 in your pocket.

Note from Dan: We currently have the capacity to onboard 75 new members. Our cloud provider typically takes 30-60 days to do a credit check in order to increase the number of computers we rent for The Boss SuperAi. We may quickly fill all 75 spots due to the nature of this offer.

Imagine this: A month from now, you're still stuck in the same trading rut while others who seized the Josh 100 Power Bundle opportunity are thriving. They're making consistent profits, trading confidently, and cruising towards a secure retirement.

Don't let this be your future. Grab the chance to test drive the transformative power of the Josh 100 Power Bundle for a full month. It's your ticket to financial freedom, all risk-free.

Let's face it, you've tried everything. From newsletters promising quick riches to ‘secret' strategies that claimed to unlock untold wealth. But where has it all led you? To the same place of financial uncertainty.

Remember, no amount of traditional trading methods, market predictions, or anything you've tried up until now has even stood a chance at working. And now you know why. They lacked the precision, the adaptability, and the intelligence of the Josh 100 Power Bundle.

Without the AI-powered insights and the diversified strategy portfolio that the Josh 100 Power Bundle offers, you're simply playing a guessing game. And that's a game where the odds are stacked against you.

So, it's time to stop relying on outdated methods and start embracing the future of trading. It's time to choose the Josh 100 Power Bundle and get off the strategy hopping bus for good.

You've reached a critical crossroads in your financial journey. You've been down the road of uncertainty before, and you know where it leads. It's a path filled with sleepless nights, anxiety over market fluctuations, and the bitter taste of lost investments.

But today, you have a choice. You can continue down that same road, or you can choose a new path. A path that's been paved by the success of traders who've used the Josh 100 Power Bundle.

This isn't a decision to be taken lightly. It's a decision that could mean the difference between another year of financial stress and a future of consistent, profitable trades.

You might be thinking, “But what if it doesn't work for me?” That's a valid concern. After all, you've been burned before. But remember, the Josh 100 Power Bundle isn't some unproven, fly-by-night scheme. It's a comprehensive package of top-performing strategies, AI-powered tools, and a supportive community.

And let's not forget about the proof. Traders just like you have used the Josh 100 Power Bundle to turn their trading around. They've gone from losing money to making consistent profits. They've replaced their fear and uncertainty with confidence and control.

So, what's it going to be? Will you choose the path of uncertainty, or will you choose the path of success with the Josh 100 Power Bundle?

Remember, the cost of the bundle is just a fraction of the potential profits you could make. And with our fully functioning 30-day trial, you can test out everything the bundle has to offer without any risk.

This is your moment. Your crossroads. Choose the path that leads to a financially secure retirement. Choose the Josh 100 Power Bundle.

…If you’re ready to enter the realm of Meta ML and hyper-consistency

…if you’re ready to trade battle-tested strategies from the #3 ranked trader on Fundseeder

…if you’re ready to leapfrog the competition

…then go ahead and sign up below.

I’ll see you in 100% Club.

Note from Dan: We currently have the capacity to onboard 75 new members. Our cloud provider typically takes 30-60 days to do a credit check in order to increase the number of computers we rent for The Boss SuperAi. We may fill quickly all 75 spots due to the nature of this offer.

To your trading success,

Josh Jarrett

Josh Jarrett

P.S. Dan mentioned that they may run into a capacity issue with The Boss so they’re going to limit to the first 75 people to sign up for the trial. I remember it taking several weeks for their cloud provider to increase the number of computers they could rent. Their credit department is notoriously slow. Click here now to get started.

Q&A (With Dan)

Q: What kind of computer do I need?

A: A modern PC with at least 4GB of RAM. Portfolio Boss supports multi-core technology. A Mac computer can be used with the Parallels emulator installed (about $80).

Q: Can I use PB on multiple computers? I have one in the office, and one at home?

A: Yes! However, the limit is three installs at once. You can also install on a virtual machine in the cloud so it’s always on. That would be perfect for auto-trading.

