From the desk of: Dan Murphy

Newport Beach, CA

FINAL NOTICE

- Josh Jarrett, who ranked among the top 5 out of 18,000 participants at Fundseeder, is now providing 100 of his pre-built strategies for you to use

- Our new Meta Ai technology (which is free) selects which strategies you should be using for maximum gains and up to 100% winning months

- Grab Josh's Top 100 strategies before it's too late

Here’s the transcript of our call:

Dan Murphy:

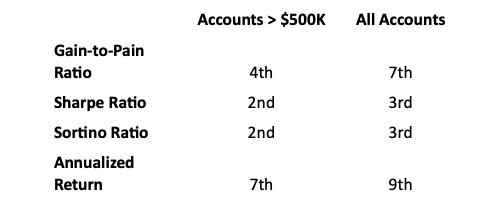

So, I’ve been really looking forward to this call with Josh Jarrett. He has managed to get himself in the top five ranking over at Fundseeder out of 18,000 people. And, his actual numbers here… Gained to Pain Ratio, fourth place. Sharp Ratio, this is a measure of how volatile things are, second place. Sorrentino Ratio, second place. Annualized Return, seventh place, and this is during a bear market.

Yeah, I really wanted to go ahead and get on this call with you and talk about that. And if you didn’t know already, Fundseeder was actually funded by Jack Schwager, the Market Wizard’s guy, so if you know anything about trading, you’ve probably read one of his books, and so he’s a co-founder over there.

And a little surprised at the end too because Josh has agreed to share 100 of his top-performing strategies with you. So, very cool and welcome to the show, Josh. How’s it going, man?

Josh Jarrett: Good, thanks, Dan. Excited to be here.

Dan Murphy: Yeah, that’s awesome. I can see a little gym in the background from you. It looks like you’ve been getting a little workout in, so that’s cool man, and congratulations again on your impressive performance at Fundseeder. And I was just kind of wondering if you could just tell us kind of a satellite view of what the heck you’re doing to get the top five over there.

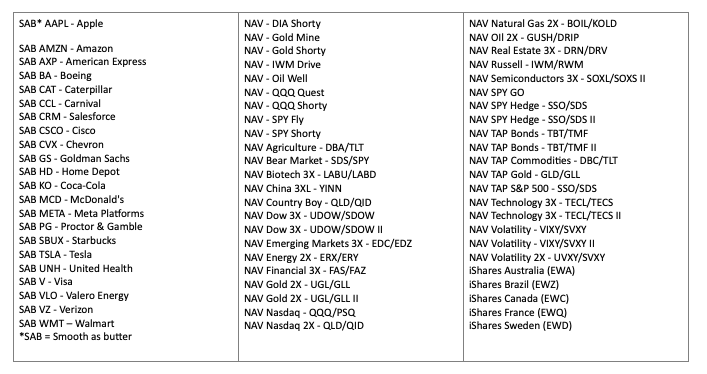

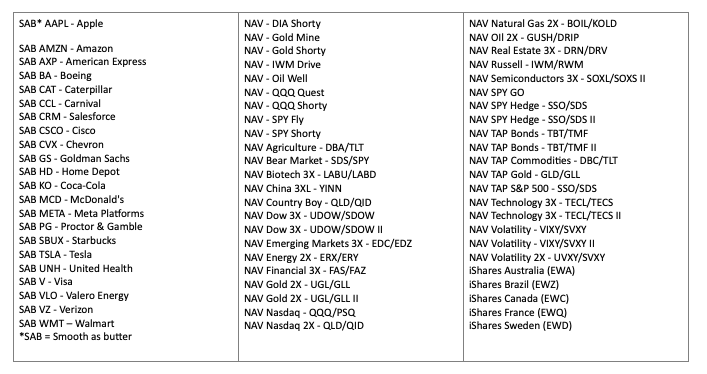

Josh Jarrett: Yeah, I mean, I’ve been using Portfolio Boss for years, but hadn’t switched over to Interactive Brokers that sort of enables you to upload a file and place 100 trades easily versus before I was sort of manually placing trade. So, I have about 200 strategies in a multi-strategy that I’ve built in Portfolio Boss ranging from ETF, commodities, stocks, sectors, countries, all of the various options out there; keeps it pretty diverse and smooth performance.

But when I switched over to Interactive Brokers, I’ve went ahead and signed up for FundSeeder and which just links to the Interactive Brokers account so they can see the portfolio and audit it and track it on a daily basis and then provide all those metrics that you mentioned earlier.

Dan Murphy: So, they automatically do. So, this is a real money account, so they’re automatically just looking at your interactive broker’s account, is that correct?

Josh Jarrett: Right. Yeah, so once it’s linked, they see it, I don’t have to send anything, it’s just automatically connected, that way they can sort of validate its real data, it’s not me uploading a spreadsheet or something like that.

Dan Murphy: I’ve got you. It kind of reminds me, because back in the day when I was getting my track record audited, I actually had to pay a CPA, it was like two grand each time I wanted to get it audited. So, kind of cool that they offer that service, I’m presuming it’s free.

Josh Jarrett: Yeah, it’s free. I think I don’t know where they’re at as far. I mean, I think they’re looking to identify some top traders and hook them up with funds or whatnot. But I think that was sort of their goal of launching that service. So, they make it free so they can hopefully try to find some of the better traders out there.

Dan Murphy: Well apparently, they’re going to find you, man. So, what’s the deal? You’re going to become a hedge fund manager and go on to all those crazy hours or recruited bunch of money?

Josh Jarrett: I mean, I’ve thought about it. I mean, it does sound exciting, but I’ve worked in insurance for so long and don’t really look forward to dealing with all the regulatory stuff, and I mean, it’s one thing trading your own account. I do think all these strategies– the 200 strategies– combined could easily handle hundreds of millions, if not in the billions, just from, they’re all trading some of the highest volume instruments out there.

But once you start introducing regulatory requirements and finding capital and making sure I can still automate it the same way I do my personal account, I think I’ll wait and just keep growing my personal accountant—not that greedy.

Dan Murphy: Well, that sounds good, man. And you, behind the scenes you’ve told me that you have three young kids as well, so that’s pretty cool. Maybe it’s better that you don’t go into that kind of thing just yet, you know?

Josh Jarrett: Yeah.

Dan Murphy: And then I’m kind of curious—I’ve seen you, we’ve never had a one-on-one conversation like this before, but I know that you’ve been a follower of mine for a long time. Do you remember like where exactly . . . How’d you find me anyway?

Josh Jarrett: Yeah, I think it was probably back during the housing collapse days when I was . . . I mean, I’ve been dabbling in market stuff for a while, but I think you had a company, 10X trader I think it was—and I was playing around with trade station and trying to program some automated trading strategies.

