FORGET INDICATORS - If You Can Spot One Tiny ETF “Glitch,” You Could Grab Consistent Gains While Wall Street Chases Its Tail

GLITCH HUNTING™

Tap Five Ready-made Strategies that Turn Subtle Price Glitches into Reliable Cash | 65% average annual growth | 80.5% winning months | Near-zero S&P correlation

If Burry, Paulson, Simons, Krieger, and Thorp minted fortunes by hunting “glitches” why not you?

Real Accounts. Real Money. Same Glitch.

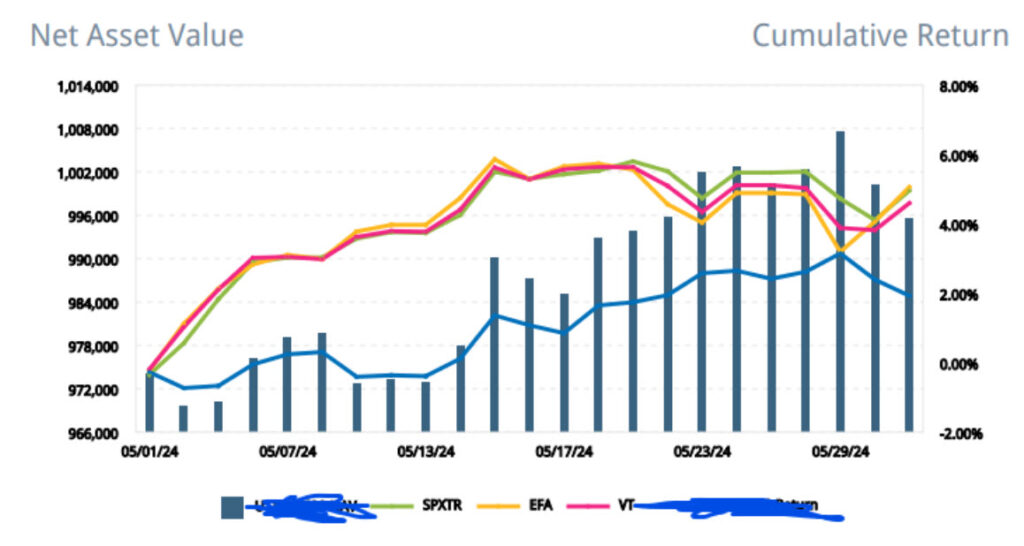

John made $36,028.86 hunting glitches. That's a 6.39% gain over a 30-day period.

Eric traded his account to nearly $1 million hunting glitches! That's what I like to see. He doesn't trade options. Zero margin. Just simple buy and sell signals so he's not worried about blowing up a 7-figure account.

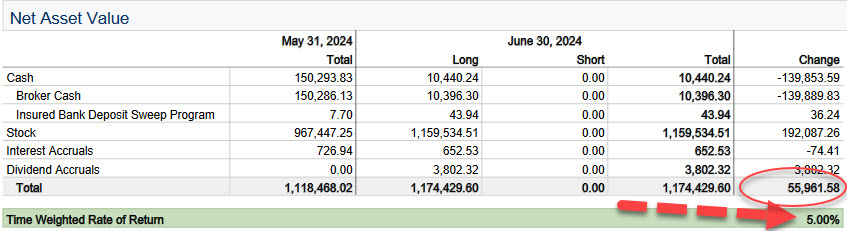

Long-time Glitch Hunter, Dave, made $55,961.58. He didn't analyze any charts. Zero news watching. He just followed the signals caused by these “glitches.”