Q: Can I use this from my smart phone?

A: No, you really need the real estate of a computer monitor to run PB.

Q: Can I trade from an IRA?

A: Yes! Josh trades multiple accounts, including an IRA. He recently showed me his 20-strategy Meta ML dedicated to trading his Roth IRA. It showed 100% winning months, and 147% annual growth rate in testing. Impressive.

Q: How am I alerted about which trades to make?

A: You can easily set up an automated email to go out every morning. Then just following the instructions. You can also use the built in Trade Plan manager which will tell you exactly how many shares to buy based on your account size. Full auto-trading is coming soon!

Q: Are the rules for the Josh 100 strategies fully revealed?

A: During the 30-day trial, they are not. However, when you join as a full member, they are completely revealed.

Q: Does the $299 trial automatically renew?

A: No. It will automatically shut off after 30 days. You MUST have a call with Adam to continue the program.

Q: Is there any kind of programming I have to do?

A: None at all. The AI does it for you.

Q: Can I use these strategies on another competitor’s platform?

A: No, because the alternative data we use for ETF mispricing (TAP) is very hard to come by. We pay significant fees, and have gone through several data providers to discover the most stable one. The vast majority of trading platforms only use price and volume data, which is significantly less profitable.

Q: Is everyone making money with Meta ML and the Josh 100?

A: No. There was one notable case where a member deviated from what I (Dan Murphy) teach. He put too much into the leveraged ETFs, and used Meta ML in a way I don’t teach. I highly suggest you use the built in templates and dial back the weights of leveraged ETFs in the beginning. It’s very easy to do.

Q: Is everyone creating 100% winning month Meta MLs?

A: Not yet, but every single one of them has a Meta ML with at least 95% winning months in testing. Past performance doesn’t guarantee future results, but it makes sense that having 100 strategies to choose from is a tremendous advantage. Several users have used The Boss to build over 200 strategies to choose from. The more, the more likely several will be in their Goldilocks Zone for maximum profitability.

Q: What if I’m already a member, and bought The Boss or Josh 100, but I’d like to be a part of the Josh 100 Power Bundle?

A: You can speak directly with Adam at: 516-220-8221

Q: Is there someone to walk me through the software?

A: I do live Zoom calls nearly every week, so I can show you. You can literally get started within seconds. You can also contact support. We've even trained a ChatGPT 4 bot on our entire User Guide so it can walk you through 24/7/365.

Don't Just Take Our Word For It...

See What People Are Saying About Portfolio Boss

Thank you for the founder’s plaque. It was my honor to be able to be one of the first on the team. I have been watching you and reading your sound advice since 2011. I was that investor you show in the progression from caveman investor to AI. I progressed through each of those steps in my trading evolution and made all the mistakes along the way. Then I found "Million Dollar Target” and have been with you ever since. You have taught me so much about investing the right way, and it has paid off big with PortfolioBoss and “The Boss”, in particular. This past year, I doubled my investment and 401K accounts and have been able to help both my adult children’s families through this tough economic time. In addition, I have been able to continue my charitable giving and am on a trajectory to fulfill my plan to retire this year (2021) so I can dedicate more of my time to my family and volunteer more of my time to my non-profit interests. I look forward to the cyber code and intraday trading enhancements to PortfolioBoss and our continued trading success.

Dan, I'm a very long time member going back to your early strategies. I'veseen all the progress along the way in both knowledge and my portfolio size. When you described the use of Artificial Intelligence, I knew it was the logical way to grow and compete in the constantly changing investment world. It is the next generation and it is here now! ”Grow or Fall Behind“. I am very anxious to work with the cryptocurrencies, BitCoin in particular.I have traded some Grayscale [GBTC] and done very well. The excitement of trading is very stimulating! I want to help my son buy his first home and this appears to be a very good way. THANK YOU for this opportunity!