And so, I’ve always appreciated your evidence-based approach to things and decided to watch you evolve. I’d say with Portfolio Boss, it’s pretty much a game changer to be able to allow the everyday trader to sort of compete with the big boys out there.

But I’ve been following you all along just because you’ve sort of, my gym is a smart gym, it’s all evidence-based equipment. So, the trading—taking the evidence-based approach—the trading is a very appealing

Dan Murphy: Well, I can see the quantify fitness behind you, man, so that’s pretty cool. You know let’s circle back just for a second because you said that you had been in insurance before, so it sounds like that you were kind of already going into a more tactical method for strategy, which we’re going to tell viewers in a little bit here.

So, stay tuned about exactly what Josh is doing and everything but you had already had some experience in quantifying things with insurance.

Josh Jarrett: Yeah, so my background’s insurance. Like I said, I’ve spent the bulk of my career in product management, so working with lots of data, building pricing models that I would say is somewhat similar to building the trading models. Both, you’re trying to identify variables and improve the model using end sample data out of sample data.

Biggest difference is with insurance, you’re buying to predict claims and losses and in general trading models, you’re trying to predict your annual growth rates and manage drawdowns and things like that.

So, I’ve been messing around with the trading stuff for, let’s say, 25 years since I was in college, starting with the penny stocks. And I’ve done everything from technical analysis, fundamental Elliot Wave, day trading, all those advisory services, analytics tools, but just at the end of the day, I mean, I don’t mess with any of that stuff anymore, it’s pretty much all portfolio Boss.

Dan Murphy: That’s awesome, man. It sounds like we have a really similar background, man. You know that was one of the things too, is I was watching the other day speaking of Elliot Wave—and for listeners, viewers that don’t know, this love is pseudoscience man, because you could go ahead and lock, let’s say, a hundred market technicians in a room, then an hour later they all come out with a different answer, right?

And then, so I could see exactly why you would want to gravitate something that’s more proven, more scientific. And again, if it’s not repeatable, it ain’t science, man.

Josh Jarrett: Yep, absolutely.

Dan Murphy: But I was kind of curious too that, well, it sounds like we’re on the same path here, so I’m kind of wondering what specifically got you into becoming a founding member for our “The Boss” Super AI? I was really curious about that.

Josh Jarrett: I mean, the biggest thing was being able to have the confidence to sort of predict what my returns are going to be in a year. I don’t try to fool, man. I mean, you can come up with some pretty amazing strategies than Portfolio Boss. I try to like divide by two, that’s just in my career.

Even in insurance, when we do projections for forecasting and stuff like that, we come up with some pretty big growth numbers or whatever, and divide by two was always, though. But with Portfolio Boss, you’re coming up with like, even with 200 strategies, I think the multi strategies 50 to 60% kegger, so I can live with a 20 to 30% annual return on a portfolio, I mean.

So, being able to have a tool like that where I just have the confidence and I don’t have to think about, “Oh, what’s the economy doing? What’s going over in Russia and Ukraine?”

I mean, it’s sort of backtest most of these—like, some of these ETFs go back to the 80s and 90s, and so we’ve had quite a few pretty big crashes in that time period in various market conditions. So, having a tool like Portfolio Boss just helps me sleep at night.

Dan Murphy: I was, I guess we should really start, just get into it. Like, if you can just do me a favour and describe kind of from the top view here is what…How are you using AI to build the trading strategies and you know, kind of in simple terms for people what’s the process, how complicated is this?

Josh Jarrett: Not very complicated at all. I mean, sort of identifying what you want to trade. And it’s pretty easy to select what your goal is by picking the fitness functions and then just basically hitting start and then having a little bit of ability to understand what the various generations and backtest, what it’s showing you so that you don’t fool yourself and just pick a backtest that was totally random or something like that without showing it.

It’s hard to describe, but the graph on Portfolio Boss sort of shows you how the backtest is performing and it makes it super easy but I’m pretty much always creating new strategies, building new models. I heard a quote one time that “All models are wrong, but some are useful.”

Dan Murphy: I like that.

Josh Jarrett: So, that’s sort of my appeal to the multi-strategy is that, everyone is going to have a model that’s not going to perform one year. So, by using the multi and the meta that you get, that’s coming out now, the meta-AI, I think that’s going to help anyone be able to sort of build trading models and compete with the big guys.

Dan Murphy: Now, one of the things too that a lot of our listeners don’t know about because between you and I and just a few other people, we started a group, it’s called 100% Club, right? So, our goal is to win 100% of months.

And so, I think with what you’re doing, we’re getting really close to that. And then I’m going to tell viewers about something new and new technology just a little bit here as well, so stay tuned about that. But there’s a new tool that can select which strategies to trade.

So, I’m really looking forward to that but that’s just a little sneak peek, let’s keep going here because we kind of need to build up a little bit and explain like, “What the heck are you trading here? So, are you trading long, short? Are you trading stocks? Are you trading ETFs? Like, what is it that’s of these 200 strategies you have? What is it you’re trading?”

Josh Jarrett: Yeah, pretty much all the above. And with Portfolio Boss, I mean, I’ve been using it for so long, you guys keep adding new features. So, I may have a SPY strategy, well then now I can build a new one and have the ability to set the cash equivalent to short SPY or now cyber codes out, or now the tap data is available. So, I think I have 15 plus SPY strategies, because they may all look good, there’s no reason to throw any away.

Dan Murphy: And just for listeners, if anyone’s new real quick Josh is SPY, I would be an Exchange-Traded Fund to trade the S&P 500, just in case. I’m not sure where every single listener will be at but on this call, I want to be able to cater from anyone that’s a beginner to extremely advanced because we’re on the cusp of all the latest technology.

So, I just want to make sure that we kind of break it down for newbies as well so that they have an opportunity to make some moolah as well as those have been like you and me doing this over 25 years, right?

Josh Jarrett: Yeah.

Dan Murphy: So, this is a fun opportunity.

Josh Jarrett: That’s about 25% will go short, but I don’t actually short anything, it’s all inverse ETF, so going long basically to short the market, just prefer to avoid being short of stock.

And it gets even more complicated if you have three strategies trading in one instrument and one is long and one is short, how do you handle that? You need separate brokerage accounts or anything, but there’s enough with most of these ETFs, you can trade short by buying the inverse.

And then the cash equivalent, being able to short that to build the model, even though you’re not going to short and change it to cash later, just helps you build even better models by punishing it for being wrong.

Dan Murphy: That was one of the really cool things that we discovered was yeah, a lot of people are going to be focused on buying—not selling short, they’re not really looking to make money, because a lot of times, and you’ll agree with this, right Josh, but that it’s really hard to find short strategies, like damn near impossible, like really hard because what does the market do over time? Why does Buffet just buy? He barely ever sells on the way up that he’s mostly buying these huge dips that happen every few years in the markets, right?