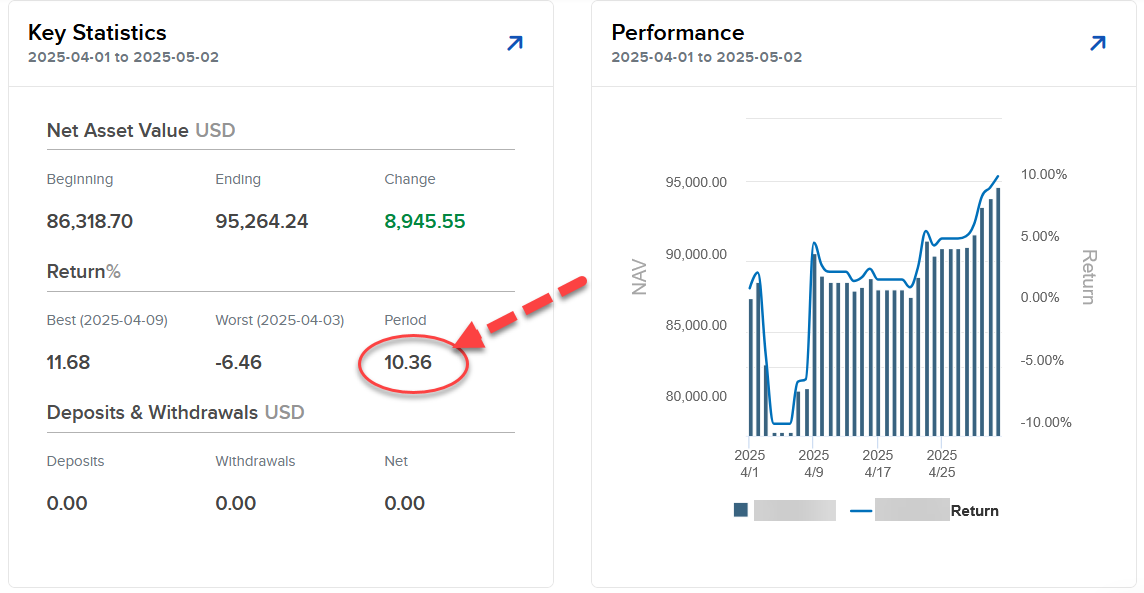

Heck, even my girlfriend — who is completely new to trading — banked $8,945.55 during the surprise Tariff fiasco in April. That's more than she ever made at her real job.

In a few moments, you’ll discover how you can break into Glitch Hunting TODAY… And finally generate consistent gains you were meant to have.

Back on September 15, 2006, Dr. Michael Burry punched a single line of code into an Excel macro, exposing Wall Street’s mispricing “glitch” in sub-prime mortgages.

That one “glitch” ballooned his $100 million fund into a $725 million payday.

Barely eight weeks later, John Paulson cloned the insight, parlaying it into a record-shattering $15 billion haul.

They didn’t chase crystal-ball forecasts, fancy indicators, or chart scribbles. They spotted a hidden mispricing–a glitch nobody else saw…and pounced.

Now it’s our turn. After investing $6.2 million in machine-learning firepower and crunching 20 years of raw ETF data, we’ve zeroed in on a unique kind of glitch: microscopic price gaps that turn bright-green right before five-to ten-day price surges.

We built five complete strategies around this anomaly and named the discipline Glitch Hunting™ – so you can press “Start,” sip your coffee, and let the system sniff out the next mispricing while mainstream traders argue about RSI settings.

All-weather Alpha 5 Performance

Here is the performance of the All-weather Alpha 5 — a collection of five strategies that are specifically designed to work together to boost gains, lower drawdowns, and maximize consistency.

The combination of these five strategies gives near-zero correlation to the stock market. That way you can rest easy instead of being glued to CNBC, or checking your phone every 15 minutes to see the latest prices. This is how you get your life back.

All-weather Alpha 5 performance 2006-2025. 44% annual growth rate.

79% winning months. Keep reading to see how we're able to boost returns to 65% without leverage.

“THE GLITCH HUNTERS’ HALL OF FAME”

Dr. Michael Burry spotted one crooked line in sub-prime data … turned a $100M fund into $725M.

John Paulson copied the logic, scaled it with swaps, and walked away with $15B.

Math PhD Jim Simons found microscopic price dislocations…his Medallion fund has averaged 66% a year for decades hunting glitches.

Currency sniper Andy Krieger noticed a fractional mis-peg in the Kiwi dollar, leveraged it 400:1, and netted $300M from a single glitch.

Probability wizard Edward Thorp hunted option mispricings and compounded at 20%+ for 28 straight years.

What links these five billionaires?

They never chased chart patterns or holy-grail indicators.

They pounced on glitches — pricing errors the herd can’t see.

Glitch Hunting™ harnesses the same principle – only instead of showing up once every few years, these mispricing glitches pop up almost weekly.

No PhD, hedge-fund leverage, or sleepless nights drawing charts required.

Here, take a look at Nvidia and how often the glitches pop up:

And here's semiconductor favorite KLAC with a consistent string of glitches to take advantage of:

FROM THREE MELTDOWNS TO A $6.2M AI BREAKTHROUGH

I’m Dan Murphy, and before Glitch Hunting™ ever existed I did everything the gurus preach-and blew out three trading accounts to prove it.

- Trading the news: spiked, whipsawed, margin-called.

- Elliott Waves & Fibonacci levels: elegant on paper, account-draining in practice

- Chart patterns, trend lines, MACD, RSI, Bollinger Bands: if it blinked on a screen, I bet on it—and lost.

- Options, penny stocks, you name it: each “can’t-miss” tactic missed spectacularly.

After the third meltdown I made a vow: never place another trade I couldn’t back-test with a computer.

That obsession birthed MillionDollarTarget.com – my public pledge to turn a small audited brokerage account into seven figures using only verified models. Transparency kept me honest…and profitable.

Yet hand-coding strategies was glacial. I wanted thousands of ideas, not dozens a year. So I went all-in:

1. Secure the firepower. Rented a 3,500-CPU cluster and hired quants who speak more C# code than English — total spend to date: $6.2M.