Aloha Dan and team! I'm very blessed to be one of the founding members! I'm also thankful to Adam, who worked with me during an acute medical issue to make sure I was a member. Ironically, when I first learned about you, Dan (the relaxed investor), I thought you were too proud and hesitated to buy any of your programs. But after reading through your free reports, attending seminars, and listening closely to your investing nuances and experience, it became clear that we both shared similar things, one of which is proof! Honestly, I believe it is priceless to have an evidence-based trading system that can also be updated as necessary to verify its algorithm or strategy is still working efficiently. I have purchased a different company's product years ago, and even though it is also algorithm-based and capable of backtests, it is NOT in the same league in regards to customizations, testing and real results … and that's prior to salivating over the 1/2-hour data and cyber code coming soon. My desire for truth has led me to improve in many areas of my life and now has led me to you and my financial growth… and my trade account has been growing quickly. I am now cautiously optimistic. Aloha, and God bless.

Hi Dan, My portfolio is only small and frankly i did not do very well.I more and more stepped out of the market and let the bank manage my money. Only recently, using the Portfolio Boss Devine Engine i shrugged off some of the fears and got back. Back into this crazy market we are in right now. And i am very happy that i did. My portfolio gained 9.8% in the first 6 weeks of 2021, even while i am only 60% invested. I am not the day trader type and stick to a strategy with periodically switching. I very much admire your approach and love your tried and tested strategies. Thanx for your commitment!

Good morning, Dan. Nice job on the call yesterday. I am very excited for the cyber-code deployment. It is amazing what you and your team have accomplished in such a short amount of time. You have given the small investor a chance to make money consistently and safely. Before purchasing Portfolioboss, I never had a strategy. I was consistently moving from one shiny thing to another. Buying access to strategy after strategy, news letter after news letter I had come to the realization that no matter what I did, the cards were stacked against me. Then one day, I stumbled across your website “Million Dollar Target.”. For whatever reason, I started following your posts and blogs. Always looking forward to the next. They resonated with me. They were so different from everything else that was out there at the time. I slowly started subscribing to your solutions over the years and slowly started building confidence and, most importantly, making money. Oh, how far you have come! As a member of Unite and the Founders Club, I feel there is no limit to what we can accomplish together. The only fear I have is: is there a world where you sell Portfolioboss to a hedge fund or private investor and me and the other founders lose access? I know you have said that you would never do that, but the thought is always on my mind. 2020 has been a banner year! With the launch of the founders club and the ability to let the “boss” create the strategies for me, I have made about $80,000. Recouping my investment in the boss and much more From a percentage standpoint, I am up about 80% for the year. Need I say more? Dan, thank you for everything!

So when I purchased the initial BOSS (before AI was added), I was very conservative, using smaller amounts traded in DB transactions, Oracle, and SMI (SPY) stocks. Anyway, I made back in the first year the cost of the subscription. 2020 turned out to be a great trading year, although FEB again made me have my doubts, but I had faith in the concept and models, back testing, and consistency over the years of what was possible. So I got back on the horse and, like Seabiscuit, closed the year up over 30%. Would have been even larger, but I did not cease trading SMI and SMI stocks, which held me back since I was in bonds when the market took off. Also only invested a fixed amount rather than reinvesting winnings. However, from December 1, 2020, through today, I have made $50,000 each month (including February) in 3 days. A couple of reasons – DB transaction was gang busters, I for some reason started using ATLAS orders again, and I created using the Boss a couple of my own models using a created portfolio ( from another service who list 26 relative best performers each month ( If we have the 1 on 1 can give you more info.) So from using only $400,000 (and adding about $200,000 towards the end of 2020), I have made over $250,000 in 13 months. I continue to trade seven strategies now; some trade once per month, others every day. The key is fully trusting that in some models' there were no losing years or very few, and that gives me the confidence to look at the long rule. One final thing: you asked if your folks were not making money if they followed the models they should have, unless they got locked into the SMI indicator and other models that use SMI. I dropped using SMI and related models when you provided the Boss 100 and Boss 100/500 models, which I switched to. Anyway, thanks to you and the team for what you do and for the training you provide, and hopefully we will report to you by the end of the year that we made FY money. Stay safe.