Because the US stock market since the bottom in the 1930s, has gone pretty much straight up, if you look from a bird’s eye view. And so, it’s been really hard to build these short strategies. And so, the AI, is it correct to say that it’s actually just trying just weird stuff?

Josh Jarrett: Yeah, I mean, it’s definitely stuff that you would never, “Oh, let me try this rule.” I mean, it’s all pretty much unique. It’s almost like a fingerprint or a snowflake like you’re never going to build the same strategy twice. No one’s going to be trading the same rules that someone else is.

Dan Murphy: And then I have to point this out too. So, we do have other members on in the 100% Club, and I was just going to go through real quick on. They’ve been nice enough to share their brokerage statements with me, which is highly unusual but it seems like we’re really cleaning up over here, so let me just name off a few that I have in front of me over here.

So, Jay Adams, he showed a 32% gain, which is insane. I think that’s way too high, I’m not sure exactly what the heck he’s doing. Maybe I’ll get him on for one of these calls as well to see what’s going on. And it’s $47,000, just the profit on this in one month. I have his Ameritrade statement. And then we have Todd, who’s up $22,000. And then David Grigsby, he’s showing a $63,000 return and then the next month he makes 400… This is not a typo, actually, I had my office call him just to verify this man, he made $428,735, had a 52% return, that’s crazy.

I don’t know exactly what he’s doing, but I do have a suspicion, and so I just want to kind of excite user listeners right now and viewers of this podcast that we’re going to talk about this new technology that these guys are using here, and that was just the beginning stage.

And off camera, I was telling you in the green room that we’ve upgraded this technology, so please stay tuned and we’ll watch a little bit more here. But in the meantime, like, sometimes I start disparaging right here, but let’s talk about the nonsense that we did.

You had kind of alluded to it earlier and we talked about, let’s say Elliot Wave and you mentioned penny stocks and stuff like that. Can you tell us a little bit more about what most traders do that is completely wrong?

Josh Jarrett: Yeah, I mean, I would say most what people do is not evidence-based, they’re not backtesting, or if they are, they’re not holding out any sample data to… they build the model. If they are building a model, to begin with, they’re building it on all of the history. And so, by when the real-world data comes in, the model just doesn’t perform.

Dan Murphy: Let me just pause real quick, Josh, because maybe this will help a little bit. I’m going to do this highly scientific thing with my hands right now. Okay, so what most people do is they try to build this nice strategy on, so it’s all their data. So, let’s say it’s from 2000 to—we’re recording this in 2023. And so, they’re trying to find rules to trade these markets and that whole timeframe.

But what you’re supposed to do is you can run a test on 80% of your data, give or take a few percent, and then you leave 20% out, you leave it hidden. So, your optimization phase, the AI does not optimize on that little 20%, 30% of the data, right? And that’s for confirmation.

And if you’re not doing that, you’re going to blow up, right? It’s like the worst thing in the world that you have this lovely backtest and then your account, what does it look like, Josh?

Josh Jarrett: Looks like garbage.

Dan Murphy: Yeah, it’s garbage. So, it’s useless if you are not sequestering a portion of your data, right? Hiding it from the AI because the AI will totally overfit to the past guys. It is kind of like summoning the demon, is what Elon Musk had talked about.

You have to be very precise in your language and settings of what you’re doing but once you do that, I mean, here you are creating 200 strategies, that’s amazing. I think that might be a record for portfolio boss users, by the way. I don’t think [inaudible 17:39].

Josh Jarrett: They’re trying to break it.

Dan Murphy: Yeah, let’s go.

Josh Jarrett: Trying find out when I have to email Ruud and be like, “Dude, it only handles 500. What the hell?”

Dan Murphy: I think it can. You know what I want to see because it can handle all those different stocks, so let’s try to break it and yeah, knowing him, he’ll say challenge accepted. So, in case viewers don’t know, so Ruud is the leader of the programming team, he’s out of the Netherlands. And so, behind me is it’s about a dozen other people.

So, it’s not just the little old me doing all this stuff, but I have some interesting news for you, by the way. But the way I want to set it up is if you could just tell me how long did it take you to build the majority of those 200 strategies? Like, are you working all night or is it over a few months or what was it?

Josh Jarrett: Yeah, I would say, I mean I have been building some of them for a while, even prior to some of the latest enhancements, but I mean, I’m planning to build another 200.

So, just based on, I sort of squeeze it in, I have Portfolio Boss running on an Amazon web in the cloud so that I can– even on my phone– pull it up and check in on how the backtests are running and kick off some new ones. So, you could easily do three or four strategies a day. So in a couple of months, you could build 200 strategies if you’re really keeping track, keep the spreadsheets.

I keep track of what I’m doing because it can get away from you if you’re just hitting start and not keeping track of what you’re actually doing, you can just end up with a crowded Portfolio Boss. But if you go in with the right intent and a strategy behind what you’re doing, I mean, you can do it in two months easy.

Dan Murphy: So, the surprise, that’s awesome, by the way, that it does take some persistency for sure and some gumption and just get-it-done attitude, and I appreciate the fact that you do. I was going to let you know behind the scenes, it took 410,000 compute hours to build all those strategies, buddy.

Josh Jarrett: Nice.

Dan Murphy: That is nice.

Josh Jarrett: It’s amazing.

Dan Murphy: That’s nice. You beat me. You beat me, I haven’t quite got there, so Yeah, that’s pretty funny. And if you didn’t know, the way that the AI works is this, real quick is we call it ‘The Boss” for fun. And we were there right in the beginning for when they went to spot pricing with cloud computing, and so that way we didn’t have to pay full price.

We could get, let’s say 85% discount, 90% off a regular computing cost, and so that was the only way that we could do this because I can’t afford, I spent $4 million on this project, but I could not afford to, to spend the $60 million or whatever it would cost for all this computing stuff and backup and just what have you when it comes to building out these networks and so forth.

So, it’s kind of cool and what happens is Josh is able on his desktop PC to say, “Hey, I want to build these strategies,” and then in the cloud, it fires up to 3,500 computer cores and that way you have a whole bunch of parallel computing at the same time instead of just running it on your desktop, so that saves a whole lot of time.

And yeah, that was the plan we found out about this in 2017, and it’s been a labour of love and a lot of blood, sweat, and tears, that’s for sure. But we are the first company to offer that to retail investors, by the way. So, that’s a whole lot of fun. No, Josh . . .

Josh Jarrett: We usually take over a week to build a strategy without being able to access that much processing power in the cloud.

Dan Murphy: Exactly. Or if ever a lot of times I’ve been saying, “Well, I would’ve never…” especially that kind of segues into the next topic. I want to discuss with you about the true asset pricing that there’s certain things that you would’ve never tried as a person, like, it makes no sense. And so, can you tell me real quick about what the true asset pricing data is and then how you’re using it for trade signals?