2. Feed the mispricing matrix. Instead of re-hashing price data like everyone else, we poured in 20 years of daily ETF premium/discount data — the slivers between an ETF’s price and its NAV that Wall Street ignores.

3. Let the AI duke it out. A genetic-programming engine wrote, mutated, and culled millions of baby algorithms. Only those delivering 5-to 10-day gains with 99% statistical confidence survived.

After 124,672 compute hours one anomaly towered over the rest: tiny mispricings acted as a fingerprint of future moves. That insight became Glitch Hunting™, and the first five ready-to-trade strategies are pre-loaded in your dashboard.

Now, instead of guessing, I simply hunt glitches – press Start, and let the mispricing tell me when to pounce.

How It Works in 60 Seconds:

The Setup: Each night our servers measure how far hundreds of ETFs stray from their true worth — Net Asset Value (NAV). Even a fingerprint-small gap, often under 0.25%, can wave the flag.

The Fingerprint: Two decades of data show that when an ETF’s price drifts even a hair from its true value, that tiny glitch forecasts sharp 5–10-day moves in a select group of stocks — not just the ETF itself.

The Signal: Our AI matches every new gap against its library of winning fingerprints and posts a green (buy) or red (exit) arrow before the opening bell. You spend minutes, not hours.

The Secret Sauce: Because each strategy marches to its own beat, blending several of them smooths the ride — historically keeping correlation to the S&P 500 around 0.14.

The Stats: In 20 years of stress tests the combined approach chalked up 79% winning months while dodging the market’s ugliest plunges.

Your Role: Check tonight’s dashboard, place tomorrow’s orders, then get on with life while the AI stalks the next glitch.

Now it might sound like we're making money from tiny mispricings. No, those just signal potential for BIG moves. Take a look at this string of trades in Nvidia. Do they look tiny to you?

Here's Boston Scientific (BSX). Notice how it hits a few small gains and losses, then catches the trends without selling way too early?

Here's Buffett's Berkshire-Hathaway. The strategy has more than doubled Buffett's returns with far less risk by trading glitches.

THE GLITCH HUNTER™ All-Weather Alpha 5

Forget juggling spreadsheets and watchlists. Each of the five engines below is laser-focused on a single market heavyweight. When tonight’s dashboard fires a green arrow, you’re looking at a 5-to-10-day swing—no more, no less.

NVDA QuickStrike — designs the GPUs driving every major AI data-center on earth. 80.2% average annual growth rate is no slouch.

KLAC Precision Pulse — the chip industry’s microscope, spotting nanoscopic defects before a wafer ever ships. 40.8% CAGR. Trading rules fully revealed.

BSX Heartbeat Hunter—pioneers life-saving stents and minimally invasive surgical tools that keep hospitals running. Trading rules fully revealed.

BRK.B Titan Tracker—Warren Buffett’s $900B conglomerate spanning insurance, railroads, energy, and a mountain of Apple stock. Trading rules fully revealed.

Mastercard (MA) Swipe Surge — the invisible network behind 210+ countries’ credit-card payments. Trading rules fully revealed.

All-weather Alpha 5 Historical Performance

Trading frictions are typically extremely small (0.15% per month)

Why five strategies? Because they almost never zig on the same day. Blending them slashes their historical link to the S&P 500 to just 0.14-so your balance can rise even when the index sinks.

For perspective: a 1.0 correlation would shadow the S&P tick-for-tick. At 0.14 you can skip Fed-watching, mute CNBC, and spend your time doing literally anything else instead of baby sitting the market.

Built-in shock absorbers: Each strategy pairs with an inverse ETF (think SH, PSQ, DOG) that automatically kicks in when the market heads south, smoothing the ride during bear tantrums.

Take a look above at historical performance during the bear markets of 2008 (+165%), 2011 (+23.7%), 2020 (+52%), 2022 (+42%), and now 2025 (+37%).

Now that's how trading should be!

Keep reading and discover how we're granting 25 Charter Members access to all the strategies and more for just $7.

Because every engine trades only mega-cap, household names, your orders clear in seconds at razor-thin spreads—no penny-stock limbo, no ugly fills. We even stress tested 0.05% slippage into every historical trade and the edge still shined.

And in those rare weeks when the market dives? Each engine’s inverse-ETF hedge automatically kicks in, dulling the blow so your equity curve stays orderly.

Bottom line: if you can log into a brokerage and click “Buy,” you already have all you need.

IS THIS DISCOUNT OFFER RIGHT FOR YOU?

Let’s shoot straight…this system isn’t a magic lamp, and it’s definitely not for everyone. Before you hit “Enroll,” run through this quick gut-check:

Probably not your cup of tea if…

❌ You don’t have an active brokerage account (the signals need somewhere to land).

❌ Your trading stake is under $10K—the math just doesn’t pencil out on tiny balances.

❌ You’re hunting a “double-your-money-by-Friday” thrill ride.

❌ Rules make you itchy…you’d rather improvise after every CNBC soundbite.