I honestly can’t imagine not having Portfolio Boss in my life—and I pray it never goes away—since it has made such an impact on my trading success. I have a robust set of 29 strategies running that gives me the peace of mind that even in a crazy volatile market, I can count on stable returns for as long as I’m alive. I love that Portfolio Boss continues to evolve and provides the opportunity to continue creating strategies that pull money from the market!

2020 was truly a breakout trading year for me: 72% in a Roth IRA – giving thanks to God for William Roth! Tax-free! I have also been trading an SPY/QQQ multi-strategy using micro e-minis with ever so slight leverage. I have been burned in the past using too much leverage. I'm very curious to see whether the cyber code can find some tradable SPY and/or QQQ strategies. I have started working on a framework for increased charitable giving and very excited about the possibilities. Looking forward to 2021. Thank you for the Founders Club plaque and for a truly tremendous trading tool, Dan and team! Best regards.

Dear Dan, I couldn't be happier working with Portfolio Boss. I have been with your team since its inception. I go way back and I can tell you that I have had many subscriptions and many money managers throughout my trading career of over 30 years. What I learned from all of them combined pales in comparison to what I learn from you. I love your core ideas of: – Relaxed Trading– Rigorous BackTesting– AI evaluation – Portfolio & Strategy Switching (with so many levers to tweak and experiment with.)– Addition of new Instruments like Crypto Currency & BitCoins– While continually honing in on efficient trading by minimizing draw-downs and maximizing returns. I get far better sleep and am even pursuing my PhD in Quantum Integrated Medicine while trading with your fabulous tool and incredible observations that you continue to share with us. Thanks is too small a word – but since I can't come up with much else. So, I'll just say many thanks. Also, I've attached a copy of my picture with the founder's plaque your team sent me. Warm Regards & Best Wishes to everyone on your team and most of all to you.

Hi Dan, Am currently trading a couple of Systems that “THE BOSS” came up with, And am more than happy with the current results and the performance / results achieved to date. Trading as a business, and as in any having the correct tools makes all the difference. Find the type of trading that suits you, whether it’s day trading in chat rooms trading stocks like Gamestop. GME, or whether a slightly longer term approach works for you. A funny story there is a company on the ASX ( Australian Stock Exchange ) with the same stock code as Gamestop (GME.ASX) this company is not related in anyway in to Gamestop. In fact this company Mines Nickel and yet this stock almost doubled just because it had the same ticker GME as GameStop and had to be placed in a trading halt. My point I prefer to be removed from the daily NOISE of chat rooms and the like. When I came across Portfolio Boss the thing that intrigued me was that the software was different It had the ability to rank Stocks based on different criteria. The rest as they say is history. Thanks Dan, keep up the good work.

Hey Dan, Here is a quick photo of me with my plaque. I also have been meaning to send you a note about my story, which I certainly owe you after all the money you have helped me make over the years. When I started trading with you a few years ago I had never bought or sold a stock on my own before. Back then you were doing swing trades on the S&P, and that got me started with some very clear signals that earned me some nice early profits. I continued following your services as you evolved over the next few years from the S&P focus to trading various indexes and stocks with programs like Crash Canary and Atlas Order and finally landed on DB Transactions, which has served me well for several years. Then you came up with Portfolio Boss and I learned how to use it to generate my signals and saw my profits get more consistent. My trading moved to the next level when I decided to join the Unite program and become a member of the Founder’s Club. That opened up the full set of PB tools and all your available programs for me. I started trying them out over time with good results and a few ups and downs with the market the last couple of years. This past July I decided to ramp up the focus on my trading by tracking my daily progress across all my strategies. The timing couldn’t have been better as the market was just taking off after the COVID crash. I experimented with a few different strategies until I landed on one that stood out above the rest and focused my efforts on it for the remainder of the year. The results were amazing. I saw my account increase by 50% between July and December. I actually made significantly more money during this time from trading than I did from my regular job, which pays quite well itself. I know it was a unique time in the market with the central banks blowing a very big bubble, but the point is that by applying The Boss I was able to turn that event into a stunning profit. I am now seriously considering the possibility of retiring soon and just focusing on trading if I continue to see results like these. I would not have thought I would be in that position yet, and it is thanks in large part to these tools that you have so generously shared. Dan, I really can’t thank you enough for the financial difference that you have made for me and my family. All the best!