Josh Jarrett: Yeah, so it’s—as it’s referred to in the forms—the tap data that I think probably people will have maybe seen at some point, but it’s the net asset value of ETF. So, it compares the actual value of the assets in a fund to what the price is currently trading at. Which basically means you can see whether ETF is trading at a premium or discount, and then Portfolio Boss can use that information to determine if that data is predictive enough to create trading rules, which it definitely is, and I think is probably behind a lot of those returns you mentioned earlier.

Dan Murphy: Now wait a second, Josh. So, you’re telling me that these ETFs are mispriced, like constantly. But people can find it, you call it “NAV,” internally we call it “TAP” just for differentiation, but people can go on these ETF websites and they, it’s called “NAV” and almost every day there’s a fluctuation on pretty much every ETF?

Josh Jarrett: Yeah, I mean the bigger ones are smaller, but there still seems to be edges on even the bigger funds with the smaller, the differences.

Dan Murphy: It’s pretty crazy. And then what’s interesting is I feel like I made a good decision because I got a lot of you guys into a group and then one of our member’s adult son, he discovered that if you put this TAP data into the Boss, into the AI in these BlackRock funds– and BlackRock, if you don’t know, is the largest fund in the world, they have $10 trillion in assets under management, and they have something like a 100 million clients around the world that use their iShares ETF products.

And I know that’s kind of a mouthful, but at the end of the day, there seem to be these patterns and these global funds. So, money moves around the world, let’s say Germany and Sweden and Australia, and it leaves these patterns of these giant whales and what the heck they’re doing with money, and it leads to really highly accurate trading strategies.

Would that be a fair statement to make?

Josh Jarrett: Yeah, that’s a good way to put it.

Dan Murphy: Okay, cool. And then, how many of your strategies—like approximately like percentage—are you switching over to TAP? Because again, that’s been one of the biggest discoveries that I’ve seen in my 26-year career now.

Josh Jarrett: Yeah. Any new strategy is using TAP, so I think it’s up out of the 200. I want to say it’s probably 60% are using the TAP data

Dan Murphy: And then the vast majority of people that are using technical analysis, like if I go to the store right now and I go buy…You know, I’ve been a long-time subscriber of Stocks and Commodities Magazine and it’s going to be all Price Data, right? Price Indicators, MACD, RSI, and so this is something completely different, is that correct?

Josh Jarrett: Yep, that’s correct.

Dan Murphy: Well, it seems like, what was that saying? It was Earl Nightingale, that he was talking about you could go into an industry and see what everyone else is doing and then do the opposite, just do something else, and there seems to be a lot more money to be made there, right?

Josh Jarrett: Yeah, and that’s sort of the beauty of it is you, even with the TAP data, it’s just like Portfolio Boss with the randomized rules. I mean, your TAP data’s going to be different than somebody else’s. So, it’s the rules are so unique that I could have 1,000 strategies and every single one would be different, even if it was all creating the same instrument.

Dan Murphy: Let’s just go, it’s a testament to AI and how it differentiates itself. But hey, do me a favour, man. Can you walk me through like what’s your trading day look like? Because I can see your fitness gym behind you here and it looks like you have to manage that. How do you manage to trade and get in the top five of Fundseeder or do all this stuff at the same time? Are you Superman or what?

Josh Jarrett: I mean, it’s a pretty smooth routine at this point. I get wake up, I got my Portfolio Boss trade email between that and the data I can export from Portfolio Boss into a spreadsheet to keep track of what my positions are out of 200 strategies and keep it all reconciled.

I maybe spend 15 minutes in the morning to create that basket file, load it into interactive brokers, and I make five minutes in the afternoon to just download what executed and update the spreadsheet.

Dan Murphy: And this is why you’re going to be one.

Josh Jarrett: Yeah, once auto trading, it’ll be even easier.

Dan Murphy: Yeah, that’s exactly what I wanted to say was we’ve had this auto trading that’s been in the works forever. It’s like a labour of love at this point. We have a full-time person working on it and we’re really getting there. I’m seeing progress, but I’ve been saying that for a while, but auto trading with interactive brokers is coming and that would be the ultimate dream, right?

So, you’re not even using the spreadsheet, you’re not importing this basket trades, everything like that. But I think it’s pretty cool that you’re able to do all this in 15 minutes. And you know what? In the beginning, I was going to ask you too. Are you doing this for income? Do you take money out of your training account?

Josh Jarrett: Yeah, I actually sort of—one of the things that drives me to keep optimizing this is I want to be able to pull money out and use it for vacations or growing the business or whatever.

So yeah, on a monthly basis, I’m pulling money out and trying to make sure the account is still growing at the same time. So, that’s pretty exciting though, it’s almost like not having to work and getting paid.

Dan Murphy: Not too bad. Well, I have to commend you though, that you were able to save some money. And then the money, it takes money to make some money, so that’s awesome to see here. I don’t want to promote this to people that unfortunately, someone like myself, 26 years ago when I first started, I had $5,000 and wanted to go trade it in the markets.

I don’t think that what I offer and what we offer is for you, but at least I would like you to listen to what Josh is saying about what it takes to become a successful trader. And it’s really shutting off the bullshit and going and switching over to scientifically proven models, is that a fair assessment?

Josh Jarrett: Yeah, that’s definitely fair.

Dan Murphy: Let’s switch gears here, because look Josh, not everyone can trade 200 strategies. It sounds like you’re doing some interesting things that are unique, like these basket traders importing all these strategies and it’s probably quite a few trades I could imagine.

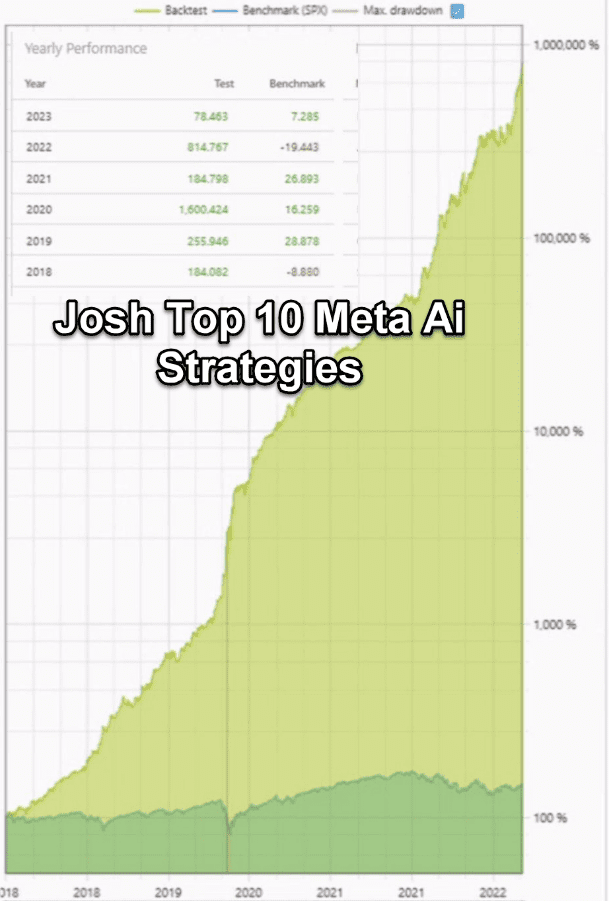

And then, you’ve been using a new technology, you’re one of our beta testers within 100% Club and that is Meta Ai. And so, what that does is it automatically could look at all your strategies and then pick, let’s say the top 20/30. I think you had a test in there that was top 10 and it was insane. It was like over like 489% compound annual growth rate.