❌ A normal drawdown sends you into full-on panic sell mode.

❌ You need constant hand-holding — Glitch Hunting is structured, but it’s not babysitting.

Still here? Awesome—because this is who does thrive:

Perfect fit if…

✅ You can comfortably allocate $10K+ and want it compounding, not collecting dust.

✅ A historically 44% average annual return (with 79% winning months) would move your retirement date closer. (Keep reading to discover how to boost returns to 65% without options or leverage)

✅ You appreciate an equity curve that hardly flinches when the S&P 500 dives (≈ 0.14 correlation).

✅ Clear, rules-based trade alerts sound better than gut calls and market gossip.

✅ You can place 3–5 trades a week – or set automation – and then get on with life.

✅ You don't want a blackbox trading method that's hard to trust. All rules are fully revealed.

If that second list feels like home, one of the 25 open seats has your name on it. Let’s start stacking glitches in your favor.

But first, let's talk about…

THE RETIREMENT GAP EMERGENCY

Nationwide, boomers say they’ll need $1.26 million to retire…but the typical household approaching 65 has stashed just $185k. That’s a $1-million shortfall staring down two-thirds of today’s pre-retirees.

My own dad? He ran the numbers and nearly choked: $402,118 still missing from his nest egg here in California.

Pop your digits in…see the damage in 60 seconds:

Pick your state (costs swing by seven figures from Hawaii to West Virginia).

Enter what you’ve saved so far.

Instantly reveal the exact gap—no email, no guesswork.

Make sure to play around with the Expected Annual Return. That's what makes the biggest difference!

What's Your Retirement Gap?

Figures for the "minimum nest‑egg needed" come from a May 2025 GOBankingRates study summarised by Kiplinger. Assumptions: inflation‑adjusted annual Social Security benefit ≈ $22,523 and life‑expectancy of 20+ years in retirement. Median savings for Americans aged 55‑64 is only $185k, so most households see a sizeable gap.

Not personal investment advice.

THE SMOOTH RIDE RETIREMENT ENGINE

Picture your trading pot sliced into five equal wedges – 20% apiece – then pointed at five very different market workhorses:

NVDA (cutting-edge chips)

KLAC (the machines that inspect those chips)

BRK.B (insurance & cash-gushing subsidiaries)

MA (global payments toll-booth)

BSX (medical-device innovation)

Because each stock lives in its own ecosystem, they rarely throw a tantrum on the same day. When semis stall, health-care or old-school insurance often pulls the cart forward…and vice-versa.

The numbers back it up:

79% winning months logged across two decades of stress tests — about four green months for every red.

A skim-milk 0.14 correlation to the S&P 500…so when the index catches a cold, your equity curve just keeps strolling.

Zero extra hassle: just check your email or the trading dashboard inside Portfolio Boss for exact instructions to send to your broker the next morning.

- Solid bear market performance because of that low market correlation: 2008 (+165%), 2011 (+23.7%), 2020 (+52%), 2022 (+42%), and now 2025 (+37%).

Bottom line: you’re no longer betting the farm on a single thoroughbred…you’re running a five-horse team that almost never trips together, making the ride to retirement a whole lot calmer.

DIY: CLICK – BUILD – TRADE — YOUR OWN GLITCH ENGINE IN 60 MINUTES

Ever wish you could bottle this edge for your favorite ticker? You can.

- Type any stock or ETF symbol. The template’s waiting—no code, no syntax.

- Press“Start.” Your computer mutates and battles millions of strategy variants until a winner emerges.

- Grab a coffee — or hit the driving range. In about an hour you’ll return to a fully back-tested engine, complete with entry/exit rules and stress-tested stats.

That’s it. No PhD, no blink-and-miss-it candlestick squiggles. Just data doing what data does best — proving whether a strategy works before you risk a dime.

Until very recently regular traders couldn’t access the data or computing power needed to get the same advantages as the big players.

But now, thanks to progress in the worlds of AI and Cloud Computing…

That same AI is available for home traders to use.

And you don’t need to learn how to program to take advantage of it.