Hi Dan, Big shout out from Canada eh. Been doing very well following The Boss. I used The Boss to build a strategy that trades the Canadian Index TSX for part of my account. Its been doing very well averaging 18-20%. As we know the DB strategies, Ping Pong, and others are killing it, with returns over 40%. On a personal note, I retired in 2020, after successfully hitting my number. Thanks to Portfolio Boss. In March 2020, during that drop in the market, we had some losses in February and March, I stopped trading because I was so close to retirement. I didn’t want to suffer heavy losses. That said I missed the summer and fall rally. I deviated from a winning strategy and missed part of the most amazing rally ever. It is tough trying to ignore those pesky personal biases. Thanks The Boss Team for all you do.

Dan, I have been following you for quite a few years. I struggled along most of those years but your videos and letters gave me hope and guidance. Since the boss has come out things are a lot more consistent but I am still very cautious and limit my exposure. Too many hard lessons learned in the past I guess. I wish I was the profit machine some of your members are but… I run a business of my own so can’t dedicate as much time to your training as I would like or need but I am confident when I retire soon that a constant income will be there. Your DB Platinum is working great. I try to develop my own strategies but have now found the right set up yet. It is fun to try though. Thank you for your willingness to help others and your dedication to them.

Hi Dan, I have been significantly distracted because of covid from learning all the possibilities of the Boss, but what I have used and learnt helped me to have my best 7 digit year! What impresses me most is that I was able to do this while only being 2/3 invested at one anytime. I bought my first shares 43 years ago at the age of fifteen. Over those years I have found to be a successful trader it requires a disciplined approach to all the various steps in a trade. Your simplest SPY system helps me deal with my largest trading weakness and that is to stay in the trade until it’s done. The structure in your trading systems would help any trader. Thank you!

EARNINGS DISCLAIMER: I like to provide full transparency and not blow smoke up your behind, so listen up.100% Club members in general are seeing between 91%-100% winning months in back tests just using the Instant Start templates I created for them. These results are out-of-sample (unseen in the optimization phase), so I put a lot of weight into that fact.

I don’t yet have a statistic for the average member as far as gains are concerned. There are a lot of variables because this is not a cookie-cutter program. I do have dozens of brokerage statements on file, and the majority are looking positive.

There were a couple outliers that weren’t good because they went off track. I believe I convinced them of where they went wrong and they are back on track (too much leverage, and some over-fitting to the past). That’s my job 🙂

There are other factors in play as well such as: Are you actually making the trades? Account size. Is your broker any good or are they fleecing you? Are you using all the leverage available to you, or are you dialing it back like I recommend?

Simply put, I believe the reason we’re seeing the highest preliminary success rate of any program EVER is because:

a) you’re selecting from 100+ supercomputer-built strategies, and the odds of them all failing at once are extremely low.

b) the strategies take advantage of highly unusual edges that very few if any know about.

c) Our Meta ML technology is completely unique in the trading world. Very few understand that all strategies have cycles, and that there are opportune times to trade them. This allows you to treat trading more like a business rather than a hobby.

d) The daily instructions are brain-dead simple to follow, and can be accomplished in just a few minutes.

Government required disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.