And so, to me, it seems like that at this point we have to kind of dial that back into something that’s less volatile, more realistic and things like that. What makes it that this AI can actually pick which strategies to trade?

And so, I wanted to tell the viewers about cycle reversals real quick. And so, that’s basically, let’s say that you have a trading strategy . . . And I think the simplest way for me to say it is, let’s say that your trading strategy, it has 70% winners over a period of 20 years, that’s pretty good strategy, right? Those are nice numbers.

But there’s some months where let’s say the win percentage drops down to 50%, right? And then there’s some months where it’s just on fire, this thing is 90% winners. Well, it turns out that those are opportune times to actually get in when the strategy’s been performing poorly over, let’s say, the course of a month or so and then get out when it’s on fire.

So, there’s this thing called Mean Reversion, where your strategy is going to go back closer to that 70%, but on the way, it’s going to have these cycles in there, and so it’s taking advantage of those.

And with that in mind, can you describe from a high level, like what you’re doing with the Metas? Is it something similar to what I’m describing to viewers?

Josh Jarrett: Yeah, I’m just starting to play around with the meta-AI stuff where it’s actually creating the rules. I mean, Meta’s been in Portfolio Boss for a little while, I actually have a retirement account that playing around with the magazine, but I just came up with my own rule, basic rules, “Quit trading a strategy if it falls below the 100-day simple moving average. Fail the strategy if it goes above the RSI or something like that.” So excited to, I know by using the AI to come up with those rules, it’ll be 100 times better.

But so out of those 200 strategies in the retirement account, I’m just trading the top 20 based on those simple rules. So, I think it should get significantly better by letting the AI come up with a little more sophistication.

Dan Murphy: No, I was just telling you off-camera that it did. We are actually done with the project and so I want to get it into your hands here. I actually thought it was going to be another month because in the software world, usually takes forever. And so, that’s actually, it’s one of the first projects that the guys had finished quite a bit early, and I can tell you that it blew me away.

So, what we’re shooting for here in a 100% club was 100% winning months. I actually told the meta-AI. I said, “Okay, I actually took the 100 strategies that you showed me and I put that into a meta and then I told the AI I wanted 100% winning months, I want 100% companion growth rate” because remember you did that test just for fun and you showed where you had the top 10 of your strategies, and it had that insane companion growth rate, right?

So, 489% annual growth rate, it’s going to be a little bit too volatile for most people, including myself and yourself as well, because you’re trying to do more stable, right? So, I told it to dial it back. So, it’s really a matter of dialling things back at this point. And so, many people are always trying to dial it up and now. As professional traders, we’re trying to dial it down, right?

And so, I told it I want to make 100% winning months, 100% annual gains. I mean, who wouldn’t want that? 20% by the way if you read Jack Swagger’s books. 20% annual gains of the long term are fantastic, like that’s going to get a lot of money thrown your way for sure. And then I told it “I wanted a really low drawdown.” So, max drawdown over that period of time, I wanted to be 5%.

And so, then the AI came to life, and just trading the top 10 strategies, it had 100% winning months, it had 97% annual growth rate, and then it had a 7% max drawdown, so pretty damn close.

Josh Jarrett: Amazing.

Dan Murphy: And then there’s some other things that we’re doing right now with that as well. So, you heard us talking about using things like RSI and those are more traditional indicators, but the Boss’ AI actually can program itself in C code.

So, what it can do is this mix together a lot of basic mathematical formulas and create its own formulas, own indicators by itself. Let say, what a time to be alive, right? This is insane. I’m kind of curious, what do you think Josh, can a person of average intelligence do this or do you have to be a super brain or what’s the deal?

Josh Jarrett: No, I mean, for sure anyone. I mean, it can be overwhelming at first, but it’s like anything else, the more you use it, the easier it becomes and it just keeps getting easier because a lot of the AI stuff is doing some of the heavy lifting.

But yeah, I mean especially if you’re probably listening to this, you’re passionate about trading, to begin with, so you’re already, and that’s going to be key. And then just nothing wrong with starting small and experimenting, but yeah, I mean, anyone that’s interested in trading can use Portfolio Boss, there’s no question.

Dan Murphy: It was interesting because speaking of that, one of my favourite testimonials that we received was one of the guys from Australia actually, he’s a truck driver and he admitted, and a lot of people are in the same boat, but they don’t admit it. It’s just kind of like when you have buddies that go to Vegas or something, they’re always winning, right? They always win. When they come back, they don’t ever say like, “Oh, I lost a bunch of money in trading.”

You see that quite a bit too, but one of the guys, he admitted that he had been trying this and dabbling at it for about 20 years and had lost money on it. And for the first time that he was able to actually make money because he’s using what actually works, what’s proven the work instead of a lot of guesswork.

I just call it Market Voodoo, when a lot of people are doing with technical analysis, drawing, trend lines on charts and just real quick I spent hundreds of thousands of dollars in a team of three. We actually were trying to prove that pattern recognition works. And so we went through like all data, 16,000 different stocks, looking for patterns, that’s what got us into supercomputing, by the way. And what we discovered is it didn’t work after trillions and trillions of patterns analysed, seeing which patterns were repeatable.

And so, the whole thing just blew up, and I realized like, “Wow millions and millions of people are trading with pseudoscience. It does not work. Those patterns that people see, those are from books like Edwards and McGee, which was out in 1946 pre-computer.” And so, I just want to warn people of all… Even Paul Tudor Jones even got caught up in this. I don’t know if you ever saw that Trader documentary, have you seen it?

Josh Jarrett: No, I haven’t.

Dan Murphy: Yeah, it’s pretty funny because I think the reason why he banished it and bought up all the copies and it gets banished all the time on YouTube is because he’s talking about Elliot Wave theory, providing his signals before the 87 crash. Can you believe that?

Josh Jarrett: Yeah.