That’s because something called…

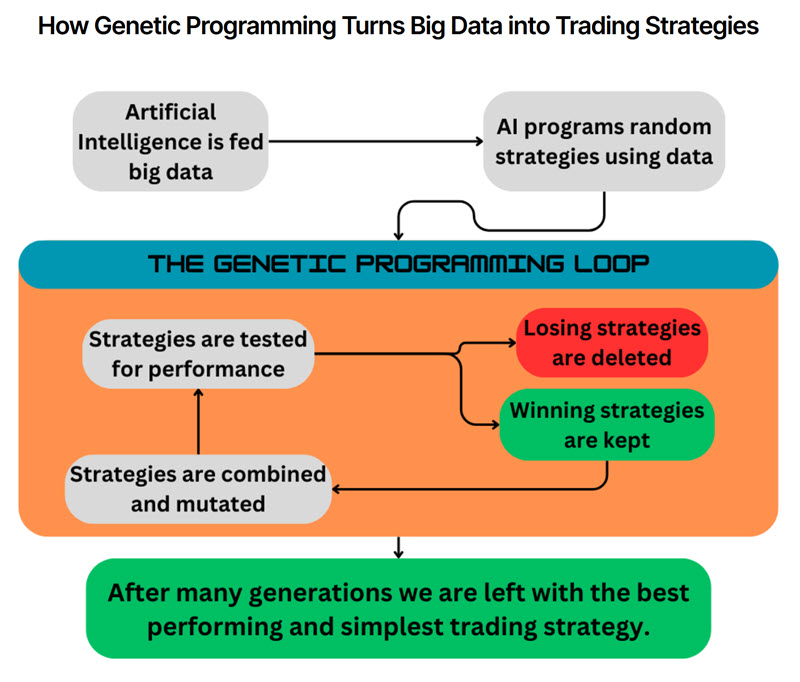

“Genetic Programming” is leveling the Playing Field

It goes like this:

With Genetic Programming… everything changes.

Suddenly you can test so much faster.

It’s nothing to reduce and simplify large batches of raw data. Resulting in simple elegant trading strategies — custom built for you automatically.

Most trading systems are over-fit to the past. They use tons of rules, and fine-tune the numbers to the point where it completley falls apart in the real word where you and I live.

Look how simple the code for this Nvidia strategy is. There's no RSI, MACD, or Fibonacci levels in sight. In fact, it doesn't even have any parameters to over-fit.

No wonder why it continues to work so well since I released it in 2023. In fact, it's up 60% for the year as a type this.

Lean in for another secret… we purposely force the strategies to trade inverse funds. That way if it gets the timing wrong, it gets severely punished.

That way only the strongest of the strong survive the ruthless evolutionary journey. That's why the code you just saw is so simple yet powerful.

FREE ≠ PROFIT: The Upgrade That Leaves 1990s Trading Tech in the Dust

“Wait—why can’t I just use the free software my broker gives me?”

I hear that a lot. On paper, those giveaways look shiny: flashing charts, a couple of canned indicators, some backtesting on price data.

But here’s the truth no broker will advertise:

Single-strategy only. They’ll let you tinker with one idea at a time—so your results swing wildly with the market’s moods. You can't combine strategies together, killing one of the biggest edges in trading. Period.

No ETF mispricing feed. They don’t even see the mispricings between an ETF and its net-asset value, let alone exploit them.

Tech straight out of the dial-up era. Most platforms were architected when Alanis Morissette topped the charts. They simply weren’t built for today’s brute-force machine learning.

That 1990s toolkit is why I sank $6.2 million—yes, real dollars out of my own pocket, not venture-capital money—into building Portfolio Boss’s Ai and multi-strategy engine. There was a gaping hole between “free” toys and an edge that actually profits. So we filled it:

Five uncorrelated strategies firing in concert, smoothing the ride against the market's bumpy road.

Proprietary NAV-premium data piped in daily, exposing glitches the public feeds never show. My testing shows this “weird” data outperforms price indicators by up to 300%.

Genetic-programmed code distilled to a few elegant rules, so it keeps working instead of over-fitting.

So the question is simple:

Do you want “free”… or do you want something that has already leapt the paywall of outdated tech and proven it can grow real accounts?

If it’s the latter, keep reading…

FAST-ACTION $997 BITCOIN STRATEGY BONUS

In 2021, I launched my #1 Bitcoin strategy to the public. It didn't disappoint. It's up over 500% since, even avoiding a nasty 89% draw down in the process.

Adding this Bitcoin strategy to the mix (6 strategies total), BOOSTS annual returns to 65% annually, lowers the worst draw down, and actually smooths out the returns.

How is that possible?

Bitcoin dances to its own rhythm. When traditional markets cough and sputter, this renegade asset often keeps moving to a different beat, acting like a built-in shock absorber for your portfolio.

And the beauty is, we trade the Bitcoin ETF…GBTC…right through an ordinary brokerage account.

No hunting for digital wallets, no fumbling with private keys, no plunging into the crypto Wild West.

It’s as easy as clicking “Buy,” then watching your entire system run hotter, faster, and calmer than ever before.

And heck, even giant funds like BlackRock, Fidelity, and Morgan Stanley are actively telling clients to get into Bitcoin. It's here to stay.

They say a picture is worth 1000 words, so here is the historical back test of using the All-weather Alpha 5 + Bitcoin strategies:

Move now—before the enrollment clock or the 25-seat cap hits—and you’ll bank these five extras that tilt the odds even further.

1. All-weather Alpha 5 (value $1,495) five strategies personally designed by me to work together in harmony. With near-zero correlation to the stock market, that means less headaches, smoother returns, and more freedom. Trading everything from high-flyers like Nvidia to multi-nationals like Berkshire Hathaway. These previously sold for $299 each. Rules are fully revealed so you can trust the trades.