Dan Murphy: You know, if you don’t know Paul Tudor Jones, he’s one of the best traders ever. He’s completely changed his mind about this whole thing. So, he’s no longer practising pseudoscience and he is worth billions of dollars. So, really nice to see for sure. But well, since you’ve been trading for quite a while, what kind of advice would you give to someone that’s just kind of starting out and trading?

Josh Jarrett: I mean, Portfolio Boss is an obvious one. I look at my last 25 years or 20 years of prior to using Portfolio Boss a tuition, because it costs me a lot of money. But if you can avoid that, I mean, you’re getting an education sort of without having to go through the GEDs and wasting your money, taking a PolySci class when you don’t care about political science and you’re getting a finance degree or something. So, you can sort of skip ahead and…

So that’s an obvious one for me. And other than that, if this is new, this whole process of building trading models is foreign and you don’t have a background in the analytics side, I think. Like I said earlier, just don’t be afraid to start small and experiment and build your confidence up over time as you start building models and seeing how they perform in the real world.

Dan Murphy: You know, that brings up a point too, that there’s a lot of people that they’re afraid to use the AI to build the strategies or they don’t have the time, they don’t feel like they have the gumption.

And so, off camera, I convinced you to give us a 100 of your best trading strategies, a 100 of them that you did use as you place in the top five at Fundseeder, and obviously you’re trading 200, but I was thinking 200 might be overkill for people, but you have offered people a 100 of your top performing trading strategies and then that way they can go ahead and they don’t have to build anything. They don’t have to spend months of design or use 410,000 compute hours on the Boss.

And so, what you can do is keep reading and I’ll explain how you can go ahead and grab Josh’s top 100 strategies on here. There’s a whole information written out, a whole letter that you can go ahead and read with the full details.

But I really appreciate you doing that, Josh. There’s going to be a lot of people that can benefit from something like that at all different levels, and especially with the new AI technology where not everyone is going to be able to trade 189 strategies at the same time, Josh. You are a fluke of nature in that regard.

But what’s really interesting is how we have this convergence of all these new technology, like a lot of people are talking about ChatGPT now, but we’ve been in the AI trading game for quite a few years now, and now it just went up to a whole new level, where you can have the AI take advantage of all these different cycle reversals in the strategies.

And I don’t get all my predictions right, but I said 2023 would be the year of meta-AI where the AI picks which strategies to use. All we needed to have was fill this gap of having a whole lot of strategies to choose from, and then all of a sudden, I heard from you man, and you were like, “Hey, I’m at the top of Fundseeder.” I’m like, “Holy crap, this is amazing!”

Give it up for Josh, by the way, for just letting us know exactly what he’s doing and taking all that I taught and then actually running with the football. It was you doing the work, man, and so I really appreciate you letting everyone know the secrets behind your success, that’s awesome.

Josh Jarrett: Fluke of nature is a nice way to put it.

Dan Murphy: Yeah. So, you want to go ahead and snatch up those strategies. Josh is not going to have these up forever, and so you might want to go ahead and read below and grab your 100 strategies, we’ll let you know more evidence about it.

So, thank you very much, Josh, for joining me today. It’s been a whole lot of fun, man.

Here is How to Get Your Hands on The Josh's 100 Strategies

As soon as I got done interviewing Josh, I knew there was a big void that needed to be filled. He put in an incredible amount of time and we provided the (very expensive) 410,000 hours of compute time on our network. While that might seem like a lot (and it is), I can only imagine the countless hours an entire team of programmers would have slaved away to try their hand at building 189 strategies.

So I FedEx’d a next-day letter Josh with a royalty deal to provide you with 100 of his best trading strategies. After a quick conversation, he said “yes.” This may be the most extraordinary deal I’ve ever done because it instantly gives YOU the best shot at making a fortune that I’ve ever seen. It also puts us in a category of one in the trading strategy business. No one in the world is offering anything near this scale.

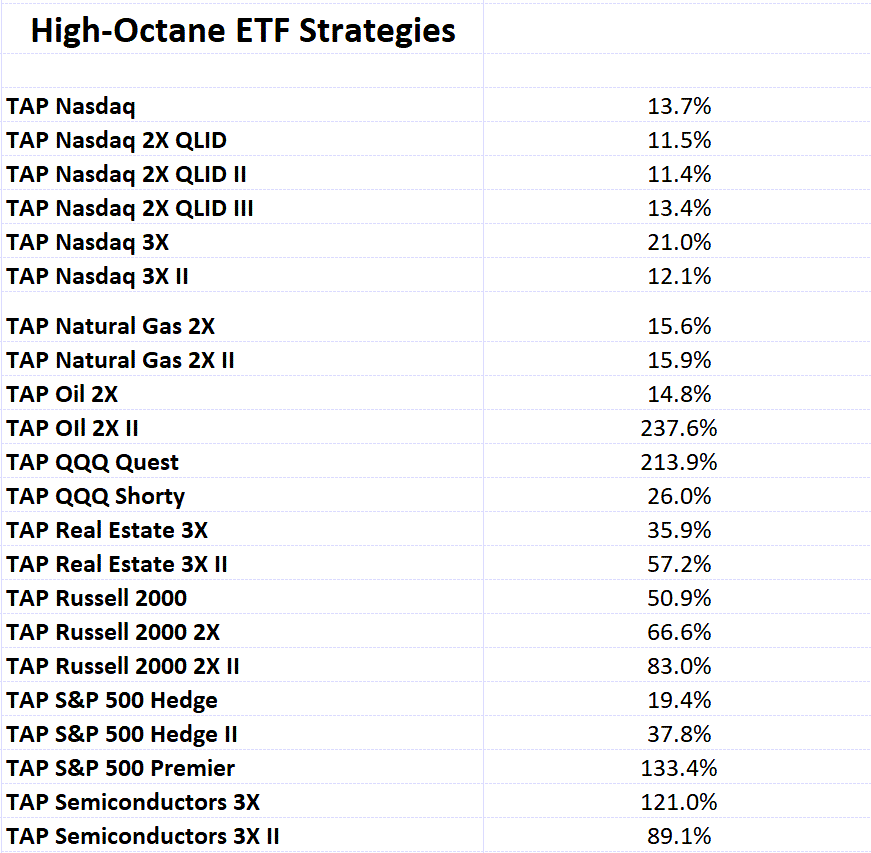

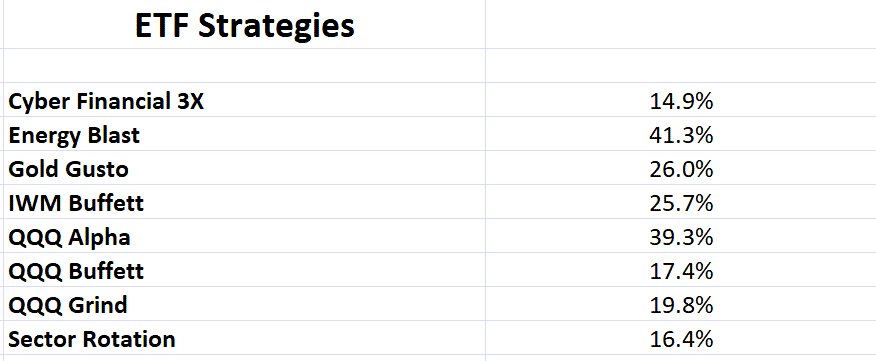

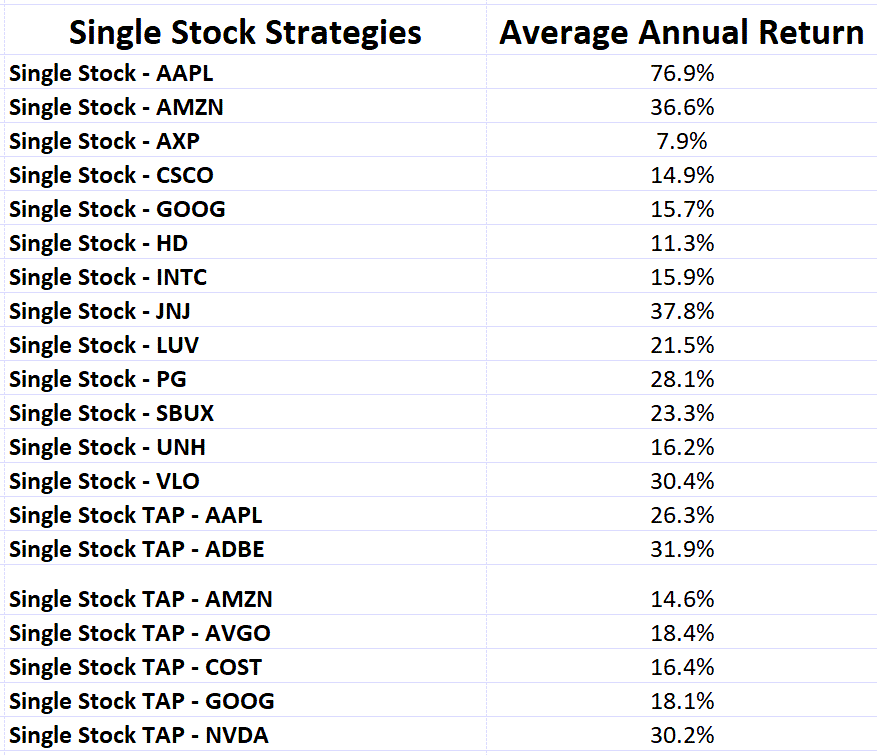

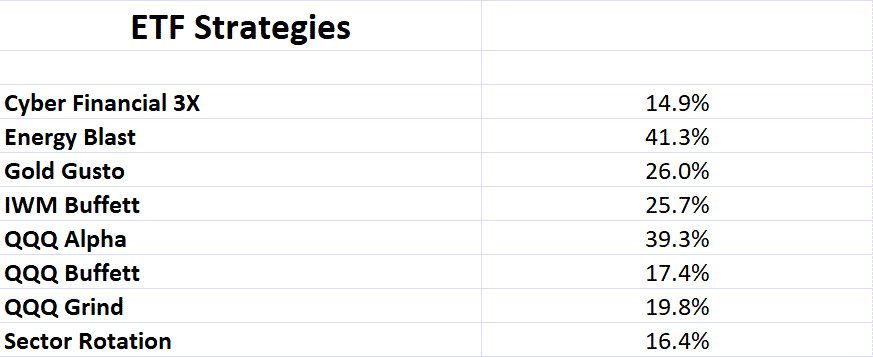

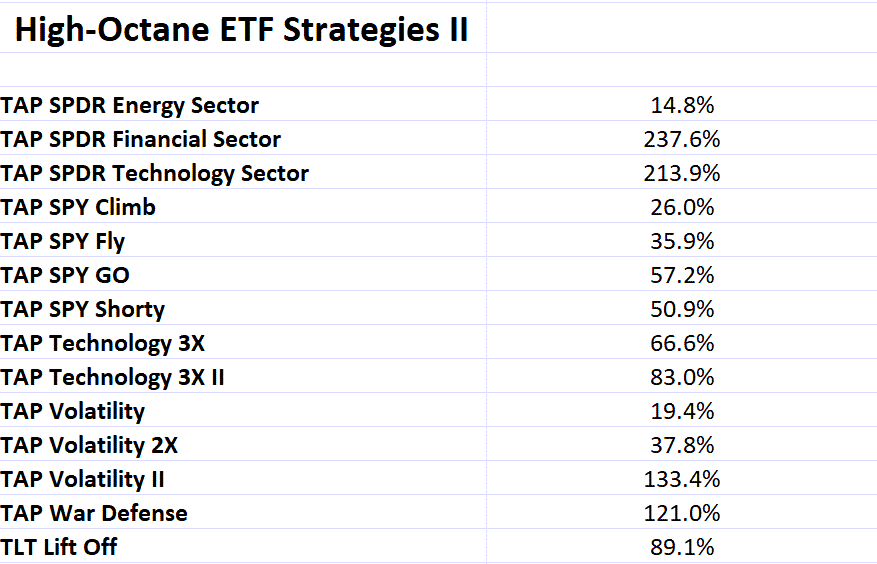

How do your strategies stack up to these? Here are seven categories and each strategy's annual returns.

Introducing the Josh 100 Strategies...

And to sweeten the pot, I’ve giving away – for free – our Meta Ai technology so you can create the trading business of your dreams.

Just tell the Ai what kind of numbers you’re looking for, and how many strategies you want to trade at once, and the Ai will automatically choose which of the 100 strategies are in an ideal cycle. And if you’ve already created some strategies of your own. No problem. Just pop them in there with a few clicks.

You’re also getting access to my 9-Episode Meta Ai Masterclass.

With the Meta AI Masterclass, you'll no longer feel like you're playing a

never-ending game of “whack-a-mole” with the market.

Instead of constantly chasing after the next hot strategy, you'll learn to harness

the power of artificial intelligence to create a tailor-made trading blueprint using the little-known power of Cycle Reversals.

Imagine the market as a raging river, full of twists and turns, and you're on a flimsy raft, struggling to stay afloat. The Meta AI Masterclass is like upgrading to a state-of-the-art speedboat, expertly navigating those treacherous waters with ease, and leaving your competitors in your wake.

You'll discover how to achieve consistent returns, minimize losses, and finally conquer the trading world with the unstoppable force of cutting-edge AI technology. Say goodbye to sleepless nights and stomach-churning market drops, and embrace the future of trading with the Meta AI Masterclass.