2.Bitcoin Glitch Engine (value $997) Our AI spotted the same pricing fingerprints in GBTC. Result: 500% cumulative gain since January 2021 when the strategy went live — with no leverage and the same 5-to-10-day hold rhythm. You get the strategy file pre-loaded with rules fully revealed. You can trade it by itself, or add it to the All-weather Alpha multi-strategy in seconds.

3.1-on-1 Kickoff Call with Alexander (value $200) A 30-minute Zoom where our lead quant walks you through account setup, risk tuning, and any “what-if” scenarios you can throw at him.

4.The 100% Club (value $500/yr) Twice-monthly live sessions where I dissect fresh signals, share my screen, and answer your toughest questions — access normally reserved for our highest-tier members, now included at no extra cost.

5. 7-figure Ai Trader (value $1999) is your shortcut to tapping into battle-tested strategies that trade with machine precision…without needing to code or stare at charts all day. It's everything I've learned over 28 years of trading. If you’ve ever felt like the market is rigged against the little guy, this is your edge.

Over 4 chapters, we cover: What works and why, how to build strategies with Ai tools, combining them for ultra-consistency, and how to trade them with cutting-edge order-types and automation. Nothing is held back.

Add them up and you’re looking at $5,191 in total value… yet the Glitch Hunter 5-Pack clocks in at a fraction of that.

ONLY 25 SEATS

We limit Glitch Hunter onboarding to 25 new members at a time—that’s all our team can handle for the one-on-one Kickoff Calls and live Q&A support.

A real-time counter on this page tracks open spots. When it hits zero, the doors lock until our current enrollees are fully ramped. No wait-list jumps, no “email me later” exceptions.

30-DAY MONEY-BACK "TAKE MY $2,000" GUARANTEE

Put every engine through its paces for a full 30 days.

If you simply decide glitch hunting isn’t your style — email us for a 100% refund, no questions asked.

You’ll even get to keep full access to my 7-Figure AI Trader course as a parting gift — yours to keep, no matter what. (Normally $1,999). That's how confident I am you'll be head over heels in love with Portfolio Boss.

Quick legal note: No one can guarantee future results with absolute certainty. What I can tell you is this—every effort has been made to avoid over-fitting to past data, and the edges behind these strategies are truly rare. They've been battle-tested with real money for up to four years. I've been building strategies since 1997, and I personally stand behind them.

WHAT WOULD THIS COST ANYWHERE ELSE?

- 12-months Portfolio Boss Ai Trader (value $1,164)

- All-weather Alpha 5 (value $1,495)

- Bitcoin Glitch Engine (value $997)

- 1-on-1 Kickoff Call with Alexander (value $200)

- The 100% Club (value $500/yr)

- 7-figure Ai Trader (value $1999)

Total Fair Market Value: $6,355

But because the heavy lifting is done—servers built, strategies tested, support team standing by… all you pay now is a measly $7. That's 23 cents a day to take Portfolio Boss and all the goodies for a test-drive.

Yup, you get everything listed for a full 30-days. The whole enchilada. Then you get the low Charter Membership rate of only $97 per month after your trial. This is a marketing test. Normally we sell this package as a 1-year commitment.

If you don't like it, I'll give you a full refund, and you keep access to my $1999 7-figure Ai training.

25 19 12 spots available for Charter Membership.

(Clicking jumps you to our secure encrypted checkout. You’ll see the $7 charter rate locked and the 30-day guarantee in writing.)

Q&A

“I’ve been burned by gurus before. Why trust this?”

Every back-test, equity curve, and closed-trade log had to pass our dual verification process to make sure the strategy isn't over-fitting to the past. Plus, you have a 6-month, money-back guarantee.

“Do I need a super computer?”

Nope. A regular PC can run and build strategies. You just log in, read tonight’s signals, and place orders with your regular broker.

“What’s the minimum account size?”

The engines are position-sized in percentages, so you can start with as little as $5,000 and scale up pain-free.

“Is this day - trading? I have a day job.”

Trades hold 5–10 days on average. Enter at the open, exit at the next signal—minutes a week, not hours a day.

“Won’t slippage kill the edge?"

We baked 0.05 % slippage into every historical test. The edge survived—and then some.

“What if the market crashes?”

Inverse ETFs automatically hedge each engine. During past bear markets the blend kept drawdowns far below the S&P’s.

“Are there any hidden fees?”

Zero. Your membership covers updates, quotes, and data.

“How hard is the setup?”

If you can copy-and-paste a ticker into your broker’s order box, you’re 95 % done. We walk you through the rest on the Kickoff Call.

“What about taxes?”

Glitch trades are short-term, so they’re taxed at ordinary income rates. You can also trade from an IRA. Most of our members do just that.

“Can I cancel anytime?”

Absolutely. If you ever decide Glitch Hunting isn’t for you, just contact my support staff.