You also receive free access to 100% Club. That’s where we pow pow together in order to achieve 100% winning months. This is where we debut the latest cutting-edge research, and new tools. See what’s working now and chat/share ideas with the cream of the crop traders like Josh on the 100% Club Forum. I also hold monthly 100% Club only Zoom meetings to discuss the latest breakthroughs.

So, what’s the investment to be a part of the “Josh 100”, Meta Ai technology, the Meta Ai virtual event, and 100% Club?

First of all, let me tell you who the Josh 100 and 100% Club are NOT for:

- It's NOT for dreamers looking to turn $5,000 into a million dollars overnight. I was in the same boat back in 1997, but this is NOT for you.

- This is NOT for those looking for beautifully drawn charts. I skipped out on throwing the $500k it would cost to add pretty charts because it’s about as useful as a screen door on a submarine.

- This program in NOT for someone that's looking to make 100% a month or other such foolish numbers. Large gains are possible, but I'll give you a tip: Amateurs focus on maximizing gains. Pros focus on consistency and minimizing losses.

Instant A.I Trading Business

You MUST understand the opportunity here. This is NOT in the same category as those who subscribe to a few newsletters, and invest as a hobby. What we are providing is an “Instant A.I Trading Business.” But instead of paying a $45,000 franchise fee to a company like McDonalds, an additional $2 million for startup costs, and a constant shuffle of employees…

…The Josh 100 + Meta Ai + 100% Club allow you to use proven strategies:

…WITHOUT any employees, and…

…WITHOUT spending 40 hours per week on the business.

In fact, Josh averages 15-minutes per day on his trading business. Soon to be even less once our auto-trading plugin is completed.

Normally, I would charge a minimum of $1,000 per strategy, which would bring the total just for the strategies to $100,000.

But since you're buying the strategies in bulk, this opportunity, with all the goodies, is priced at a very reasonable 75% discount: $25,000.

However, we're currently running a special to celebrate Josh's success. Just call Adam Kaye, my Director of VIP Client Relations for details.

If you would like to have access to The Boss SuperAi to create your own strategies like Josh, there’s a special package deal that Adam can set up for you.

I’m also taking on five (5) students 1-on-1 to help you with your dream trading business. If you’re interested in learning from the inventor of all this tech…who has seen it all over 26 years of trading…ask Adam for more details (The one-time investment is $100k). Update: 1-on-1 SOLD OUT

So, here’s what to do next: Call Adam Kaye for a custom quote based on your prior purchases.

Call Adam Kaye: 516-220-8221

Quick recap of what you’ve learned in this letter:

- How Josh just became one of the highest ranked traders at Fundseeder (trading dozens of machine-designed strategies)

- How every strategy goes through Cycle Reversals. Get into a great strategy when it has had a bad month. Get out when it has a great month – it’s likely going to be followed by a mediocre month

- The answer to the age-old question of “when should I stop trading a strategy”

- Use Meta Ai technology to do the selection process for you

Here’s what to do next: Call Adam Kaye to discuss which package is right for you.

Call Adam Kaye: 516-220-8221

Let’s recap what you’re getting:

- 100 of Josh’s top performing strategies he used to get to the top of Fundseeder

- Meta Ai tech that takes advantage of Cycle Reversals, and can custom select which strategies to use based on your needs. More like a bespoke suit instead of a one size fits all solution.

- Meta Ai Masterclass 9-Part Series. Learn all about this new technology for adding hyper-consistency to your portfolio. Discover how to make Cycle Reversals work in your favor.

- 100% Club membership. That’s where we put our heads together in order to achieve 100% winning months. What a great goal eh? This is where we debut the latest cutting-edge research, and new tools (like intraday trading in the near future). See what’s working now and chat/share ideas with the cream of the crop traders like Josh on the 100% Club Forum. I also hold monthly 100% Club only meetings to discuss the latest breakthroughs.

This opportunity is priced in the very reasonable low 5-figures. If you would like to have access to The Boss SuperAi to create your own strategies like Josh, there’s a special package deal that Adam Kaye, my Director of VIP Client Relations can talk with you about.

I’m also taking on five (5) students 1-on-1 to help you with your dream trading business. If you’re interested in learning from the inventor of all this tech…who has seen it all over 26 years of trading (The one-time investment is $100k). Update: 1-on-1 SOLD OUT

90-Day "If is ain't worthy, I'll replace it" Guarantee

I guarantee my team and I will do everything in our power to help you become successful. The rules of all 100 strategies are fully revealed, so I can not offer a money-back guarantee. If for some reason you believe that a strategy isn’t worthy of being on the Top 100 list, I’ll replace it in the next 90 days.

The clock is ticking, and the discounted deal will expire before you know it.

Call Adam Kaye: 516-220-8221

Imagine having 100 new money-makers in your hands. They’ve gone through all the rigors of in-sample and out-of-sample testing. Months of work. Audited real-money results by a trusted 3rd party. Hundreds of thousands of hours of compute time. The Meta Ai then tells you which strategies to follow based on your needs. Want balls to the wall gains? It can do that. Want super-stable, low volatility gains that don’t keep you up at night? Meta Ai has you covered. Josh runs his top-ranked trading business in about 15-minutes a day. All you have to do is follow the signals.

Frankly, I don’t know any company that offers this level of proof that our stuff works. (It better…I’ve spent over $4 million of my own pocket). You’ve seen Josh’s audited Fundseeder results. You’ve seen actual brokerage statements from 100% Club members. You understand that Meta Ai ranks all 100 strategies so the duds are left out. You get how Cycle Reversals occur, and how you can put the odds in your favor by trading the RIGHT strategies at the RIGHT time. At this point I have one question:

Are you in or out?

Call Adam Kaye: 516-220-8221

Trade Smart,

Dan Murphy

CEO Portfolio Boss

P.S. The clock is ticking, and the live event will be here before you know it. Make sure to call Adam Kaye about our special package deal.

P.P.S. Josh’s 100 strategies combined with Meta Ai completely revolutionizes the trading world forever. We were the first to offer supercomputing Ai tools to everyday traders. Now we’ve filled the void that has plagued many of our users: Having the time to build dozens of strategies that work together.

P.P.P.S. I’m also taking on five (5) students 1-on-1 to help you with your dream trading business. If you’re interested in learning from the inventor of all this tech…who has seen it all over 26 years of trading…ask Adam for more details (The one-time investment is $100k). Update: 1-on-1 SOLD OUT

Call Adam Kaye: 516-220-8221

Government required disclaimer: The results listed herein are based on hypothetical trades. Plainly speaking, these trades were not actually executed. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under (or over) compensated for the impact, if any, of certain market factors such as lack of liquidity. You may have done better or worse than the results portrayed.