TWO VERY DIFFERENT FUTURES

Right now you’re standing at a fork in the road:

Path A: Keep leaning on the same indicators, news flashes, and “expert” hunches Wall Street feeds the crowd. Ride every stomach-churning whipsaw and hope the next hot tip finally sticks.

Path B: Step into Glitch Hunting™ — a data-driven lane where tiny, proven mispricings do the heavy lifting and your equity curve barely notices the market’s mood swings. One path looks familiar… and, if you’re honest, hasn’t delivered the life-changing account growth you’re after. The other is new, but mapped by 20 years of carefully vetted results, 80% winning months, and a risk-free six-month test drive. The clock below decides which future you take.

Below this paragraph you’ll see a clock ticking down to midnight Pacific, or the moment the 25th new member checks out — whichever comes first. When that timer or the seat-counter hits zero, enrollment shuts until our current cohort is fully onboarded. No exceptions, no back-door links. Miss the window and the charter price disappears.

(Clicking jumps straight to our secure encrypted checkout with the $7 30-day trial and then $97 per month printed in black and white.) 25 19 12 spots available.

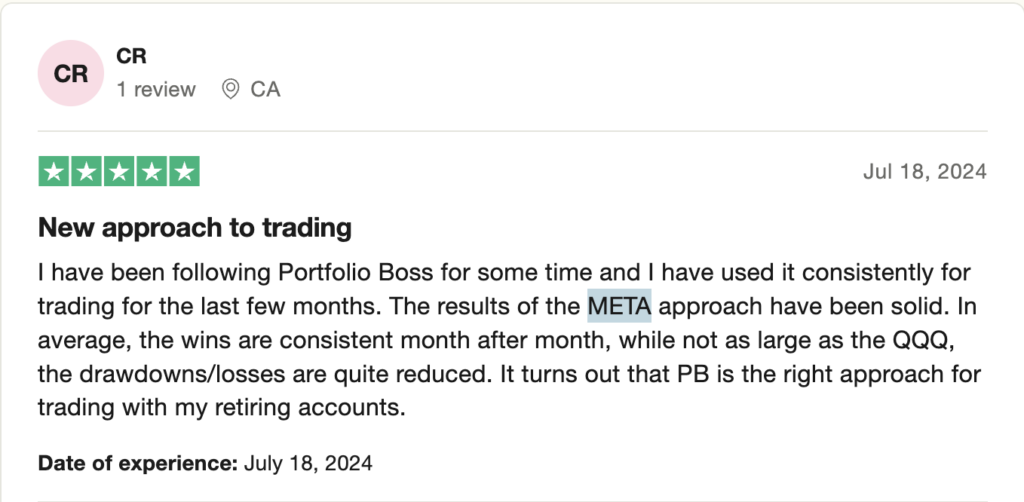

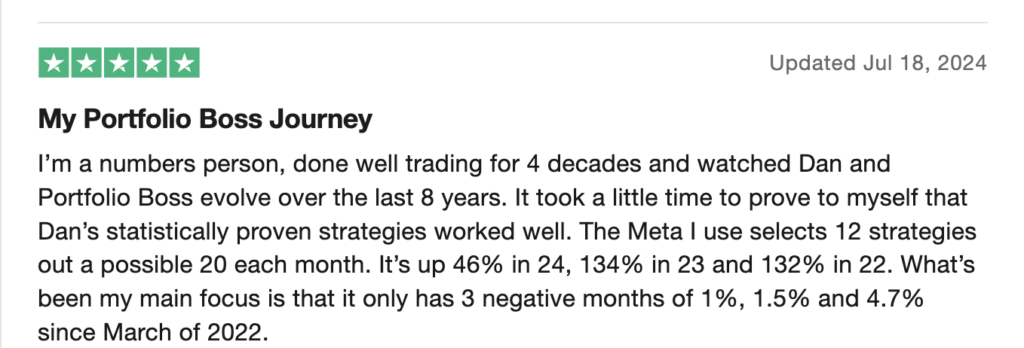

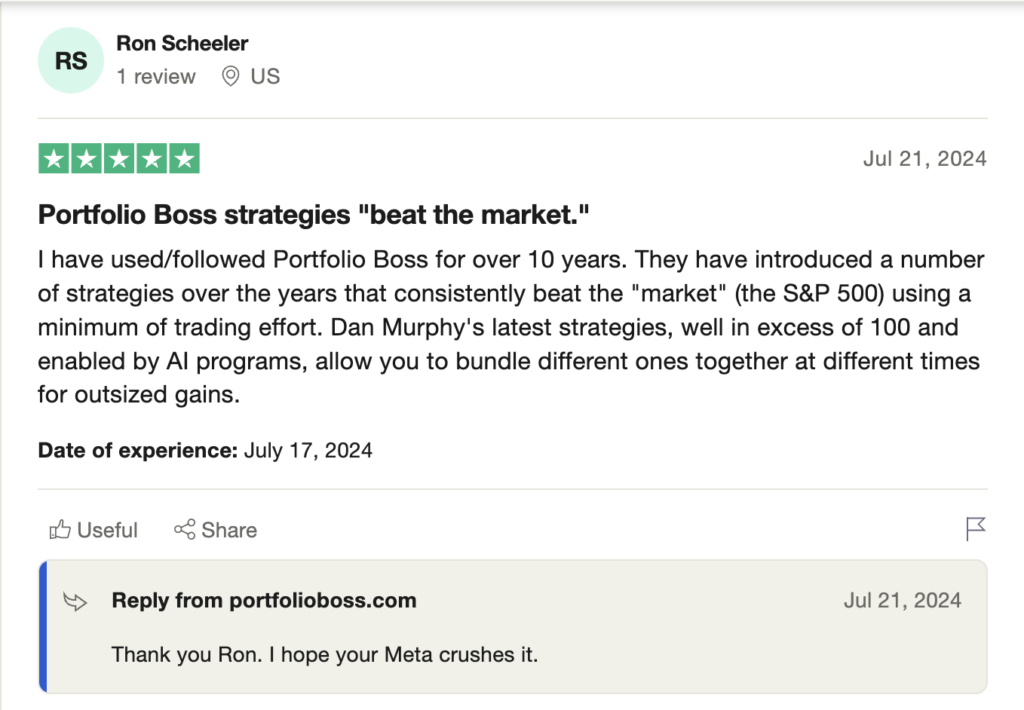

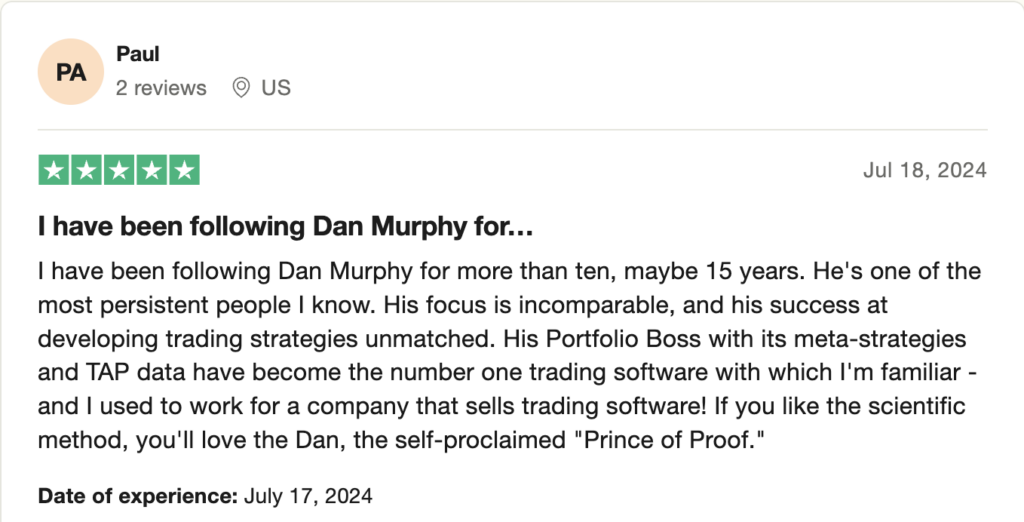

Take a look at what others are saying:

READ WHAT PEOPLE ARE SAYING

Trade smart,

Dan Murphy

P.S. ONE LAST REMINDER

Still on the fence? Remember: you’re getting five glitch-hunting engines pre-tested across five brutal bear markets, a Bitcoin bonus strategy, live coaching, and 30-days to road-test everything risk-free.

And yes, the strategies handled the recent surprise Tariff decline exceptionally well, ending the month up 9%.

In fact, it's done exceptionally well during bear markets: 2008 (+165%), 2011 (+23.7%), 2020 (+52%), 2022 (+42%), and now 2025 (+37%).

If it doesn’t boost your bottom line-or simply isn’t your style-ask for your money back. No hassle.

P.P.S.—THE CLOCK IS STILL TICKING

The seat counter above is live. Once the 25th charter membership is gone, the checkout link vanishes and the $7 30-day trial charter rate with it. Hit the button now and lock in:

- 65% annual return with Bitcoin bonus strategy

- 80% winning months

- 0.14 minuscule correlation to the S&P 500

- Built-in inverse ETF hedges that smooth the ride when markets dive

Click “Secure My Spot Now” before the timer or the counter hits zero. 25 19 12 spots available.

LEGAL & EARNINGS DISCLAIMER

Past performance does not guarantee future results. Trading involves risk, including the possible loss of principal. Examples are provided for illustrative purposes only and do not represent a guarantee of returns. The Glitch Hunting™ service is educational… it does not provide personalized investment advice. Consult your financial professional before investing. All trademarks are property of their respective owners